February 2026

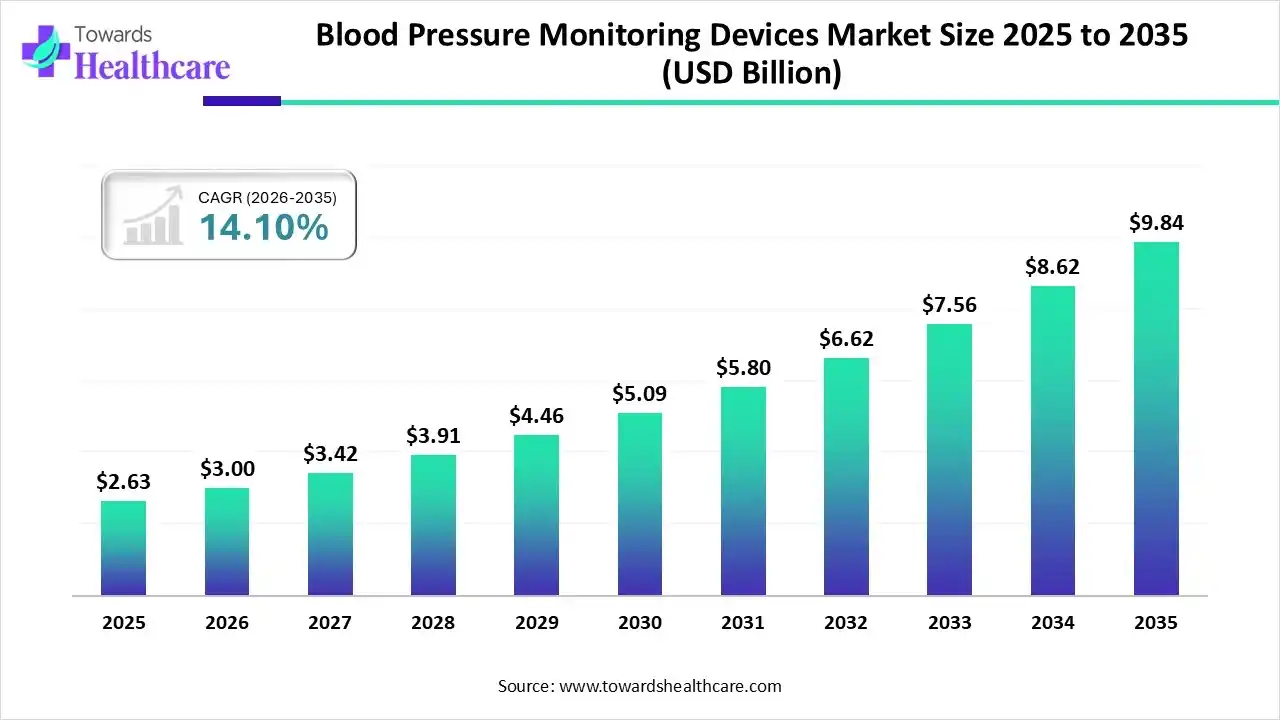

The global blood pressure monitoring device market size is calculated at USD 2.63 billion in 2025 and is expected to be worth USD 9.84 billion by 2035, expanding at a CAGR of 14.10% from 2026 to 2035.

| Key Elements | Scope |

| Market Size in 2025 | USD 2.63 Billion |

| Projected Market Size in 2035 | USD 9.84 Billion |

| CAGR (2026 - 2035) | 14.10% |

| Leading Region | North America |

| Market Segmentation | By Solution, By Application, By Deployment Mode, By End User, By Region |

| Top Key Players | Siemens AG, Dassault Systèmes, Rockwell Automation, Honeywell International, GE Vernova/GE Digital , ABB Ltd., AspenTech , Schneider Electric , AVEVA Group , SAP SE , Veeva Systems, IBM Corporation, Emerson Electric Co., POMSnet (Werum IT Solutions), Thermo Fisher Scientific, Lonza Group AG, Catalent, Inc., Samsung Biologics, Cytiva (Danaher), Amazon Web Services (AWS) Healthcare & Life Science |

The burden of hypertension-related deaths is particularly significant in low and middle-income countries (LMICs), where nearly 90% of annual fatalities are reported.

The BP monitoring devices market is a growing sector within the healthcare industry that focuses on devices used for measuring and monitoring blood pressure. The market includes a range of devices, from traditional manual sphygmomanometers to digital and wearable devices.

The demand for BP monitoring devices is driven by several factors. Firstly, the increasing prevalence of hypertension and other cardiovascular diseases worldwide has created a need for regular blood pressure monitoring. Hypertension is a common health condition, and its early detection and management are crucial for preventing complications. This has led to a growing awareness among individuals and healthcare professionals about the importance of monitoring blood pressure regularly.

Technological advancements have also played a significant role in the growth of the BP monitoring devices market. Digital and wearable devices, such as automated blood pressure monitors and smartwatches with built-in blood pressure sensors, have made it easier for individuals to monitor their blood pressure at home or on the go. These devices often provide more accurate and convenient measurements, enhancing the overall user experience.

The BP monitoring devices market is experiencing growth due to factors such as the rising prevalence of hypertension, technological advancements, increasing adoption of telehealth, and the aging population. The market is competitive, with a wide range of products offered by established and emerging players. For instance, in December 2020, the US Blood Pressure Validated Device Listing (VDL) was launched, providing a platform for manufacturers to submit their blood pressure measurement devices for review. Initially, 16 devices met the requirements and were listed as clinically accurate. As the importance of regular blood pressure monitoring continues to be emphasized, the market for BP monitoring devices is expected to expand further in the coming years.

The global market for BP monitoring devices spans various geographic regions, each with its own characteristics and factors influencing market growth. North America, particularly the United States, holds a significant share of the BP monitoring devices market. The region has a high prevalence of hypertension, which is a major driving factor for the demand for monitoring devices. Moreover, the well-established healthcare infrastructure in North America enables easy access to healthcare services, including blood pressure monitoring. The presence of key market players and continuous advancements in technology further contribute to the growth of the market in this region.

The Centers for Disease Control and Prevention (CDC) conducted a study to assess hypertension prevalence in the U.S. Between August 2021 and August 2023, the prevalence of adult hypertension was 47.7%. The American Heart Association and Elevance Health Foundation provided home blood pressure monitors to 75% of patients with hypertension, ensuring access to monitoring devices.

In addition, the Asia Pacific region offers significant growth opportunities for the BP monitoring devices market. The region is home to a large population, rapid urbanization, and a rising burden of chronic diseases, including hypertension. The increasing healthcare expenditure and growing awareness about preventive healthcare contribute to the demand for BP monitoring devices in this region. Additionally, advancements in medical technology and the presence of key market players who are expanding their presence in Asia Pacific further drive market growth.

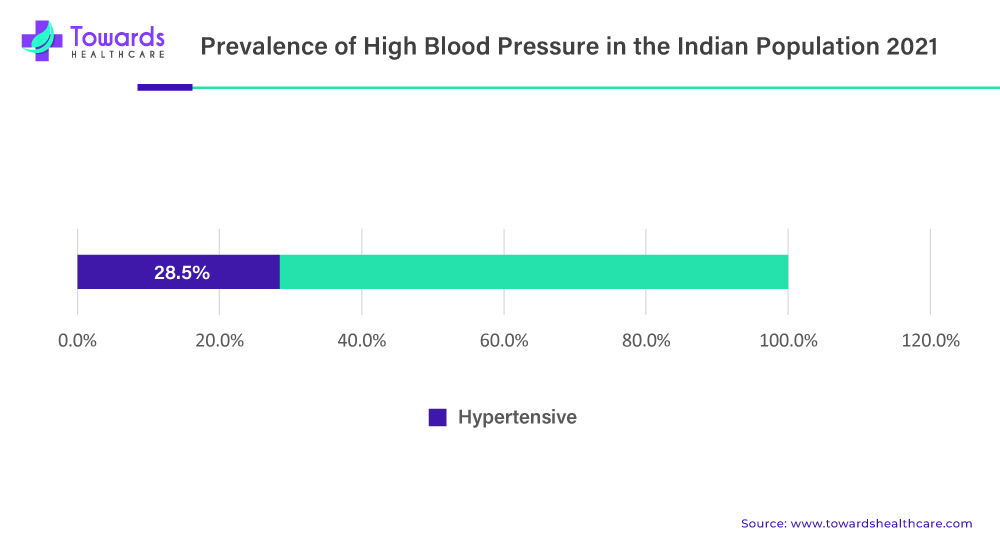

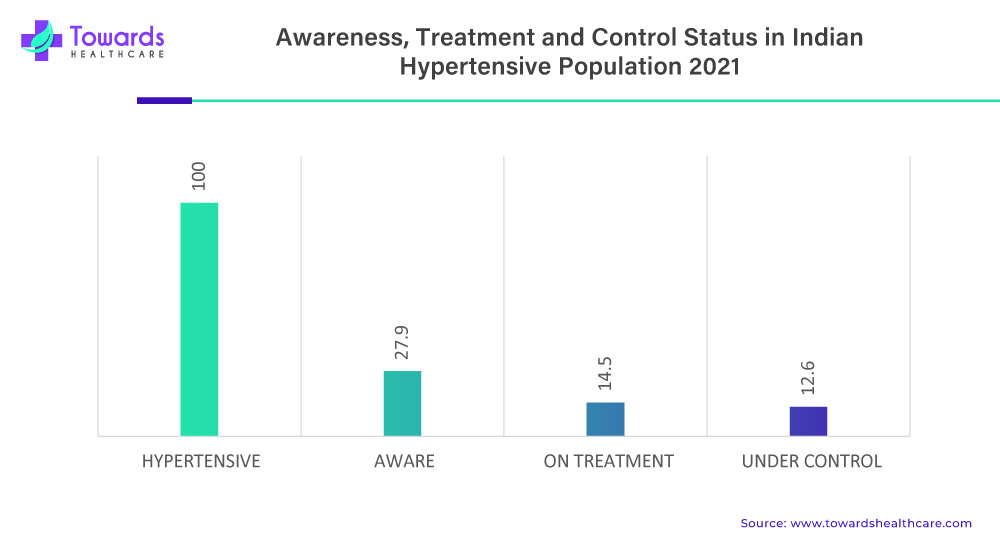

Furthermore, India is a significant market for BP monitoring devices due to its large population and increasing burden of hypertension. The country has witnessed a rapid rise in the prevalence of hypertension in recent years, attributed to factors such as changing lifestyles, urbanization, and dietary habits. The growing awareness about the importance of blood pressure monitoring and the need for early detection and management of hypertension has fueled the demand for BP monitoring devices in India.

Europe is expected to grow significantly in the blood pressure monitoring devices market during the forecast period. Due to the increasing incidence of cardiovascular diseases, there is a rise in the demand for the use of blood pressure monitoring devices in Europe. Furthermore, their development is under the regulatory guidelines, which enhance the safety. Thus, all these factors promote the market growth.

UK Market Trends

Due to the growing awareness, as well as the rising cardiovascular problems, the use of blood pressure monitoring devices is continuously increasing in the UK. At the same time, the increasing production of such devices also drives the market growth.

Germany Market Trends

To deal with the rising demand for blood pressure monitoring devices, the industry is enhancing the development process using various technological advancements and skilled personnel. Moreover, the collaboration between the companies also increased. It is further supported by the government.

The Middle East & Africa are expected to grow at a notable CAGR in the blood pressure monitoring devices market in the foreseeable future. Countries like the UAE, Saudi Arabia, South Africa, and Oman are at the forefront of developing and providing widespread access to blood pressure monitoring devices in the MEA region. This is supported by government initiatives and funding from various organizations. Stringent regulatory policies and the burgeoning medical device sector contribute to market growth

Noon, Carrefour UAE, and myAster provide blood pressure monitoring devices in the UAE. The UAE health data reported that approximately 30% of adults have high blood pressure. The government formed the national hypertension campaign, propelled by government action and robust partnerships in line with the “We the UAE 2031” vision, aiming to establish a future-ready healthcare ecosystem focused on prevention and early intervention.

Furthermore, the competitive nature of the market drives manufacturers to differentiate themselves by launching new products with unique features and capabilities. This competition fosters innovation and pushes the boundaries of technology in the development of BP monitoring devices. Manufacturers strive to provide devices that are more accurate, reliable, portable, and user-friendly, creating a positive impact on market growth.

Moreover, product launches also stimulate market growth by expanding the reach of BP monitoring devices into new geographical regions. Manufacturers often target emerging markets with their product launches, capitalizing on the increasing prevalence of hypertension and the growing healthcare infrastructure in these regions. This expansion into new markets not only increases the consumer base but also creates opportunities for revenue growth for manufacturers.

The continuous rise in product launches is a significant driver of market growth in the BP monitoring devices industry. The introduction of new and advanced devices caters to the increasing demand for accurate and convenient blood pressure monitoring solutions. These product launches empower healthcare professionals and individuals to monitor blood pressure effectively, promote patient engagement, and drive better healthcare outcomes. Additionally, the competitive nature of the market and the expansion into new geographical regions further contribute to the growth of the market.

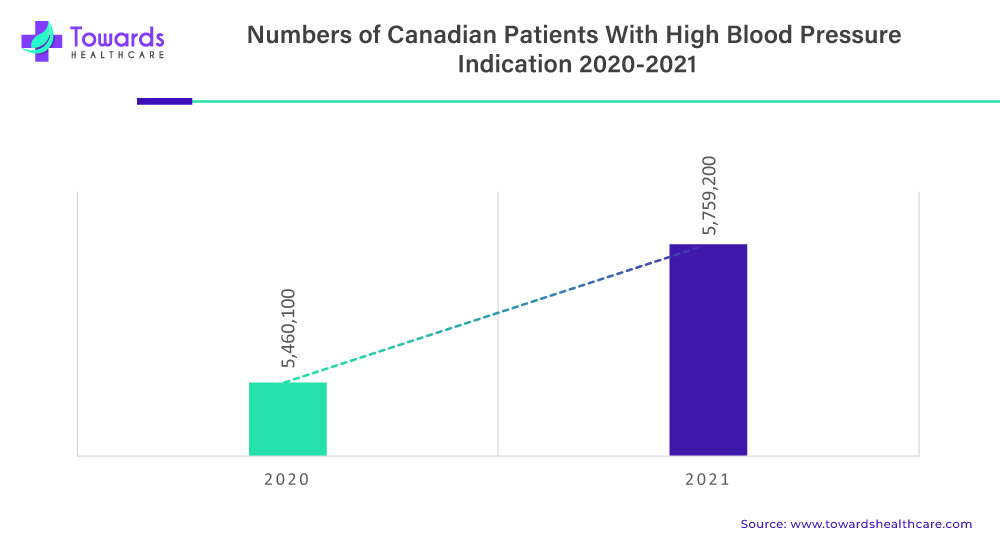

The rising prevalence of high blood pressure (BP) is a key driver behind the growth of the BP monitoring devices market. High blood pressure is a common health condition that affects a significant portion of the global population. It is a leading cause of various cardiovascular diseases, including heart attacks and strokes. As the awareness about the importance of managing and monitoring blood pressure increases, the demand for BP monitoring devices also rises. According to the World Health Organization (WHO), the prevalence of hypertension among adults aged 30–79 years has seen a significant increase over the years. The number of individuals affected by hypertension has risen from 650 million to 1.28 billion in 2021, spanning a period of 30 years. This notable growth highlights the global health challenge posed by hypertension and the need for effective management and prevention strategies. For instance, there has been an extensive increase in the number of Canadian patients suffering from high blood pressure have been reported from 2020 to 2021.

The increasing prevalence of high blood pressure can be attributed to several factors. These include sedentary lifestyles, unhealthy dietary habits, obesity, stress, and aging populations. With the growing incidence of these risk factors, the number of individuals diagnosed with high blood pressure is on the rise globally. This has created a need for regular monitoring of blood pressure levels to effectively manage the condition and reduce the risk of associated complications. In response to this growing demand, the BP monitoring devices market has witnessed significant growth. These devices play a crucial role in monitoring blood pressure levels, enabling individuals to track their readings conveniently and regularly. They provide accurate and reliable measurements, allowing healthcare professionals and patients to make informed decisions regarding treatment and lifestyle modifications.

Advancements in technology have also contributed to the growth of the BP monitoring devices market. The development of portable and user-friendly devices has made it easier for individuals to monitor their blood pressure at home or on the go. Digital blood pressure monitors, wearable devices, and smartphone-compatible monitoring devices have become increasingly popular, offering convenience and accessibility to users.

Moreover, the integration of digital health technologies and connectivity features in BP monitoring devices has further fueled market growth. These devices can sync with mobile applications and cloud-based platforms, allowing users to store and analyze their blood pressure data over time. This data can be shared with healthcare providers for remote monitoring and timely intervention, leading to better management of high blood pressure.

Device complexity is a significant restraint that can impact the market growth of BP monitoring devices. While technological advancements have brought about innovative and sophisticated devices, the complexity associated with their use can pose challenges for both healthcare professionals and patients. Complex devices often require proper training and knowledge to operate effectively. Healthcare professionals may need to invest additional time in training patients on how to use the devices correctly and interpret the readings accurately. Moreover, the complexity of the device can lead to user errors, resulting in inaccurate measurements and unreliable data.

The complexity of BP monitoring devices can be overwhelming and discouraging for patients. Complicated user interfaces, multiple buttons, and complex instructions may deter patients from using the devices consistently. Some individuals, particularly older adults or those with limited technological literacy, may struggle to understand and navigate through the device's features, leading to frustration and potential non-compliance. Device complexity can also increase the cost of manufacturing and maintenance, which may hinder market growth. Sophisticated technologies and intricate designs may require specialized components and expertise, leading to higher production costs. These increased costs can potentially impact the affordability and accessibility of BP monitoring devices, limiting their adoption and market penetration.

To overcome this restraint, there is a need for continuous focus on device simplification and user-friendliness. Manufacturers should prioritize the development of devices that are intuitive, easy to operate, and require minimal user intervention. Streamlining the user interface, simplifying data interpretation, and implementing clear instructions can enhance the usability of BP monitoring devices, making them more accessible to a broader range of users.

Additionally, healthcare professionals and organizations play a crucial role in addressing device complexity as a restraint. They can provide comprehensive training and support to patients, ensuring they are comfortable and confident in using the devices. Simplified educational materials, user manuals, and instructional videos can also aid in overcoming the challenges associated with device complexity.

The integration of remote patient monitoring presents a significant opportunity for the BP monitoring device market. Remote patient monitoring allows healthcare providers to track and monitor patients' blood pressure readings remotely, without the need for frequent in-person visits. This approach offers several advantages, particularly for individuals with chronic conditions such as hypertension. Remote patient monitoring enables real-time monitoring of blood pressure levels, providing healthcare professionals with continuous access to patient data. This allows for timely intervention and adjustments in treatment plans, leading to improved patient outcomes. By utilizing BP monitoring devices connected to remote monitoring systems, healthcare providers can detect any fluctuations or abnormalities in blood pressure and respond promptly, potentially preventing complications or emergencies.

The opportunity for remote patient monitoring in the BP monitoring device market is further amplified by the increasing adoption of digital health technologies and the growing preference for home-based healthcare. Patients can conveniently measure their blood pressure from the comfort of their own homes using user-friendly devices and transmit the data to healthcare providers remotely. This not only enhances patient convenience but also reduces the burden on healthcare facilities and minimizes the risk of exposure to contagious diseases, such as during a pandemic.

Furthermore, remote patient monitoring enables personalized and proactive care. Through data analysis and algorithms, healthcare providers can identify patterns and trends in blood pressure readings, allowing for customized interventions and treatment adjustments. This personalized approach to care can optimize treatment plans, improve medication adherence, and empower patients to actively participate in their own healthcare management.

The integration of remote patient monitoring in the BP monitoring device market also presents opportunities for telehealth and telemedicine services. Virtual consultations between healthcare providers and patients can be complemented by the availability of accurate and reliable blood pressure data. This enables healthcare professionals to make informed decisions remotely and provide appropriate guidance and recommendations.

To capitalize on this opportunity, stakeholders in the BP monitoring device market, including manufacturers and healthcare providers, should invest in the development and integration of remote patient monitoring capabilities. This involves designing devices that are compatible with remote monitoring systems, implementing secure data transmission protocols, and establishing efficient data management and analysis platforms. Additionally, raising awareness among healthcare professionals and patients about the benefits and usage of remote patient monitoring can facilitate its widespread adoption.

Which Product Segment Dominated the Blood Pressure Monitoring Devices Market?

By product, the automated/digital blood pressure monitor segment held a dominant position in the market. A digital blood pressure monitor is easy to use and measures blood pressure irrespective of the presence of skilled professionals. The rising geriatric population results in at-home testing, thereby increasing its demand. Additionally, the latest innovations, such as wearable devices, foster continuous blood pressure monitoring, potentiating the demand.

By product, the blood pressure cuffs segment will gain a significant share of the market over the studied period. Blood pressure cuffs are widely used along with BP monitoring devices. They can be either disposable or reusable.

How the Hospital Segment Dominated the Blood Pressure Monitoring Devices Market?

By end-use, the hospital segment led the global market. The segment’s growth is attributed to the increasing number of patients in the hospital, the availability of suitable facilities, favorable infrastructure, and the presence of trained professionals.

By end-use, the homecare segment is predicted to witness notable growth in the market over the forecast period. The rising geriatric population, growing demand for wearable devices, and increasing awareness about health boost the segment’s growth.

Mr. Frans Velkers, Chief Operating Officer of OMRON Healthcare Singapore Pvt. Ltd., commented that the company’s vision is “Going for Zero” by enhancing the usage of preventive care to minimize the occurrence of events within the cardiovascular, respiratory, and pain management domains.

Researchers focus on developing cuffless, wearable technologies for continuous, real-time monitoring of blood pressure

Key Players: Omron Healthcare, A&D Medical, and SunTech Medical.

Clinical trials are conducted to assess the accuracy, reliability, and usability of novel blood pressure monitoring devices in various settings

Key Players: GE Healthcare, Philips Healthcare, and PyrAmes Inc.

Healthcare professionals guide patients about the usage of the device and provide treatment based on real-time monitoring.

By Product

By End Use

By Region

February 2026

January 2026

January 2026

December 2025