February 2026

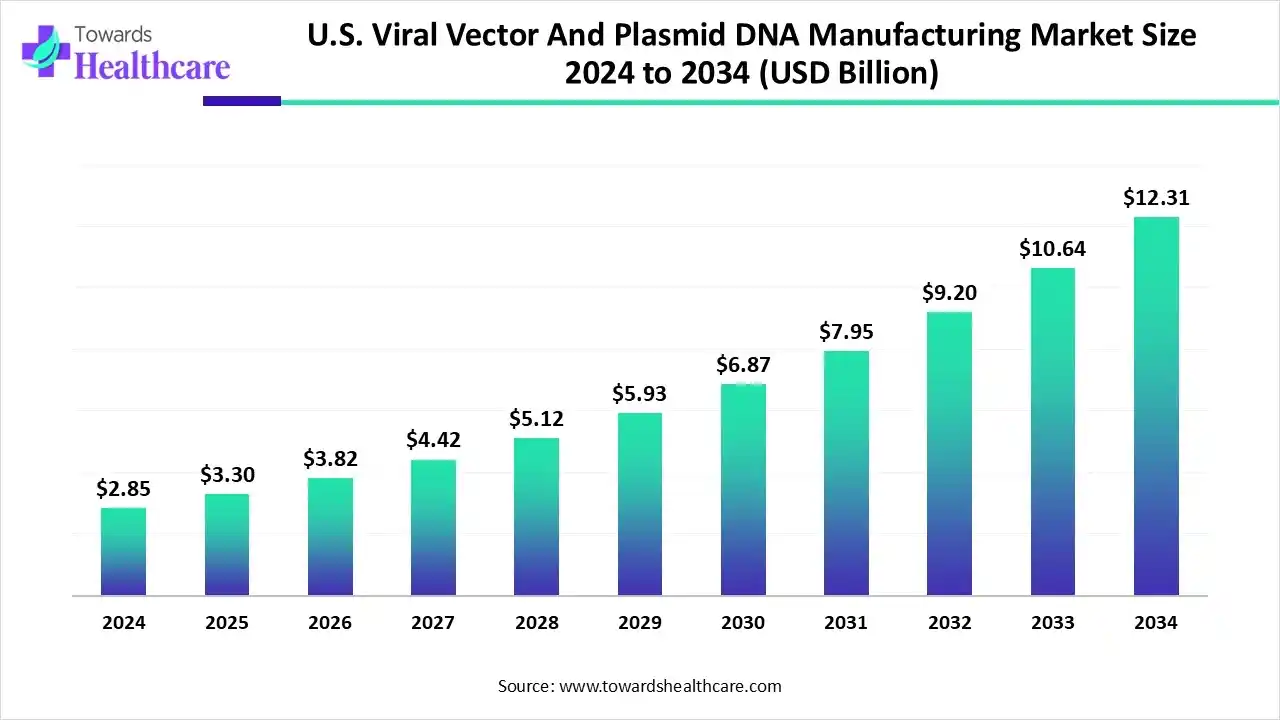

The U.S. viral vector and plasmid DNA manufacturing market size is calculated at US$ 2.85 billion in 2024, grew to US$ 3.3 billion in 2025, and is projected to reach around US$ 12.31 billion by 2034. The market is expanding at a CAGR of 15.72% between 2025 and 2034.

The U.S. viral vector and plasmid DNA manufacturing market is primarily expanded due to adherence to good manufacturing practices (GMP), which improve productivity and quality, offer flexibility and expertise, and deliver advanced equipment. The other growth parameters revolve around stability testing, analytical methodology development, qualification, verification, GMP manufacturing, etc. Moreover, process development and process verification also contribute to R&D and novel innovations. Charles River Laboratories International, Inc., Lonza Group AG, and Thermo Fisher Scientific Inc. are some of the leading industrial players in the U.S. and global markets. They are pivotal in driving collaborations, acquisitions, facility expansion, and technological development.

| Table | Scope |

| Market Size in 2025 | USD 3.3 Billion |

| Projected Market Size in 2034 | USD 12.31 Billion |

| CAGR (2025 - 2034) | 15.72% |

| Market Segmentation | By Product Type, By Workflow, By Application, By End User, By Scale of Manufacturing, By Region |

| Top Key Players | Thermo Fisher Scientific, Inc., Catalent Cell & Gene Therapy, Lonza Houston, Charles River Laboratories, FUJIFILM Diosynth Biotechnologies, Wuxi Advanced Therapies, Resilience, Oxford Biomedica Solutions, Sarepta Therapeutics, Andelyn Biosciences, AGC Biologics, Novartis Gene Therapies, Brammer Bio, Cobra Biologics, BioReliance, Vigene Biosciences, Catalent Viral Vector Manufacturing, REGENXBIO, Bluebird Bio, Virovek |

The U.S. viral vector and plasmid DNA manufacturing market refers to the production and supply of viral vectors (such as adeno-associated virus [AAV], lentivirus, adenovirus, retrovirus) and plasmid DNA used in gene and cell therapies, vaccines, and advanced biologics. These components are crucial for delivering genetic material into target cells for therapeutic purposes. Demand is rising due to the accelerating pipeline of cell and gene therapy products, regulatory approvals, and increasing adoption of nucleic acid–based vaccines and gene-editing technologies. The U.S. leads globally due to strong biotech investment, advanced manufacturing capabilities, and a robust regulatory framework supporting advanced therapy medicinal products (ATMPs).

Advancements in artificial intelligence and machine learning can potentially boost capsid optimization and reduce development time and manufacturing costs. AI can revolutionize the U.S. viral vector and plasmid DNA manufacturing market through the development of nanovectors for mRNA vaccines and gene therapy. AI improves the function of CRISPR/Cas systems and develops novel nanobots and mRNA vaccine carriers. AI is used to optimize the design of gene delivery vectors. AI is helpful to develop vehicles for the delivery of genetic fragments, mRNA vaccines, and CRISPR/Cas technology.

The new strategies help companies to strengthen their position and invest in future manufacturing technologies. For instance, in December 2024, Lonza announced a new organizational structure, guidance, and a new investor strategy that focuses on the CDMO business, reshaping the operating model, boosting execution in manufacturing and engineering, and expanding its approach to buy and build.

The new CDMO site introduces the most advanced and large-scale single-use bioreactors in Japan, which accelerate the U.S. viral vector and plasmid DNA manufacturing market. For instance, in April 2025, AGC Biologics announced the successive growth of a single-use technology network where the CDMO introduced two 5,000 L Thermo Scientific DynaDrive Single-Use Bioreactors for large-scale mammalian-based biologics production to a new Yokohama, Japan facility, for which GMP operations will begin in 2027.

| Sr. No. | Name of the Company | Renowned Offerings |

| 1. | Aldevron GMP |

|

| 2. | Charles River Laboratories |

|

| 3. | Thermo Fisher Scientific, Inc. | GMP viral vector and plasmid DNA manufacturing capabilities |

| 4. | Catalent | Gene therapy manufacturing services |

| 5. | Lonza | Large biologics manufacturing site in Vacaville, California |

The viral vectors segment dominated the U.S. viral vector and plasmid DNA manufacturing market in 2024, with a revenue share of approximately 72% owing to the excellent role of vectors as delivery systems and viral vectors as final products used to deliver therapeutic genes. They help in the manufacturing of vaccines and biopharmaceuticals and the development of gene therapies. The critical role of plasmid DNA in the manufacturing of viral vectors and gene therapies drives the production of viral vector systems.

The plasmid DNA segment is expected to grow at the fastest CAGR in the market during the forecast period due to the availability and critical role of various types of plasmids, such as transfer plasmid, packaging plasmid, helper, or envelope plasmid. The U.S. viral vector and plasmid DNA manufacturing market is also driven by improvements in the core stages of plasmid DNA manufacturing, such as cloning, design, fermentation, cell harvest, lysis, purification, quality control, formulation, and storage, which allow the production of high-quality plasmid DNA. Plasmid DNA serves as a potential drug substance, therapeutic agent, and a starting material for producing biotherapeutics.

The downstream processing segment dominated the market in 2024, with a revenue share of approximately 60% owing to the key functions in the removal of contaminants, concentration, formulation, and sterilization. Downstream processing, including harvesting, clarification, and purification, is a crucial parameter for the growth of the U.S. viral vector and plasmid DNA manufacturing market. This technique and related methods allow the delivery of a highly pure, concentrated, and active product that meets stringent regulatory standards for clinical use, including vaccines and cell and gene therapies.

The upstream processing segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to the increased focus on cell bank creation, fermentation, harvesting, selection, and engineering of host cell lines. The upstream processing helps in the determination of product yield, controlling product quality, and impacting process scalability. It improves consistency in industrial processing and enables efficient downstream processing that fuels the growth of the U.S. viral vector and plasmid DNA manufacturing market.

The gene therapy segment dominated the market in 2024, with a revenue share of approximately 55% owing to the major importance of gene therapies relying on plasmid DNA and viral vectors for delivering therapeutic genetic material to patients. The efficient gene delivery vehicles aid in efficient transduction, long-term expression, and targeting specific cells. The gene therapy manufacturing, plasmid DNA, is crucial to serve as a direct gene delivery vehicle and provides the genetic instructions to produce viral vectors.

The cell therapy segment is anticipated to grow at a notable rate in the U.S. viral vector and plasmid DNA manufacturing market during the upcoming period due to the versatile applications of CAR-T cell therapy, stem cell therapy, and immunotherapy, and the need for reprogramming and gene correction. The plasmid-enabled viral vectors empower cell therapy, which further advances viral vector and plasmid manufacturing. The growing demand for advanced cell therapies led to innovations that enhance quality and efficiency.

The biopharmaceutical & biotechnology companies segment dominated the market in 2024, with a revenue share of approximately 68% owing to the capacity expansion, process optimization, and strategic acquisitions led by biopharmaceutical companies. The U.S. viral vector and plasmid DNA manufacturing market is massively growing as biotechnology companies and CDMOs hold specialized expertise, enable R&D, and drive growth through partnerships and acquisitions. They help in supply chain management and offer capital and market reach for commercialization.

The contract manufacturing organizations (CMOs)/CDMOs segment is predicted to grow at a rapid rate in the market during the studied period due to their key functions in process development, scale-up, and manufacturing. They are expanding access to technologies, helping to address bottlenecks, and providing regulatory support. There are several benefits of outsourcing to CMOs and CDMOs, which reduce costs and risks, enable flexibility, and provide access to expertise and facilities across the U.S. viral vector and plasmid DNA manufacturing market.

The commercial-scale manufacturing segment dominated the market in 2024, with a revenue share of approximately 58% owing to the broad access to therapies and adherence to GMP and regulatory standards. It helps in process optimization and technological innovation. It impacts industrial processing, supply chain management, cost reduction, and accessibility.

The clinical-scale manufacturing segment is expected to grow at the fastest CAGR in the market during the forecast period due to compliance with good manufacturing practices and increased efforts for process development and process optimization. The improved analytical methods and comprehensive testing contribute to product analytics and quality assurance in the U.S. viral vector and plasmid DNA manufacturing market. It helps to identify critical process parameters and validate process modifications.

The East Coast U.S. dominated the market in 2024, with a revenue share of approximately 45% owing to the expansion of the gene therapy pipeline and major manufacturing investments. In September 2025, Governor Wes Moore announced the recognition of the Maryland Department of Commerce with an award and grants to support the implementation of smart manufacturing efforts.

The Maryland MADE Grant Program provided the funding of $18,000 to assist small manufacturers across the U.S. viral vector and plasmid DNA manufacturing market in investing in the adoption and deployment of high-performance manufacturing technologies and smart manufacturing. These efforts will reduce emissions, increase energy efficiency, and enable long-lasting improvements. Furthermore, Philadelphia marked the position of government-supported gene therapy research and significant government-led investments. The major pharmaceutical companies are investing in new manufacturing facilities with hundreds of millions of dollars in Pennsylvania.

In June 2025, the U.S. Food and Drug Administration (FDA) announced the urgent need for review of clinical trials that are involved in the export of Americans’ cells to foreign laboratories in hostile countries for genetic engineering.

The West Coast U.S. is expected to grow at the fastest CAGR in the U.S. viral vector and plasmid DNA manufacturing market during the forecast period due to strong biotechnology and academic hubs, and an expanding cell and gene therapy pipeline. The funding and R&D initiatives are led by a strong presence of the California Institute for Regenerative Medicine (CIRM) and the California State University (CSU) system.

California remains a major hub for biotechnology investments, investments in private industry, and federal funding. It holds its state agency for stem cell research and funding for academic biotechnology initiatives. Moreover, in San Diego, WILMINGTON, U.S., in May 2024, Charles River Laboratories International, Inc. launched its modular and fast-track viral vector technology transfer frameworks.

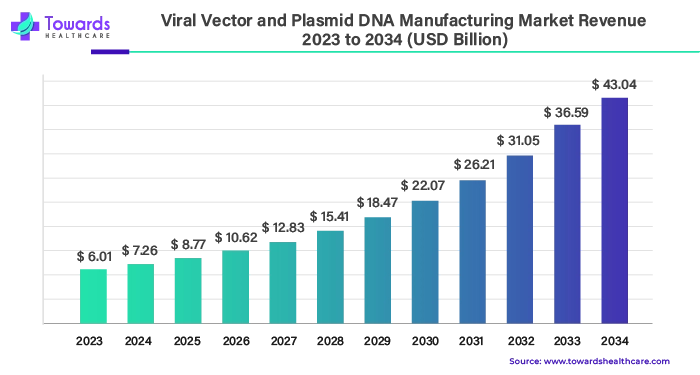

The global viral vectors and plasmid DNA manufacturing market was valued at around US$ 6.01 billion in 2023 and is expected to reach US$ 43.04 billion by 2034, growing at an impressive compound annual growth rate (CAGR) of 20.7% between 2024 and 2034. This rapid growth is being fueled by the increasing use of plasmids and viral vectors across a wide range of applications.

In July 2025, Wolfgang Wienand, CEO of Lonza Houston, said that the significant performance of One Lonza in the first half of 2025 is driven by the company’s position as a leading CDMO partner for the biopharmaceutical industry and its potential to deliver customer-centric products and services. He also announced that Lonza expects to see sustained commercial demand across its CDMO business and expand its CapEx program.

By Product Type

By Workflow

By Application

By End User

By Scale of Manufacturing

By Region (U.S. Breakdown)

February 2026

February 2026

February 2026

February 2026