January 2026

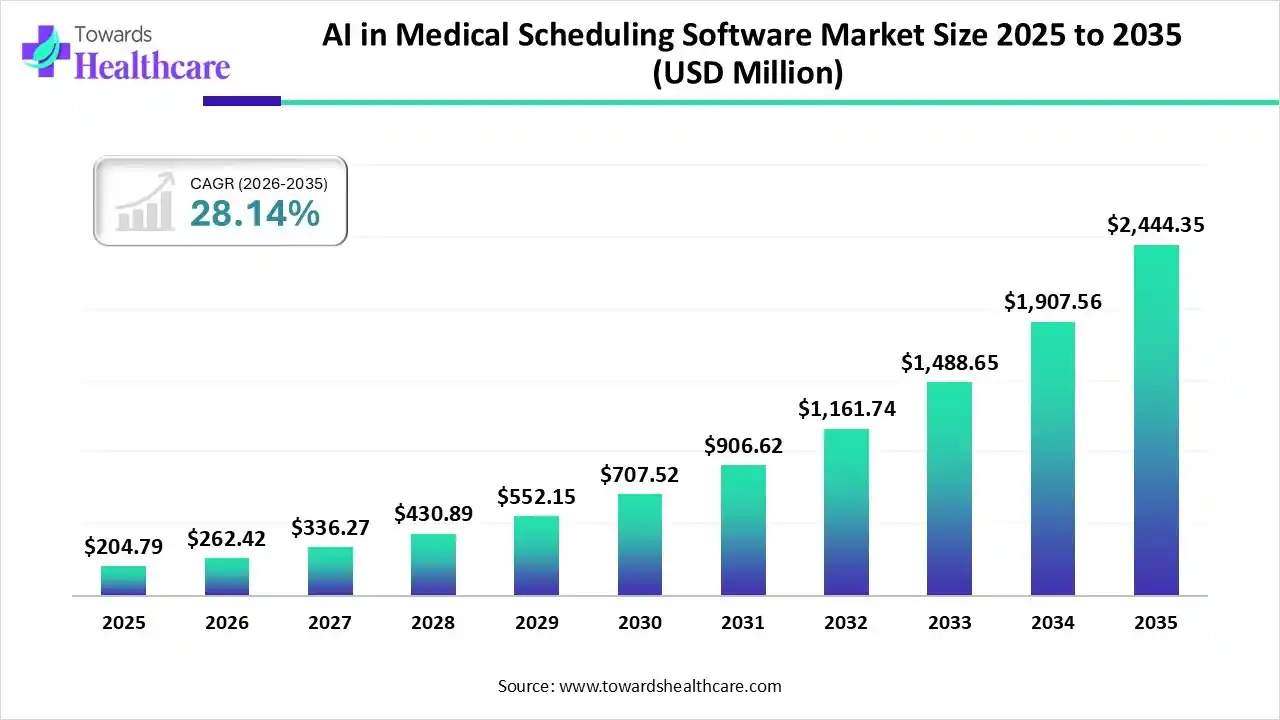

The global AI in medical scheduling software market size is calculated at USD 204.79 million in 2025, grew to USD 262.42 million in 2026, and is projected to reach around USD 2444.35 million by 2035. The market is expanding at a CAGR of 28.14% between 2026 and 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 262.42 Million |

| Projected Market Size in 2035 | USD 2444.35 Million |

| CAGR (2026 - 2035) | 28.14% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Deployment Model, By End-Use, By Region |

| Top Key Players | Phreesia, CentralReach, QGenda, RXNT, Skedulo, PracticeSuite, Doctor Connect, TIMIFY, Clearwave, WellSky |

The AI in medical scheduling software market is primarily driven by the increasing patient population and the shortage of healthcare professionals. Artificial intelligence (AI) automates scheduling medical staff and patients, enhancing efficiency and accuracy. Regulatory agencies authorize the use of medical scheduling software, enabling high-quality, personalized outcomes. The increasing integration with electronic health records (EHRs) and electronic medical records (EMRs) presents future opportunities for the market.

The AI in medical scheduling software market is experiencing robust growth, driven by the increasing adoption of advanced technologies, growing demand for personalized care, and the rising awareness of remote monitoring and telemedicine. It encompasses the development and deployment of AI-based software for medical scheduling. Medical scheduling software is a suite of digital tools that help healthcare organizations schedule patients and medical staff faster. It reduces administrative tasks by checking in patients, conducting outreach, and billing for care.

Which Product Type Segment Dominated the AI in Medical Scheduling Software Market?

The patient scheduling segment held a dominant position in the market in 2024, due to the need for timely patient care, resource optimization, and the increasing hospital admissions. As of March 2025, over 8.9 crore hospital admissions were authorized under the Ayushman Bharat – Pradhan Mantri Jan Aarogya Yojana scheme by the Indian government. Patient scheduling software plays a vital role in coordinating consultations, follow-ups, and medical procedures. It helps healthcare professionals to streamline administrative tasks, such as appointment reminders and confirmations, to improve patient adherence.

Care Provider Scheduling

The care provider scheduling segment is expected to grow at the fastest CAGR in the AI in medical scheduling software market during the forecast period. The shortage of healthcare professionals in various nations necessitates them to use AI-based software to treat multiple patients. The Association of American Medical Colleges (AAMC) estimated that the U.S. will face a physician shortage of up to 86,000 physicians by 2036. Care provider scheduling software allows providers to collect primary health information to ensure better care delivery.

Nurse Scheduling

The nurse scheduling segment is expected to grow in the coming years, due to major advantages for nurses, such as flexible workdays, more per diem options, and steady workflow. Nurse scheduling software facilitates scheduling nurses for various functions, such as outpatient, surgery, educators, managers, and case managers. It addresses the potential challenges of the nurse shortage.

Why Did the Cloud-based Segment Dominate the AI in Medical Scheduling Software Market?

The cloud-based segment held the largest revenue share of the market in 2024 and is expected to grow at the fastest CAGR during the forecast period, due to high scalability and flexibility. Cloud-based software can store vast amounts of data and can be accessed from anywhere and at any time. It eliminates the need for a specialized infrastructure to install patient scheduling devices, saving extra costs for maintenance. It offers much better security and backup facilities for easier and faster data recovery.

On-Premises

The on-premises segment is expected to grow at a significant CAGR in the AI in medical scheduling software market during the studied years. On-premises tool provides complete control over medical scheduling, eliminating the need for internet connectivity. It is not available on a subscription basis, and the data is easily portable. Since on-premises tools are not based on internet connectivity, they offer enhanced security. They are mostly used in large enterprises as they have suitable infrastructure for their installation.

How the Hospitals Segment Dominated the AI in Medical Scheduling Software Market?

The hospitals segment contributed the biggest revenue share of the market in 2024, due to the availability of favorable infrastructure and suitable capital investments. Hospitals witness the highest number of patient admissions, potentiating the need for managing providers’ and patients’ scheduling. Patients prefer visiting hospitals due to the presence of multidisciplinary expertise and favorable reimbursement policies. Hospitals are encouraged to use advanced software tools by regulatory agencies.

Clinics

The clinics segment is expected to expand rapidly in the AI in medical scheduling software market in the coming years. The increasing number of specialized clinics and the presence of skilled professionals favor the segment’s growth. Scheduling software is essential for outpatient clinics to enhance efficiency and timely access to healthcare services. It improves patient experience, attracts more patients, and increases clinic productivity.

North America dominated the global market in 2024. The availability of a robust healthcare infrastructure, the presence of key players, and favorable regulatory support are the major factors that contribute to market growth in North America. The increasing number of hospital admissions and the rising adoption of advanced technologies propel the market.

Key players, such as AdvancedMD, NextGen Healthcare Information Systems, LLC, and Veradigm, Inc., are major contributors to the market in the U.S. Medical scheduling software in the U.S. must comply with HIPAA guidelines to ensure data encryption and access controls, protecting patient confidentiality and meeting legal requirements.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. Government organizations provide funding and launch initiatives to adopt advanced technologies, streamlining workflows. The increasing patient population and the growing geriatric population enable healthcare professionals to provide personalized care. Countries like China, India, and Japan face a shortage of doctors owing to the increasing population.

In 2023, China witnessed over 301 million hospital admissions, representing a staggering 21.4% of its population. This means that for every 100 Chinese people, more than 21 hospital admissions occurred. In China, more than 16,000 hospitals have adopted EHRs. moCal, Healthray, and eHospital Systems are major healthcare scheduling solutions in China.

Europe is expected to grow at a considerable CAGR in the upcoming period. The burgeoning healthcare sector, favorable government support, and evolving regulatory landscapes boost the market. Increasing investments and public-private partnerships augment the market. The European Commission allocated €1.3 billion as part of the “Digital Europe Programme” from 2025 to 2027 to support the deployment of AI by businesses and public administration.

Medesk, e-clinic, Systematic, and AspireCRM provide high-quality medical scheduling software. The UK government makes constant efforts to encourage the use of AI in hospitals to improve patient care while protecting patient data and privacy. NHS clinicians will be supported to use AI tools to free up staff time and deliver better care to patients.

The AI in medical scheduling software market is gaining significant traction across South America. Healthcare providers are rapidly adopting these solutions to optimize staff allocation, reduce patient wait times, and drastically enhance operational efficiency. This digital shift supports improved overall patient access and care coordination.

Brazil stands out as the frontrunner in Latin America for healthcare AI adoption. Government and private sector investments are strongly backing AI development agendas. The integration of advanced AI platforms for rapid medical record analysis demonstrates a serious commitment to modernizing healthcare delivery.

The Middle East and Africa (MEA) region is experiencing a notable surge in digital health modernization. GCC countries in particular are anchoring a major portion of this spend with large enterprise AI suite deployments. Smart hospital projects and rising health information technology investments are key drivers across this area.

Gulf Cooperation Council nations are heavily investing in AI for improved patient outcomes and care delivery productivity. AI-driven tools are providing solutions to automate various administrative tasks like initial assessments and resource allocation. This strategic approach aims to supercharge the entire healthcare ecosystem.

| Companies | Headquarters | Offerings |

| NexHealth | California, United States | It offers patient scheduler software resources to streamline healthcare scheduling, optimize appointments, and enhance patient care. |

| AdvancedMD | Utah, United States | AdvancedScheduling software is flexible for solo & multiple providers, as well as practices with complex front office staff. |

| NextGen Healthcare Information Systems, LLC | Georgia, United States | It offers medical practice registration and scheduling to automate eligibility verification, customize functionality, and optimize utilization of appointment times. |

| Ops Labs | Texas, United States | OSP develops customized healthcare scheduling systems for hospitals to optimize human resources management and reduce staff burnout due to overtime. |

| Veradigm, Inc. | Illinois, United States | It offers practice management software to effortlessly manage front-office and back-office operations for easy scheduling, billing, and claims processing. |

Corporate Information

History and Background

Key Milestones/Timeline:

Business Overview

Provides enterprise-wide solutions for automated, optimized physician and staff scheduling, and resource management. Its core AI function optimizes complex rules, availability, and labor laws.

Business Segments/Divisions

Geographic Presence

Primarily North America (U.S., Canada), with growing presence in Europe and Australia.

Key Offerings

End-Use Industries Served

Large hospital systems and health networks, academic medical centers, specialty groups, and ambulatory centers.

Key Developments and Strategic Initiatives (2024-2025)

Technological Capabilities/R&D Focus

Competitive Positioning

Recent News and Updates (2024-2025)

Corporate Information

History and Background

Epic's core philosophy is a fully integrated EHR platform from a single database. Its Cadence module was foundational, integrating patient scheduling directly with the clinical and financial systems.

Key Milestones/Timeline

Business Overview

Provides the integrated Electronic Health Record (EHR) platform, of which Cadence is the core AI-enhanced appointment, resource, and patient self-scheduling solution.

Business Segments/Divisions

EpicCare (Clinicals), Resolute (Billing/Revenue Cycle), and Access/Cadence (Scheduling, Registration, Patient Engagement).

Geographic Presence

Largest market share in U.S. acute care hospitals (over 40%); strong global presence in Canada, Europe, Middle East, and Australia.

Key Offerings

End-Use Industries Served

Large integrated delivery networks (IDNs), academic medical centers (AMCs), major children's hospitals, and multi-specialty clinics.

Key Developments and Strategic Initiatives (2024-2025)

Technological Capabilities/R&D Focus

Competitive Positioning

Recent News and Updates (2024-2025)

By Product Type

By Deployment Model

By End-Use

By Region

January 2026

January 2026

January 2026

January 2026