January 2026

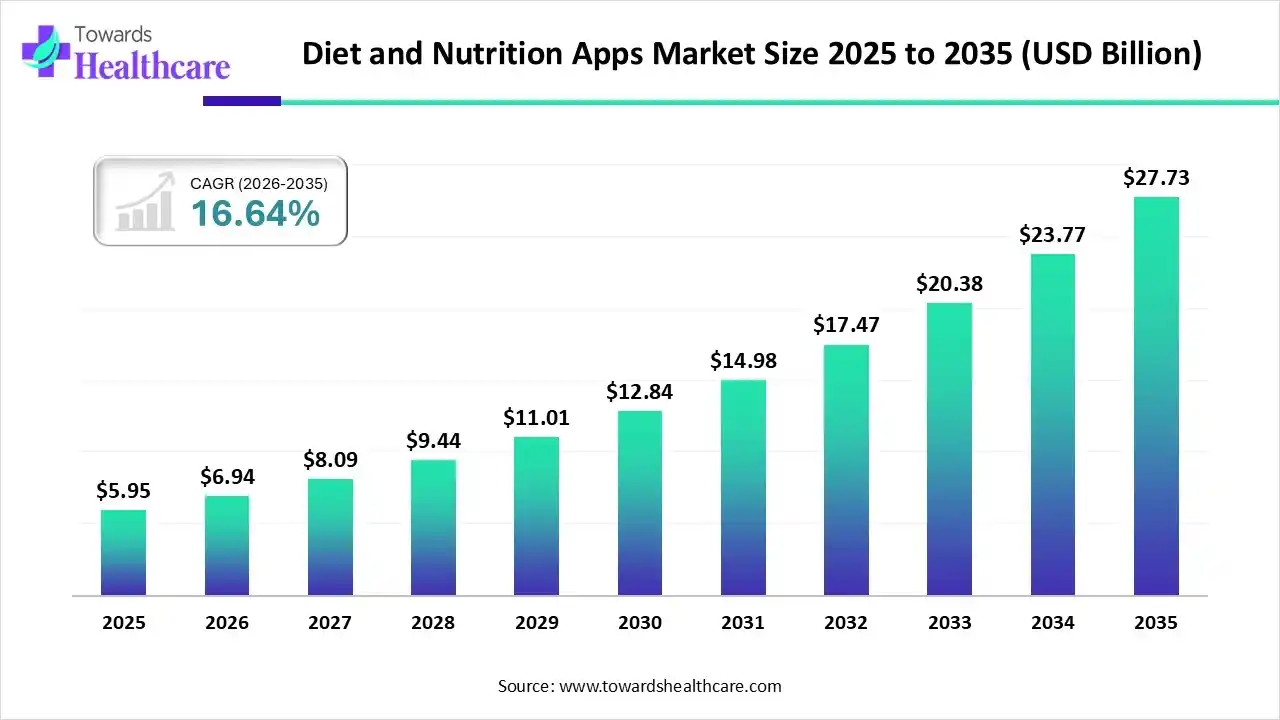

The global diet and nutrition apps market size was estimated at USD 5.95 billion in 2025 and is predicted to increase from USD 6.94 billion in 2026 to approximately USD 27.73 billion by 2035, expanding at a CAGR of 16.64% from 2026 to 2035.

The diet and nutrition apps market is growing steadily, driven by rising health awareness, lifestyle diseases, and widespread smartphone adoption. These apps offer calorie tracking, personalized meal plans, and fitness integration. Increasing demand for preventive healthcare, AI-based personalization, and digital wellness solutions continues to support strong global market expansion.

| Key Elements | Scope |

| Market Size in 2026 | USD 6.94 Billion |

| Projected Market Size in 2035 | USD 27.73 Billion |

| CAGR (2026 - 2035) | 16.64% |

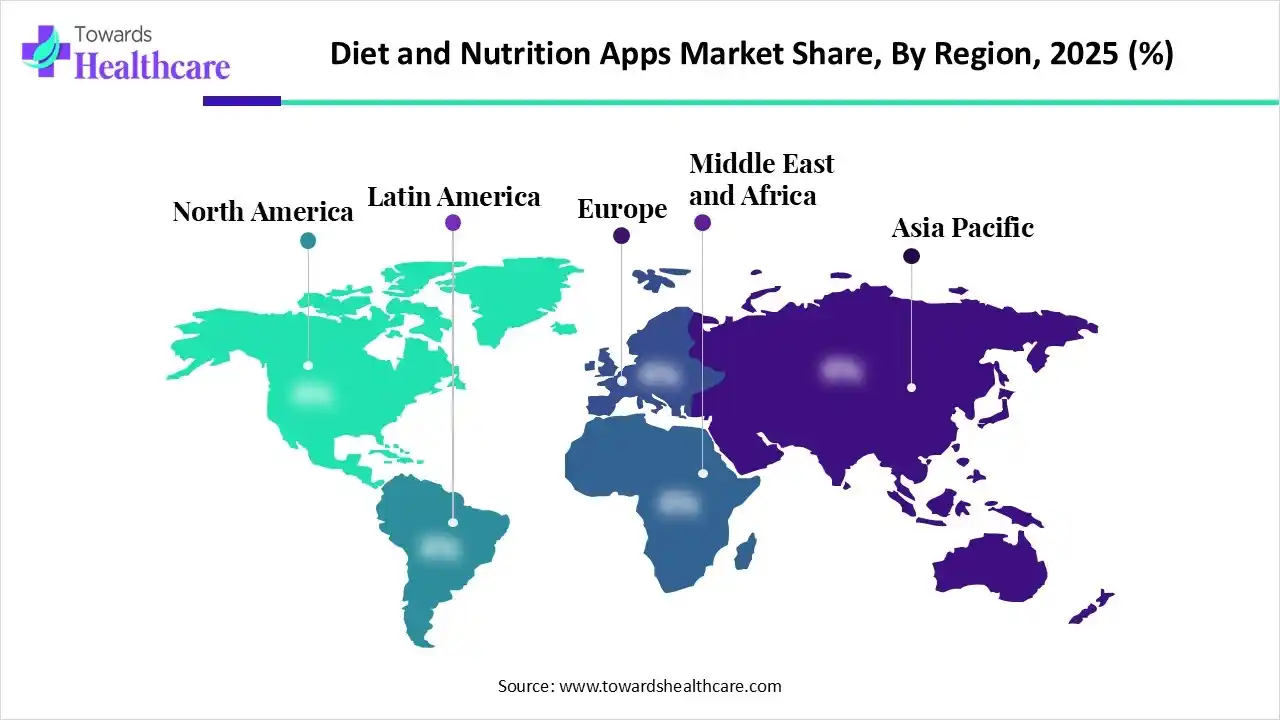

| Leading Region | North America |

| Market Segmentation | By Platform, By Service, By Deployment Type, By Region |

| Top Key Players | PlateJoy LLC, YUMMLY, Lifesum AB, Ate, MyNetDiary Inc., Noom, Inc, SPOKIN, INC, Ovia Health, MyFitnessPal, Inc., MyPlate Calorie Cunter |

Diet and nutrition apps are digital tools that help users track food intake, manage nutrition, and achieve health goals through personalized insights and meal planning.

The diet and nutrition apps market is growing due to rising health consciousness, increasing obesity and lifestyle-related diseases, and widespread smartphone adoption. Demand for personalized diet plans, AI-driven insights, fitness integration, and preventive healthcare solutions, along with convenient remote health management and growing interest in wellness-focused lifestyles, continues to drive market expansion globally.

Artificial intelligence (AI) can significantly affect the diet and nutrition apps market by enabling personalized meal plans, real-time dietary recommendations, and predictive health insights. AI improves user engagement through smart tracking, behavior analysis, and integration with wearable devices, making apps more accurate, interactive, and effective in supporting long-term health and wellness goals.

AI-powered recommendations and meal planning will redefine user experiences, tailoring diets to individual health data, preferences, and goals for more effective and engaging diet management.

Seamless syncing with wearables and health ecosystems will allow real-time tracking of nutrition, activity, and biomarkers, creating holistic wellness insights.

Future apps will expand beyond calorie counting to include mental health, lifestyle coaching, and chronic disease prevention, aligning with broader preventive healthcare trends.

Why Did the iOS Segment Dominate in the Market in 2025?

In 2025, the iOS segment held the largest share of the diet and nutrition apps market due to higher user spending, strong adoption of premium health apps, and seamless integration with Apple Health and wearable devices. iOS users show greater willingness to pay for subscriptions, while Apple’s robust data privacy, ecosystem reliability, and advanced analytics capabilities further support developer innovation and user trust.

Android

The Android segment is expected to grow at the fastest CAGR due to its large global user base, especially in emerging markets. Wider smartphone penetration, affordability of Android devices, and increasing internet access are driving adoption. Additionally, the availability of free and low-cost diet and nutrition apps, multilingual support, and easier app accessibility further accelerate growth across diverse demographic groups during the forecast period.

What made the Paid (in-app purchase) Segment Dominant in the Market in 2025?

The Paid (in-app purchase) segment led the diet and nutrition apps market due to growing demand for personalized meal plans, advanced analytics, and expert-led guidance. Users increasingly prefer premium features such as AI-driven recommendations, ad-free experiences, and integration with wearables. Rising health awareness and willingness to invest in long-term wellness solutions further support the dominance of paid subscription and in-app purchase models.

Free Services

The free services segment is expected to grow at a significant rate due to increasing adoption among cost-sensitive users and first-time app users. Easy access to basic features such as calorie tracking and meal logging attracts a broad audience. Additionally, ad-supported models, freemium strategies, and rising smartphone penetration in emerging markets further drive the growth of free diet and nutrition apps.

How Does the Smartphone Segment Dominate the Market in 2025?

The smartphone segment dominated the diet and nutrition apps market and is expected to grow at the fastest CAGR due to widespread smartphone adoption and constant user accessibility. Smartphones enable real-time food tracking, personalized notifications, and seamless integration with wearables. Rising mobile internet penetration, improved app functionality, and the convenience of managing nutrition on-the-go continue to drive strong growth during the forecast period.

North America dominates the diet and nutrition apps market due to high health awareness, widespread smartphone usage, and strong adoption of digital health solutions. The region has a high prevalence of obesity and lifestyle-related diseases, driving demand for nutrition management apps. Additionally, advanced healthcare infrastructure, higher disposable income, early adoption of AI-based wellness technologies, and the presence of leading app developers support continued market leadership.

U.S. Sets the Pace: Leading Revenue Growth in Diets and Nutrition Apps 2025

The U.S. led the market due to high health consciousness, strong smartphone penetration, and widespread adoption of digital wellness solutions. Rising obesity and lifestyle-related issue increased demand for personalized diet and fitness apps. Additionally, high disposable income, advanced healthcare infrastructure, and early adoption of AI-powered nutrition technologies contributed to capturing the largest revenue share.

Asia Pacific is expected to grow at the fastest CAGR in the diet and nutrition apps market, due to rising smartphone penetration, increasing health awareness, a growing middle-class population, rising urbanization, expanding internet access, and the population. Rapid urbanization, expanding internet access, and the popularity of digital wellness solutions drive demand for diet and nutrition apps. Additionally, governments' focus on preventive healthcare and rising interest in fitness and healthy lifestyles accelerate market growth across the region.

India on the Fast Track: Surging Growth in Diet and Nutrition Apps

India is anticipated to grow at a rapid CAGR due to rising smartphone adoption, increasing health consciousness, and growing awareness of preventive healthcare. The popularity of affordable digital wellness solutions, expanding internet penetration, and the influence of social media and fitness trends are driving the demand for diet and nutrition apps. Young, tech-savvy consumers further accelerate market growth in the country.

Europe is expected to grow at a notable CAGR in the diet and nutrition apps market, due to increasing health awareness, rising lifestyle-related disorders, and strong adoption of digital health solutions. The demand for personalized nutrition, AI-driven diet recommendations, and integration with wearables drives market expansion. Supportive government initiatives, high smartphone penetration, and growing interest in preventive healthcare and wellness apps further boost growth across European countries.

UK Sees Soaring Demand for Diet and Nutrition Apps

The UK is anticipated to grow at a rapid CAGR due to increasing health awareness, rising prevalence of lifestyle-related diseases, and high smartphone adoption. Growing demand for personalized nutrition plans, AI-driven diet tracking, and integration with wearable devices fuels market growth. Additionally, strong government support for digital health initiatives and a tech-savvy population contribute to the rapid adoption of diet and nutrition apps.

| Companies | Headquarters | Offerings |

| PlateJoy LLC | Fort Mill, South Carolina | Personalized meal planning and nutrition platform providing customized meal plans and shopping lists based on user lifestyle and goals. |

| YUMMLY | California, U.S. | A discovery and personalization app that delivered curated recipes and nutrition insights. |

| Lifesum AB | Stockholm, Sweden | Offers personalized food tracking, nutrition insights, meal planning, and healthy eating guidance for weight loss and wellness. |

| Ate | New Jersey, U.S. | Focuses on mindful eating and photo-based food journaling. |

| MyNetDiary Inc. | New Jersey, U.S. | Provide calorie and nutrition tracking, meal logging, and personalized diet insights. |

| Noom, Inc | New York, U.S. | Combine behavior-change psychology with diet and weight-management tools. |

| SPOKIN, INC. | Illinois, U.S. | Offers food allergy-focused diet recommendations, safe recipes, and dietary support. |

| Ovia Health | Massachusetts, U.S. | Provides women’s and family health support, including personalized nutrition and health tracking. |

| MyFitnessPal, Inc. | California, U.S. | Features an extensive food database, calorie/macro tracking, and fitness integration. |

| MyPlate Calorie Cunter | New York, U.S. | Offers calorie and exercise tracking, basic meal logging, and nutrition goals. |

By Platform

By Service

By Deployment Type

By Region

January 2026

January 2026

January 2026

January 2026