January 2026

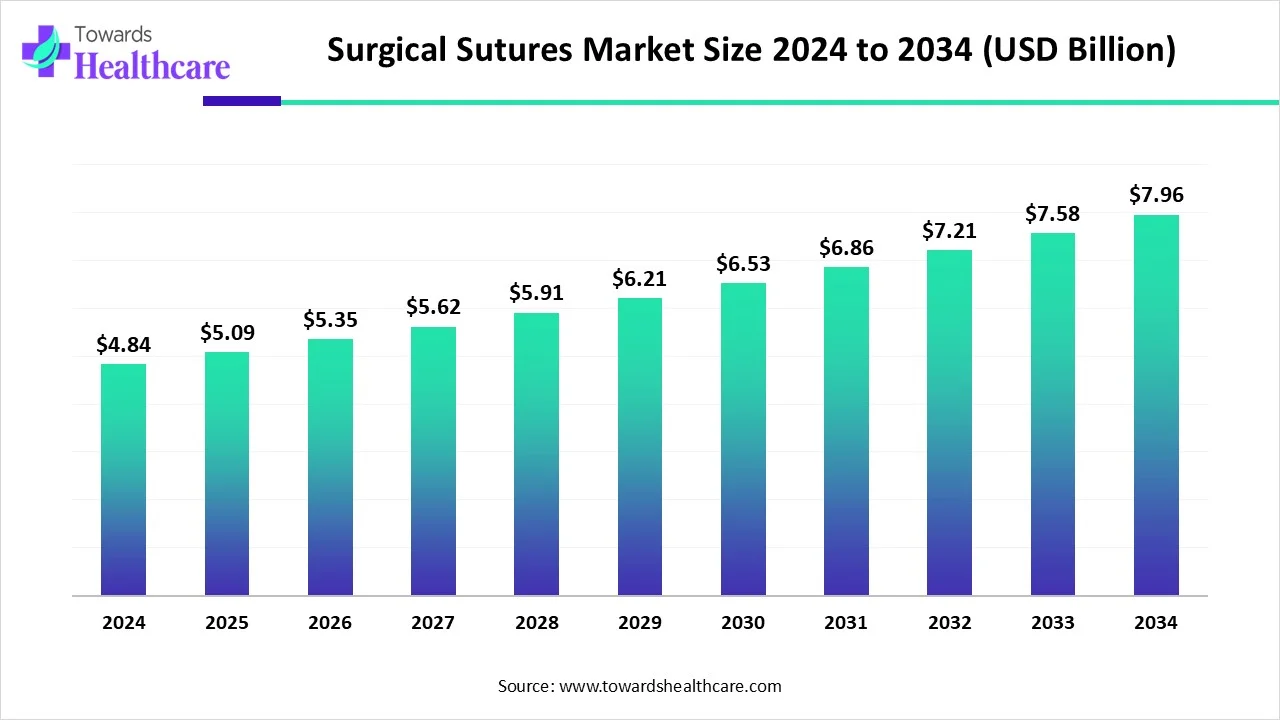

The global surgical sutures market size is calculated at USD 4.84 in 2024, grew to USD 5.09 billion in 2025, and is projected to reach around USD 7.96 billion by 2034. The market is expanding at a CAGR of 5.14% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 5.09 billion |

| Projected Market Size in 2034 | USD 7.96 billion |

| CAGR (2025 - 2034) | 5.14% |

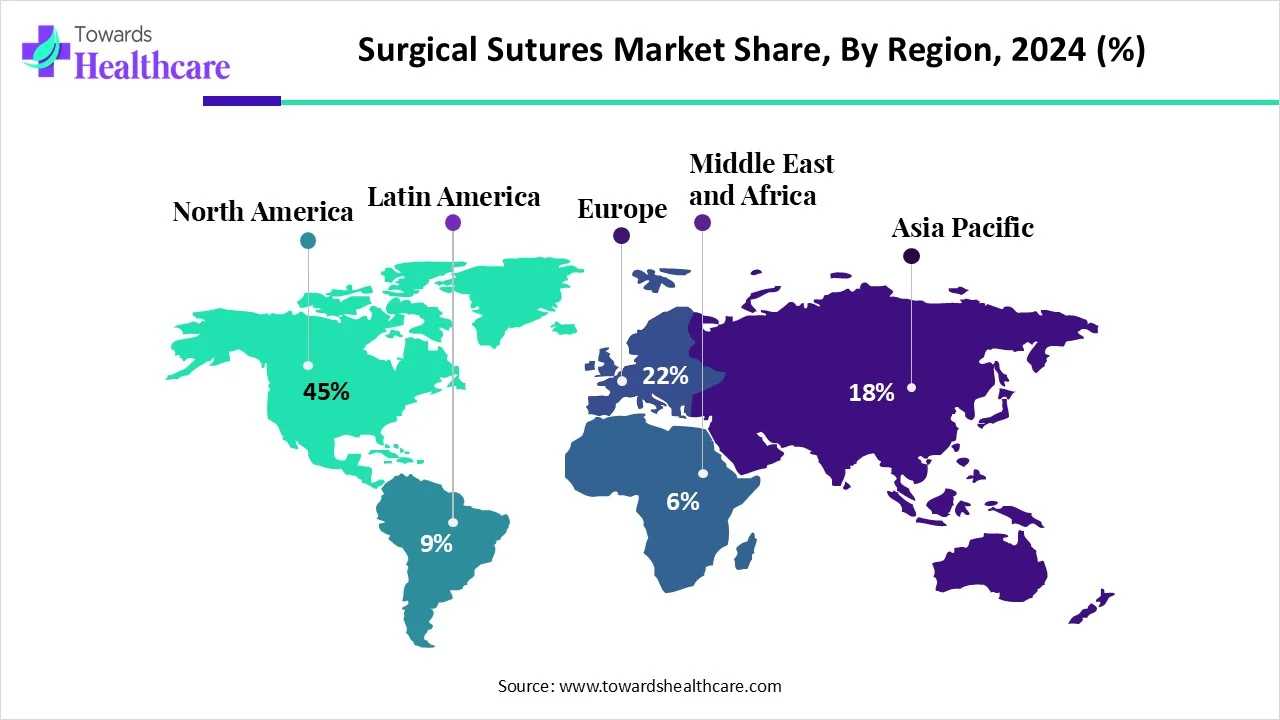

| Leading Region | North America share by 45% |

| Market Segmentation | By Type, By Filament, By Application, By Region |

| Top Key Players | B. Braun Melsungen AG, Ethicon (Johnson & Johnson), Medtronic, Smith & Nephew, Surgical Specialties Corporation, Teleflex Incorporated, Unisur Lifecare, Healthium Medtech, Dolphin Sutures |

Surgical sutures are also known as stitches, which are made from sterile threads employed by doctors and surgeons to close wounds and clasp the body tissues after injury or surgery. Whereas, the growth of the surgical sutures market is influenced by the rising geriatric population, boosting surgical approaches volumes, and technological advancements in the surgical domain. Primarily, the emerging minimally invasive methods demand specialized sutures made for tiny incisions and increasing maneuverability. Furthermore, to improve patient results and decrease the infection risk, researchers and manufacturers are developing novel suture designs with new materials possessing biodegradable sutures and sutures with antibacterial properties.

AI has a major role in the market as it allows the rising production efficiency, optimizing suture quality, and promoting technological advancements in surgical approaches. Integration of robotics and machine learning supports rapid production and more efficient operations, lessens human error, and reduces production expenses. AI can be utilized in designing suture and material composition, which enhances patient outcomes, particularly in minimally invasive surgeries. Also, AI can track supply chain, estimate trends, leading to rising novel management and resource allocation.

An Aging Population and the Increasing Number of Surgical Procedures

In 2025, an aging population associated with various chronic diseases like cancer, diabetes, and cardiovascular conditions is impacting on market along with accelerating the number of surgical procedures as well. Numerous novel surgical approaches coupled with advanced technologies, such as minimally invasive surgeries, like laparoscopy, are widely used, providing benefits like tiny incisions and rapid healing.

Competitive Wound Care Products and Substitute Wound Closure Approaches

Globally, the development and easy accessibility of advanced wound care products, like foam and compounded dressings, are affecting the growth of the surgical sutures market. In addition to this, substitute wound closure approaches, including staples, tissue adhesives, and hemostats, are being used to replace conventional sutures in specific surgical segments.

Maximized Adoption of Minimally Invasive Surgical Techniques

Minimally invasive procedures (MIPs) are often used in small wounds and specialized instruments to carry out surgical methods with minimum disturbance to the tissue area, providing advantages like less pain, scarring, and rapid healing. Laparoscopy, endoscopy, and arthroscopy are widely used. Also, emerging innovations in suture materials, like biodegradable and bioabsorbable options, are influencing the growth of the surgical sutures market.

By type, the absorbable segment held the major share in 2024 and is expected to grow at the fastest CAGR during the forecast period. These are usually made from materials like collagen or synthetic polymers, which are highly used in deep tissue closure or in areas where experiencing difficulties for suture removal. They are impelled by the rising demand for minimally invasive surgeries and advancements in suture materials. Novel innovations are added in suture materials like antimicrobial coatings and increased tensile strength, which are driving the growth of the surgical sutures market.

By filament, the multifilament segment led the market in 2024 and is predicted to grow fastest over the projected period. The multifilament is generally employed in complex surgeries such as intestinal surgery, due to its high tensile strength and reliability. Moreover, they are used with coating to reduce friction and the probability of infection.

By application, the cardiovascular surgery segment dominated the market in 2024. Nowadays, cases of cardiovascular diseases are growing, which increases the number of surgeries, ultimately impacting the growth of the surgical sutures market. More often, cardiovascular surgeries demand sutures with specific characteristics, including high strength, less tissue responsiveness, and firm closure capabilities.

By application, the orthopedic surgery segment is estimated to grow at the fastest CAGR in the projected timeframe. Recently, rising cases of orthopedic conditions, such as arthritis, and aging populations require high interventions, which leads to a rise in several orthopedic surgical procedures. These orthopedic procedures demand surgical sutures, which include joint replacements, fracture repairs, and ligament surgeries, influencing the growth of the surgical sutures market. In sports, many cases of soft tissue damage, injuries affecting tendons require surgical procedures, resulting in the growth of the market.

North America held the largest share by 45% in 2024. In North America, the healthcare system has been developed with well well-established infrastructure, coupled with advanced surgical techniques are mainly driving the growth of the market. Moreover, rising advanced and specialized surgical facilities are contributing to an increase in the number of surgical procedures, with enhanced demand for surgical sutures.

In the US, the growing instances of cardiovascular diseases, cancer, and orthopedic diseases in the rising geriatric population are leading factors for the growth of the market. In geriatric populations, there is a high possibility of joint replacement and hip fractures, requiring advanced surgical approaches, which is driving the market growth.

Canada is experiencing significant growth due to the progress of technological developments of novel suture materials, which raises the precision, safety, and efficacy of surgical approaches. Along with this, enhanced accessibility to healthcare facilities and awareness of advanced treatments are encouraging for surgical sutures.

Asia Pacific is anticipated to grow fastest in the upcoming years. In Asia-Pacific, an aging population is the most important concern, because this population is facing a greater number of chronic diseases, like in China and India. These concerns are influencing the growth of the market by rising demand for beneficial advanced surgical sutures and wound closure technologies.

China has been experiencing significant growth due to enhanced aging population with chronic diseases and rising technological advances in the surgical domain. Minimally invasive surgeries and other advances in surgical techniques are fueling the growth of the market.

For instance,

In India, several factors are propelling the growth of the market, including of rising geriatric population, an increased number of incidents of chronic diseases, and enhanced applications of advanced surgical technologies. Moreover, an increasing volume of surgical procedures is demanding surgical sutures, which is impacting growth.

For instance,

The market growth in Europe is driven by factors like elevated awareness among healthcare professionals and patients about the significance of sutures in avoiding hurdles. Furthermore, accelerated investments in healthcare infrastructure and services in Europe are putting the ultimate growth of the medical device market, including sutures.

The growing geriatric population, increasing surgical approaches, and rising advances in surgical techniques are boosting demand for advanced surgical sutures. This results in the elevated number of surgeries, and emerging technologies are accelerating the expansion of the market.

In the UK, primarily, growth has been influenced by developments of innovative materials such as antimicrobial and biodegradable sutures. Along with this, single-use and automated suturing devices elevate effectiveness in surgeries, minimize the risk of infection, and assist in rapid recovery.

Latin America is considered to be a significantly growing area in the surgical sutures market, due to the increasing number of surgeries and growing research activities. The rising prevalence of chronic disorders and the growing geriatric population contribute to market growth. The rapidly expanding medical tourism sector and the presence of key players facilitate the use of surgical sutures. The burgeoning healthcare sector and the demand for quality treatment also augment the market.

Companies like Atramat, Sutumed Corp Mexico, and Coats Group plc provide high-quality surgical products in Mexico. Mexico is preferred for medical tourism due to its favorable geographical location and affordable treatment costs. Approximately 1.2 million foreign medical travelers visit Mexico annually.

Brazil is a global leader in medical tourism due to advanced healthcare facilities, skilled medical professionals, and affordable pricing, attracting thousands of international patients annually. There are more than 6,500 hospitals in Brazil. Companies like Bioline Fios Cirúrgicos Ltd and MZF4 Medical are major manufacturers of surgical sutures in Brazil.

In May 2024, the global investment firm KKR acquired Healthium Medtech Ltd., which is the chief Indian medical devices company, from Apax Partners. The announced agreement was done at approximately Rs 7000 crore, which has a special purpose vehicle possessed by KKR-managed acquiring the govern of Healthium. KKR head of India Private Equity, Akshay Tanna, said that Healthium has a robust track record of delivering quality products and has a broader distribution matrix both in India and across the globe. Source- (Fortune India)

By Type

By Filament

By Application

By Region

January 2026

January 2026

January 2026

January 2026