January 2026

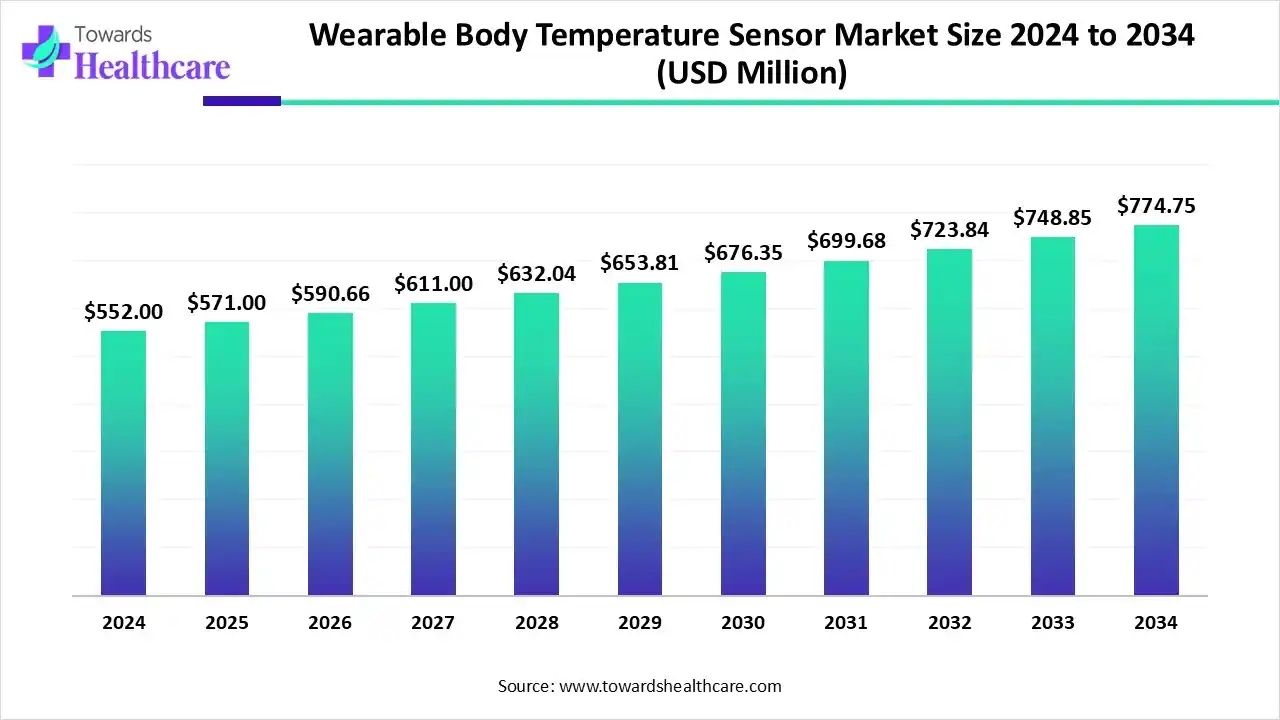

The global wearable body temperature sensor market size is calculated at US$ 570.99 million in 2025, grew to US$ 590.63 million in 2026, and is projected to reach around US$ 800.78 million by 2035. The market is expanding at a CAGR of 3.44% between 2026 and 2035.

Various ASAP countries, such as China, Japan, and South Korea, are increasingly promoting the wider use of digital health solutions in the rising chronic diseases. However, the leading companies are widely focusing on the expanded use of AI algorithms, which promotes early disease detection and better efficiency. The wearable body temperature sensor market is further emphasising innovations in fabrication materials. And non-invasive approaches for tracking core body temperature (CBT). Also, the significant players are leveraging advances in Bluetooth Low Energy and cellular 5 G solutions.

| Table | Scope |

| Market Size in 2026 | USD 590.63 Million |

| Projected Market Size in 2035 | USD 800.78 Million |

| CAGR (2026 - 2035) | 3.44% |

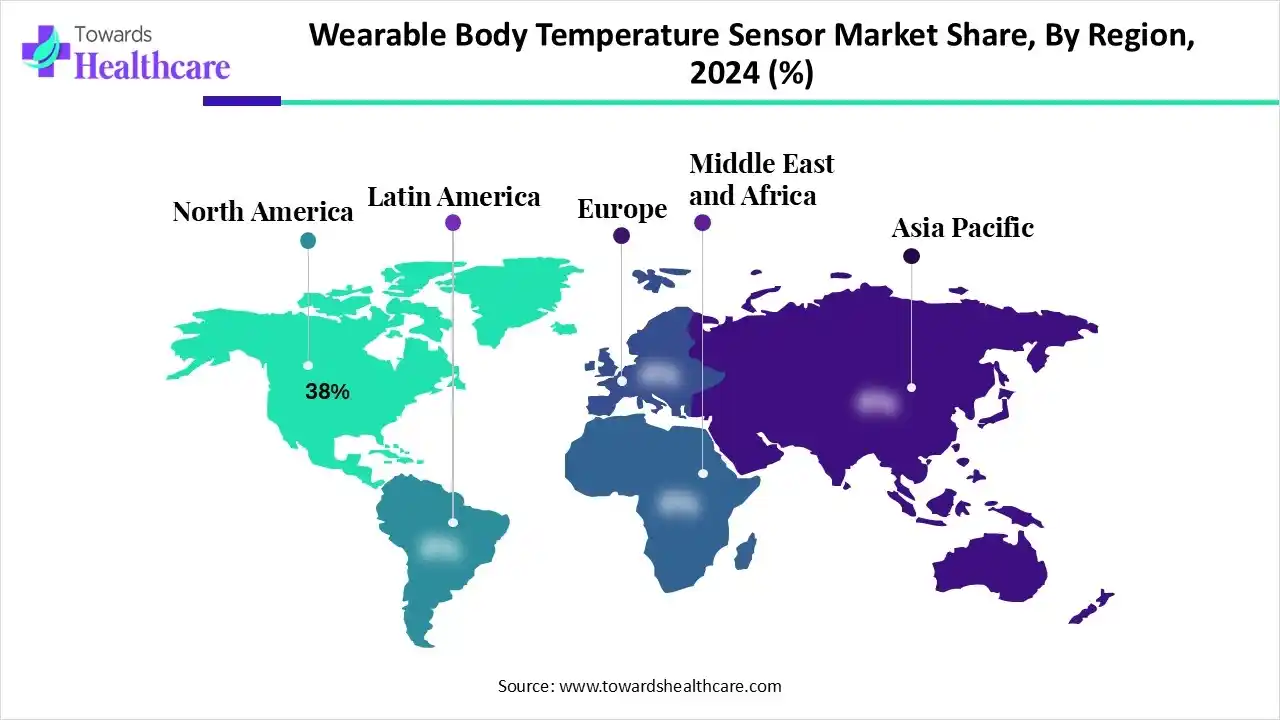

| Leading Region | North America by 38% |

| Market Segmentation | By Product Type, By Technology, By Application, By Connectivity, By End User, By Region |

| Top Key Players | NXP Semiconductors N.V., Maxim Integrated, Omron Healthcare Co., Ltd., STMicroelectronics N.V., Abbott Laboratories, Masimo Corporation, BioIntelliSense, Inc., VivaLNK, Inc., TempTraq (Blue Spark Technologies), Valencell, Inc., Fitbit (Google LLC), Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Kinsa Health, Inc. |

The wearable body temperature sensor market refers to the ecosystem of smart devices and sensor technologies designed to continuously or intermittently monitor human body temperature for health tracking, clinical diagnostics, sports performance, and remote patient monitoring. Market growth is driven by the rising demand for real-time health tracking, the expansion of telehealth services, infectious disease monitoring (e.g., COVID-19), and an increasing focus on personalised wellness and chronic disease management.

These sensors are integrated into wearables such as smartwatches, patches, fitness bands, ear devices, and smart clothing, using advanced materials, wireless connectivity (Bluetooth, NFC, Wi-Fi), and AI-driven analytics.

Ongoing contribution of AI algorithms in these kinds of sensors, particularly BioIntelliSense, is leveraging the analysis of long-term skin temperature, heart rate, and respiratory patterns. Furthermore, diverse companies are exploring various wearable patches that are created for continuous temperature monitoring, mainly for fever management in children. Alongside, different linked apps to these solutions are widely using AI for monitoring fever progression and further giving alerts.

By capturing nearly 35% share, the wearable patches segment led the wearable body temperature sensor market in 2024. A rise in demand for continuous health monitoring, and these patches enable early detection of fevers and infections, is impacting the segmental growth. Currently, the market is emphasising AI integration, optimised sensor miniaturisation for non-invasive monitoring, & innovations of patches for specific diseases, especially cancer. The major developments in the creation of patches with expanded more comfortable, accuracy, and integration into healthcare systems are also fueling their adoption.

During 2025-2034, the smartwatches & fitness bands segment will expand rapidly. The segment is mainly fueled by the increasing health and fitness awareness, the rise of remote patient monitoring, and breakthroughs in wearable technology. Currently, the rising use of advanced sensor technologies and ML are boosting devices with robust interpretation of external factors, such as ambient temperature. The latest developments include the Apple Watch Series 11, particularly its predecessors (Series 8 and later), which feature a temperature sensor that takes nightly readings.

The thermistor-based sensors segment dominated with approximately 37% share of the market in 2024. The significant advantages of NTC (Negative Temperature Coefficient) thermistors are relatively affordable, which accelerates numerous consumer-grade wearables and budget-friendly medical devices. In this era, researchers are focusing on enhancing flexibility, sensitivity, and integration with other systems through materials, specifically PEDOT: PSS and more sophisticated fabrication techniques.

Whereas the semiconductor-based sensors segment is predicted to expand at a rapid CAGR. An eventual rise in various chronic diseases and the progression of the Internet of Things (IoT) are escalating the requirement for smaller, more precise, and power-efficient sensors in wearable devices, especially smartwatches and patches. In the case of fabrication, researchers are fostering the use of novel materials, including MXenes and transition metal dichalcogenides, with their expanded sensitivity and potential for room-temperature operation.

In 2024, the medical & healthcare monitoring segment held approximately 40% share of the wearable body temperature sensor market. Ongoing integration of these sensors with other sensors, AI-enabled analytics for tailored insights, and enhanced miniaturisation and energy effectiveness. Recent developments are focused on sensor performance in real-world conditions through features, specifically hydrophobicity, ensuring continuous accuracy despite factors such as moisture and movement.

On the other hand, the remote patient monitoring (RPM) segment will expand fastest. Nowadays, the market is emphasising the expansion of clinical-grade patches with longer wear times, combination with modern web and backend technologies for data management, and accelerated security features like blockchain. Additionally, the emergence of trends, such as interactive and immersive technologies, is being explored for integration with RPM to enhance patient involvement in their own care.

The Bluetooth Low Energy (BLE) segment was dominant with nearly 43% share of the wearable body temperature sensor market in 2024. The segment is driven by its efficiency and feasible smartphone integration, which allows devices with long battery life and compact form factors. The wider contribution of Nordic Semiconductor and Texas Instruments in the production of ultra-low-power BLE modules promotes wearable temperature sensors to operate for much longer on a single battery.

However, the wi-fi & cellular (4G/5G) segment is anticipated to expand rapidly. A prominent innovation of 5G networks is assisting rapid and more reliable data transmission for wearable health devices, which is vital for real-time applications.

In October 2025, Ceva, Inc., the major licensor of silicon and software IP for the Smart Edge, announced general availability of its Ceva-Waves Wi-Fi 7 1×1client IP, which possesses advanced Wi-Fi 7 capabilities to AI-driven IoT devices and emerging physical AI systems.

In 2024, the hospitals & clinics segment held approximately a 32% share of the wearable body temperature sensor market. The increasing understanding of the importance of earlier detection of temperature-related complications, particularly hypothermia and fever, with raised workflow effectiveness and lowered manual checks, is influencing the overall expansion. The widespread application of wearable sensors is immensely supporting the management of chronic issues, with hospitals using them for in-hospital monitoring (e.g., to flag neutropenic fever in chemotherapy patients).

Moreover, the homecare & individual users segment is estimated to grow at a rapid CAGR. In this era, the globe is increasingly using advanced patches, like the Vivalink Axillary Temperature Patch is a FDA-cleared, clinical-grade patch. This further assists in RPM with the detection of fevers and tracking infection progression from home. Nowadays, manufacturers are aiming at the development of innovative washable, durable, and breathable smart fabrics, which boost users’ comfort for functionality.

By capturing nearly 38% share, North America led the wearable body temperature sensor market in 2025. This dominance is powered by the growing early adoption in digital health, strong regulatory support, and the presence of top wearable brands. These brands are highly promoting more user-friendly products with longer battery life, wireless charging, and real-time data transmission to apps. The region is imposing improvements in accuracy through contact-based sensors and integration with AI for sophisticated diagnostics.

The US market is widely fostering the progression of novel sensors, including smart rings. These rings further help in monitoring different health metrics, such as temperature, with comprehensive insights regarding health and sleep patterns.

For instance,

In the upcoming era, the Asia Pacific is predicted to expand rapidly in the wearable body temperature sensor market. A rise in the faster expansion of consumer electronics and healthcare wearables manufacturing in China, Japan, and South Korea is bolstering the ASAP market growth. Along with this, South Korean researchers have established highly sensitive, combined wearable sensors employing bulk and hollow gold nanowires. Exsense and AMS OSRAM have displayed the use of advanced materials like flexible substrates and thermistors for gaining higher accuracy for wrist-worn devices.

Specifically, the Japanese researchers are broadly establishing non-invasive approaches for tracking core body temperature (CBT) to offer a more accurate physiological indicator than skin temperature alone.

For instance,

Europe’s wearable body temperature sensor market is experiencing notable growth due to the rising emphasis on promoting health and fitness awareness, which further accelerates the adoption of wearable devices for fitness tracking and general well-being. Besides this, this region is increasingly adopting low-energy wireless connectivity, particularly Bluetooth Low Energy, which makes it feasible for these devices to connect and share data with other devices and services.

Eventually, the different European countries, like Germany, are exploring their development of wearable temperature sensors that harvest energy from body heat, enabling continuous, real-life monitoring without an external power source. Alongside the emergence of new regulations, especially the EU's Medical Device Regulation (MDR) and Germany's Digital Healthcare Act (DiGA), are an encouraging data privacy and security for medical devices.

The wearable body temperature sensor market is focusing on the requirements and design phase, prototyping and hardware development, firmware and software development, calibration and testing, & finally, manufacturing and commercialisation.

Key Players: greenteg AG, VitalConnect, Vivalink, etc.

This mainly offers in-hospital patient monitoring, post-operative care, and at-home care for chronic diseases, with a non-invasive way for monitoring critical signs and potentially enabling early hospital discharge.

Key Players: VinCense, Biobeat, Empatica, etc.

By Product Type

By Technology

By Application

By Connectivity

By End User

By Region

January 2026

November 2025

October 2025

December 2025