January 2026

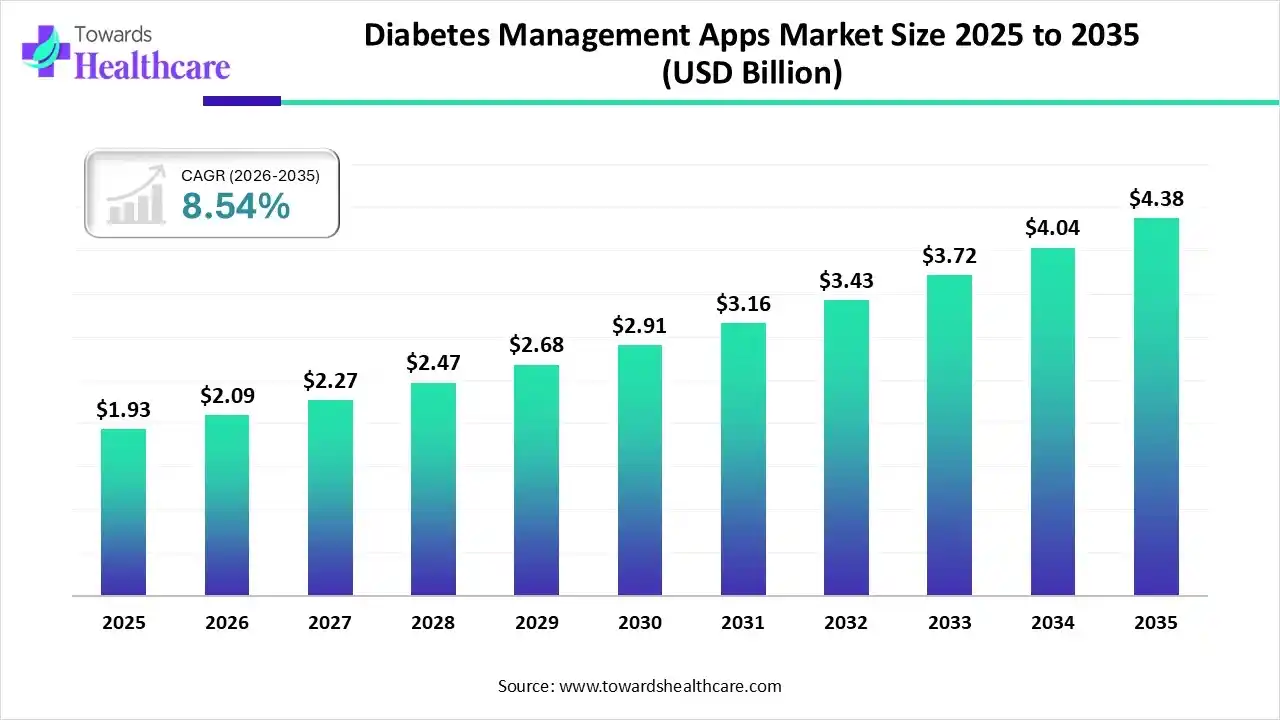

The global diabetes management apps market size was estimated at USD 1.93 billion in 2025 and is predicted to increase from USD 2.09 billion in 2026 to approximately USD 4.38 billion by 2035, expanding at a CAGR of 8.54% from 2026 to 2035.

The diabetes management apps market is accelerated by the introduction of versatile applications such as Gluroo, Glucose Buddy, mySugr, Diabetes: M, Health2Sync, and many others to manage diabetes effectively. These applications help diabetes patients track their meals, see blood sugar changes, auto-sync blood glucose data, and understand their blood sugar.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.09 Billion |

| Projected Market Size in 2035 | USD 4.38 Billion |

| CAGR (2026 - 2035) | 8.54% |

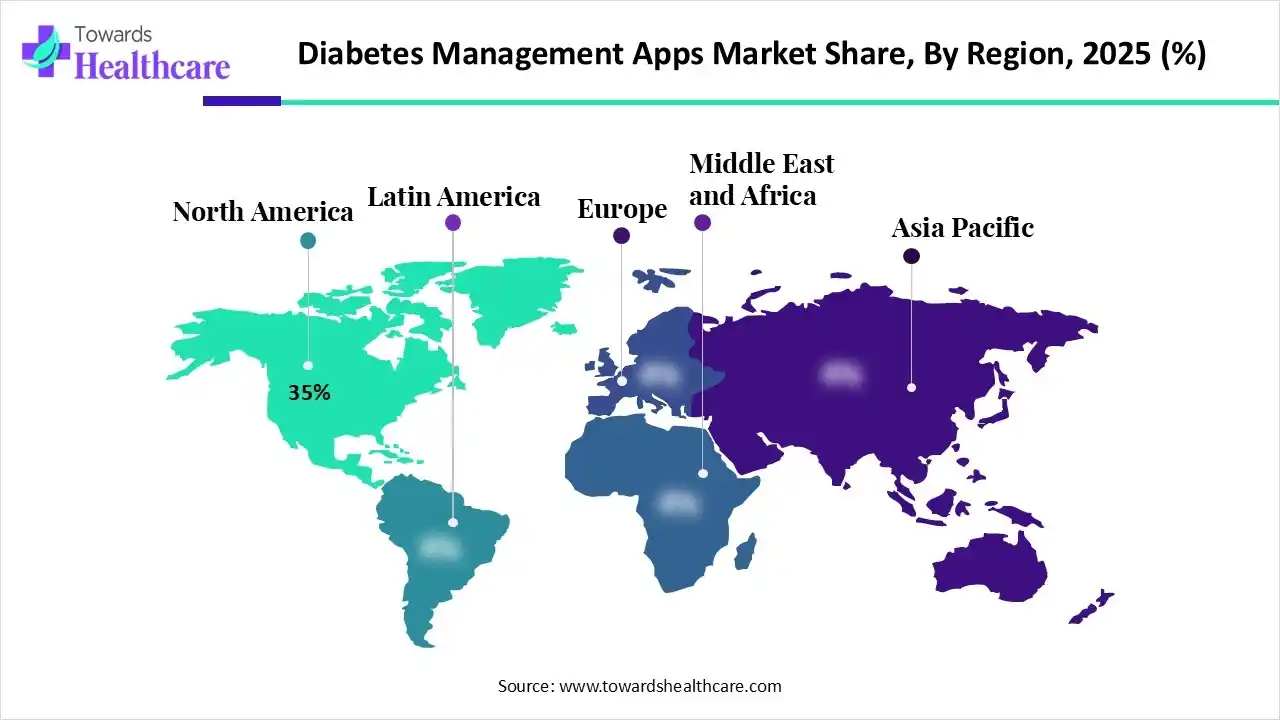

| Leading Region | North America by 35% |

| Market Segmentation | By Product Type, By Deployment Type, By Application, By Technology/Mode of Action, By End-User, By Region |

| Top Key Players | Roche, Teladoc Health, Omada Health, Azumio Inc., One Drop, Beat Diabetes, Glooko, Dexcom, Abbott, Medtronic |

The diabetes management apps market refers to the global ecosystem of mobile and web-based applications designed to assist patients with diabetes in monitoring, managing, and improving their health outcomes. These apps offer functionalities such as blood glucose tracking, insulin dose calculation, medication reminders, diet and lifestyle management, remote patient monitoring, and integration with wearable devices. They aim to enhance patient adherence, optimize glycemic control, and provide actionable insights to both patients and healthcare providers. The market growth is driven by increasing prevalence of diabetes, rising smartphone adoption, advancements in digital health technologies, the growing emphasis on personalized care, and the integration of AI and analytics to improve disease management outcomes.

AI-powered applications for diabetics help patients with designing their daily menu, reminding them to measure their blood glucose levels, and monitoring their activity during the entire day. These apps are vital in expanding the market due to their major role in predicting sugar levels based on the body’s response to certain factors, determining the right dose of insulin, and self-monitoring sugar levels.

How does the Blood Glucose Monitoring Apps Segment Dominate the Diabetes Management Apps Market in 2025?

The blood glucose monitoring apps segment dominated the market in 2025, with a revenue share of 40%, owing to their common functions such as blood glucose monitoring, integration with measuring devices, diabetes education, and medication adherence reminders. They track diabetes risk factors and enable teleconsultation services. They improve communication with healthcare providers and result in better clinical outcomes.

Diet & Lifestyle Management Apps

The diet & lifestyle management apps segment is expected to grow at the fastest CAGR in the diabetes management apps market during the forecast period due to their major benefits in data tracking, monitoring, personalized guidance and feedback, education, and awareness. The potential features of these apps include a user-friendly interface, integration with devices, and evidence-based information. The robust data security and privacy measures protect sensitive personal health information to build patient trust.

What made Cloud-Based the Dominant Segment in the Diabetes Management Apps Market in 2025?

The cloud-based segment dominated the market in 2025, with a revenue share of 55%, owing to its offline functionality, real-time device integration, data privacy, and security. The integration with cloud-based systems facilitates real-time monitoring, trend analysis, and collaboration with a caregiver team. These systems give immediate feedback, allow automated data entry, and enable insulin dose calculation.

On-Premise/Local Installations

The on-premise/local installations segment is estimated to grow at a significant rate in the diabetes management apps market during the predicted timeframe due to the huge adoption of cloud-based solutions for centralized data management, enhanced accessibility, and real-time monitoring. The cloud-based systems facilitate collaborative care and improve scalability and interoperability. The cloud-based servers are capable of managing the computational power required for AI and ML algorithms.

How did the Blood Glucose Monitoring & Management Segment Dominate the Diabetes Management Apps Market in 2025?

The blood glucose monitoring & management segment dominated the market in 2025, with a revenue share of 45%, owing to the key features of diabetes-friendly applications such as automated data logging, monitoring, data analysis, and comprehensive tracking. These apps manage diabetes and empower patients to take complete self-care. The educational resources present in many apps aim to enhance the self-care management skills of patients and motivate users.

Diet & Lifestyle Optimization

The diet & lifestyle optimization segment is anticipated to grow at a notable rate in the diabetes management apps market during the upcoming period due to the efforts to empower patients with self-monitoring and tracking of their food and carbohydrate intake, blood glucose, and weight. Mobile Health applications give nutritional recommendations and diabetes education. They enhance communication and professional support through data sharing and remote coaching.

Which Segment by Technology/Mode of Action Dominated the Diabetes Management Apps Market in 2025?

The mobile & web platforms segment dominated the market in 2025, with a revenue share of 35%, owing to the increased focus on real-time patient self-management and data collection. The web platforms facilitate clinician-led remote patient monitoring and detailed data analysis. They provide clinical decision support and conduct detailed review and analysis of data.

The AI & machine learning-based analytics segment is predicted to grow at a rapid rate in the diabetes management apps market during the studied period due to their assistance in personalized treatment plans, automated insulin delivery systems, and early warning systems. They enable smart monitoring, data analysis, and lifestyle and dietary management. They help in risk assessment, screening complications, and enhancing patient engagement.

Why did the Individual Patients/Consumers Segment dominate the Diabetes Management Apps Market in 2025?

The individual patients/consumers segment dominated the market in 2025, with a revenue share of 50%, owing to seamless communication with healthcare providers, data-driven decision-making, and self-monitoring benefits offered by digital health applications. They help people with informed decision-making, education, and support. They serve as convenient and powerful tools that improve long-term health outcomes.

The pharmaceutical & biotech companies segment is predicted to grow at a rapid rate in the diabetes management apps market during the studied period due to the increased focus on improving medication adherence and outcomes, real-world data collection, and accelerating R&D. The partnerships between pharmaceutical companies and digital health startups aim to leverage technology and expertise. The improved R&D helps to design more targeted medications.

North America dominated the market in 2025, owing to the rising diabetes population, a supportive healthcare system, and policies. In December 2024, the American Diabetes Association (ADA) announced that it had been selected as the winner for the 2024–2025 Amazon Web Services IMAGINE Grant for Nonprofits for using technologies to solve the most powerful challenges in the world. In November 2025, the Pan American Health Organization (PAHO) launched new resources on the occasion of World Diabetes Day to strengthen the diagnosis, treatment, and control of diabetes in primary healthcare, further expanding the diabetes management apps market.

The Trump Administration partnered with Big Tech to introduce a health data tracking program. The initiative will also focus on diabetes and weight management, digital tools such as QR codes and apps, and conversational AI. Recently, Senseonics, situated in Maryland, USA, signed an MoU with Ascensia Diabetes Care to accelerate the commercialization and distribution of a glucose monitor named Eversense 365.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to high smartphone and internet penetration and the growing focus on self-management. The Asian Pacific countries, like India, Singapore, South Korea, Indonesia, and Taiwan, have launched government programs involving collaborations among private tech and healthcare companies. These initiatives focus on integrating devices and apps into national healthcare systems to encourage the massive growth of the diabetes management apps market.

In October 2024, the Watershed Development Fund (WDF), the World Health Organization (WHO), and the Government of India collaborated through a national project to strengthen global non-communicable disease (NCDs) care. India’s healthcare startups focus on adopting AI and wearables to help manage the country’s disease crisis.

Europe is expected to grow at a notable rate in the market in 2025, led by the growing adoption of connected devices, demand for remote healthcare, and increased digital health literacy. The European Union and the European Commission run EU4Health projects that work on diabetes prevention, further expanding the diabetes management apps market. In June 2025, IBM and Roche launched innovative solutions to support people dealing with diabetes in their daily routine with AI-enabled glucose predictions.

In October 2025, Diamontech, situated in Germany, secured EUR 12 million to transform diabetes management with needle-free technology. Germany built a national system for reimbursement of digital health applications for diabetes management. The country focuses on application inclusion, app delisting, and program evolution.

| Sr. No. | Name of the Company | Headquarter | Latest Update |

| 1 | Roche | Vienna, Austria | In September 2025, Roche expanded AI-enabled Accu-Chek SmartGuide CGM by integrating the mySugr app across Asia Pacific, Europe, and Latin America. |

| 2 | Teladoc Health | Purchase, New York | Teladoc Health introduced a diabetes management program to offer personalized support from certified diabetes education and care specialists. |

| 3 | Omada Health | San Francisco, California, U.S. | In August 2025, Omada Health reported revenue of $61 million for the second quarter. |

| 4 | Azumio Inc. | Palo Alto, California, USA | Azumio Inc. is committed to creating next-generation health applications with its AI-powered solutions. |

| 5 | One Drop | New York City, USA | One Drop improved productivity for workers with type 2 diabetes. |

| 6 | Beat Diabetes | Dubai, United Arab Emirates | In October 2025, Beat Diabetes, the Gurugram-based nutritionist, introduced 9 veggies that control blood sugar and fight insulin resistance. |

| 7 | Glooko | Palo Alto, California, USA | In October 2025, Glooko made efforts to easily sync health data and fitness for better diabetes management. |

| 8 | Dexcom | San Diego, California, U.S.A | In September 2025, Dexcom Inc. issued a correction for G7 apps and ONE+ apps due to errors in software design. |

| 9 | Abbott | Chicago, Illinois, USA | Abbott moved forward to advance diabetes care through technology and nutrition. |

| 10 | Medtronic | Dublin, Ireland | In May 2025, Medtronic reported its intent to separate its diabetes business. |

By Product Type

By Deployment Type

By Application

By Technology/Mode of Action

By End-User

By Region

January 2026

January 2026

January 2026

December 2025