January 2026

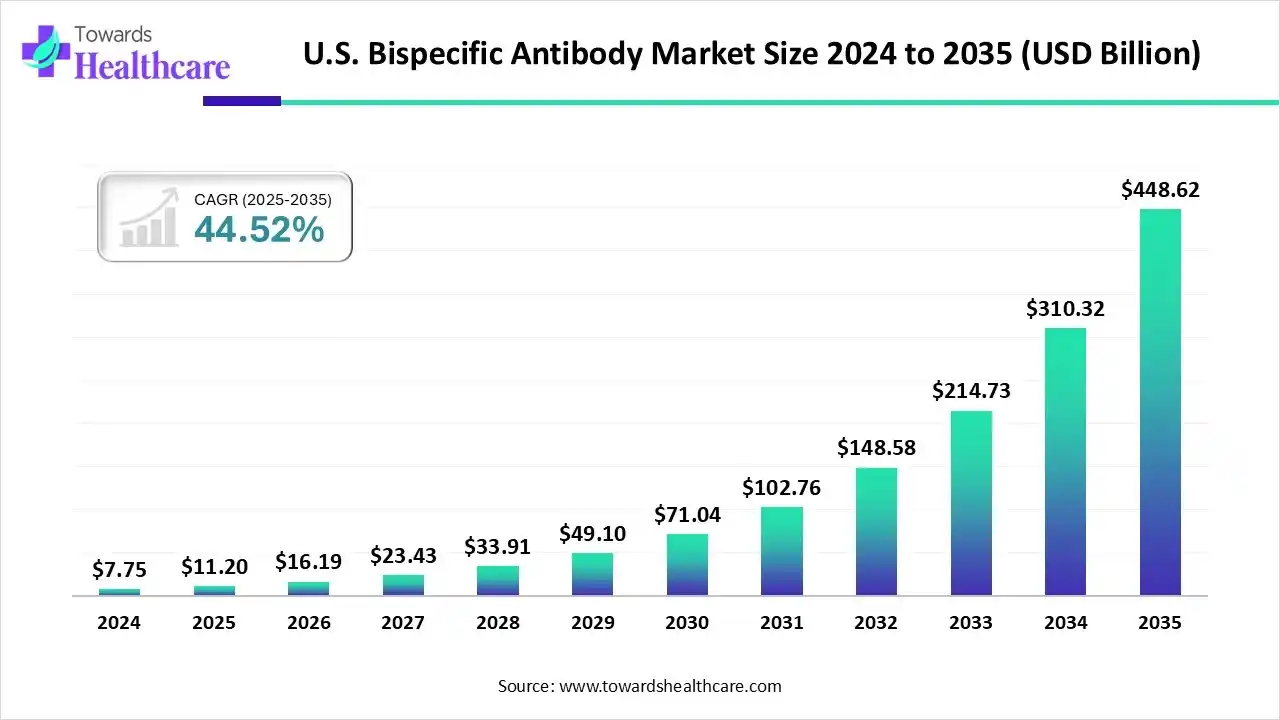

The U.S. bispecific antibody market size is estimated at US$ 11.2 billion in 2025, increased to US$ 16.19 billion in 2026, and is expected to reach around US$ 448.62 billion by 2035. The market is growing at a CAGR of 44.52% between 2026 and 2035.

The growth of the U.S. bispecific antibody market is driven by the tremendous potential of these antibodies in treating hematological malignancies. A wave of regulatory approvals, expanding development pipelines, and new clinical data are fueling the growth of the market. Additionally, the rising incidence of cancer and the increasing demand for targeted therapies further support market growth.

| Table | Scope |

| Market Size in 2025 | USD 11.2 Billion |

| Projected Market Size in 2035 | USD 448.62 Billion |

| CAGR (2026 - 2035) | 44.52% |

| Market Segmentation | By Therapeutic Area/Indication, By Format/Architecture, By Development Stage, By End User/Payer Channel, By Region |

| Top Key Players | Amgen, Genentech/Roche, Bristol Myers Squibb/Celgene-era assets, Gilead/Kite, Pfizer Inc., Merck & Co., Xencor Inc., AbbVie Inc., Johnson & Johnson |

The U.S. bispecific antibody market is primarily driven by new product approvals, expanding applications in non-oncology diseases, and innovations in manufacturing. The market encompasses the development, clinical translation, manufacturing, and commercialization of engineered antibodies that bind two distinct antigens or epitopes. Key formats in the market include T-cell engagers (CD3×tumor antigen), checkpoint-modulating bispecifics, dual-targeting tumor antigen pairs, and Fc-engineered multispecific antibodies for oncology, immunology, and infectious diseases. Growth is fueled by a robust clinical pipeline, multiple regulatory filings and approvals, significant biotech and pharma R&D investment, and expanding manufacturing capacity for complex biologics.

| Sr. No. | Name of the Bispecific Antibody | Name of the Producer |

| 1 | Tebentafusp (Kimmtrak) | Immunocore |

| 2 | Teclistamab (Tecvayli) | Janssen Biotech |

| 3 | Mosunetuzumab (Lunsumio) | Genentech |

| 4 | Epcoritamab (Epkinly) | Genmab and AbbVie |

| 5 | Glofitamab (Columvi) | Genentech |

AI is transforming the U.S. bispecific antibody market by accelerating the discovery and design of complex antibody structures, enabling more precise identification of dual-targeting candidates. Machine learning algorithms optimize lead selection, predict immunogenicity, and streamline protein engineering, reducing time and cost in preclinical development. AI-driven data analytics also enhance clinical trial design and patient stratification, improving success rates and personalized therapy outcomes. Additionally, AI supports manufacturing process optimization, ensuring higher yield, consistency, and scalability for these complex biologics.

How Does the Oncology Segment Dominate the U.S. Bispecific Antibody Market in 2024?

The oncology (solid tumors & hematologic cancers) segment dominated the market in 2024, holding a revenue share of approximately 68%, owing to the recent product approvals for multiple myeloma, hematologic, and solid tumors. The major drivers of oncology sector growth are combination therapies, recent U.S. FDA approvals, and strong financial outcomes. Moreover, the high investments in cancer research support technological innovations.

The ophthalmology/rare diseases/others segment is expected to expand at the fastest CAGR during the forecast period due to strong R&D in autoimmune diseases, investments in innovations, and strategic collaborations. The development of new treatments for rare diseases, regulatory focus on these conditions, and product development drive the U.S. bispecific antibody market. A strong biopharmaceutical hub, a supportive regulatory environment, and substantial R&D investments enhance the market’s leadership across the U.S.

The immuno-inflammation / autoimmunity segment is expected to grow significantly in the coming years due to targeted therapies for complex diseases, investments in clinical pipelines, and expanding therapeutic uses. Bispecific antibodies are crucial in advancing precision medicine for autoimmune disorders. They facilitate personalized and more targeted treatments.

What Made Dual-variable/IgG-based Bispecifics the Dominant Segment in the U.S. Bispecific Antibody Market?

The dual-variable/IgG-based bispecifics (full-length, knob-into-hole, CrossMab) segment dominated the market with a revenue share of about 38% in 2024, due to the growing focus on oncology, regulatory approvals, and IgG-based formats. The increased investment in dual-variable/IgG bispecifics for certain medical conditions, such as autoimmune and infectious diseases, boosts the adoption of bispecific antibodies. The new platforms enhance drug properties and scalability, enabling the development of new bispecific antibody candidates.

The T-cell engagers (BiTEs, DARTs, CD3-engagers) segment is expected to grow at the fastest rate in the upcoming period, driven by the next-generation therapeutics, improved patient accessibility, and growth in combination therapies. This growth is also driven by robust R&D and numerous strategic collaborations and partnerships. T-cell engagers have immense potential for targeting hematologic malignancies, such as multiple myeloma and lymphoma.

The bispecific Fc-fusion/Fc-silent multispecifics segment is expected to grow significantly in the coming years due to ongoing focus on blood cancers, cancer treatments, and research on solid tumors. New discoveries and advancements in clinical R&D are driven by academic research institutions and major biotechnology companies. These promising treatment approaches help address unmet medical needs.

How Did the Phase I/I–II Trials Segment Dominate the U.S. Bispecific Antibody Market in 2024?

The phase I/I-II trials segment dominated the market in 2024, capturing approximately 35% of the revenue share due to the major R&D hub, significant investments, and focus on oncology research. Clinical trial phases are influenced by the shift toward combination therapies and advanced engineering. Investments by U.S.-based companies like Johnson & Johnson played a notable role in advancing clinical research.

The late-stage segment is expected to grow at the fastest CAGR in the coming period due to the successful commercialization of innovative cancer treatments. The FDA is granting accelerated approvals for solid tumors and hematologic cancers. Companies like Amgen have received FDA approval for their first bispecific T-cell engager targeting a solid tumor, specifically extensive-stage small cell lung cancer.

The preclinical & discovery segment is expected to grow significantly in the coming years due to pioneering R&D and innovation hubs across the U.S. Advances in translational research and next-generation formats drive biotechnology innovations. AI and data-driven discovery, along with regulatory support, promote acquisitions.

Which Segment End User Dominates the U.S. Bispecific Antibody Market in 2024?

The oncology hospitals / cancer centers segment led the market in 2024, holding about 52% of the revenue share. This is primarily due to their role as the main point of care and their expanding access to treatment. They support clinical development and shift focus toward bispecifics. Additionally, they adopt next-generation technologies and are influenced by rapid regulatory approvals.

The academic medical centers segment is expected to grow rapidly during the studied period due to ongoing clinical research and innovations. They handle complex treatments and set treatment standards and protocols. They promote personalized medicine through precise targeting and biomarker detection.

The specialty infusion clinics segment is expected to grow significantly in the coming years due to increasing access to complex therapies. They follow strict safety protocols and educate patients and caregivers. They provide decentralized care and prioritize cost savings and convenience.

The Northeast & Mid-Atlantic area led the market in 2024, capturing about 32% of the revenue share. This is mainly due to accelerated FDA approvals, strong local product development, significant investments, venture capital funding, and a dense biotechnology hub in the area. The development and approval of several bispecific antibodies further propel this region's expansion within the U.S. Additionally, federal and regional initiatives in the life sciences sector support bispecific antibody research and innovation. Tax incentive programs launched in the Northeast and Mid-Atlantic, such as Massachusetts's, offer refundable tax credits to life sciences companies for expanding operations and staffing. A state law in Pennsylvania ensures insurance coverage for biomarker testing, improving patient access to personalized treatments and promoting health equity.

In August 2025, Legend Innovation Life Science Fund announced an investment of up to $50 million in a clinical-stage biotechnology company in Mid-Atlantic BioTherapeutics in Pennsylvania to advance novel therapies for anti-aging, cancer, and neurological diseases.

New Jersey remains a key center for research and development of bispecific antibodies. State and federal initiatives aim to bolster the life sciences industry, which focuses on developing bispecific antibodies. Biocon’s new manufacturing plant in New Jersey has passed an FDA inspection.

The South U.S. is expected to grow at the fastest CAGR in the market during the forecast period due to the FDA's expansion of treatment options, the expansion of oncology applications, technological advancements, and the growing demand for personalized medicine. The ongoing innovations include advanced platforms and AI-driven discovery that enable scalable production, improve drug stability, and reduce development risks. Recent advances in antibody engineering have enabled the production of more effective, standardized bispecific formats. Biotechnology research and development introduced precise treatment approaches to treat cancer. The growth of clinical trials, increased R&D, and a focus on effective treatment options are driving the expansion of the market in the South U.S.

The state's Cancer Prevention and Research Institute of Texas (CPRIT) funds numerous bispecific antibody projects at leading research institutions. A Texas-based biotech startup seeks to develop several bispecific antibody drug candidates by securing funding for clinical trials and focuses on forming partnerships with pharmaceutical companies.

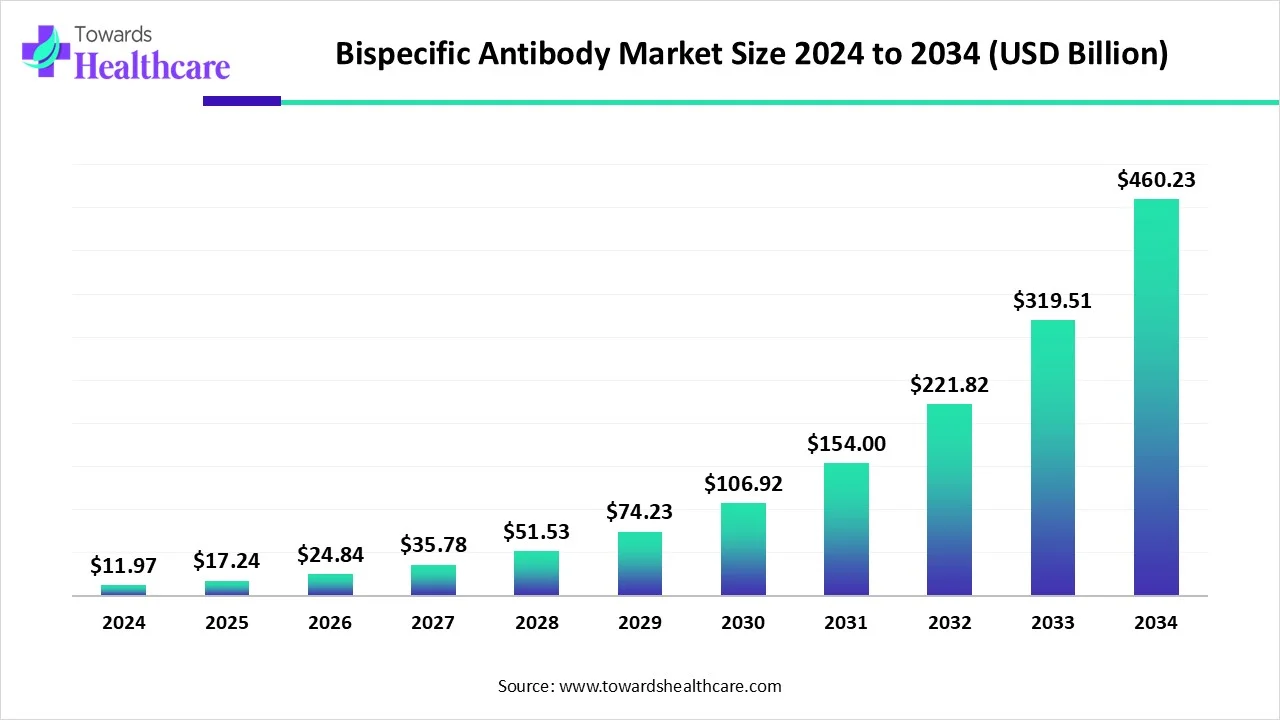

The global bispecific antibody market size is calculated at USD 11.97 in 2024, grew to USD 17.24 billion in 2025, and is projected to reach around USD 460.23 billion by 2034. The market is expanding at a CAGR of 44.04% between 2025 and 2034.

The R&D process for a new bispecific antibody candidate includes discovery and preclinical development, manufacturing and regulatory considerations, clinical development, and post-approval activities.

Key Players: Regeneron, Amgen, Genentech (Roche), Janssen (Johnson & Johnson), Pfizer, MacroGenics, and AbbVie.

Distribution of bispecific antibodies to pharmacies is driven through online and retail pharmacies by emphasizing increased outpatient use and expanded application.

Key Players: McKesson Corporation, Cencora, Inc., Cardinal Health, Inc., Amgen, Johnson & Johnson, Genentech, AbbVie, Pfizer, and Regeneron Pharmaceuticals.

Patient support focuses on managing side effects, educating patients, expanding access to care, providing financial assistance, and helping navigate reimbursement.

Key Players: Roche/Genentech, Amgen, Johnson & Johnson, Genentech, AbbVie, Pfizer, and Regeneron Pharmaceuticals.

Corporate Information

Business Overview

Amgen is a leading U.S.-based biotechnology company focused on discovering, developing, manufacturing, and delivering innovative human therapeutics. The company’s strategic focus spans oncology, cardiovascular, inflammation, rare disease, and general medicine, and it increasingly invests in advanced biologics and next-generation modalities, including bispecific antibodies.

Business Segments / Divisions

While Amgen previously reported its operations simply as “Human Therapeutics”, it is increasingly organized around therapeutic areas and technology platforms:

Rare Diseases

General Medicine / Cardiovascular / Bone Health

Additionally, Amgen emphasizes its biologics manufacturing, biosimilars, and advanced molecular engineering platforms.

Geographic Presence

Amgen has a global footprint, operating in approximately 100 countries and regions worldwide. Its manufacturing and R&D operations are located in the U.S. (California, Rhode Island, Massachusetts, North Carolina) and internationally (Ireland, Netherlands, Singapore), among others.

Key Offerings

SWOT Analysis

By Therapeutic Area/Indication

By Format/Architecture

By Development Stage

By End User/Payer Channel

By Region within the U.S.

January 2026

January 2026

January 2026

January 2026