February 2026

The third-party medical institutions market size was valued at US$ 254.88 billion in 2025 and is projected to grow to 274.15 billion in 2026. Forecasts suggest it will reach approximately US$ 528.27 billion by 2035, registering a CAGR of 7.56% during the period.

The global third-party medical institutions market size is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2024 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry. The demand for third-party institutions is increasing due to the growing senior population. This population constantly needs medical support. However, hospitals are fully occupied most of the time, and hence, not everyone can visit the hospital for healthcare purposes and seek medical attention from third-party institutions.

| Key Elements | Scope |

| Market Size in 2026 | USD 274.15 Billion |

| Projected Market Size in 2035 | USD 528.27 Billion |

| CAGR (2026 - 2035) | 7.56% |

| Leading Region | North America |

| Market Segmentation | By Type, By Application, By Region |

| Top Key Players | Steriguard Medical, Julikang, Aecssd Medical, Laoken Medical, LabCorp, Sonic Healthcare, Quest Diagnostics, Unilabs, Sterigenics, STERIS, DaVita, Baxter, Fresenius |

The third-party medical institutions market comprises healthcare providers that operate independently outside the significant medical systems and hospitals. Third-party service providers include laboratories, clinics, rehabilitation centers, and imaging centers. These institutions provide various healthcare services in specialized areas or multiple areas of healthcare. The institutions also collaborate with major healthcare systems to mitigate the gaps in medical services and provide support in various areas such as care options, diagnostics, and treatment. The market is growing significantly due to the growing number of patients. It becomes hectic and complicated for hospitals to handle all the services associated with patient care; hence, third-party medical institutions support hospitals to provide quality care.

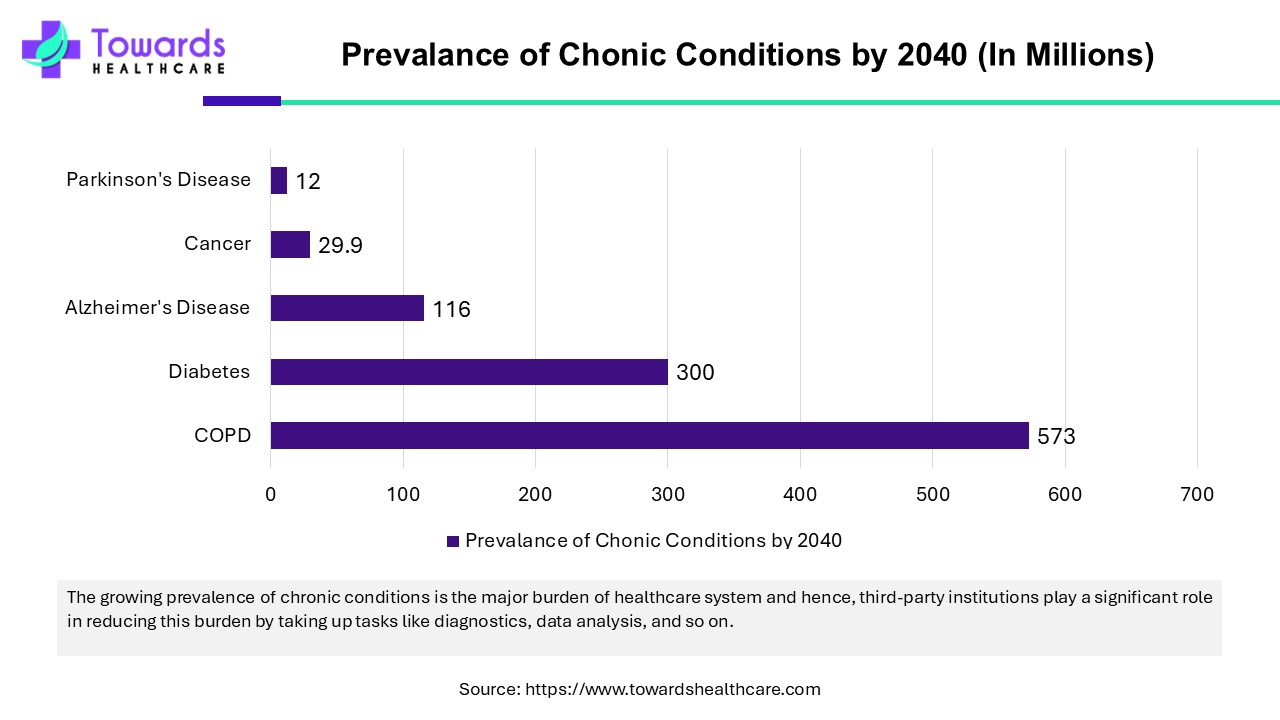

Chronic conditions pose a huge burden on healthcare resources and hospitals. Chronic conditions require continuous monitoring and treatment to avoid emergency situations. The growing elderly population and unhealthy lifestyles are the major causes of the growing number of patients with chronic conditions. Third-party medical institutions play a significant role in supporting major medical systems by providing test results, data analysis, and treatment options. Many third-party institutions specialize in one area and are capable of providing better services to highly skilled professionals.

The third-party medical institutions market faces challenges because of the continuous changes in healthcare policies. The institutions need to strictly stick to the rules and guidelines provided in the new policies to avoid any legal issues, which becomes a challenge in the long run.

Why Did the Technical Medical Third-Party Institutions Segment Dominate in the Third-Party Medical Institutions Market?

By type, the technical medical third-party institutions segment dominated the third-party medical institutions market. These institutions provide various services in the medical industry but services are not directly related to healthcare. The services include maintenance & calibration of medical equipment, technical support, and data analysis. Such institutions are in high demand because they reduce healthcare costs by maintaining equipment and other functions.

Clinical Medical Third-Party Institutions

By type, the clinical medical third-party institutions segment is expected to grow at the fastest rate during the forecast period. These institutions are becoming popular as they provide specialized clinical services. Services provided by these institutions include medical testing, clinical trials, data analysis, and specialized medical procedures. They play a crucial role in providing support to hospitals to improve the quality of care.

How Hospital Segment Dominated the Third-Party Medical Institutions Market?

By application, the hospital segment held the largest share of the market in 2023. Many patients visit hospitals daily, and many tests are conducted daily to diagnose diseases and develop proper treatment options. It becomes hectic for hospital staff to handle everything on their own, and hospitals collaborate with third-party institutions to run tests, analyze data, and provide treatments.

North America Dominated the third-party medical institutions market. North America is home to advanced healthcare infrastructure, technological advancements, and highly skilled healthcare professionals, all of which contribute to the market’s growth. There are several other factors that add up to the growth, including government initiatives, collaboration among key players, investments by government & organizations, and growing awareness among people. The U.S. and Canada have contributed significantly to the growth.

U.S. Third-Party Medical Institutions Market Trends

The U.S. is the major shareholder in the third-party medical institutions market due to the presence of a highly advanced medical system, health insurance companies, and partnerships between different organizations. Another major factors that contribute to the market’s growth is the growing prevalence of diseases like obesity, cancer, diabetes, COPD, cardiovascular diseases, etc. Also, there is a strong presence of healthcare laboratories in the U.S. that are responsible for providing top-quality care. According to the Centers for Disease Control and Prevention, there are more than 330,000 CLIA-certified laboratories in the U.S. responsible for conducting 14 billion tests annually. Around 70% of medical decisions depend on these laboratory tests.

Canada Third-Party Medical Institutions Market Trends

Canada held the second-largest share of the third-party medical institutions market in 2023. Canada has a strong presence of third-party institutions such as physicians' offices and diagnostic laboratories. According to the Government of Canada, there were 99,142 physicians' offices and 4,215 medical & diagnostics laboratories in Canada. The government is also investing significantly in the life science sector to improve healthcare services.

For instance,

Asia Pacific is expected to grow at the fastest rate during the forecast period. Asia Pacific is advancing in healthcare systems and technology. Governments and various organizations are taking necessary steps to promote the growth of the third-party medical institutions market in Asia Pacific. The region consists of the largest population, which puts the burden on the healthcare sector. Therefore, third-party institutions are important for addressing healthcare needs. The region also has a growing number of various diseases, including diabetes, cancer, COPD, and infectious diseases.

India Third-Party Medical Institutions Market Trends

India is a significant contributor to the market’s growth because there has been a growing number of policies and investments by the government and organizations to improve the country's healthcare system. For instance, the number of DMCs has increased by 80% from 2014 (13583) to 2023 (24449). In the last decade, there have been 6196 new molecular diagnostic laboratories, and TB treatment centers’ numbers increased from 127 in 2014 to 792 in 2022. Apart from this, the ABPM-JAY scheme launched by the India Government is also promoting people's use of healthcare services. For instance, under this program, there has been a total of 6.11 crore hospital admissions accounting for Rs. 78,188 crores, out of which 1.7 crore admissions occurred in 2023, which accounted for Rs. 25,000 crores.

For instance,

Europe is expected to grow significantly in the third-party medical institutions market during the forecast period. The third-party medical institutions in Europe are adopting various technological advancements that improve the services they provide to patients. This helps in the development of new diagnostic and treatment options at affordable prices. Thus, this promotes the market growth.

UK Third-Party Medical Institutions Market Trends

The influence of third-party medical institutions in the UK is increasing due to the convenient services they provide to the population. Furthermore, this attracts the aging population, which in turn, enhances the patient outcomes. Due to the advanced services offered by the third-party medical institutions in Germany, patients are preferring them. Moreover, the services are cost-effective as well as can help in remote monitoring, which increases patient adherence and satisfaction.

South America is expected to grow significantly in the third-party medical institutions market during the forecast period, due to growth in the healthcare sector. At the same time, the growing outsourcing trend is also increasing their collaborations, where the affordable services are promoting the market growth.

Brazil Third-Party Medical Institutions Market Trends

Due to expanding healthcare in Brazil, the demand for third-party medical institutions is increasing. The growing chronic diseases and outsourcing trends are also increasing their demand, where the growing innovations are also being supported by government investments.

MEA is expected to grow significantly in the third-party medical institutions market during the forecast period, due to increasing outsourcing trends. The growing healthcare infrastructure and chronic disease rates are increasing the demand for accurate diagnostic and effective treatment options, driving their collaboration, and enhancing the market growth.

Saudi Arabia Third-Party Medical Institutions Market Trends

Rising demand for specialized services in Saudi Arabia is increasing the demand for third-party medical institutions. At the same time, affordable outsourcing and growing healthcare investments are leading to their collaboration to accelerate R&D activities and expand the diagnostic networks.

By Type

By Application

By Region

February 2026

January 2026

January 2026

January 2026