December 2025

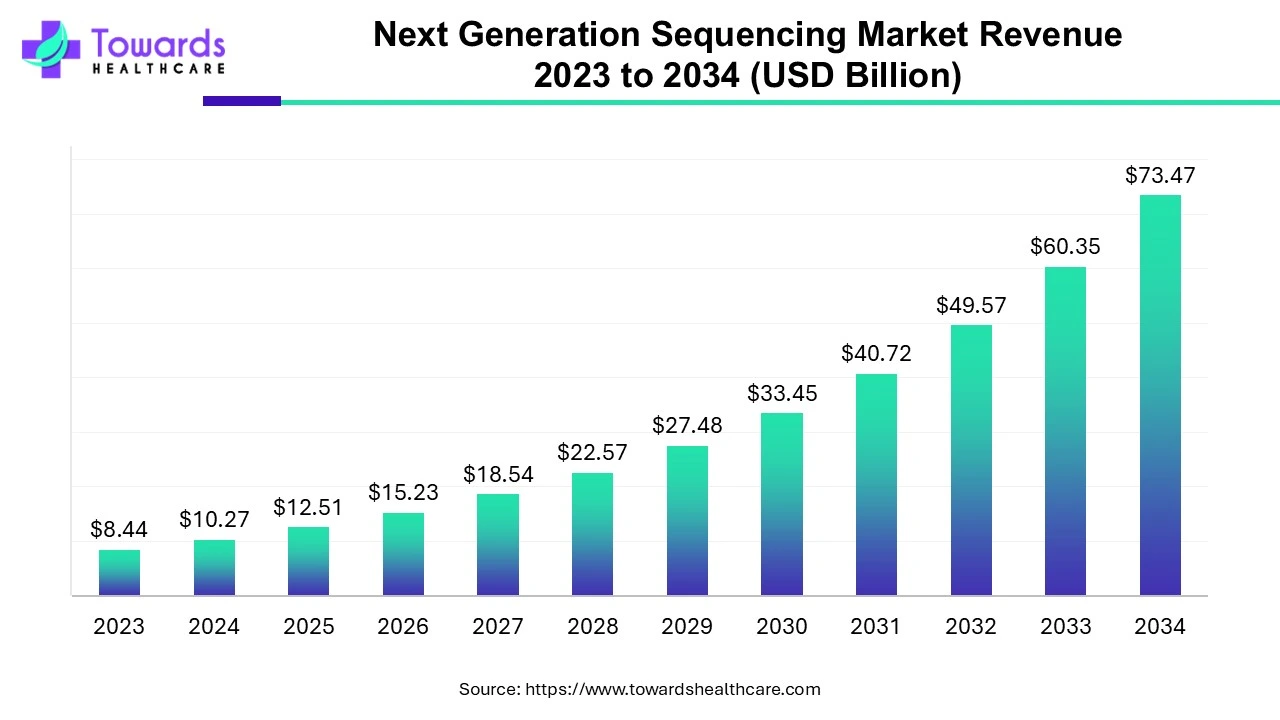

The global next generation sequencing market size is calculated at US$ 10.27 billion in 2024, grew to US$ 12.51 billion in 2025, and is projected to reach around US$ 73.47 billion by 2034. The market is expanding at a CAGR of 21.74% between 2024 and 2034.

The next generation sequencing market deals with products, services, and devices needed for sequencing of genetic materials. The market also encompasses research and development associated with next generation sequencing (NGS). The technique known as next-generation sequencing (NGS) is used to identify the DNA or RNA sequence in order to investigate genetic variation linked to illnesses or other biological phenomena. The biological sciences have undergone a revolution thanks to it, as labs are now able to investigate biological systems and carry out a wide range of applications. Traditional DNA sequencing technologies are unable to provide the depth of information required to answer today's complicated genomics issues. That vacuum has been filled by NGS, which is now a common tool for answering these queries.

The healthcare system is evolving as a result of the widespread application of artificial intelligence (AI), especially deep learning, in many biological contexts today. In NGS-based diagnostics, artificial intelligence (AI) has shown encouraging potential in improving variant calling accuracy, improving variant prediction, and making electronic health record (EHR) systems more user-friendly.

For instance,

Applications in Disease Diagnosis: Hundreds of thousands of genes or entire genomes can be sequenced quickly with NGS. Patient follow-up, prognosis, diagnosis, and treatment decisions have all made extensive use of the sequence variations and mutations found by NGS. Its enormous parallel sequencing capacity opens up new possibilities for precision treatment that is tailored to each patient.

Ethical Challenges: There are aspects of using NGS in clinical and research settings that make it difficult to uphold established ethical standards for safeguarding patients and research participants. NGS produces vast volumes of data and findings with varying levels of established clinical significance. The right procedures for data management, communication, and protection must be decided.

Diagnosis and Treatment of Rare Diseases: Roughly 30 million Europeans, 25–50 million Americans, and 8% of Australians suffer from a rare disease. Because it is difficult to get a precise diagnosis, rare diseases are a major challenge for physicians and contribute to the high expenditures of healthcare around the world. The wide phenotypic spectrum of most genes, the significance of mosaic and de novo mutations, the affordability and speed of genetic diagnosis, the detection of digenic inheritance or the presence of multiple rare diseases in a single patient, and the development of promising new treatments have all been made possible by NGS.

By technology, the target sequencing & resequencing segment dominated the market. This segment dominated as researchers can concentrate their effort, resources, and data analysis on certain areas of interest by employing targeted techniques with NGS. Additionally, targeted techniques can provide significantly better coverage levels, making it possible to identify variations that whole-genome or Sanger sequencing cannot detect since they are rare and more costly.

For instance,

By product, the consumables segment held the largest share of the market and is expected to grow at the fastest rate during the forecast period. Consumables include kits, reagents, chemicals, enzymes, buffers, solutions, catalysts, and other formulations needed for genetic sequencing. With growing applications of NGS, the demand for consumables is also estimated to grow significantly in the future.

By application, the oncology segment held the major share of the market. This segment dominated due to the rising prevalence of cancer and the growing need for screening and early diagnosis of cancers in high-risk individuals. According to projections from the Global Cancer Observatory (GLOBOCAN), 19.3 million incident cases of cancer occurred globally in 2020. It is predicted that the number of cancer cases will rise by 12.8% in 2025 compared to 2020. NGS is used to bulk-sequence tumors and find genetic alterations in tumors, which helps with targeted therapy development and liquid biopsies to track the progression of cancer.

By application, the consumer genomics segment is expected to grow at the fastest rate in the next generation sequencing market during the predicted timeframe. With over 10 million customers now genotyped, the consumer genomics market is developing and gaining traction. Finally, the general public is being exposed to new uses and developments, some of which were unexpected.

By workflow, the sequencing segment was dominant in the market. It is anticipated that the information included in DSVs will retool clinicians through medical DNA sequencing. DSVs with high effect sizes are probably going to be useful in preclinical and early diagnosis, prognostication, and therapeutic customization.

By workflow, the NGS data analysis segment is anticipated to grow as the fastest rate in the next generation sequencing market during 2024-2034. Because Next Generation Sequencing (NGS) technologies are producing previously unheard-of volumes of data in the domains of genomes, transcriptomics, and epigenomics, they have completely transformed bioscience, biotechnology, and medicine. Nevertheless, in order to obtain valuable insights and make practical deductions, the data produced by NGS technologies must be thoroughly examined.

By end-use, the academic research segment dominated the market. This is due to sequencing technologies that are quickly making their way into clinical care and are currently being utilized in research settings. Whole genome sequencing is currently being investigated in trials to determine future dangers and suitable treatments for both healthy and ill populations.

By end-use, the clinical research segment is estimated to grow rapidly in the next generation sequencing market during the forecast period. Clinical research helps us better grasp the role that genes play in the development of certain diseases. Researchers at NHGRI are collaborating with patients and families who have a history of hereditary diseases in order to better understand the genetic components of both common and uncommon disorders and to create new, more efficient diagnostic and therapeutic approaches.

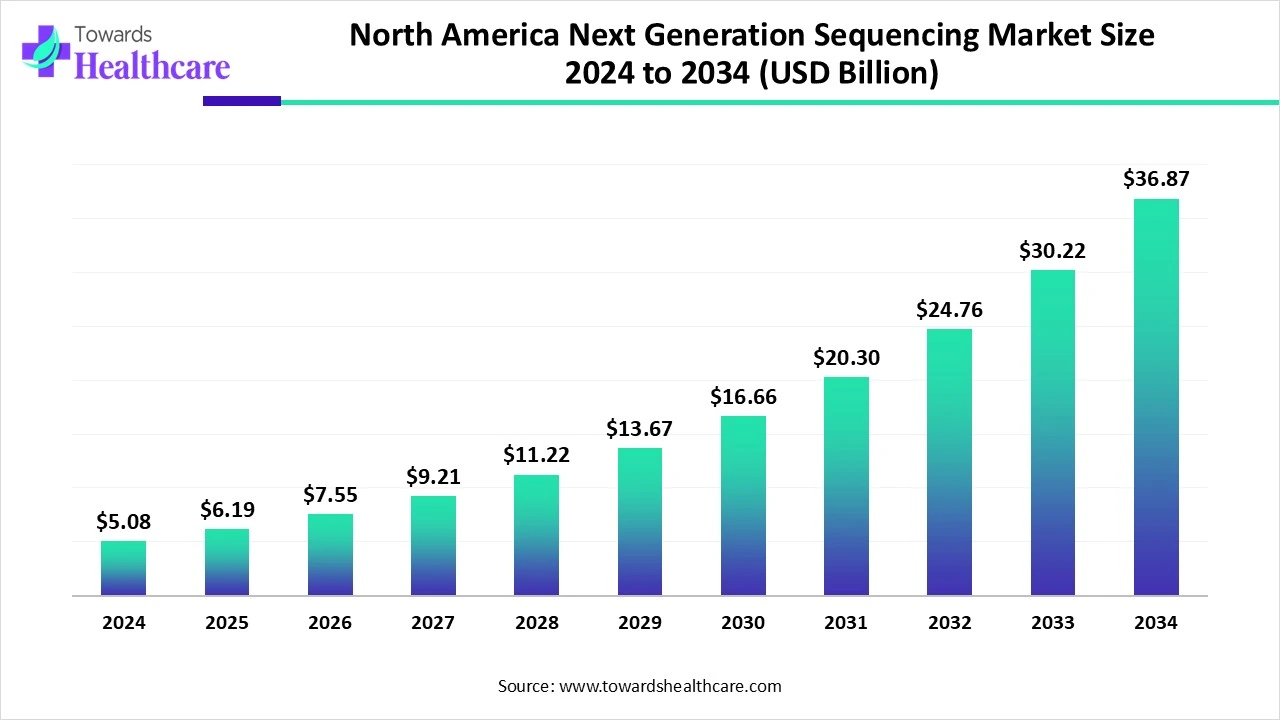

The North American next-generation sequencing market is valued at $5.08 billion in 2024, expected to grow to $6.19 billion in 2025, and projected to reach around $36.87 billion by 2034, with a strong annual growth rate of 21.93% from 2025 onward.

North America held the largest next generation sequencing market share in 2023. The region's broad use of next-generation sequencing technologies is a result of several reasons. These include government support for genomics research, a well-established healthcare system, and the rising incidence of chronic illnesses. The next-generation sequencing market in the region is expected to increase due to the presence of major market participants and easy access to cutting-edge genomic research technology.

Furthermore, thanks to developments in genetic research, falling sequencing technology costs, and the growing use of NGS in personalized medicine, the United States led the North American market in 2023. NGS is transforming diagnostics by offering thorough insights into genetic variants and mutations. This is especially true in oncology, where it makes exact tumor profiling and tailored therapy possible. The market forecast for next-generation sequencing is also being bolstered by the increase in research efforts pertaining to pharmacogenomics, infectious diseases, and genetic disorders.

For instance,

The U.S. Next-Generation Sequencing Market Trends

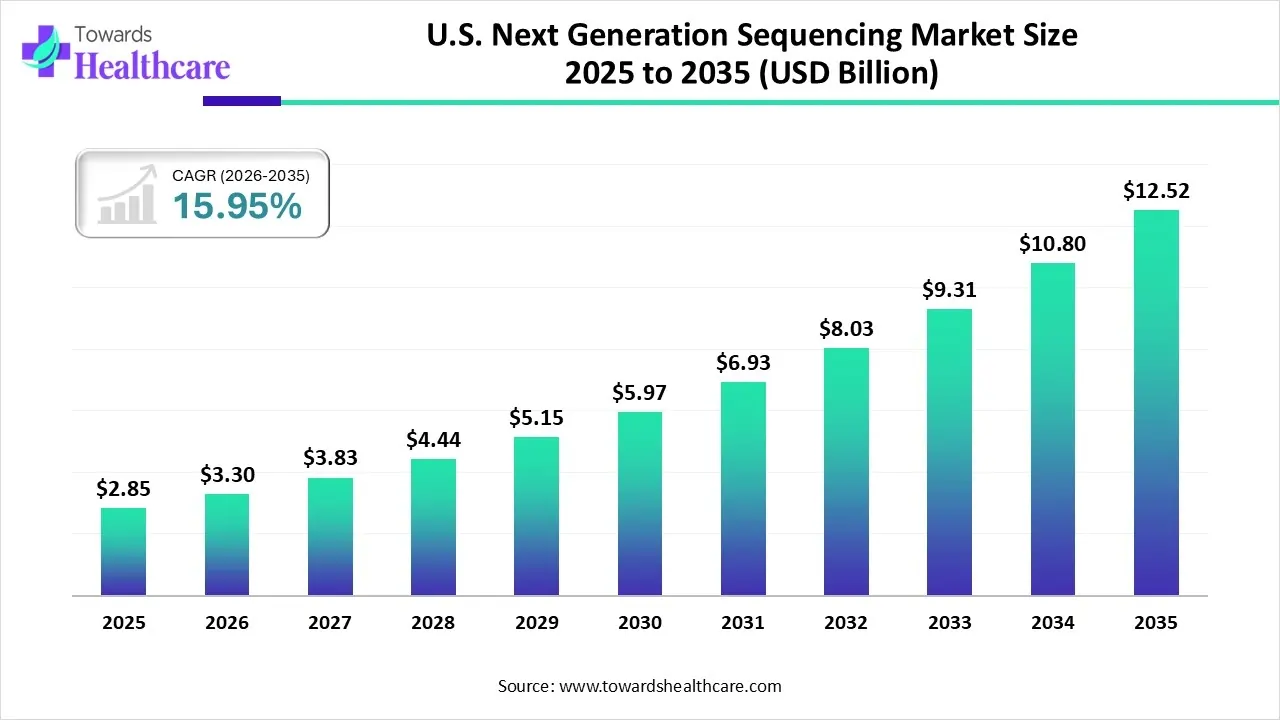

The U.S. next generation sequencing market size is calculated at USD 2.85 billion in 2025, grew to USD 3.3 billion in 2026, and is projected to reach around USD 12.52 billion by 2035. The market is expanding at a CAGR of 15.95% between 2026 and 2035.

The U.S. market is experiencing significant growth due to increased government funding, technological advancements, and the rising demand for personalized medicine. Key initiatives like those from the NIH and innovations such as Illumina’s NovaSeq X, which reduces sequencing costs, are driving market expansion. Additionally, NGS is widely used in oncology for targeted therapies. The growing interest in consumer genomics and continuous improvements in sequencing technology further fuel the market’s growth, positioning the U.S. as a leader in genomic research and clinical applications.

The Canada Next-Generation Sequencing Market Trends

The Canadian market is expanding due to significant government support, including initiatives from Genome Canada, which drive innovation in genomics. Technological advancements in sequencing platforms and bioinformatics tools have improved NGS accessibility and efficiency, spurring adoption in clinical and research settings. NGS is increasingly used in oncology, rare disease diagnostics, and personalized medicine, enhancing patient care. Additionally, Canada’s growing genomics education programs and research institutions are fostering a skilled workforce, further promoting market growth and contributing to the country’s leadership in the field.

Asia Pacific is expected to grow at the fastest rate during the forecast period. Because next-generation sequencing is becoming more and more advanced and cheaper, the number of cancer cases is rising, and next-generation sequencing is being used more and more in cancer research. The next generation technology has been adopted by emerging economies like China, Japan, and India since it is less expensive. Advances in genomics and the creation of various sequencing techniques and tactics have contributed to the decline in sequencing costs in India over time. In addition, India's generation market grew at the fastest rate in the Asia-Pacific area, while China's generation market held the greatest next generation sequencing market share.

In addition to facing public health challenges, including HIV/AIDS, malaria, TB, and other infectious diseases, India is poised to become the third-largest economy in the world by 2030. In India, one in nine people is expected to get cancer in their lifetime, and up to 96 million people are thought to have a rare disease1. Increasing genomics access in India will contribute to the development of health care and the fight against climate change.

The China Next-Generation Sequencing Market Trends

China’s market is growing due to advancements in sequencing technologies and increased demand for precision medicine. With a strong focus on clinical applications like oncology, genetics, and infectious diseases, NGS is increasingly used for early disease detection and personalized treatments. The expansion of domestic companies, such as BGI Genomics, is enhancing the local manufacturing and technology ecosystem, reducing reliance on international suppliers. Additionally, increased government support and investments in biotechnology are driving the widespread adoption of NGS technologies in China.

The India Next-Generation Sequencing Market Trends

India's next-generation sequencing (NGS) market is expanding due to key factors like government initiatives such as the Genome India Project, which aims to map genetic data from 10,000 individuals, enhancing genomic research and personalized medicine. Technological advancements have reduced sequencing costs, making NGS more accessible for clinical and research use. The growing application of NGS in oncology, reproductive health, and infectious diseases is driving its adoption. Furthermore, large-scale genomic studies by institutions like IGIB, including the IndiGen program, are fueling the market's growth.

Europe is expected to grow at a considerable CAGR in the next generation sequencing market in the upcoming period. The rising prevalence of genetic and rare disorders and the increasing investments by government and private organizations drive the market. Several government organizations launch initiatives for screening and early diagnosis of rare disorders. The increasing adoption of advanced technologies to streamline complex genomics research workflows promotes the market. The European Medicines Agency (EMA) regulates the approval of novel diagnostics for various disorders. The growing demand for personalized medicines also enables researchers to study disease progression and identify potential biomarkers using next generation sequencing technologies.

Germany Market Trends

Approximately 4 million people are living with rare diseases in Germany. The German government launched the genomeDE – National Strategy for Genomic Medicine project to integrate genomic medicine into the healthcare sector. The German Network for Personalized Medicine aims to maintain high diagnostic quality and effectively manage side effects.

UK Market Trends

The Huntington’s Disease Association reported that approximately 3.5 million people in the UK suffer from one of over 7,000 rare diseases identified. (Source: https://www.hda.org.uk/news/england-rare-diseases-action-plan-2024/) The UK government launched the “England Rare Diseases Action Plan 2024” to help patients get a final diagnosis faster, increase awareness among healthcare professionals, and improve access to specialist care, treatment, and drugs.

By Technology

By Product

By Application

By Workflow

By End-use

By Region

December 2025

December 2025

January 2026

November 2025