February 2026

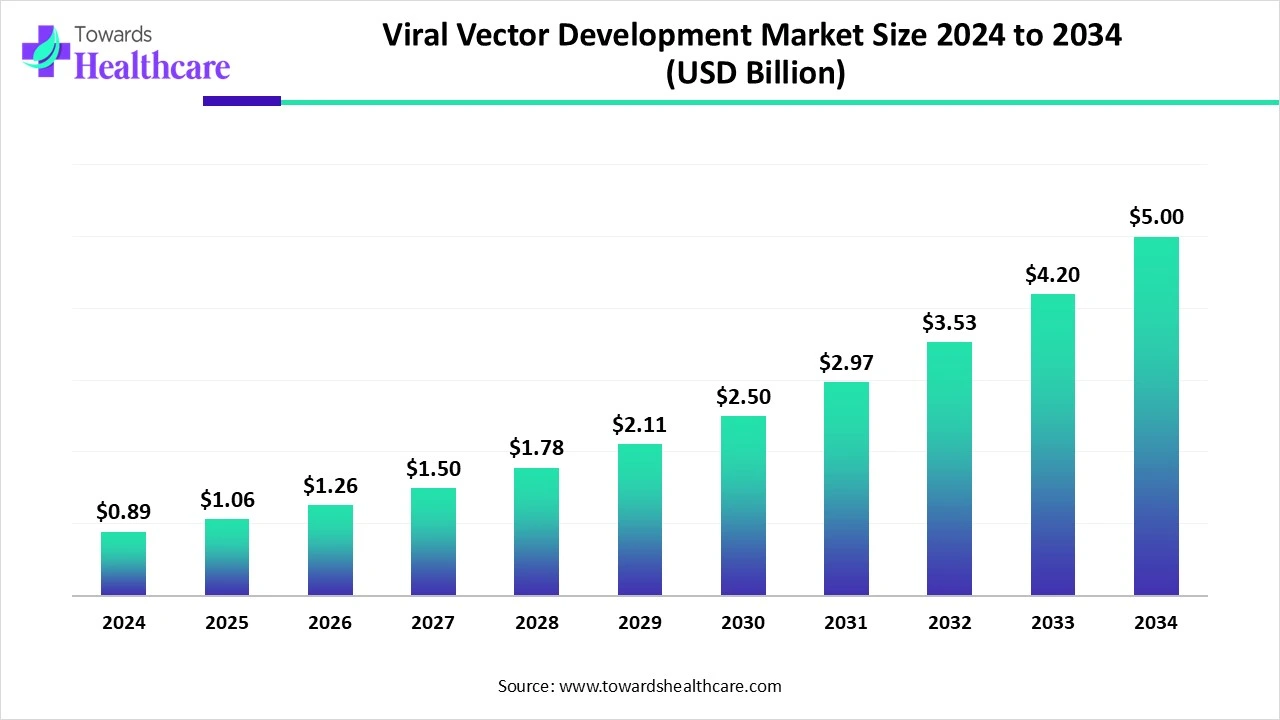

The global viral vector development market size is calculated at US$ 0.89 in 2024, grew to US$ 1.06 billion in 2025, and is projected to reach around US$ 5 billion by 2034. The market is expanding at a CAGR of 18.84% between 2025 and 2034.

The global viral vector development market is developing significantly due to factors including increasing instances of genetic disorders and various cancers, with escalating technological advancements in gene therapy and cancer therapy. Also, accelerating initiatives and funding by governments in R&D of viral vector production and vaccine development is fueling the market growth.

In the future, numerous opportunities will develop, such as in vaccine development against diverse infectious diseases, including HIV, Malaria, Ebola, and, more recently, SARS-CoV-2, and in bioprocessing due to advancements in techniques, such as upstream processing are boosting efficiency and scalability of the production.

| Metric | Details |

| Market Size in 2025 | USD 1.06 Billion |

| Projected Market Size in 2034 | USD 5 Billion |

| CAGR (2025 - 2034) | 18.84% |

| Leading Region | North America |

| Market Segmentation | By Virus, By Expression System, By Application, By End User, By Region |

| Top Key Players | Lonza Group AG, Merck KGaA, Thermo Fisher Scientific Inc., Catalent Inc., WuXi AppTec, FUJIFILM Corporation, Oxford Biomedica. |

The process of designing modified viruses to transfer genetic material into cells, mainly for gene therapy and vaccine development, is termed viral vector development. The global viral vector development market is primarily propelled by the growing several genetic disorders, rising focus on precision medicine, and the developing pipeline of gene therapy candidates. Moreover, it has wide-ranging applications across the development of different cell and gene therapies, cancer therapies, and vaccinology, as well, including COVID-19, cancer, and HIV/AIDS.

In 2025, AI has experienced numerous advancements in other aspects, such as automation and high-throughput screening technologies, which are making it more rapid and efficient in the production and development of viral vectors. Moreover, AI-powered enhancement of manufacturing processes can decrease the expenses of production and allow making gene therapies more approachable and cost-effective as AI algorithms can do the analysis of huge biological datasets, including genomic data, protein structures, and viral vector properties, in the identification of potential candidates for gene therapy, and improve their design.

Rising Instances of Targeted Conditions and Technological Breakthroughs

Around the world, different targeted diseases are growing enormously, including genetic disorders like cystic fibrosis and muscular dystrophy, rising cases of cancer that need immunotherapy, and other concerns, such as infectious diseases and autoimmune disorders, are primarily driving the viral vector development market growth. Besides this, many technological advancements are happening, like novel production platforms, including in development of new cell lines and culture techniques, and developing automated and digital tools in the manufacturing of viral vectors, which enhances process control, reliability, and complete effectiveness with reduced costs.

Requirement of Specialized Infrastructure and Strict Regulatory Considerations

Challenges arising across the viral vector development market growth are the need for specialized facilities and equipment in viral vector production, which may result in high upfront and operational expenditure. Along with this, another challenge is the rigorous guidelines set by regulatory agencies like the FDA and EMA for the development and production of viral vectors, which are increasing the difficulties in the process.

Escalating Applications in gene therapy & vaccine development, and bioprocess

The number of opportunities is developing by using viral vectors, such as viral vectors have major role in delivering genetic materials in gene therapies for different conditions, like metabolic, cardiovascular, muscular, hematologic, ophthalmologic, and infectious diseases, and different types of cancer. As well as viral vectors are broadly employed in vaccine development against diverse infectious diseases, including HIV, Malaria, Ebola, and, more recently, SARS-CoV-2. Furthermore, it has rising opportunities in bioprocessing due to advancements in techniques, such as upstream processing are boosting efficiency and scalability of the production.

By virus, the adeno-associated viral vectors segment held the largest revenue share of the viral vector development market in 2024. As these vectors have a broad target range, ongoing R&D approaches are focused on optimizing AAV vector design, such as capsid engineering and transgene expression control are fueling the further market expansion. Also, numerous AAV-reliant gene therapies have acquired regulatory approvals and are showing potential clinical trial results in spinal muscular atrophy and inherited retinal diseases.

By virus, the retrovirus segment is expected to grow at a notable CAGR during 2025-2035. The segment growth is driven by growing cases and awareness about genetic disorders, which often demand gene therapies in which retroviral vectors are highly employed. Also, accelerating research activities into enhancing retroviral vector design, production approaches, and safety characteristics is propelling further market growth.

By expression system, the transient segment was dominant in the market in 2024. This segment enables a quick and highly flexible approach in viral vector manufacturing and making it ideal for research and early-stage clinical trials.

By expression system, the stable segment is expected to grow rapidly during the forecast period. However, various conditions targeted by gene therapy need long-term gene expression for therapeutic advantage, in which a stable system plays a vital role.

By application, the gene therapy segment dominated the viral vector development market in 2024. Various genetic disorders, such as cystic fibrosis, hemophilia, and a variety of cancer cases, are boosting and demanding for viral vector-based gene therapies. Also, in COVID-19 vaccines, viral vectors showed positive results, which has spurred prospective research and investment in this area, especially for other infectious diseases.

By application, the cancer therapy segment is expected to be the fastest-growing application in the upcoming years. Other factors, along with rising cancer cases, are escalating investments in cancer research and clinical trials, including a focus on gene therapy, and in the modification of immune cells in therapies like CAR-T cell therapy, which is used in cancer treatment, are driving the overall segment and market growth.

By end user, the pharmaceutical & biotechnology companies segment held the highest revenue share of the global viral vector development market in 2024. The segment is driven by the increasing demand for gene therapy in which viral vectors are playing a crucial role, and also their successful application in vaccine development, especially in the COVID-19 pandemic, enhancing the usage of viral vectors in the same approaches.

By end user, the contract research organization (CRO) segment is expected to grow at the fastest CAGR over the projected period. As CROs enable companies to gain specialized knowledge, infrastructure, and economies of scale, minimizing development spending and timelines. Moreover, investments by various pharmaceutical and biotechnology companies in R&D demand for CRO services, as companies look for partners to boost their research programs and bring novel therapies to market faster.

North America held the largest revenue share of the market in 2024. Due to a surge in investments in gene therapy development is majorly impacting the demand for viral vectors. As well as a robust pipeline of these therapy products in clinical trials, particularly in the US and Canada, with this expansion generating major demand for viral vectors.

Along with rising genetic disorder cases, various factors, including growing initiatives by the government and investments in biotechnology and gene therapy research activities, are driving the market growth. Also, an essential support from numerous contract development and manufacturing organizations (CDMOs) for viral vector production and supply is expanding the respective market.

In Canada, progressing research and development processes in biotechnology research, especially in gene therapy, vaccine development, and regenerative therapeutics with robust regulatory support, are propelling demand for viral vectors.

Asia Pacific is expected to be the fastest-growing region during 2025-2034. In ASAP, governments and private entities are primarily investing in healthcare infrastructure and research processes, including the development and adoption of viral vector and plasmid DNA manufacturing technologies. Also, clinical trial areas are developing by using viral vectors in the development of gene therapy is fueling the expansion of the market.

China is experiencing major growth in the market due to a shifting focus towards advanced therapies from biopharmaceutical companies, such as cell and gene therapies, as well as rising innovations and adoption of novel technologies to achieve affordable and scalable viral vector production.

In India, rising cases of cancer, genetic concerns, and infectious diseases are highly demanding for gene therapies in which viral vectors are widely employed. Besides this, expanding strategic collaborations among companies are supporting in manufacturing capacity, simplifying processes, and probably reducing the cost of production is also encouraging the market growth.

Europe is leading in the adoption of advanced bioprocessing technologies, automation, and analytical tools, which accelerate the effectiveness and quality of viral vector production. However, Europe is experiencing significant growth due to regulatory bodies such as the EMA are strongly supporting novel gene therapy products with developed regulatory guidelines.

Numerous applications of viral vectors are increasing, like in vaccinology, cell therapy, and gene therapy are majorly contributing to the market growth. Along with merging investment in the biotechnology area, especially in vaccine and gene therapy development, is also boosting the market.

Several factors, including advancements in genome sequencing, government initiatives, and the emergence of Contract Development and Manufacturing Organizations (CDMOs), are assisting in the expansion of the market.

By Virus

By Expression System

By Application

By End User

By Region

February 2026

January 2026

January 2026

December 2025