February 2026

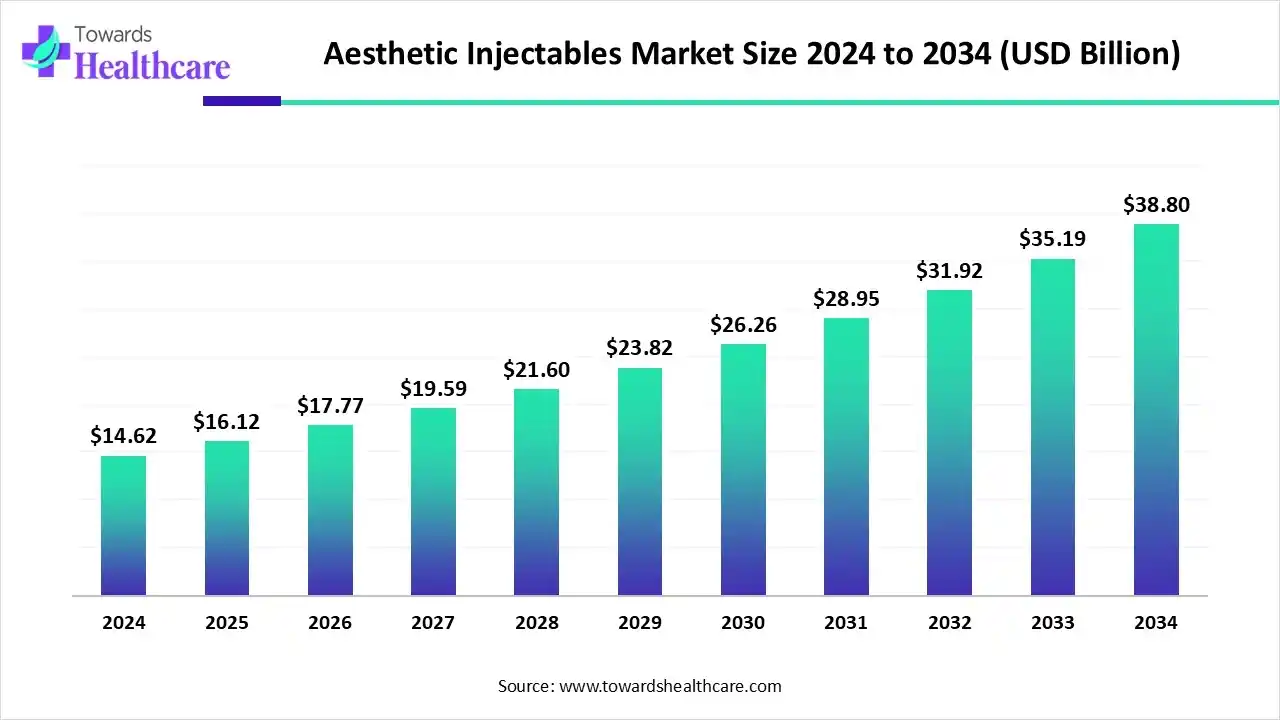

The global aesthetic injectables market size is calculated at US$ 16.12 billion in 2025, grew to US$ 17.77 billion in 2026, and is projected to reach around US$ 38.8 billion by 2034. The market is expanding at a CAGR of 10.26% between 2025 and 2034.

The aesthetic injectables market is expanding due to a number of factors, such as the elderly population's desire for non-surgical remedies for aging symptoms, the growing awareness of beauty among all age groups, continuous technological developments that enhance product safety and effectiveness, and the minimally invasive nature of these procedures.

| Table | Scope |

| Market Size in 2025 | USD 16.12 Billion |

| Projected Market Size in 2034 | USD 38.8 Billion |

| CAGR (2024 - 2034) | 10.26% |

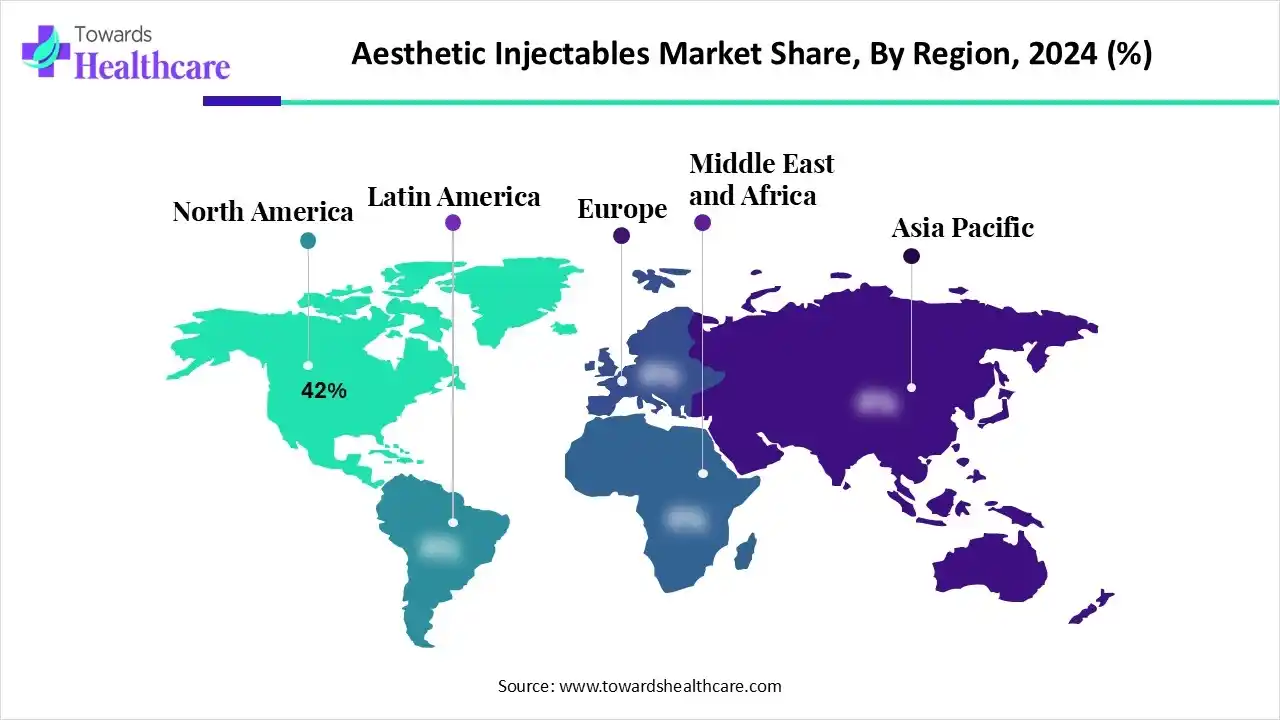

| Leading Region | North America by 42% |

| Market Segmentation | By Product Type, By Indication/Treatment Area, By Treatment Setting/End User, By Distribution Channel, By Patient Demographic, By Region |

| Top Key Players | AbbVie/Allergan Aesthetics, Galderma, Merz Aesthetics, Ipsen, Revance Therapeutics, Evolus, Teoxane Laboratories, Croma-Pharma, Sinclair Pharma, Suneva Medical, Hugel, Daewoong Pharmaceutical, Medytox, Bloomage Biotech, Anika Therapeutics |

The aesthetic injectables market is driven by aging populations, broader social acceptance, a preference for minimally invasive procedures, the growth of male and younger user segments, a rise in various beauty standards, and the expansion of clinic networks and DTC marketing. The market covers prescription injectable products used to alter or restore facial appearance, smooth wrinkles, add volume, or improve skin quality.

It includes neuromodulators (botulinum toxin type A products), dermal fillers (hyaluronic acid, calcium hydroxylapatite, poly-L-lactic acid, polymethylmethacrylate, autologous fat grafts, where used as an injectable), biostimulatory injectables, and adjunctive injectable skin-rejuvenation products (e.g., micro-botox, mesotherapy cocktails delivered by injection). The market serves medical aesthetic clinics, dermatology and plastic surgery practices, medspas, and increasingly non-physician providers under medical oversight.

By increasing diagnostic precision, providing virtual treatment result simulations, and enabling hyper-individualized treatment plans based on patient data, artificial intelligence (AI) improves cosmetic operations. While robotic technologies help with precision-based activities, AI-driven chatbots and virtual assistants expedite patient contacts.

What made the Neuromodulators Dominant in the Market in 2024?

The neuromodulators segment accounted for approximately 36% of the aesthetic injectables market revenue in 2024 because neuromodulation is rapidly becoming one of the most popular cosmetic procedures among patients. By preventing the formation of fine lines, neuromodulators give your skin a renewed look without making it appear frozen or unnatural.

Poly-L-Lactic Acid (PLLA) & Other Biostimulators

The poly-L-lactic acid (PLLA) & other biostimulators segment is expected to be the fastest-growing during 2025-2034 because of its exceptional biocompatibility and ability to stimulate collagen over an extended period of time. Poly-L-lactic acid (PLLA) has become a preferred injectable filler in cosmetic procedures. With patient satisfaction rates above 90%, recent clinical trials have validated the efficacy of PLLA in treating face wrinkles, volume loss, and improving skin elasticity and moisture.

Hyaluronic Acid (HA) Dermal Fillers

The hyaluronic acid (HA) dermal fillers segment is growing in the market because of its biocompatibility, reversibility, and efficiency in improving the hydration, volume, and general look of the skin. Hyaluronic acid (HA) fillers are widely used in aesthetic medicine. Most of these fillers are made by microbial fermentation, which is followed by a crucial cross-linking step that increases their durability by preventing enzymatic breakdown.

Which Indication Dominated the Aesthetic Injectables Market in 2024?

The glabellar/forehead lines & crow’s feet segment accounted for approximately 34% of market revenue in 2024. Because crow's feet and glabellar/forehead lines are so widespread and most individuals will have them as they age naturally. More noticeable lines start to show in the 30s and 40s, but crow's feet can start to show as early as the mid-to-late 20s.

Lip Augmentation & Perioral Rejuvenation

The lip augmentation & perioral rejuvenation segment is expected to be the fastest-growing segment during 2025-2034. One of the most common cosmetic procedures performed nowadays is lip augmentation. It is now possible to change the appearance of the lips using a variety of injectable drugs and surgical treatments, thanks to developments in reliable techniques.

Skin Quality & Microinjections

The skin quality & microinjections segment is growing in the market as modern culture becomes more concerned with aging, especially facial aging. The use of microinjections as a skin-rejuvenation treatment has grown in popularity in recent years. Skin hydration, stiffness, and viscoelastic qualities can all be enhanced by hyaluronic acid (HA), which is crucial for the hydration of the extracellular space.

How the Specialist Aesthetic & Plastic Surgery Clinics Dominated the Market?

The specialist aesthetic & plastic surgery clinics segment accounted for approximately 36% of the aesthetic injectables market revenue in 2024 due to a combination of improved patient experience, cutting-edge technology, and shifting consumer attitudes has led to specialized aesthetic and cosmetic surgery clinics controlling the industry. Because these clinics provide a more individualized, specialized, and private setting, patients frequently choose them over traditional hospitals for cosmetic operations.

Medspas & Non-Hospital Ambulatory Centers

The medspas & non-hospital ambulatory centers segment is expected to be the fastest-growing during 2025-2034. With cutting-edge services like IV hydration, injectables, and cosmetic improvements, medical spas have become increasingly popular. Compared to a hospital or surgical center, this kind of clinic offers services in a far more opulent and cozy setting, which helps many patients unwind and feel less nervous when undergoing treatments and operations.

Dermatology Practices

The dermatology practices segment is growing in the market due to advancements in related technologies. Aesthetic dermatology has lately made strides in addressing issues such as wrinkles, pigmentation, and skin laxity. A number of techniques, such as subject surveys, instrumental measures, and evaluators' overall ratings, have been presented for evaluating cosmetic skin disorders.

Which Distribution Channel Dominated the Market in 2024?

The direct-to-clinics/manufacturer sales segment accounted for approximately 48% of the aesthetic injectables market revenue in 2024. Bypassing conventional middlemen like wholesalers and distributors, a producer sells goods directly to medical clinics under a direct-to-clinics sales strategy. Although this strategy offers producers more control over pricing, customer interactions, and the sales process, it also comes with hefty logistical and financial obligations.

Online Medical Marketplaces & D2C

The online medical marketplaces & D2C segment is expected to be the fastest-growing during 2025-2034. In recent years, there has been a notable increase in the number of customers who routinely make direct-to-consumer (D2C) e-commerce purchases from firms throughout the globe. This demonstrates how the Direct-to-Consumer (D2C) business model is becoming more and more popular.

Medical Distributors & Wholesalers

The medical distributors & wholesalers segment is growing in the market. Aesthetic clinics and medical spas can benefit greatly from the cost reductions, availability of premium goods, supply chain efficiency, and business assistance provided by medical distributors and wholesalers who specialize in aesthetic injectables.

How the Women Dominated the Aesthetic Injectables Market in 2024?

The women (25-54 years) segment dominated the aesthetic injectables market in 2024, accounting for approximately 58% of revenue. Women continue to dominate the aesthetic patient group, accounting for 85.5% to 94% of operations. Enhancing self-esteem is the main reason people utilize BT. Demand for cosmetic procedures is driven by social media, as 95% of patients look for information online.

Men (All Adult Ages)

The men (all adult ages) segment is expected to be the fastest-growing during 2025-2034. There has been a discernible change in perceptions of male attractiveness and self-care behaviors in recent years. Numerous causes, such as the impact of media portrayal, societal changes, and evolving gender standards, might be blamed for this metamorphosis.

Women (55+ Years)

The women (55+ years) segment is growing in the market due to the desire for a younger appearance, improvements in cosmetic treatments, and rising costs have all contributed to the recent growth in older women's usage of Botox injections.

North America dominated the aesthetic injectables market, accounting for approximately 42% of revenue in 2024. The increased number of people between the ages of 25 and 65 is to blame for this, since they are particularly concerned about the appearance of wrinkles, dark spots, and loose skin. The need for cosmetic enhancement products has increased as a result. Furthermore, it is anticipated that throughout the projection period, the region's growing disposable income will propel market expansion.

The use of FDA-approved botulinum toxin from registered providers in clinical settings was emphasized after the FDA and CDC looked into instances of counterfeit injections in 2024. In 2024, more than 9.8 million neuromodulator operations were carried out, and projections for 2025 indicate a rise in demand for more subdued outcomes, prophylactic measures, and therapeutic purposes that go beyond cosmetics.

Asia Pacific is estimated to host the fastest-growing aesthetic injectables market during the forecast period. Rapidly evolving lifestyles and rising spending power on personal care in developing nations like China, South Korea, Japan, and others are to blame for the rise. To take advantage of the growing demand from both domestic and foreign patients, these countries have increased their investments in medical tourism.

In terms of injections per person, South Korea is the world leader. In 2024, 1.17 million international medical tourists visited South Korea. In 2023, the second most common medical tourism procedure was cosmetic surgery. Additionally, the most popular location for medical visitors was Seoul. Reputable clinics in Seoul provide a range of plastic operations at reasonable costs.

Europe is expected to grow at a significant CAGR in the aesthetic injectables market during the forecast period because of well-established dermatological facilities, strict safety and quality regulations, and an emphasis on these factors in the market for cosmetic dermatology. Advanced safety-standardized regenerative and biostimulating fillers were introduced in March 2025 by a number of European clinics in compliance with very stringent safety regulations.

According to estimates, 900,000 Botox injections are performed annually in the UK, making it one of the most popular non-surgical cosmetic procedures. In an effort to raise standards in the aesthetics sector, the UK government also announced new licensing guidelines for non-surgical cosmetic procedures in September 2025.

South America is expected to grow significantly in the aesthetic injectables market during the forecast period, driven by rising disposable incomes, growing social media influence, and increasing acceptance of minimally invasive cosmetic treatments. Urban populations and younger consumers are fueling demand for facial rejuvenation and contouring procedures.

Brazil’s Botox market is expanding as the country performs over two million minimally invasive aesthetic procedures annually. High medical aesthetic expertise, social media influence, and a beauty-focused culture are driving widespread adoption across both men and women seeking youthful, natural results.

The Middle East and Africa are expected to grow at a lucrative CAGR in the aesthetic injectables market during the forecast period due to evolving beauty trends, medical tourism, and expanding aesthetic clinic networks. Growing awareness of non-surgical treatments and adoption of advanced injectables by dermatologists are enhancing accessibility and patient confidence across the region.

In the UAE, Botox popularity is rising as the country becomes a hub for premium medical aesthetics. Advanced clinics, skilled dermatologists, strong medical tourism, and social media-driven beauty trends fuel the growing acceptance of non-surgical facial rejuvenation.

Emphasizes the creation of novel injectable formulations, biocompatibility optimization, safety profile enhancement, longevity, and natural aesthetic results.

Prior to commercial introduction and physician usage, the medicine undergoes multi-phase clinical testing to ensure safety, effectiveness, and compliance with regional regulatory criteria.

Offers instructional materials, digital engagement, and post-treatment care programs to enhance long-term cosmetic results, treatment compliance, and patient happiness.

Company Overview

Business Overview

Key Developments & Strategic Initiatives

Competitive Positioning

SWOT Analysis

Recent News and Updates

Press Releases:

Company Overview

Business Overview

Key Developments & Strategic Initiatives

Competitive Positioning

SWOT Analysis

Recent News and Updates

Press Releases:

| Company | Key Offerings | Latest Contributions | Focus / Impact |

| Merz Aesthetics | Xeomin®, Radiesse®, Belotero® | Introduced Radiesse Lido and Belotero Revive for enhanced comfort and hydration. | Strengthened the biostimulator segment and the global filler portfolio. |

| Ipsen | Dysport®, IPN10200 (in development) | Advancing long-acting toxin IPN10200 into Phase III for durable aesthetic outcomes. | Targeting fewer injections and extended patient satisfaction. |

| Revance Therapeutics | Daxxify®, RHA® Collection | Expanded Daxxify launch in Europe and Asia in 2025. | Competing in the long-duration neuromodulator niche. |

| Evolus / Teoxane Labs | Evolysse™, Estyme®, RHA®, Teosyal® | Evolus gained FDA approval; Teoxane achieved MDR certification. | Boosted EU market access and premium HA injectable innovation. |

Explore how leading innovators are transforming the global Aesthetic injectables market at: https://www.towardshealthcare.com/companies/aesthetic-injectables-companies

By Product Type

By Indication/Treatment Area

By Treatment Setting/End User

By Distribution Channel

By Patient Demographic

By Region

February 2026

February 2026

February 2026

February 2026