February 2026

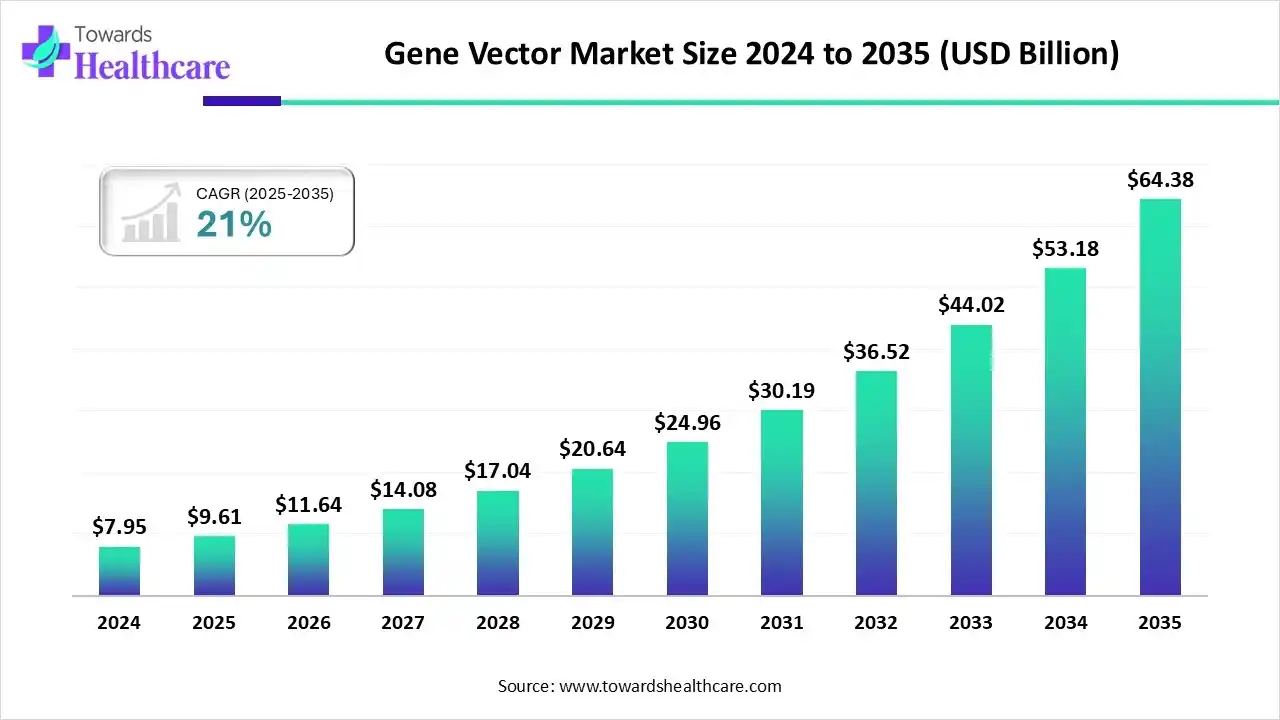

The global gene vector market size is calculated at US$ 9.61 billion in 2025, grew to US$ 11.64 billion in 2026, and is projected to reach around US$ 64.38 billion by 2035. The market is expanding at a CAGR of 21% between 2026 and 2035.

The development of more sophisticated gene editing technologies, the growing demand for personalized medicine, and the rising incidence of infectious diseases, cancer, and genetic disorders are some of the factors propelling the growth of the gene vector market. Numerous products that deliver therapeutic genes via viral vectors have been approved for use in the treatment of infectious diseases, cancer, and monogenic disorders.

| Table | Scope |

| Market Size in 2025 | USD 9.61 Billion |

| Projected Market Size in 2035 | USD 64.38 Billion |

| CAGR (2026 - 2035) | 21% |

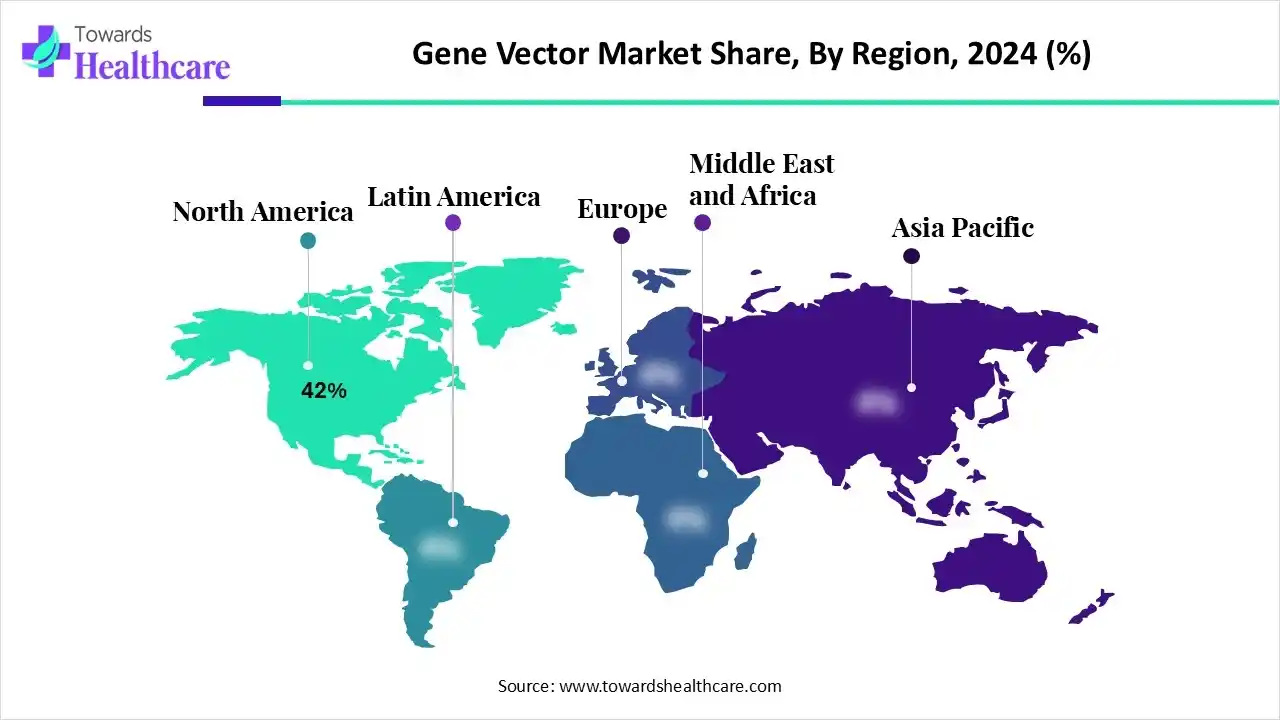

| Leading Region | North America by 42% |

| Market Segmentation | By Type, By Application, By Form, By End-User Industry, By Region |

| Top Key Players | Lonza, Thermo Fisher Scientific, Merck KGaA (MilliporeSigma), Catalent, WuXi AppTec, Samsung Biologics, Charles River Laboratories, Novasep, Oxford Biomedica, Aldevron, GenScript, Brammer Bio, VGXI, Viralgen, AGC Biologics, Takara Bio, REGENXBIO, AskBio, Acuitas Therapeutics, SIRION Biotech |

The gene vector market comprises the development, manufacturing, and supply of delivery vehicles, viral (AAV, adenovirus, lentivirus) and non-viral (plasmids, lipid nanoparticles, polymeric carriers, nanoparticles), used to transport genetic material (DNA, RNA, gene-editing tools) into cells for research, gene therapy, and vaccine applications. It includes specialized vector CDMOs, reagent and plasmid suppliers, equipment and consumable manufacturers, and platform technology providers that together support discovery, clinical development, and commercial-scale production of gene-based medicines and vaccines.

Capsid optimization could be accelerated while development time and manufacturing costs are decreased, thanks to the development of artificial intelligence (AI), especially machine learning. An essential component of artificial intelligence (AI), machine learning (ML) allows computers to learn from data and make decisions using algorithms without requiring a lot of programming.

Why the Viral Vectors Dominating the Gene Vector Market?

The viral vectors segment dominated the market, accounting for 65% of revenue in 2024, as viruses have evolved to efficiently deliver their genetic payload to cells, making them the most powerful and efficient gene delivery vehicles. In cancer applications, viral vectors have received the most attention. Additionally, viral vectors have been used to treat monogenic illnesses. Additionally, viral vectors have been used to treat monogenic illnesses.

Non-Viral Vectors & Delivery

The non-viral vectors & delivery segment is expected to grow at the highest rate in the gene vector market during 2025-2034, as non-viral vectors are widely used in gene therapy and are essential tools for therapeutic gene delivery. Because of their low immunogenicity, good biocompatibility, ease of synthesis and modification, and affordability, non-viral vectors are frequently developed and used in clinical practice. Interestingly, non-viral vectors can enhance therapeutic effects, prolong circulation time, improve cargo uptake, and deliver cargo to specific locations.

Services, Reagents & Platform Support

The services, reagents & platform support segment is growing significantly in the market due to comprehensive gene vector services, including extensive GMP CDMO production and manufacturing facilities. High-quality reagents, including plasmids, capsids, and enzymes, as well as thorough analytical, QC, and characterization services for safety and potency, support this.

How the Commercial Therapeutics Dominate the Gene Vector Market in 2024?

The commercial therapeutics segment dominated the market, accounting for 40% of revenue in 2024. In order to treat illnesses like cancer, genetic disorders, and infectious diseases, a gene vector introduces therapeutic genetic material into target cells. These can be non-viral (like lipid nanoparticles) or viral (like AAV, lentivirus), with viral vectors predominating in the market because of their high efficiency.

Clinical Development/Trial Supply

The clinical development/trial supply segment is expected to grow at the fastest CAGR in the gene vector market during 2025-2034. Gene vectors used in clinical development and trial supply require careful production, strict cold chain logistics, and reliable tracking for efficacy and safety. To deliver a viable therapeutic, the intricate supply chain necessitates precise coordination.

Vaccines & Preventive Applications

The vaccines & preventive applications segment is growing significantly in the market. New platforms for vaccine design, such as those based on viral vectors and virus-like particles (VLPs), have emerged to get around the drawbacks of traditional vaccines. Vaccines using viral vectors are very effective and provide protection quickly.

Which Form Dominated the Gene Vector Market in 2024?

The bulk GMP viral vector drug substance segment accounted for 45% of market revenue in 2024 because of its demonstrated clinical effectiveness and high efficiency in delivering genetic material. Although there are other non-viral approaches, viral vectors are better at transducing (transferring genes into) target cells, which allows for more successful treatment outcomes for a variety of illnesses.

Formulated Drug Product/Fill-Finish

The formulated drug product/fill-finish segment is expected to grow at the fastest rate in the gene vector market during 2025-2034. This crucial final step in delivering cutting-edge treatments to patients is represented by fill/finish operations for medications and vaccines based on viruses and viral vectors. It can take years to become proficient in aseptic fill/finish. Through experience with a variety of products and regulatory interactions, CDMOs with a proven track record have already mastered these obstacles and improved their procedures.

Plasmids & Raw Materials

The plasmids & raw materials segment is growing significantly in the market. For many years, plasmids and plasmid DNA (pDNA) have been essential elements in the molecular biology of recombinant DNA. A key component of the production of viral vector ATMP is its use as a precursor raw material.

Which End-User Industry Dominated the Gene Vector Market in 2024?

The biopharmaceutical & gene-therapy developers segment dominated the market, accounting for 55% of revenue in 2024. Pharmaceutical firms have been creating treatments to cure or stop illnesses. In order to repair genetic mutations or introduce functional genes to replace or inhibit the mutated gene, biopharma companies utilize genetic material to create genomic gene, cell, and gene editing treatments.

The academic & research institutes segment is expected to grow at the fastest CAGR in the gene vector market during 2025-2034. Viral and non-viral gene vectors are used by academic and research institutions to introduce genetic material into cells for gene therapy and research. The National Institutes of Health (.gov), King's College London, the San Raffaele Telethon Institute for Gene Therapy, and the Center for Stem Cell Research (CSCR) are a few notable organizations.

CDMOs/CMOs

The CDMOs/CMOs segment is growing significantly in the market. The choice to outsource development is more crucial than ever in the rapidly evolving field of biotechnology. A wider range of capabilities and integrations is now available thanks to the evolution of the CDMO model. The hybrid idea of a CDMO that supports manufacturing and scale-up processes emerged as a result of the need for "development support" over time, which included formulation, method development, and analytical testing.

North America dominated the gene vector market in 2024, accounting for 42% of revenue. Major factors driving the growth of the market in North America include the presence of numerous academic research institutions active in the fields of molecular biology and genetics, the region's well-established biotech and pharmaceutical industries, and improvements in the research and development infrastructure in the United States and Canada.

The ASGCT reported 679 clinical-stage asset indications in Q2 2025, up from 645 in Q1. Approximately 2,210 (49%) of the 4,469 therapies that were monitored were gene therapies, while 962 (22%) were non-genetically modified cell therapies. About 83% of genetically modified cell therapies target oncology, with CAR-T accounting for 55% of these treatments.

Asia Pacific is estimated to host the fastest-growing gene vector market during the forecast period as the region makes large investments in the development of biotechnology and therapeutics. Leading the way in this expansion are South Korea, Japan, and China. Governments are supporting infrastructure upgrades and the approval of clinical trials. Both established pharmaceutical companies and new biotech startups are focusing on new delivery technologies and local production.

Clinical trials for cell therapy have advanced quickly in China in recent years. Clinical trials for cell therapy are increasing quickly in China, reaching a peak of 43 in 2022 and 61 in 2023. Furthermore, China's cell therapy clinical trials encompass a wide range of cell types, indications, and targets. Furthermore, there are cell therapy clinical trials spread across 16 provinces in China. Jiangsu, Beijing, and Shanghai are the top three provinces.

Europe is expected to grow at a significant CAGR in the gene vector market during 2025-2034. Growing funding for gene therapy research and an encouraging regulatory environment from the European Medicines Agency (EMA) are the main drivers of the region's expansion. Two major factors driving market expansion are the increasing prevalence of genetic diseases and the need for cutting-edge therapeutic solutions. Leading nations with big players like Novartis and Boehringer Ingelheim are the UK, France, and Germany.

A roadmap for enhancing healthcare and bolstering Germany as a gene and cell therapy hub was created in June 2024 by about 150 experts from different stakeholder groups, including several scientists from the German Center for Infection Research (DZIF) network. The Berlin Institute of Health (BIH) at Charité was tasked by the German Federal Ministry of Education and Research (BMBF) to supervise and coordinate the strategy's development.

South America is expected to grow significantly in the gene vector market during the forecast period. South America’s biotech sector is growing as healthcare systems integrate gene-based therapies. Governments fund clinical trials for rare diseases and cancer, while regional biotech hubs collaborate with global firms to advance vector manufacturing and strengthen therapeutic innovation pipelines.

Brazil’s pharmaceutical ecosystem is rapidly evolving, driven by ANVISA’s support for gene and cell therapy development. Local biotech firms expand viral-vector production, while national programs invest in advanced therapy research to boost healthcare self-sufficiency and regional export potential.

The Middle East and Africa are expected to grow at a lucrative CAGR in the gene vector market during 2025-2034. The Middle East and Africa are investing heavily in genomic medicine, with biotech startups focusing on vector-based therapies. Governments strengthen healthcare infrastructure, enable clinical trial networks, and foster collaborations with global pharma players to advance innovative treatment accessibility.

The UAE is transforming into a biotech and healthcare innovation hub. National genome projects and research grants drive vector-based therapy studies, while pharma investments enhance local manufacturing capacity, clinical research facilities, and regulatory frameworks for cutting-edge biopharmaceutical growth.

Finding and confirming a target gene for a particular disease is the first stage of research and development. The gene is then modified to create a vector, usually a virus, that can deliver the gene to target cells safely and effectively. The vector is created in host cells and purified to a very pure bulk drug substance as part of upstream procedures.

Clinical trials use phased testing, starting with safety evaluation in small cohorts and progressing to large-scale efficacy studies, to assess the gene vector's safety and effectiveness in human subjects. Health agencies thoroughly examine all clinical data, manufacturing specifics, and safety profiles before granting regulatory approval.

Using excipients, formulation development stabilizes the purified vector to stop deterioration during transportation and storage. To guarantee consistency and sterility prior to patient administration, final dosage preparation entails sterile filtration, accurate fill-and-finish into containers, and rigorous quality control testing.

Key Developments and Strategic Initiatives:

SWOT Analysis:

Key Developments and Strategic Initiatives:

SWOT Analysis:

Recent News and Updates:

Press Releases:

April 24, 2025: Announced investment to enhance U.S. innovation and support customers’ manufacturing.

| Company | Offerings | Contribution to Gene Vector Market | Focus Area |

| Merck KGaA (MilliporeSigma) | Provides viral vector manufacturing, plasmid DNA, and gene-editing tools. | Expands global viral vector capacity and invests in advanced therapy production platforms. | AAV, lentiviral manufacturing, and process optimization. |

| Catalent | Offers end-to-end viral vector development and GMP manufacturing. | Enhances capacity through facility expansions and automation to support gene therapy demand. | Cell and gene therapy CDMO services. |

| WuXi AppTec | Provides viral vector CDMO, plasmid DNA, and analytical testing. | Expands global footprint and accelerates time-to-market for gene therapies. | Integrated vector development and manufacturing. |

| Samsung Biologics | Develops scalable viral vector production platforms. | Invests in biomanufacturing infrastructure and global partnerships. | Advanced therapies and bioprocess optimization. |

| Charles River Laboratories | Offers viral vector testing, safety, and development support. | Strengthens supply chain through end-to-end preclinical and manufacturing services. | Analytical and biosafety solutions for gene therapies. |

By Type

By Application

By Form

By End-User Industry

By Region

February 2026

February 2026

February 2026

February 2026