January 2026

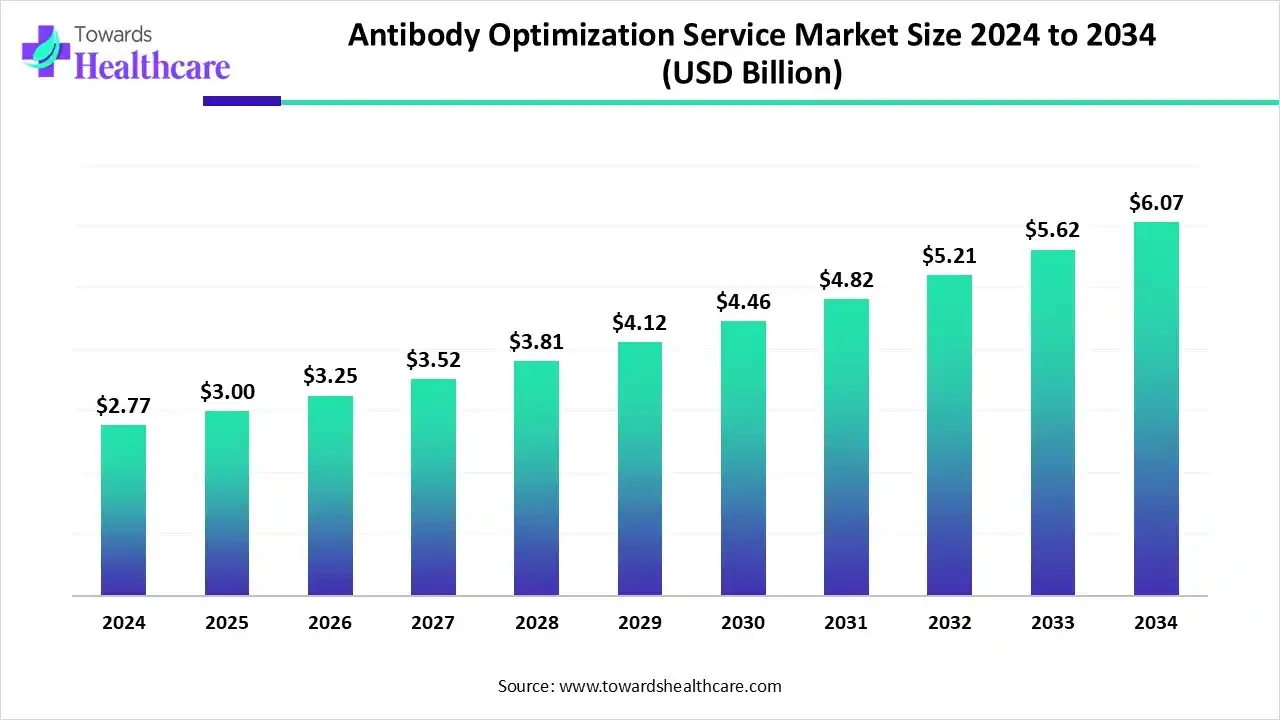

The global antibody optimization service market size is calculated at US$ 2.77 billion in 2024, grew to US$ 3 billion in 2025, and is projected to reach around US$ 6.07 billion by 2034. The market is expanding at a CAGR of 8.45% between 2025 and 2034.

The computational tools are reshaping the workflow of in silico antibody discovery and optimization. The antibody optimization service market supports faster and cost-effective development of therapeutic antibodies for different health diseases. The integration of artificial intelligence and machine learning into R&D enables faster identification and design of high-quality therapeutic antibody leads. Leading biopharmaceutical companies design and develop antibodies to combat antigens associated with neurodegenerative diseases.

| Table | Scope |

| Market Size in 2025 | USD 3 Billion |

| Projected Market Size in 2034 | USD 6.07 Billion |

| CAGR (2025 - 2034) | 8.45% |

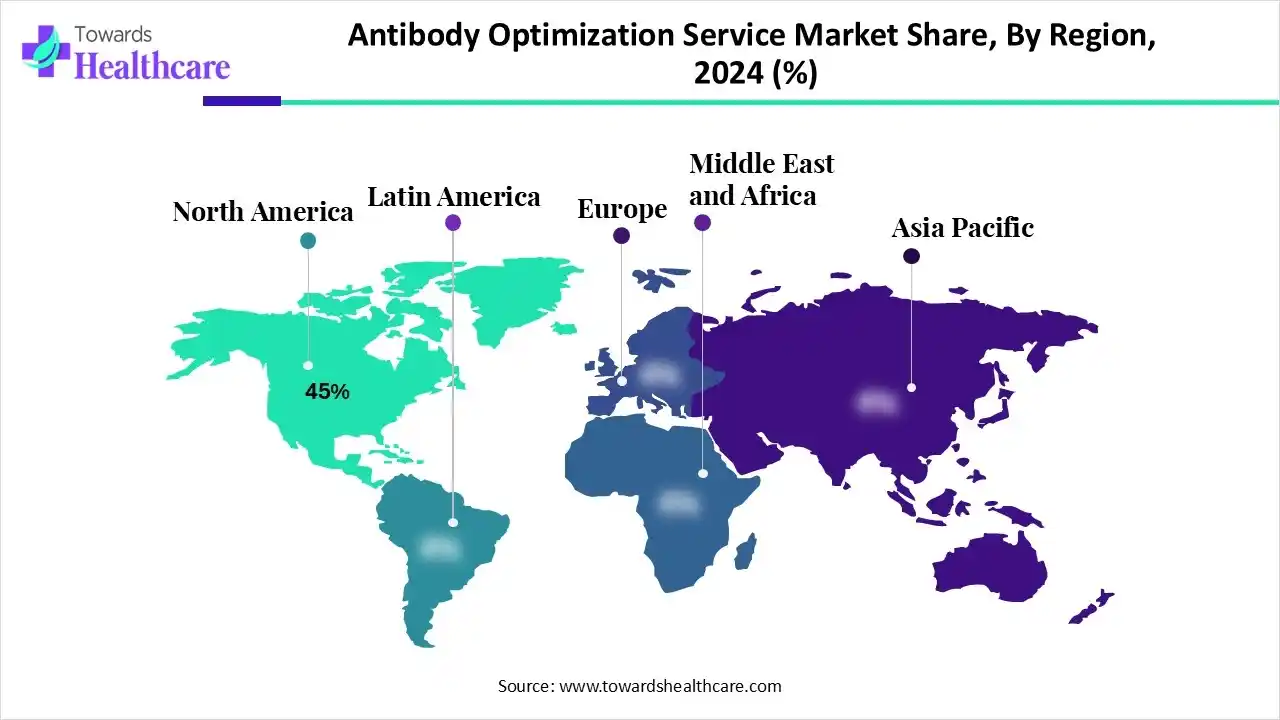

| Leading Region | North America by 45% |

| Market Segmentation | By Service Type, By Technology/Platform, By Therapeutic Application, By End User, By Region |

| Top Key Players | Abzena, GenScript, Creative Biolabs, FairJourney Biologics, Absolute Antibody, Lonza, Merck KGaA/MilliporeSigma, Thermo Fisher Scientific, Charles River Laboratories, WuXi AppTec, Adimab, Abcam, Bio-Rad Laboratories, Sino Biological, ProteoGenix, Evotec, Bio-Techne, ProMab Biotechnologies, AbCellera, Sartorius |

Researchers are leveraging cutting-edge technologies to bring promising therapeutic antibodies for patients with unmet medical needs like infectious and neurodegenerative diseases. The antibody optimization service market covers contracted services and platforms that improve candidate antibodies after initial discovery so they are suitable for therapeutic, diagnostic, or research use.

Typical services include affinity maturation, humanization, Fc-engineering (to modify effector function or half-life), stability and aggregation reduction, sequence/developability optimization, de-immunization, isotype/format engineering (e.g., fragments, bispecifics), expression and manufacturability optimization, in-vitro / in-vivo screening and characterization (binding kinetics, stability, immunogenicity), and computational design and developability assessments. Buyers are pharma/biotech companies and research organizations that outsource these technical activities to specialist CROs/CDMOs or platform companies to accelerate lead optimization and reduce clinical / manufacturing risk.

The AI-aided computational design enhances the binding affinity of clinically significant and well-developed antibodies. AI streamlines the antibody development process by using protein sequence alone. Based on the type of available data, AI is used to enhance the lead optimization efforts.

The affinity maturation segment dominated the market in 2024, with a revenue share of 18%, owing to its wider applicability to improve diagnostic and therapeutic antibodies. It involves the latest techniques, such as AI, advanced display technologies, and high-throughput screening, to boost and refine the affinity maturation process with greater efficiency and precision. The rising trends in affinity maturation and optimization include next-generation sequencing (NGS), AI, ML, and outsourcing to CROs and CDMOs, which result in clinical trial success.

The computational design & developability assessment segment is expected to grow at the fastest CAGR in the antibody optimization service market during the forecast period due to its critical role in enabling data-driven and de-novo antibody design. It guides high-throughput virtual screening and enables early-stage risk mitigation. It optimizes laboratory workflows and will drive laboratory automation by AI integration.

The phage display segment dominated the market in 2024, with a revenue share of 25%, owing to its expansion with advancements in next-generation sequencing, AI, and computational biology. It is widely integrated into streamlined workflows to create, mature, and design advanced antibody formats. Phage display remains a standard method to refine the binding strength and specificity of existing antibodies.

The computational/AI-based optimization segment is estimated to grow at the fastest rate in the antibody optimization service market during the predicted timeframe due to its integral part in improving the quality of therapeutic candidates. It facilitates de novo antibody design and rapid identification of candidates. The generative AI and deep learning are becoming powerful antibody design tools beyond simple data analysis.

The oncology segment dominated the market in 2024 with a revenue share of 40%, owing to the prominent role of antibody optimization in advancing cancer treatment. It improves the safety, efficacy, and production of antibody-based therapeutics. It leverages AI and ML, and optimizes bispecific and multispecific antibodies. It supports companion diagnostics and non-invasive monitoring by enhancing precision medicine and patient selection.

| Cancer type | 2022 cases (Global) | 2050 cases (Projected) | Percentage change (2022–2050) |

| All cancers | ~20 million | 35.3 million | 76.6% |

| Lung | 2.5 million | 4.6 million | 85.5% |

| Female breast | 2.3 million | 4.1 million | 78.5% |

| Colorectum | 1.9 million | 3.6 million | 85.5% |

| Prostate | 1.5 million | 2.7 million | 84.3% |

| Stomach | 0.97 million | 1.8 million | 87.5% |

| Liver | 0.87 million | 1.5 million | 76.0% |

The neurological disorders segment is anticipated to grow at a notable rate in the antibody optimization service market during the upcoming period because antibodies can overcome the blood-brain barrier in treating neurological conditions. The optimized antibodies can manage complex pathology and enhance drug specificity and efficacy. The use of advanced engineering and AI allows these services to improve the pharmacological properties of new and current antibody therapies.

As of 2021, over 3.4 billion people lived with a neurological condition, and this burden is expected to double by 2050. Dementia cases are projected to nearly triple from 50 million in 2017 to 152 million by 2050. Parkinson's cases are expected to reach 25.2 million by 2050, a 112% increase from 2021. Stroke deaths could reach 10 million annually by 2050.

The pharmaceutical companies segment dominated the market in 2024, with a revenue share of 45%, owing to the strong position of the pharma industry as the largest end-user of antibody discovery and optimization services. The large companies are investing in their own internal R&D capabilities by integrating advanced technologies. The major pharma leaders and AI experts are making partnerships that help to optimize drug discovery pipelines.

The biotechnology companies segment is predicted to grow at a rapid rate in the antibody optimization service market during the studied period due to their central role in adopting automation, AI, high-throughput screening, next-generation platforms, and novel phage display technologies. They provide specialized antibody optimization services like affinity maturation, manufacturing, stability engineering, Fc engineering, etc. The partnerships with CROs provide expertise and advanced platforms to clients.

North America dominated the market in 2024, with a revenue share of approximately 45%, owing to the rising demand for biologics, personalized medicine, a strong biotechnology infrastructure, and a supportive regulatory environment. The harmonized regulations are reducing complexity and speeding up market access. The aligned standards, processes, and documentation needs across North America and other regions minimize the need for repeated testing or multiple regulatory submissions designed for individual markets. The U.S. dominates the biotechnology sector in North America and globally, by holding the presence of a large number of biotechnology firms. Vancouver is one of the leading life science hubs in this region, which is home to over 70 biotechnology companies that directly employ around 2,600 life sciences professionals.

Researchers at the Lawrence Livermore National Laboratory (LLNL) situated in California, U.S., leverage AI-driven platforms in collaboration with other leading institutions to improve antibodies against mutations and boost pandemic preparedness. The U.S. National Science Foundation (NSF) focuses on its investments in biotechnology to strengthen scientific discovery. The funding and grants are growing the U.S. economy and transforming fields like medicine, manufacturing, agriculture, and clean energy.

In April 2025, Sanofi announced the approval for Dupixent in the U.S. as the first new targeted therapy to treat chronic spontaneous urticaria.

In August 2025, ImmunoPrecise Antibodies Ltd. reported its advancements in AI-discovered and developed universal Dengue vaccine initiative and planned to step forward into preclinical antibody generation.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to the cost-effectiveness in clinical research and competitive advantages in outsourcing to contract research organizations (CROs). The public sector is crucial in empowering biotechnology innovations in the Asia Pacific region. The global pharma sector is committed to innovation, intellectual property protection, stability, and regulatory alignment. Singapore remains an emerging biotechnology leader in the Asia Pacific due to Asia’s growing strengths in cell and gene therapy, mRNA, antibody-drug conjugates (ADCs), and AI-driven drug discovery. The government and public sector are driving biotechnology research and development through their policy tools, talent strategies, and research infrastructure.

The Government of India, Press Information Bureau, reported that India’s bioeconomy grew from USD 10 billion to USD 165.7 billion in 10 years, and is targeting USD 300 billion by 2030. It has also been proclaimed that 47% of bioindustrial, 35% of biopharma, 8% of BioAgri, and 9% of bioresearch are the four major subsectors in India’s bioeconomy. India is a global bioeconomy powerhouse and a global vaccine hub, with Serum Institute’s share rising to 24% in 2024.

In January 2025, Jitendra Singh, the science minister, announced that India is set to revolutionize the global biotechnology sector in 2025 with the Indian government allocation of ₹1000 crores to boost biotechnology innovations in 2024.

Europe is expected to grow at a notable rate in the market in 2024, led by more flexible and cost-effective approaches offered by outsourcing development tasks to CROs. EuropaBio recognized a new initiative, which is a new EU Biotech Act that will boost biotechnology and biomanufacturing in the European Union. Europe supports the development of antibodies and antibody-derived proteins to prevent and treat infectious diseases, with the rising epidemic potential in the EU and globally.

The European Commission launched a biotechnology and biomanufacturing hub to help small firms and start-ups launch novel biotechnology-based products in the market. The European Commission, in collaboration with the European Investment Bank (EIB) and Health Emergency Preparedness and Response Authority (HERA), signed an agreement under the HERA Invest Initiative to accelerate biopharmaceutical research and development in Europe.

Germany has set a national pharma strategy that displays simplified agreements, manufacturing incentives, digitalization, and pricing reforms. It aims to safeguard pharmaceutical supply chains, address global clinical trials, and speed up approvals. It also aims to boost clinical research and enhance Germany’s appeal to pharmaceutical companies.

The R&D process for antibody optimization services includes computational design and in silico analysis, high-throughput (HTP) library generation, high-throughput screening and characterization, and validation and preclinical studies.

Key Players: WuXi Biologics, Thermo Fisher Scientific Inc., GenScript Biotech Corporation, Creative Biolabs, Lonza, Samsung Biologics.

The regulatory updates include FDA guidance for antibody-drug conjugates, harmonized analytical procedures, EMA changes for lifecycle management, and monoclonal antibody standardization. The major antibody therapeutic approvals in 2024 are given for several antibody-based drugs to treat multiple myeloma, cancers, and other diseases.

Key Players: WuXi AppTec/WuXi Biologics, Thermo Fisher Scientific, ICON plc, Charles River Laboratories, GenScript Biotech.

It includes patient assistance programs, personalized clinical support, infusion support, treatment education, and clinical trial support.

Key Players: F. Hoffmann-La Roche, Amgen, AstraZeneca, Regeneron, Adimab.

By Service Type

By Technology/Platform

By Therapeutic Application

By End User

By Region

January 2026

January 2026

January 2026

January 2026