January 2026

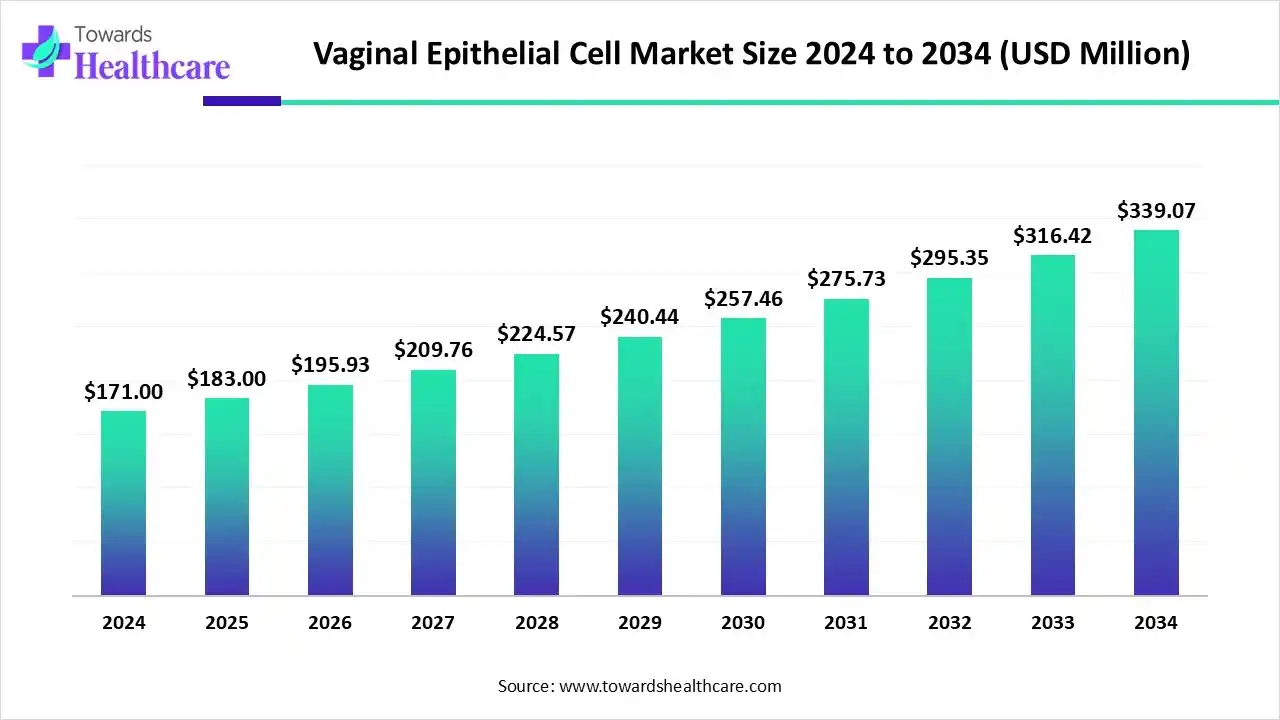

The global vaginal epithelial cell market size is calculated at US$ 171 million in 2024, grew to US$ 183 million in 2025, and is projected to reach around US$ 339.07 million by 2034. The market is expanding at a CAGR of 7.06% between 2025 and 2034.

Around the globe, a rise in bacterial vaginosis (BV), vulvovaginal candidiasis (VVC), and sexually transmitted infections (STIs) cases, and expanding R&D activities are mainly fostering the application of vaginal epithelial cells. Along with this, the global vaginal epithelial cell market is fostering the utilization of primary human cells in toxicity and efficiency testing of feminine-care and pharmaceutical products. Moreover, researchers are exploring 3D organotypic tissue models (e.g., EpiVaginal), cell culture media, and custom services.

| Table | Scope |

| Market Size in 2025 | USD 183 Million 2025 |

| Projected Market Size in 2034 | USD 339.07 Million 2034 |

| CAGR (2025-2034) | 7.06% |

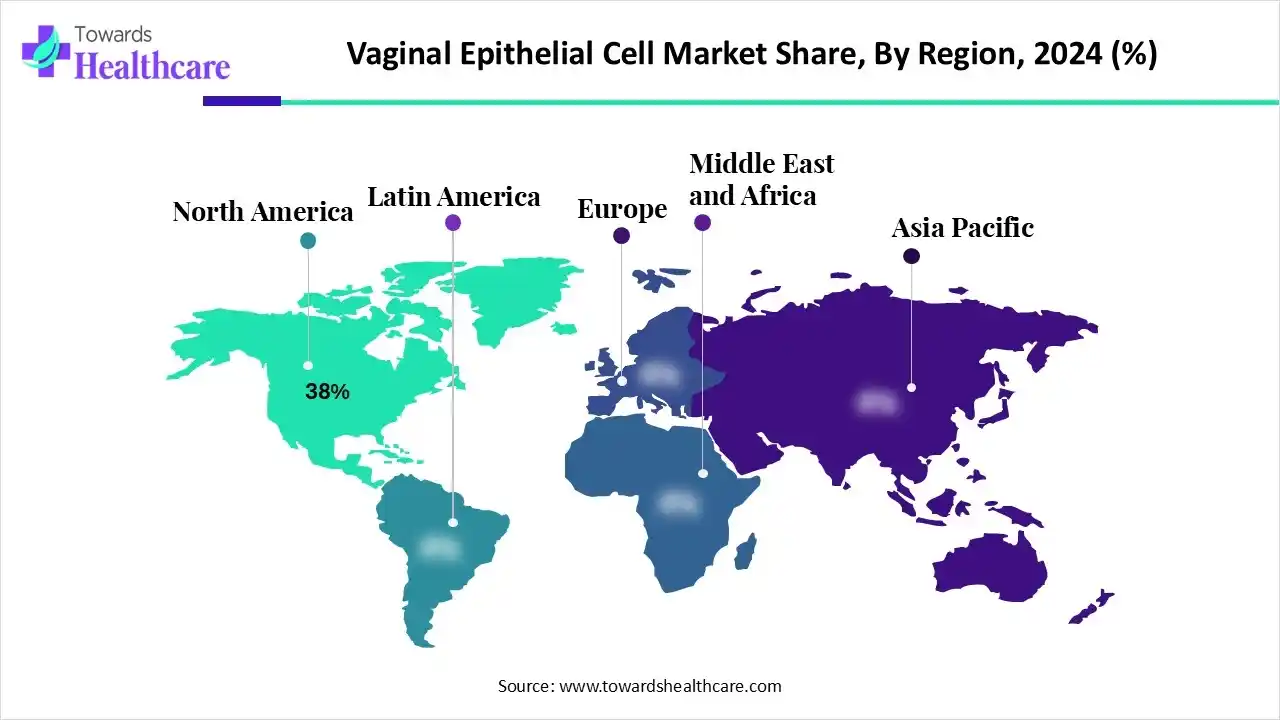

| Leading Region | North America by 38% |

| Market Segmentation | By Product/Cell Type, By Application, By Product Format/Offering, By End User, By Service Type, By Region |

| Top Key Players | Lifeline Cell Technology, Celprogen Inc., BioIVT, PromoCell GmbH, ScienCell Research Laboratories, Advanced BioMatrix Inc., Stemcell Technologies Inc., AcceGen Biotech, Cell Biologics Inc., Epithelix SARL, AMS Biotechnology, Visikol Inc, Cell Systems Corporation, GenScript ProBio, Regional CROs and Primary-Cell Suppliers in China, Japan, and India |

The vaginal epithelial cell market encompasses the supply, development, and use of human vaginal epithelial cells and reconstructed vaginal tissue models for applications in safety testing, drug discovery, infectious disease and microbiome research, tissue engineering, and diagnostic R&D. Growth is driven by increasing adoption of 3D organotypic models, expanding research on vaginal microbiome and mucosal immunology, and rising use of primary human cells in toxicity and efficacy testing of feminine-care and pharmaceutical products. It includes primary vaginal epithelial cells (cryopreserved or plated), immortalized cell lines, 3D organotypic tissue models (e.g., EpiVaginal), cell culture media, and custom services such as donor sourcing, cell banking, and assay development.

| Publication | Details |

| Vaginal microbes alter epithelial function. | In May 2024, revealed that vaginal bacteria, specifically Lactobacillus crispatus and Gardnerella vaginalis, majorly alter the transcriptome and epigenome of cervicovaginal epithelial cells. |

| Immune responses to Candida albicans | In May 2025, a study investigated how diverse probiotic Lactobacillus species modulate the vaginal epithelial and immune response to a Candida albicans infection. |

| Cytotoxicity of heavy metals | In May 2025, a conference publication studied the cytotoxicity of lead on an immortalized vaginal epithelial cell line. |

In 2025, diverse technological advances are impacting the respective market, such as vaginal organoids. This breakthrough utilizes a method that mimics the structure and function of native vaginal tissue, enabling the study of disease progression and the testing of novel drug candidates. As well as organ-on-a-chip models are also exploring the microenvironment of the vaginal mucosa and its interaction with microorganisms. Moreover, this technology facilitates controlled testing of possible treatments and a better understanding of host-microbiome dynamics in health and disease.

In 2024, the primary human vaginal epithelial cells segment held nearly 48% share of the market. This kind of cell offers the biology of the female reproductive tract, with a normal diploid karyotype, and is unchanged in cancer-derived or immortalized cell lines. Recently, researchers have been fostering tissue-engineered constructs from VECs and other cells, and the development of new bioreactor systems.

Moreover, the 3D reconstructed vaginal tissues/organotypic models segment will expand fastest. The increasing demand for sophisticated, human-relevant models for drug and product testing, lowered dependence on animal testing, and the expanding field of personalized medicine are impacting the segmental growth. In this era, the market is utilizing advanced bioinks, with a major contribution of tissue-specific decellularized extracellular matrix (ECM), in the creation of scaffolds with optimized biocompatibility and printability.

In 2024, the safety & toxicology testing segment accounted for nearly 28% share of the vaginal epithelial cell market. Primarily, various cells, including VK2 E6/E7, are employed for preliminary cytotoxicity testing with assays, such as the MTT reduction assay. The latest study explored the use of immortalized vaginal epithelial cells in assessing the toxicity and absorption of heavy metals, specifically lead found in consumer products such as tampons.

Whereas the infectious disease & microbiome research segment is predicted to register the fastest growth. A rise in % of vaginal infections, particularly bacterial vaginosis (BV), vulvovaginal candidiasis (VVC), and sexually transmitted infections (STIs), is mainly fueling the overall adoption of VEC in research activities. Alongside, studies are demonstrating that lowered estrogen levels during menopause result in a shift from a lactobacilli-dominant microbiome to a more diverse, anaerobic-rich community. They are using the integrated next-generation sequencing (NGS), proteomics, and metabolomics to offer a detailed, more holistic view of the VEC-microbiome relationship.

The cryopreserved vials segment led with approximately 42% revenue share of the vaginal epithelial cell market in 2024. The segment is mainly driven by the accelerating use in research and drug discovery instead of broader clinical therapy. Nowadays, worldwide researchers are emphasizing the application of vitrification, an ultra-rapid cooling technique that solidifies the cell suspension into a glass-like state, omitting the formation of damaging ice crystals.

During 2025-2034, the 3D tissue inserts/organotypic tissues segment will expand rapidly. A vital catalyst is a rise in demand for physiologically precise in-vitro models, the escalating focus on alternatives to animal testing, and boosting investments in drug discovery for women's health. The widespread organotypic models are employed for high-throughput screening of a broader range of vaginal-care products, such as contraceptives, microbicides, lubricants, and anti-fungal creams, providing a non-animal alternative for studying irritation.

In 2024, the pharmaceutical & biotechnology companies segment held nearly 40% share of the market. These companies are leveraging well-transformed nanoparticle-based therapies, vaginal rings, and 3D organoids to facilitate targeted treatments for reproductive health concerns, such as infections, atrophy, and even certain cancers. Recently, they have stepped into developing a new, nonhormonal approach to restoring vaginal epithelial barrier function and further promoting applications for women on progestin-only contraceptives or post-menopause.

In the future, the cosmetics & feminine-care manufacturers segment is predicted to expand at a rapid CAGR. These facilities are mainly involved in ensuring their intimate care products, especially washes and wipes, are safe and implemented by testing them on engineered vaginal epithelial tissues. In the last year, MyMicrobiome launched a novel standard for intimate care, certifying products as "microbiome-friendly" by ensuring they respect the balance of both the vaginal and vulval microbiomes.

In 2024, the off-the-shelf cell products segment accounted for nearly 55% revenue share of the vaginal epithelial cell market. Ongoing innovations in mucoadhesive and bio-adhesive polymers are highlighting the risk of quicker drug clearance by prolonging the residence time of formulations in the vaginal tract. Moreover, the market is pushing efforts in non-surgical, less-invasive cosmetic and reconstructive procedures, like laser and radiofrequency-based treatments, mainly in cell-based therapies.

On the other hand, the 3D tissue model & assay development services segment will expand rapidly. They have a crucial role in drug discovery, toxicity testing, and studying female reproductive health concerns, such as sexually transmitted infections (STIs) and the vaginal microbiome. The latest innovation "EVATAR" system, is linking various reproductive tissues, particularly the cervix and vagina. Alongside, globe is the globe is facilitating 3D bioprinting is allowing the progress of patient-specific, regenerative solutions.

In 2024, North America held a nearly 38% revenue share of the vaginal epithelial cell market. The region is mainly fueled by the rising awareness of women's health, a high incidence of gynecological disorders, and breakthroughs in diagnostic and treatment technologies. Nowadays, the region is focusing on new biomaterials for regenerative medicine, the role of the microbiome, enhanced diagnostics, and advanced in-vitro modeling.

The US market has been promoting significant steps in technological innovation, especially in organoid development and AI-powered analysis. Furthermore, the leading players in the US are exploring vaginal organoids and single-cell RNA sequencing to allow a detailed understanding of vaginal epithelial cell function and are accelerating demand for these models.

Currently, Canada is promoting its cervical cancer screening programs to employ self-collected vaginal swabs for human papillomavirus (HPV) testing. In the last few months, a study in British Columbia examined vaginal swabs that yielded sufficient DNA for testing germline BRCA mutations, which are associated with an enhanced risk of breast and ovarian cancer. Alongside, they have developed primary HPV testing for cervical screening for those aged 25–69, moving away from cytology.

In the prospective period, the Asia Pacific is anticipated to witness the fastest expansion in the vaginal epithelial cell market. This region is fostering milestone solutions in R&D of in-vitro models, such as those applying vaginal epithelial cells, for reproductive health research and testing. Alongside, many countries, like India, are boosting their focus on escalating awareness of women's health conditions and the significance of early diagnosis and preventive care. Whereas, the developing economies are widely investing in their healthcare systems to raise access to gynecological services and diagnostic tools.

A prominent driver of the market is a rise in point-of-care HPV testing in India, with the faster development in transforming affordable POC tests for Human Papillomavirus (HPV) detection. However, the Truenat HPV-HR assay, implemented by MolBio Diagnostics, is a real-time PCR test to show the results in Hr.

Recently, Chinese researchers unveiled a vaginal epithelial cell membrane-based nanoplatform created to treat and protect against recurrent vulvovaginal candidiasis. The "three-in-one" phototherapeutic decoy strategy demonstrated an innovative approach to treating intravaginal infections. Moreover, researchers have evolved new methods to automatically understand and count epithelial cells and bacteria in vaginal smear images.

The vaginal epithelial cell market comprises isolation from donor tissue or acquisition of immortalized cell lines, subsequent culture, characterization, and application in different in vitro models.

Key Players: ATCC, AcceGen, Freya Biosciences, etc.

It covers major preclinical studies on lab models, cell expansion, tissue engineering with a scaffold, or a product derived from the cells, like extracellular vesicles.

Key Players: Alliance for Clinical Trials in Oncology, University of Wisconsin, Madison, Case Comprehensive Cancer Center, etc.

They are mainly emphasizing underlying conditions that affect the vaginal epithelium, like infections, atrophy, and cancer, along with patient education, including vagina hygiene.

Key Players: ConTIPI Medical Ltd, Alkem Laboratories Limited (India), GlaxoSmithKline (GSK), etc.

In June 2025, Samsung Biologics, a leading contract development and manufacturing organization (CDMO), launched Samsung Organoids, an advanced drug screening service to assist clients in drug discovery and development.

By Product/Cell Type

By Application

By Product Format/Offering

By End User

By Service Type

By Region

January 2026

January 2026

January 2026

January 2026