January 2026

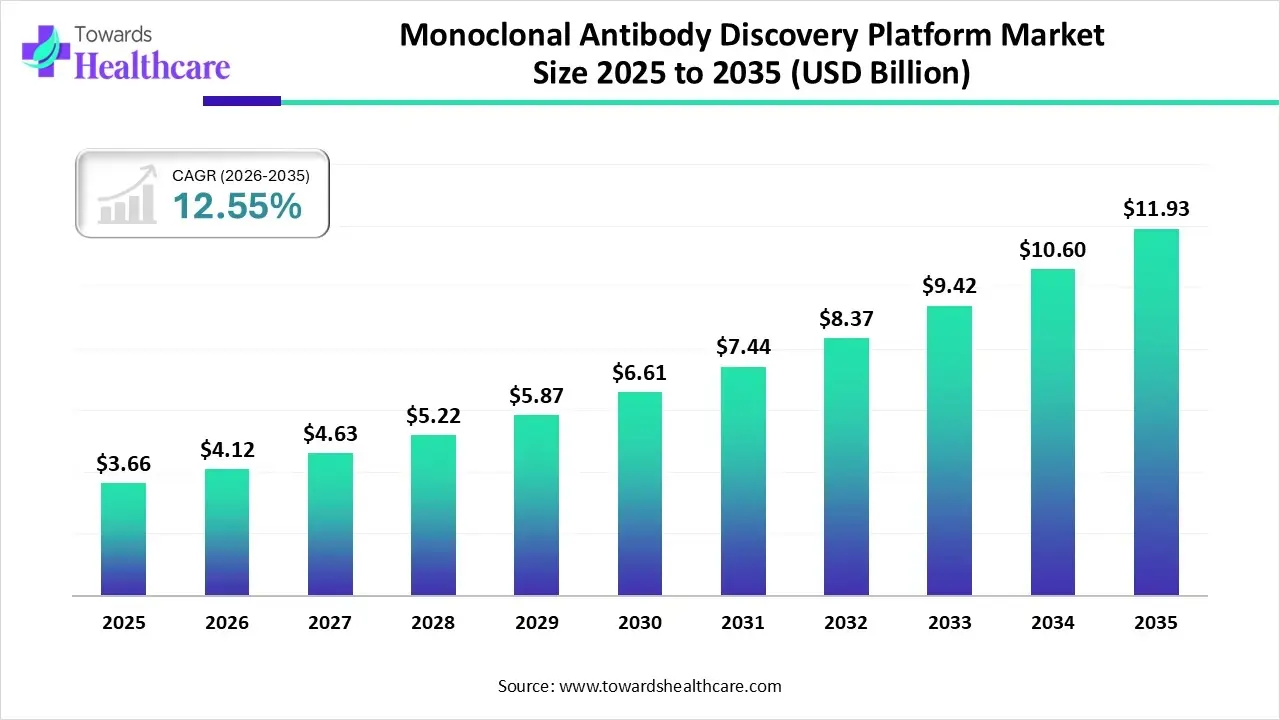

The monoclonal antibody discovery platform market size stood at US$ 3.66 billion in 2025, grew to US$ 4.12 billion in 2026, and is forecast to reach US$ 11.93 billion by 2035, expanding at a CAGR of 12.55% from 2026 to 2035.

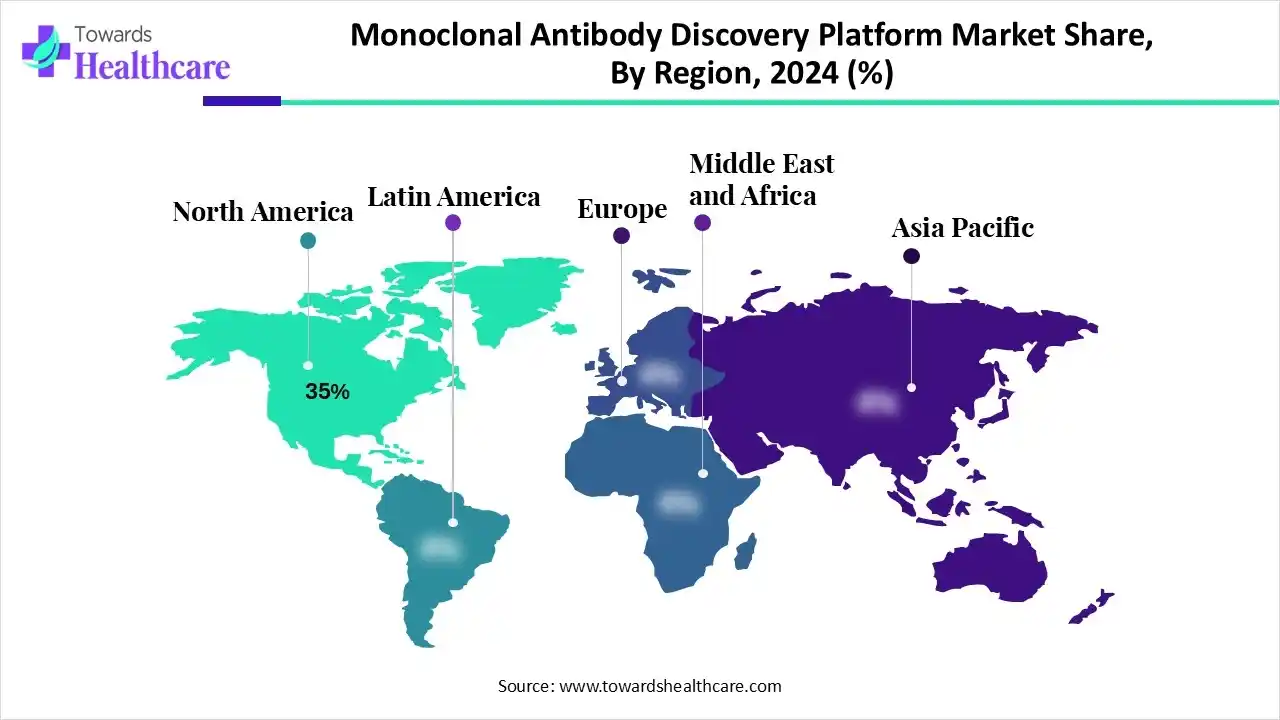

The monoclonal antibody discovery platform market is witnessing strong growth due to increasing demand for targeted therapeutics and advanced biologics. North America dominates the market, supported by robust biopharmaceutical research, strong funding for antibody innovation, and the presence of key industry players. The rising prevalence of cancer and autoimmune diseases continues to accelerate regional and global market expansion.

| Key Elements | Scope |

| Market Size in 2025 | USD 3.66 Billion |

| Projected Market Size in 2035 | USD 11.93 Billion |

| CAGR (2025 - 2035) | 12.55% |

| Leading Region | North America by 35% |

| Market Segmentation | By Technology / Platform Type, By Antibody Type, By End-User, By Application, By Region |

| Top Key Players | Thermo Fisher Scientific, Charles River Laboratories, WuXi AppTec / WuXi Biologics, AbCellera, Adimab, Abcam, GenScript Biotech (GenScript / GenScript ProBio), Twist Bioscience, Creative Biolabs, Sartorius, Biocytogen, Abveris, Abzena, LakePharma, ImmunoPrecise Antibodies, Integral Molecular, GigaGen, Morphosys, Regeneron Pharmaceuticals (VelocImmune platform), Bio-Rad Laboratories |

The monoclonal antibody discovery platform market is driven by the growing demand for precision medicine, advancements in biotechnology, and rising investments in biopharmaceutical R&D. Increasing prevalence of chronic diseases such as cancer and autoimmune disorders further accelerates market growth. Monoclonal antibody discovery platforms are advanced systems used to identify, screen, and optimize antibodies that target specific antigens. These platforms integrate technologies such as hybridoma, phage display, single B-cell screening, and AI-driven antibody design to enhance efficiency and accuracy. They play a critical role in drug discovery, enabling faster development of therapeutic antibodies for various diseases with improved efficacy and safety profiles.

AI integration is revolutionizing the monoclonal antibody discovery platform by accelerating candidate identification, reducing screening time, and enhancing precision in antibody-antigen interaction prediction. Machine learning models enable in-silico screening of vast antibody libraries, improving success rates in early-stage discovery. In 2025, collaborations like Takeda and Nabla Bio’s AI-driven antibody design partnership exemplify how computational tools streamline development, cut costs, and support the rapid design of high-affinity, humanized antibodies for complex therapeutic targets.

The phage display segment remains the dominant segment in the market with a share of 25–30% due to its proven reliability, high-throughput screening capability, and ability to generate fully human antibodies efficiently. It enables rapid identification of high-affinity candidates, reduces development timelines, and supports the creation of bispecific and multispecific antibodies. Extensive adoption by pharmaceutical and biotech companies, coupled with decades of optimization and robust intellectual property frameworks, reinforces its leadership in antibody discovery for therapeutic and diagnostic applications.

The computational/in-silico discovery platforms segment is rapidly gaining traction in the monoclonal antibody discovery market due to their significant advantages in speed, cost-efficiency, and precision. These platforms leverage artificial intelligence (AI) and machine learning (ML) to predict antibody-antigen interactions, optimize binding affinities, and design novel antibody candidates with improved efficacy and reduced immunogenicity. For instance, in October 2025, Nabla Bio's AI platform, Joint Atomic Model (JAM), enables rapid antibody design within 3–4 weeks, accelerating the development process. Increasing adoption of AI-driven platforms by pharmaceutical companies underscores the growing reliance on computational methods to enhance discovery efficiency.

The full-length monoclonal antibodies segment dominates the market with a share of approximately 40–45% due to its established therapeutic efficacy, versatility in targeting diverse antigens, and compatibility with proven production and purification processes. Widespread adoption by pharmaceutical companies for oncology, autoimmune, and infectious disease treatments reinforces its leading position.

The bispecific/multispecific antibodies segment is estimated to be the fastest-growing segment in the monoclonal antibody discovery platform market due to their ability to simultaneously target multiple antigens, enhancing therapeutic efficacy. Their versatility in treating complex diseases like cancer and autoimmune disorders drives demand. Advancements in antibody engineering and high-throughput screening technologies have accelerated their development, leading to increased adoption in clinical settings. Collaborations between biotech companies and pharmaceutical firms further propel innovation and market expansion in this segment.

The pharmaceutical & biopharmaceutical companies segment dominates the market with share of 50–55% due to their extensive R&D capabilities, strong funding, and in-house expertise in antibody engineering. Their large-scale adoption of advanced discovery technologies, focus on therapeutic innovation, and established commercialization channels reinforce their leading role in driving market growth.

The contract research organizations (CROs) segment is estimated to be fastest-growing segment in the market due to increasing outsourcing of early-stage discovery and development. They offer specialized expertise, scalable infrastructure, and cost-efficient solutions, enabling pharmaceutical and biotech companies to accelerate antibody candidate identification and reduce time-to-market for therapeutic antibodies.

The oncology segment dominates the market with a share of 40–45% due to the high demand for targeted cancer therapies. Monoclonal antibodies offer precise targeting of tumor-associated antigens, improving treatment efficacy and reducing side effects. Rising cancer prevalence worldwide and ongoing clinical research further drive adoption, making oncology the leading application for antibody discovery platforms.

The autoimmune diseases segment is estimated to be the fastest-growing application segment in the monoclonal antibody discovery platform market due to the increasing prevalence of conditions like rheumatoid arthritis, lupus, and multiple sclerosis. Monoclonal antibodies provide targeted immune modulation, offering improved efficacy and safety over traditional therapies. Advances in antibody engineering and growing R&D investments are accelerating development for autoimmune indications.

North America dominates the monoclonal antibody discovery platform market share by 35% due to its strong biotechnology and pharmaceutical infrastructure, high R&D investments, and presence of leading global companies like Roche, Amgen, and Pfizer. Advanced research facilities, extensive clinical trial networks, and supportive regulatory frameworks accelerate antibody discovery and development. The rising prevalence of cancer, autoimmune, and infectious diseases drives therapeutic demand, while government funding, private venture capital, and collaborations between academia and industry further bolster innovation and adoption of cutting-edge monoclonal antibody discovery technologies across the region.

In 2025, the United States continues to experience a significant cancer burden, with approximately 1.85 million new cancer cases reported in 2022 and over 613,000 cancer-related deaths in 2023. This high prevalence underscores the critical need for innovative therapies, driving the demand for monoclonal antibody discovery platforms. The focus on targeted treatments for various cancer types, including breast, lung, colorectal, and prostate cancers, further propels advancements in antibody discovery technologies. Consequently, the U.S. remains a pivotal region for the development and application of monoclonal antibody therapies.

Canada is experiencing rapid growth in the monoclonal antibody discovery platform market due to several key factors. The country boasts a robust healthcare infrastructure and strong government support for biomedical research. In 2025, an estimated 2 in 5 Canadians are expected to be diagnosed with cancer in their lifetime, highlighting the increasing demand for advanced therapeutic solutions. This rising cancer prevalence drives the need for innovative antibody therapies, fueling market expansion. Additionally, Canada's emphasis on personalized medicine and biotechnology innovation further accelerates the adoption of monoclonal antibody discovery platforms.

The Asia-Pacific region is the fastest-growing market for monoclonal antibody discovery platforms, driven by several converging factors. Rapid expansion of pharma and biotech R&D in China, India, South Korea, and Japan is fueling demand. Governments are increasing funding for biologics, and specialized antibody discovery facilities are being established. Talent availability, lower operational costs, and rising prevalence of chronic diseases like cancer and autoimmune disorders increase the need for targeted therapies. Outsourcing is rising as global players partner with APAC CDMOs to leverage these advantages.

China is a dominant country in the Asia-Pacific monoclonal antibody discovery platform market because of its rising burden of both autoimmune diseases and cancer. About 2.7-3.0% of Chinese adults (over 31 million people) suffer from one or more autoimmune diseases, including autoimmune thyroid disease and rheumatoid arthritis. Meanwhile, China reported approximately 4.82 million new cancer cases and 2.57 million cancer deaths in 2022. These disease burdens drive demand for targeted antibody therapeutics, spurring discovery platform investment, domestic R&D, and biotech partnerships.

India is becoming a fast-growing country in the monoclonal antibody discovery platform market due to rising burdens of cardiovascular disease and infectious disease. Recent studies estimate that cardiovascular disease affects ~11% of Indian adults, with higher rates in urban regions. Tuberculosis infection prevalence is about 41% in community cohorts, indicating high infectious disease pressure. These significant public health challenges drive demand for targeted antibody therapies, fueling investment in discovery platforms and biotech innovation.

Europe is growing notably in the monoclonal antibody discovery platform market due to several key factors. The region’s high prevalence of chronic diseases, including cancer and autoimmune disorders, creates strong therapeutic demand. Countries like Germany, France, and the UK have excellent biotech infrastructure and research institutions. Regulatory support, generous public funding (e.g., EU initiatives), and reimbursement systems that favor biologics also help. Finally, Europe’s focus on precision medicine and adoption of next-gen mAb formats further accelerates discovery platform investments.

Approximately 10% of UK people, or around 6–7 million individuals, have at least one autoimmune disorder, including rheumatoid arthritis, type 1 diabetes, and multiple sclerosis. This high disease burden increases demand for targeted antibody therapies, pushing investment into antibody discovery platforms. Pharmaceutical firms scale up R&D, adopt high-throughput screening, and develop therapeutic antibodies or biologics to meet clinical need.

In Germany, about 8.61% of the population (~6.3 million people) have at least one diagnosed autoimmune disease. High incidence of conditions like rheumatoid arthritis, psoriasis, and autoimmune thyroiditis drives the monoclonal antibody discovery platform market. Local biotech firms and CROs are increasingly focused on developing antibodies for autoimmune therapies to address unmet patient needs.

The R&D phase begins with the identification of a target antigen linked to a disease such as cancer, autoimmune disorder, or infectious disease. Scientists then use technologies like phage display, hybridoma generation, or in silico modelling to create antibody candidates. These antibodies undergo optimization for binding affinity, specificity, and stability before preclinical testing. Advanced computational tools and AI algorithms are now employed to accelerate the screening and candidate selection process.

Key organizations include pharmaceutical and biopharmaceutical companies (e.g., Pfizer, Roche, and AstraZeneca), biotech startups (e.g., AbCellera, IONTAS), and academic research institutions (e.g., Harvard Medical School, Max Planck Institute). Many companies collaborate with contract research organizations (CROs) such as Charles River Laboratories and WuXi Biologics to enhance antibody screening and characterization.

After successful preclinical testing, antibody candidates move into clinical trials (Phase I–III) to evaluate safety, efficacy, and dosage in human participants. Post-trial, data are submitted to regulatory bodies for approval and commercialization. Clinical validation also involves biomarker studies and immunogenicity testing to ensure therapeutic precision.

Organizations Involved:

This phase involves regulatory authorities such as the U.S. FDA, European Medicines Agency (EMA), and China’s NMPA, along with CROs and clinical research units like IQVIA and Labcorp Drug Development. Pharmaceutical companies often partner with academic hospitals and biotech firms for patient recruitment and data collection.

Once monoclonal antibody drugs are approved, companies implement patient access, affordability, and adherence programs. This includes pharmacovigilance, ongoing safety monitoring, and post-market clinical follow-up. Support programs also focus on educating patients and healthcare providers about proper usage and potential side effects.

Organizations Involved:

Major organizations include pharmaceutical patient-support divisions (e.g., Roche’s “Access to Care” program, Novartis Patient Support), healthcare providers, specialty pharmacies, and non-profit organizations like the American Autoimmune Related Diseases Association (AARDA). These entities ensure smooth therapy delivery, patient education, and continuous improvement of treatment outcomes.

WuXi Biologics (China)

WuXi offers fully integrated antibody discovery services, including target identification, hybridoma, phage/yeast display, single B-cell screening, lead optimization (humanization, affinity maturation, Fc engineering), and IND-enabling support.

Thermo Fisher Scientific (USA)

Thermo Fisher provides "Integrated Antibody Discovery Solutions", covering antibody generation, engineering, characterization (binding, potency, immunogenicity), recombinant expression, purification, and cell-based assays.

AbCellera Biologics (Canada)

AbCellera uses AI-powered and single-cell screening platforms to quickly identify high-affinity antibody candidates, especially from natural immune repertoires. Their platform accelerates discovery timelines.

GenScript Biotech

GenScript specializes in hybridoma and phage display technologies, offering end-to-end antibody discovery services such as SMABody® for bispecific antibodies, humanization, and optimization.

Aragen Life Sciences (India)

Aragen offers antibody discovery through hybridoma and phage display as part of its cell and protein sciences suite, including antigen generation, immunization, screening, and purification to identify high-affinity antibodies.

By Technology / Platform Type

By Antibody Type

By End-User

By Application

By Region

January 2026

January 2026

December 2025

December 2025