February 2026

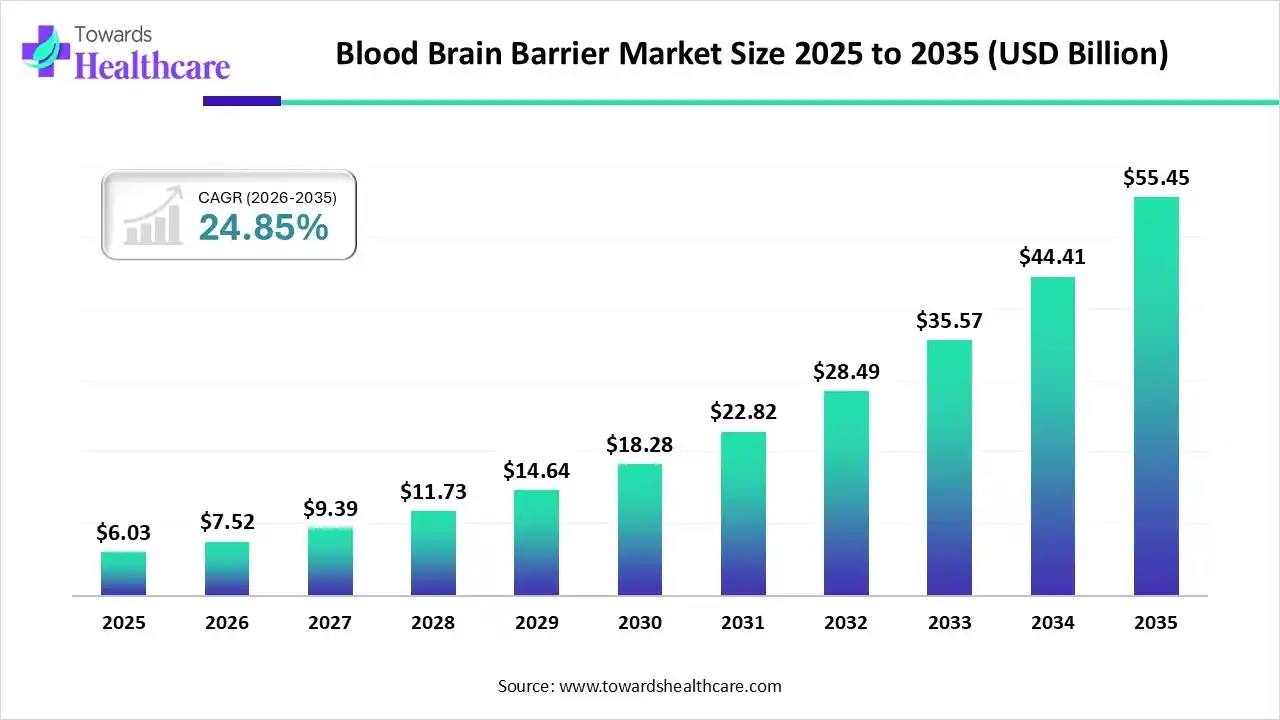

The global blood-brain barrier market size is expected to be worth around USD 55.45 Billion by 2035, from USD 6.03 billion in 2025, growing at a CAGR of 24.85% during the forecast period from 2026 to 2035.

The blood-brain barrier market is experiencing robust growth, driven by the expansion of CNS drug pipelines, growing research and development activities, and the increasing development of medical devices. Key players invest in innovative technologies to develop novel drugs, medical devices, and drug delivery systems for targeted delivery. Government organizations launch initiatives to encourage the general public to screen for and diagnose neurological disorders.

| Key Elements | Scope |

| Market Size in 2026 | USD 7.52 Billion |

| Projected Market Size in 2035 | USD 55.45 Billion |

| CAGR (2026 - 2035) | 25.85% |

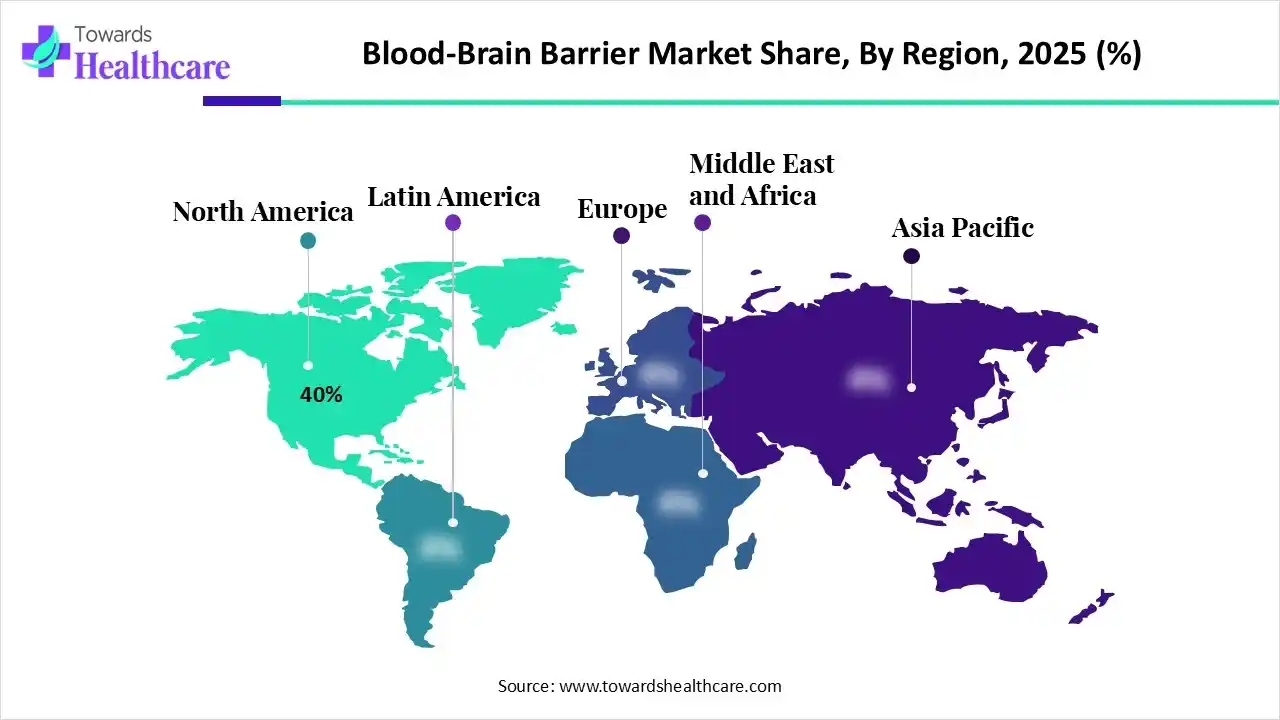

| Leading Region | North America by 40% |

| Market Segmentation | By Technology/Solution, By End-Use, By Application, By Therapeutic Area, By Region |

| Top Key Players | Gate2Brain, Roche Holding AG, ABL Bio, Bristol-Myers Squibb, Ossianix, Denali Therapeutics, Cordance Medical, IRBM, NeOnc Technologies Holdings, Inc. |

The blood-brain barrier market comprises technologies, platforms, tools, and services designed to study, model, transport across, or therapeutically modulate the blood-brain barrier (BBB). It includes in vitro assay systems, in vivo models, computational platforms, drug delivery technologies, biomarkers, and related services used in neuroscience research, CNS drug discovery & development, diagnostic applications, and therapeutic delivery to the brain.

This market supports research on neurological diseases (Alzheimer’s, Parkinson’s, brain tumors, multiple sclerosis), CNS infection and inflammation, and neuropharmacology.

Recent advances in artificial intelligence (AI)-based computational technologies foster innovations in drug discovery and development. AI and machine learning (ML) algorithms analyze vast amounts of data and enable researchers to predict the BBB permeability of novel drugs. AI-based BBB prediction is a vital step in screening drug candidates at an early stage. AI and ML can also be used to study the behavior of drugs within the human body and after crossing the BBB.

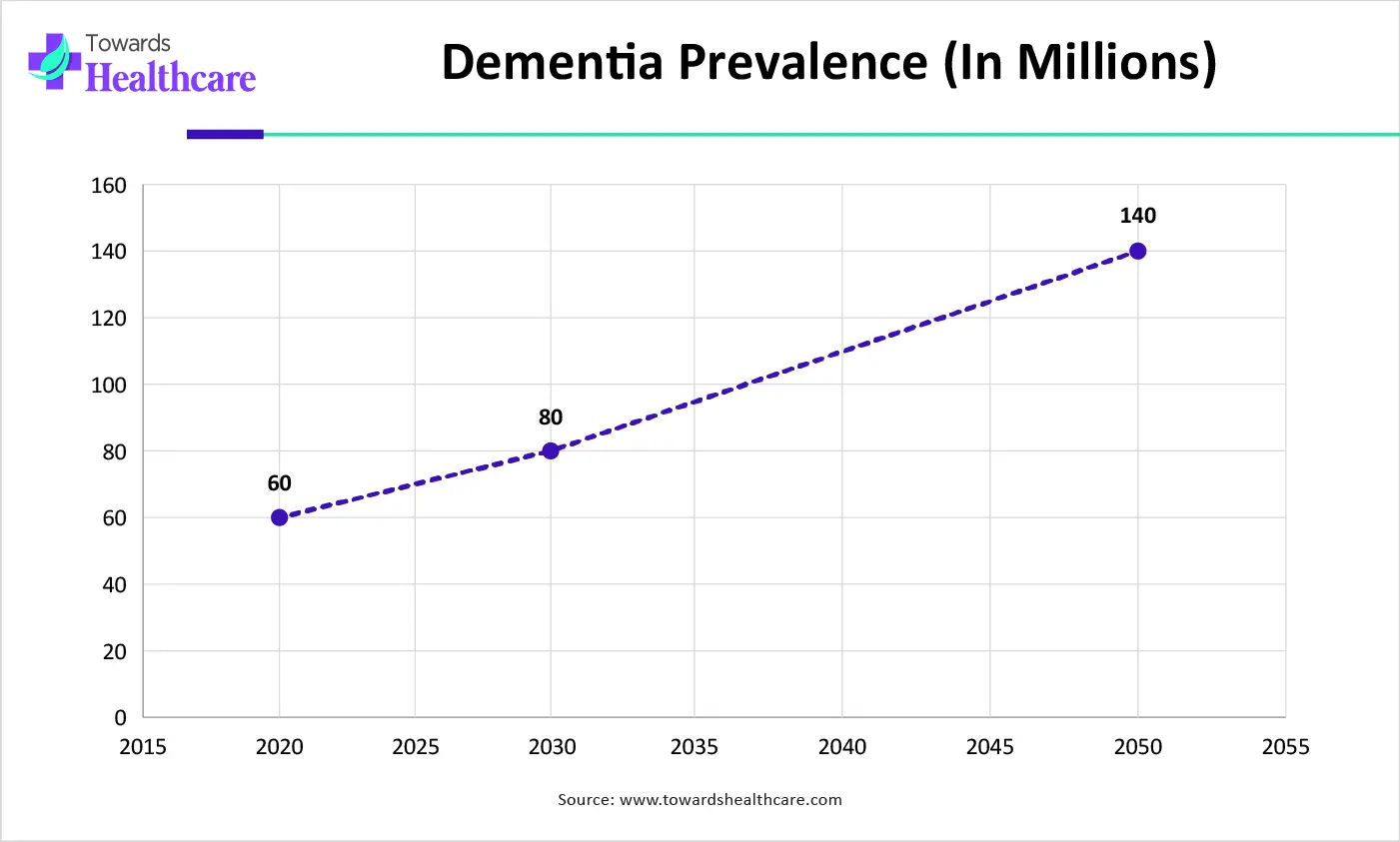

| Years | Dementia Prevalence (in millions) |

| 2020 | 60 |

| 2030 | 80 |

| 2050 | 140 |

Which Technology/Solution Segment Dominated the Blood-Brain Barrier Market?

The in vitro BBB models segment held a dominant position with a share of approximately 35% in the market in 2025, due to the increasing development of novel CNS drugs and the increasing awareness of reducing animal use for drug testing. Stringent regulatory policies necessitate researchers to test the efficacy of drugs in in vitro models and assess their permeability. Advancements in microfluidics and molecular biology favor the use of the BBB-on-a-chip model, enhancing research efficiency and outcomes.

The organ-on-chip BBB systems sub-segment is expected to expand rapidly with a CAGR of approximately 18% in the market. The emerging microfluidic models have controlled fluid delivery and give flexible integration abilities. Microfluidics-based BBB models provide control over the extracellular microenvironment. AI-based biosensors provide real-time information about drug penetration into the BBB. The advent of 3D printing technology promotes the development of tailored models.

How the Pharmaceutical & Biotechnology Companies Dominated the Blood-Brain Barrier Market?

The pharmaceutical & biotechnology companies segment held the largest revenue share of approximately 40% in the market in 2025, due to favorable infrastructure and suitable capital investment. Pharma & biotech companies receive funding from government and private organizations to develop or adopt advanced BBB technologies. They collaborate with each other to access advanced technologies. The increasing competition among market players necessitates companies to expand their product pipeline, strengthening their market position.

Contract Research Organizations (CROs)

The contract research organizations (CROs) segment is expected to grow with the highest CAGR of approximately 20% in the market during the studied years. Large pharmaceutical companies outsource their neurological research activities to CROs, enabling them to focus on their core competencies, such as product sales and marketing. The increasing number of biotech startups potentiates the demand for CROs as they lack specialized infrastructure and sufficient skilled professionals.

Why Did the CNS Drug Discovery & Screening Segment Dominate the Blood-Brain Barrier Market?

The CNS drug discovery & screening segment contributed the biggest revenue share of approximately 45% in the market in 2025, due to the rising prevalence of CNS disorders and the growing demand for personalized medicines. In vitro and in vivo BBB models are required to assess the efficacy and permeability of drug-like candidates within the BBB in humans. Advanced computational tools are found to be beneficial in screening drug candidates at an early stage, reducing failure rates in clinical development.

Drug Delivery & Permeability Assessment

The drug delivery & permeability assessment segment is expected to show the fastest growth with a CAGR of approximately 20% over the forecast period. Ongoing efforts are made to develop innovative delivery systems for targeted delivery of hydrophilic compounds and macromolecules. Particle size, shape, and surface characteristics are optimized to evade clearance mechanisms and enhance targeting to specific regions in the CNS. Advances in nanotechnology and medical technologies propel the segment’s growth.

Which Therapeutic Area Segment Led the Blood-Brain Barrier Market?

The Alzheimer’s disease & dementia segment led the market with a share of approximately 30% in 2025, due to the increasing prevalence of dementia and the rising geriatric population. This encourages researchers to develop innovative products for the prevention, diagnosis, and treatment of Alzheimer’s disease (AD). As of December 2025, 3,997 clinical trials were registered on the clinicaltrials.gov website related to Alzheimer’s disease. Several studies have found that the BBB is involved in the pathogenesis of AD.

Brain Tumors & Oncology

The brain tumors & oncology segment is expected to witness the fastest growth with a CAGR of approximately 21% in the market over the forecast period. The increasing incidence of brain cancer and its complexity foster the segment’s growth. The National Brain Tumor Society projected approximately 93,000 new brain tumor cases in the U.S. Scientists develop innovative drugs, implants, and other devices to manage tumors and control their proliferation.

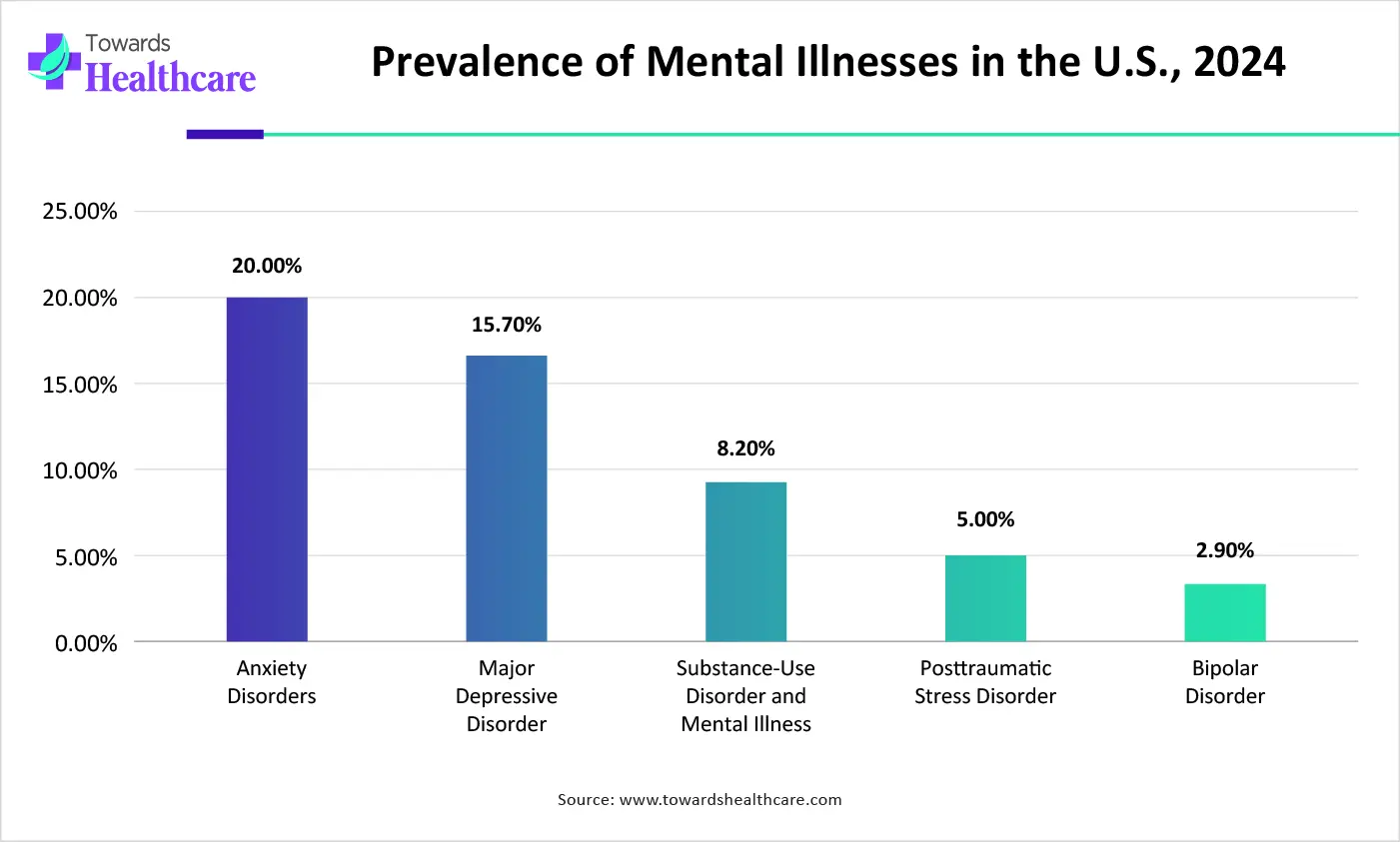

North America dominated the global market with a share of approximately 40% in 2025. The availability of state-of-the-art research and development facilities, the presence of key players, and the increasing prevalence of mental illnesses are factors that govern market growth in North America. Government organizations provide research funding and launch initiatives to promote the development of innovative products for the prevention, diagnosis, and treatment of CNS disorders. North American countries have a robust healthcare infrastructure that uses advanced technology.

The Food and Drug Administration (FDA) regulates the approval of drugs and medical devices related to neurological conditions in the U.S. The U.S. FDA approved a total of 226 pharmaceuticals for 32 novel neurological indications from 2018 to 2023. The National Institute of Neurological Disorders and Stroke (NINDS) provides funding and support for clinical trials in the neurobiology field. The FY2025 President’s Budget of NINDS was $2.83 billion.

| Mental Illnesses | Prevalence Rate of Mental Illnesses in the U.S., 2024 |

| Anxiety Disorders | 20.00% |

| Major Depressive Disorder | 15.70% |

| Substance-Use Disorder and Mental Illness | 8.20% |

| Posttraumatic Stress Disorder | 5.00% |

| Bipolar Disorder | 2.90% |

Asia-Pacific is expected to grow at the fastest CAGR of approximately 21% in the market during the forecast period. The growing geriatric population, the rising prevalence of neurological disorders, and growing research activities augment the market. Countries like China, India, South Korea, and Japan have a suitable research and manufacturing infrastructure, encouraging foreign companies to set up their facilities in the region. The region represents a major market opportunity for global players due to a high patient population base and government support.

China had approximately 297 million people aged 60 years and above in 2023, representing 21.1% of the total population. China also reports the highest cases of Alzheimer’s disease, accounting for 13.14 million, or 25.5% of the global cases. To address this, the Chinese government launched a national action plan to combat senile dementia and set a series of targets to be achieved by 2030.

Europe is expected to grow at a considerable CAGR in the upcoming period. The rising adoption of advanced technologies and increasing investments and collaborations among key players bolster market growth. European nations focus on establishing advanced R&D centers for neuroscience research and adopt innovative techniques like focused ultrasound. People are increasingly aware of advanced neuroscience research, as well as the screening and early diagnosis of neurological disorders.

The UK government has launched the Neuro Forum to address gaps in treatment care in neurology, improving care and support for people affected by neurological conditions. The forum will drive patient-centered care and address unwarranted variation in access to care across the country. In December 2025, the NIHR announced an investment of £13.7 million to support groundbreaking research to develop novel brain tumor treatments in the UK.

| Companies | Headquarters | Offerings |

| Gate2Brain | Barcelona, Spain | The biotech company focuses on the development of therapeutics that efficiently cross biological barriers, such as the BBB. |

| Roche Holding AG | Basel, Switzerland | It offers Brainshuttle technology to enable effective medicine delivery across the BBB. |

| ABL Bio | Seoul, South Korea | Its Grabody-B platform overcomes BBB-penetrance challenges of traditional mAbs, while delivering optimal safety & efficacy. |

| Bristol-Myers Squibb | New York, United States | The company is advancing neuroscience R&D through breakthroughs in human biology, biomarkers, and computational science. |

| Ossianix | Hertfordshire, United Kingdom | Its Brain Shuttles are based on deimmunized single domain VNAR antibodies originating from the shark. It specializes in BBB-penetrant biologics. |

| Denali Therapeutics | California, United States | It offers the TransportVehicle platform to unlock the potential of a new class of medicines that cross the BBB. |

| Cordance Medical | California, United States | The NeuroAccess medical device enables precision medicine, the ability to deliver drugs, measure circulating biomarkers, and track brain diseases by opening the BBB. |

| IRBM | Pomezia, Italy | It offers BBB assay services to provide high-quality data on BBB permeability and compound transport, using both in vitro and in vivo models. |

| NeOnc Technologies Holdings, Inc. | California, United States | NeOnc claims that its novel intranasal delivery platform can bypass the BBB and better target cancer cells. |

By Technology/Solution

By End-Use

By Application

By Therapeutic Area

By Region

February 2026

February 2026

February 2026

February 2026