January 2026

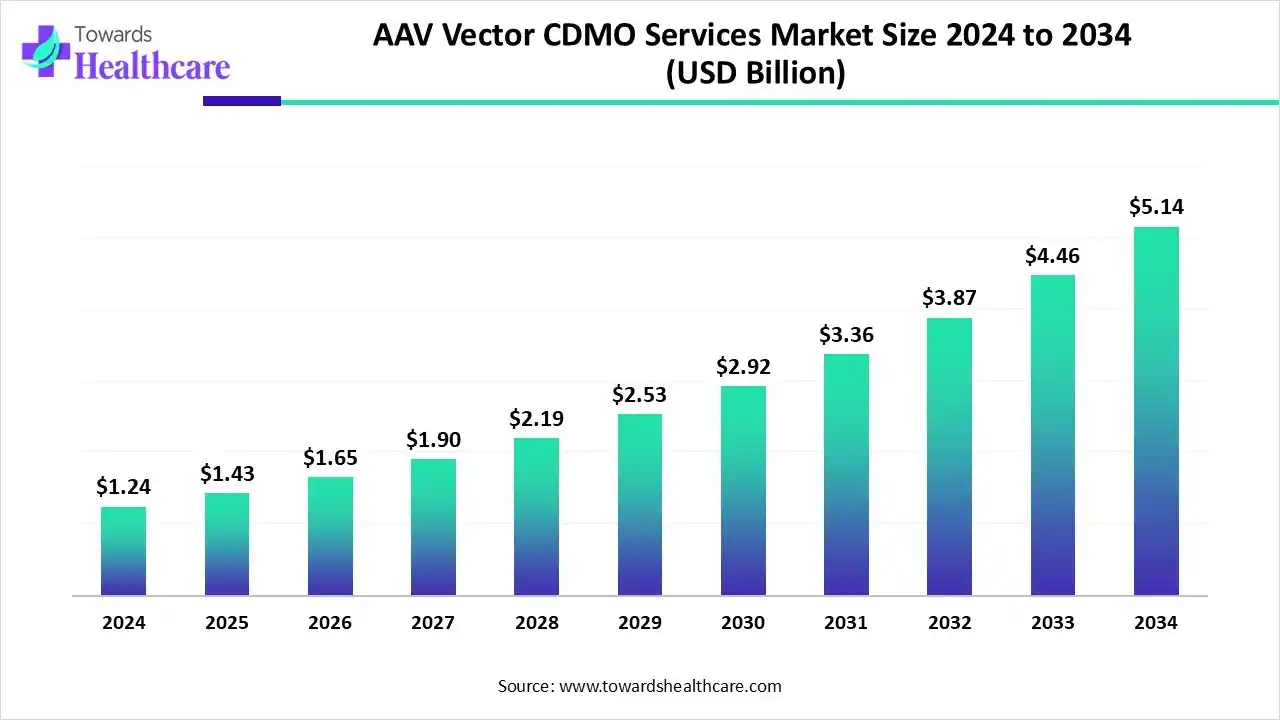

The global AAV vector CDMO services market size is calculated at USD 1.24 billion in 2024, grew to USD 1.43 billion in 2025, and is projected to reach around USD 5.14 billion by 2034. The market is expanding at a CAGR of 15.24% between 2025 and 2034.

The AAV vector CDMO services market is primarily driven by the increasing prevalence of genetic disorders and the growing demand for personalized medicines. The increasing number of AAV-based gene therapies in clinical pipelines propels the market. Contract development and manufacturing organization (CDMO) services leverage advanced technologies to provide customized solutions to biopharmaceutical companies. Artificial intelligence (AI) streamlines the research and manufacturing activities of CDMO, enhancing efficiency and reproducibility.

| Table | Scope |

| Market Size in 2025 | USD 1.43 Billion |

| Projected Market Size in 2034 | USD 5.14 Billion |

| CAGR (2025 - 2034) | 15.24% |

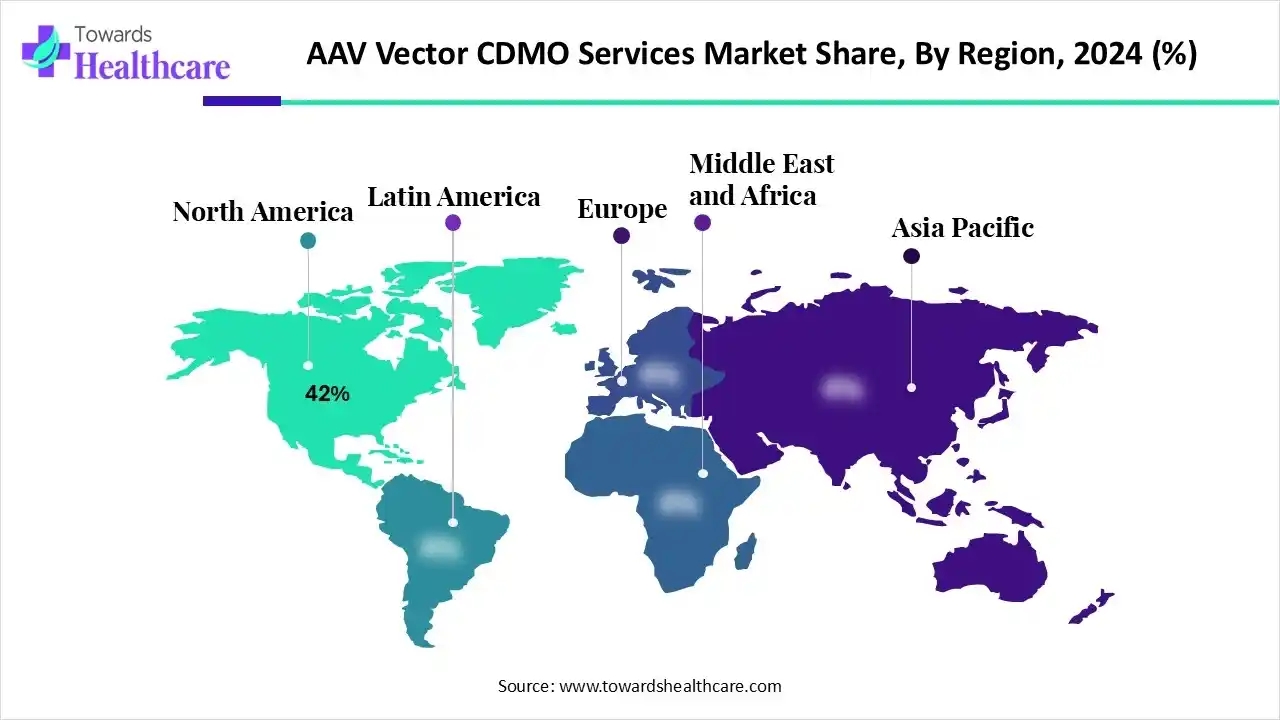

| Leading Region | North America by 42% |

| Market Segmentation | By Service Type, By Scale of Operation, By Vector Serotype/Type, By Application/Therapeutic Area, By End-User, By Region |

| Top Key Players | Vigene Biosciences (a part of Charles River), Boehringer Ingelheim, BioXcellence, Oxford Biomedica plc, Fujifilm Diosynth Biotechnologies, Samsung Biologics, Kaneka Eurogentec, Yposkesi, Novasep, Viralgen, 4D Molecular Therapeutics, Aldevron (Danaher Corp.), ViroCell Biologics, CGT Catapult, GenScript, ProBio, Resilience Biotechnologies |

The AAV vector CDMO services market is experiencing robust growth due to the growing demand for gene therapies, regulatory approvals, rising biotech outsourcing, and technological advancements. It includes contract development and manufacturing of adeno-associated virus (AAV)-based viral vectors used in gene therapy and vaccine applications. AAV vectors are preferred for their safety profile, stable gene expression, and low immunogenicity. CDMO services encompass process development, plasmid DNA (pDNA) production, upstream (cell culture) and downstream (purification) operations, analytical testing, and fill–finish operations.

AI assists researchers in developing tailored AAV vectors to deliver gene therapies by optimizing the design of AAV vectors. It enables researchers to conduct multiple experiments simultaneously and manage experimental records. AI and machine learning (ML) algorithms can analyze vast amounts of data and develop innovative gene therapies. AI systems require comprehensive, high-quality datasets to make accurate predictions and drive meaningful improvements. AI and ML can streamline the manufacturing of AAV vectors, whether on a small or large scale. They assist researchers in expediting the regulatory process, leading to faster time-to-market approval of AAV gene therapies.

The German Center for Infection Research (DZIF) developed a roadmap to improve healthcare and strengthen Germany as a hub for cell and gene therapies (CGTs). They aim to create new treatment options for patients in the long term.

The U.S. government’s Global Gene Therapy Initiative to bring gene therapy trials to India and Uganda. The initiative focuses on gene therapy research, manufacturing improvements, and infrastructure development to open sustainable pathways to global gene therapy access.

| Products | Indications | Companies | Approval Year |

| Glybera | Hereditary lipoprotein lipase deficiency (LPLD) | uniQure, Inc. | 2013 |

| Luxturna | Leber congenital amaurosis | Spark Therapeutics | 2017 |

| Zolgensma | Spinal muscular atrophy in pediatric patients | Novartis AG | 2019 |

| Upstaza | Severe aromatic L-amino acid decarboxylase (AADC) | PTC Therapeutics | 2022 |

| Hemgenix | Hemophilia B (congenital Factor IX deficiency) | uniQure, Inc. and CSL Behring LLC | 2022 |

| Elevidys | Duchenne muscular dystrophy in ambulatory and non-ambulatory patients | Sarepta Therapeutics | 2023 |

| Roctavian | Severe hemophilia A without active factor VIII inhibitors | BioMarin Pharmaceuticals | 2023 |

By service type, the process development segment held a dominant presence in the market with a share of approximately 32% in 2024, due to the need for efficient and high-quality AAV vectors. Upstream process development services refer to optimizing the production process with high scalability and reproducibility. Appropriate downstream processing facilitates the preparation and purification of AAV vectors. CDMOs comply with stringent quality and regulatory standards, as well as customize upstream and downstream processes based on AAV vectors.

By service type, the manufacturing segment is expected to grow at the fastest CAGR in the market during the forecast period. CDMO services for manufacturing AAV vectors are essential as small- and medium-sized companies lack suitable manufacturing infrastructure and equipment. Flexible production platforms enable CDMOs to derive high-quality AAV vectors and help companies scale up their manufacturing workflow.

By scale of operation, the preclinical/early clinical segment held the largest revenue share of approximately 45% in the market in 2024, due to the stringent regulatory policies of testing AAV vectors on laboratory animals. CDMOs provide high-quality, research-grade AAV vectors to support pre-clinical CGT product development. This segment also dominated because the majority of active AAV programs are still at an early stage. CDMOs optimize and modify AAV vectors based on the response generated from lab animals and humans, thereby providing customized solutions.

By scale of operation, the commercial manufacturing segment is expected to grow with the highest CAGR in the market during the studied years. CDMO possesses suitable facilities to scale up the manufacturing operations of AAV vectors. Commercial manufacturing services are required for large-scale clinical trials or for clinical purposes. This enables companies to ensure the timely delivery of products across a wide patient population.

By vector serotype/type, the AAV2 segment contributed the biggest revenue share of approximately 30% in the market in 2024, due to superior benefits over other vector serotypes. Several studies have studied the significance of AAV2 vectors in various disorders. AAV2 vectors have been proven in the long-term maintenance of coagulation factors in patients with hemophilia, eliminating the need for administering coagulation factor preparations. They were also found to be better than AAV1 for liver-directed gene transfer.

By vector serotype/type, the AAV9 segment is expected to expand rapidly in the market in the coming years. AAV9 is a vector that can cross the blood-brain barrier (BBB) and infect motor neurons, making it a promising candidate for gene therapy applications. Hence, AAV9 vectors are developed for CNS-related disorders, making them highly effective for neurological gene therapies.

By application/therapeutic area, the neurological disorders segment led the market with a share of approximately 35% in 2024, due to the rising prevalence of neurological disorders and potential complexities of these disorders. Conventional therapies fail to provide the desired therapeutic effects in patients with neurological disorders, such as spinal muscular atrophy, Parkinson’s disease, and Alzheimer’s disease. This necessitates researchers to develop tailored AAV vector gene therapies as they provide targeted therapy due to their ability to cross the BBB.

By application/therapeutic area, the others segment is expected to show the fastest growth during the forecast period. Scientists are exploring novel applications for AAV-associated gene therapies, such as musculoskeletal, cardiovascular, and oncology disorders. This is supported by clinical trials for various applications. As of October 10, 2025, 10 clinical trials were registered to assess AAV gene therapies for the treatment of musculoskeletal disorders.

By end-user, the biopharmaceutical/biotechnology companies segment accounted for the highest revenue share of approximately 60% in the market in 2024, due to increasing market competition and the need to timely deliver advanced therapeutics. Large companies conduct multiple projects, requiring the assistance of CDMOs. This enables them to focus on their core competencies, including product sales and marketing. Small biopharma companies get access to advanced technologies and relevant expertise.

By end-user, the academic & research institutes segment is expected to witness the fastest growth in the market over the forecast period. CDMO services offer end-to-end services to support every stage of a product’s development, including product assessment, proof-of-concept, and formulation development. They comply with stringent regulations to develop and manufacture high-quality AAV vector gene therapies. They help academic institutions accelerate the gene therapy development process, saving time and cost for researchers.

North America dominated the global market with a share of approximately 42% in 2024. The presence of prominent biotech companies, an increasing number of CDMOs, and favorable regulatory policies are the major growth factors that govern market growth in North America. The rapidly expanding clinical pipeline of AAV vector-associated gene therapies and increasing collaborations among key players contribute to market growth. Government organizations launch initiatives to facilitate gene therapy development and regulate personalized medicines in North America.

Key players, such as Thermo Fisher Scientific, Charles River Laboratories, and Resilience Biotechnologies, are some U.S.-based leading global CDMO companies. As of July 2025, a total of 8 AAV-based gene therapies were approved by the U.S. FDA. Americans are becoming increasingly aware of personalized medicines, owing to rapidly changing demographics.

Health Canada regulates gene therapy products in Canada. As of June 2024, 10 gene therapy products were approved by Health Canada. Companies like SK Pharmteco, AGC Biologics, and Aurigene Pharmaceutical Services have a strong presence in Canada, offering CDMO services. As of October 10, 2025, 21 clinical trials were registered on the clinicaltrials.gov website related to the AAV gene therapy.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. Countries like China, Japan, South Korea, and Singapore are at the forefront of revolutionizing personalized medicines within the Asia-Pacific. Government bodies of these countries provide funding to conduct research and manufacturing activities of gene therapies. The rising adoption of advanced technologies and the burgeoning biopharmaceutical sector foster the market. Research institutions conduct seminars, conferences, and workshops to share the latest updates on AAV gene therapies.

China is becoming a global hub in the biotech sector. Shanghai will host the Cell & Gene Therapy Summit in 2026 to gather researchers and biopharmaceutical organizations from China, facilitating the exchange of breakthrough methodologies, with a specialized focus on cell therapies, gene therapy, and editing platforms.

It is estimated that more than 4 million people in India have some form of dementia. The presence of favorable manufacturing infrastructure and favorable government policies enables foreign companies to set up their gene therapy manufacturing facilities in India. The President of India recently launched the indigenously developed gene therapy for cancer patients.

By Service Type

By Scale of Operation

By Vector Serotype/Type

By Application/Therapeutic Area

By End-User

By Region

January 2026

January 2026

January 2026

January 2026