February 2026

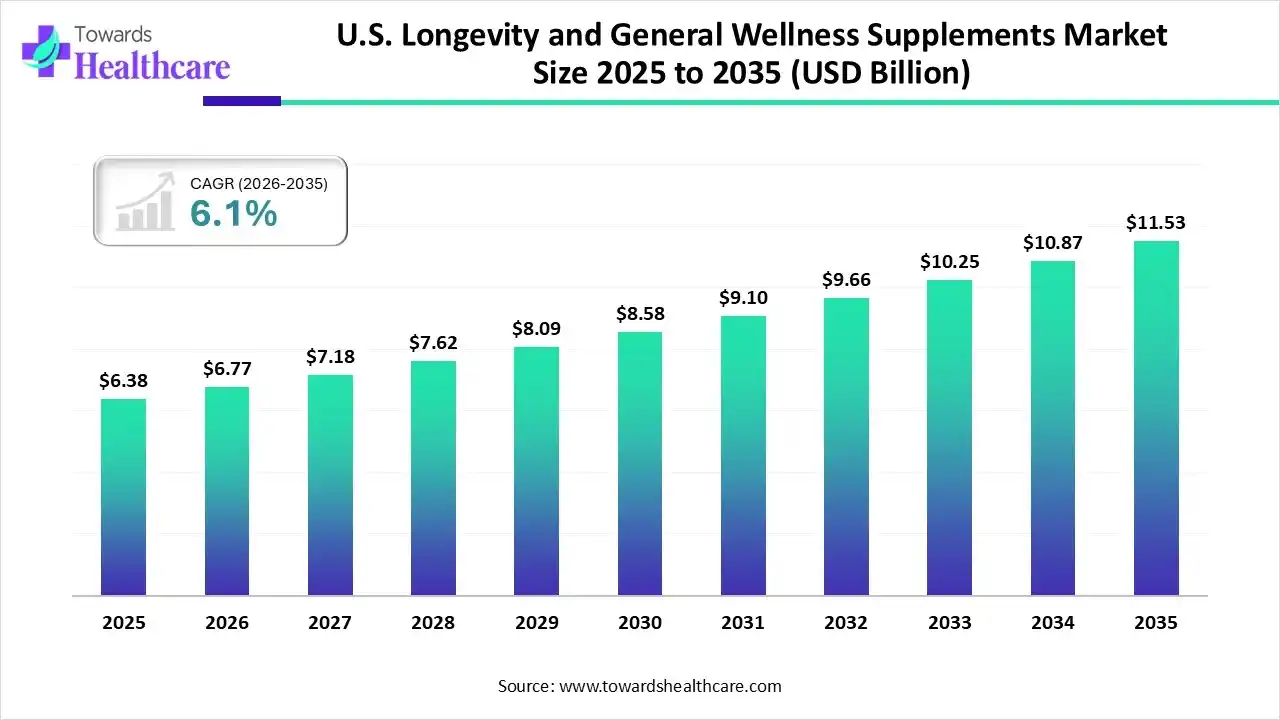

The U.S. longevity & general wellness supplements market size is expected to be worth around USD 11.53 Billion by 2035, from USD 6.38 billion in 2025, growing at a CAGR of 6.1% during the forecast period from 2026 to 2035.

The U.S. longevity & general wellness supplements market is experiencing robust growth, driven by growing research and development activities, shifting trend towards nutraceuticals, and increasing awareness of health & wellness. People are becoming increasingly aware of cellular health and, therefore, take necessary measures to promote healthy aging. Technological advancements, such as wearable devices, help patients keep track of their vital signs continuously.

| Key Elements | Scope |

| Market Size in 2026 | USD 6.77 Billion |

| Projected Market Size in 2035 | USD 11.53 Billion |

| CAGR (2026 - 2035) | 6.1% |

| Leading Region | North America |

| Market Segmentation | By Application, By Type |

| Top Key Players | Life Extension, NOVOS, AdvaCare Pharma, ProHealth Longevity, NOW Foods, Nature’s Bounty, Elysium Health, Thorne, Niagen Bioscience |

The U.S. longevity & general wellness supplements market encompasses the curation, production, and distribution of supplements to support longevity and wellness among individuals. These supplements range from antioxidant-rich botanicals to advanced nutraceutical blends to support healthy aging, cellular vitality, and overall wellness. Some common examples of supplements include creatine, curcumin, magnesium, resveratrol, taurine, and vitamin D.

Artificial intelligence (AI) and machine learning (ML) algorithms provide unprecedented tools for analyzing complex biological data and suggesting measures to promote healthy aging. They monitor the calories and food intake of individuals, enabling them to make necessary changes. They also aid researchers in developing personalized medicines based on their biological conditions. AI-based robotics and automated monitoring systems significantly improve elderly care, lifestyle interventions, and clinical trials, demonstrating the potential to extend both healthspan and lifespan.

Which Application Segment Dominated the U.S. Longevity & General Wellness Supplements Market?

The general wellness supplements segment held a dominant position in the market in 2025, due to the growing demand for preventive health. Certain government and private bodies conduct wellness programs to reduce elevated health risks like blood pressure, glucose, and cholesterol. Focusing on general wellness enables individuals to augment lifespan, boost immune function, and improve mental health. It is estimated that approximately 55% of Americans are regular users of dietary supplements.

Longevity Supplements

The longevity supplements segment is expected to grow at the fastest CAGR in the market during the forecast period. The growing awareness of enhancing life expectancy among the general public boosts the segment’s growth. According to the Centers for Disease Control and Prevention (CDC), the average life expectancy rate of Americans is 78.4 years. Thus, people rely on supplements to increase longevity. Numerous studies have demonstrated the role of multivitamins and mineral supplements in longevity.

Which Factors Govern the U.S. Longevity & General Wellness Supplements Market?

The increasing need for preventive health, the rising disposable income, and favorable government support are major factors that govern market growth in the U.S. The region has a well-established clinical trial infrastructure, enabling researchers to assess the biological role of supplements on humans. As of 8th January 2025, 5 trials related to longevity supplements and 19 trials related to general wellness supplements were registered in the U.S.

The U.S. government has launched the “Healthy People 2030” initiative to improve health and well-being over the next decade. Moreover, Gen Zs and millennials account for over one-third (36%) of the total adult population in the U.S., driving more than 41% of annual wellness spend, primarily due to the burgeoning prioritization of wellness. According to a McKinsey survey on 3,700 people in November 2024, more than 30% of respondents considered aging prevention.

Patient support & services refer to conducting wellness programs to promote awareness of functional medicine practices.

| Companies | Headquarters | Offerings |

| Life Extension | Florida | Its science-based anti-aging supplements can help promote youthful cellular health and longevity by providing the nutritional support the body needs. |

| NOVOS | New York | NOVOS creates evidence-based formulas for long-term wellness through its longevity supplements and anti-aging solutions. |

| AdvaCare Pharma | Wyoming | It is the manufacturer of AdvaLife longevity supplements, scientifically formulated to support healthy aging and vitality. |

| ProHealth Longevity | California | It creates high-quality anti-aging supplements to restore health and regenerate functions through the aging process. |

| NOW Foods | Illinois | Its supplements offer an affordable and effective way to get the daily recommended intake of vitamins, minerals, and nutrients essential for optimal health. |

| Nature’s Bounty | New York | Its herbal supplements offer plant-based wellness support with high-quality ingredients designed to enhance a healthy lifestyle |

| Elysium Health | New York | It offers a longevity starter pack, Basis pack (NAD+ supplement for cellular aging), and Matter (tri-vitamin complex for brain aging). |

| Thorne | South Carolina | It offers a wide range of supplements for anti-aging and longevity, including CoQ10 and Hawthorn. |

| Niagen Bioscience | California | The company provides Niagen, which is one of the most advanced, scientifically researched NAD+ precursors, to restore aging. |

By Application

February 2026

February 2026

February 2026

February 2026