January 2026

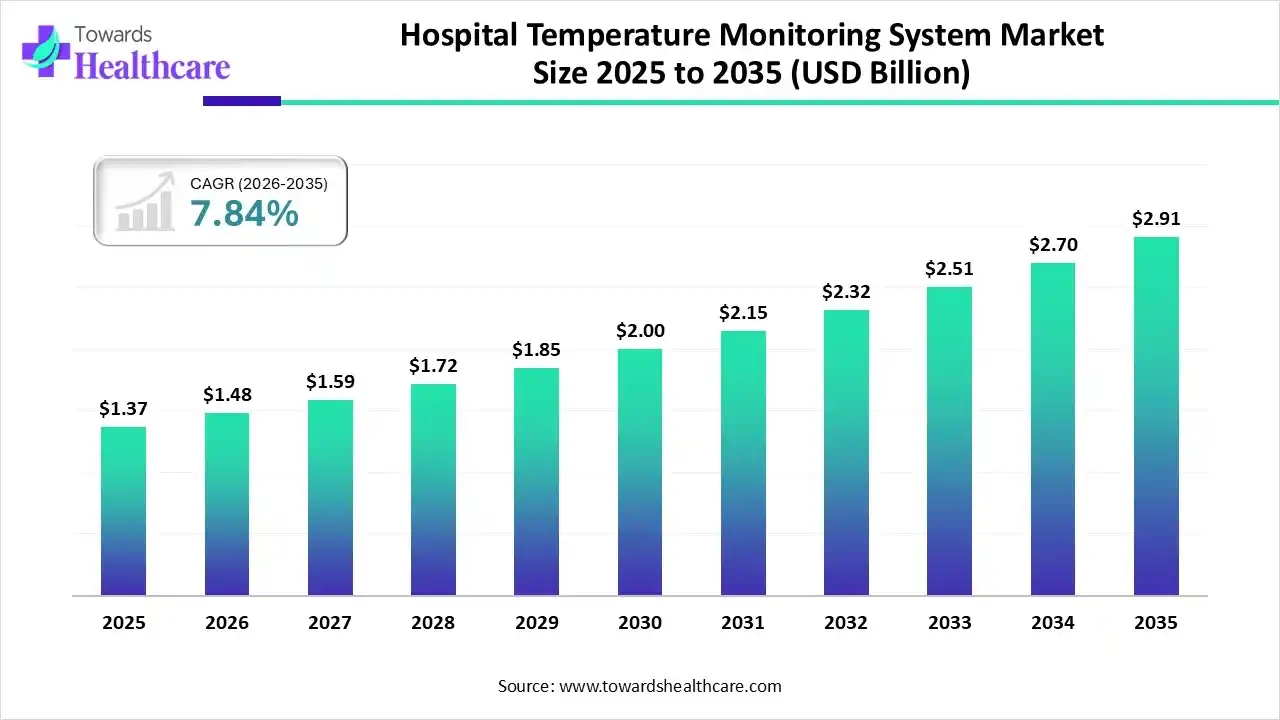

The global hospital temperature monitoring system market size was estimated at USD 1.37 billion in 2025 and is predicted to increase from USD 1.48 billion in 2026 to approximately USD 2.91 billion by 2035, expanding at a CAGR of 7.84% from 2026 to 2035.

Across the globe, a rising number of chronic condition cases and a huge rise in demand for advanced contactless temperature monitoring solutions. Nowadays, companies are bolstering AI algorithms to develop integrated solutions and smart temperature monitoring patches.

Primarily, the hospital temperature monitoring system market comprises an automated, specifically IoT-based, technology for consistent tracking & recording the temperature of substantial, sensitive storage areas and patient surroundings. The need for this system is mainly fueled by the growing instances of chronic illnesses, rising demand for wearable/non-contact devices. The era has revolutionised the development of innovative devices, such as the Remote Upper Arm Temperature Monitoring (RUATM) system, enabling precise, non-invasive remote patient monitoring with greater accuracy in in-hospital and home care settings.

Particularly, the globe is widely leveraging Convolutional Neural Networks (CNNs) to denoise thermal images & eliminate artifacts, which enables precise, real-time mapping of temperature, even separating among inflammatory responses and simple raised skin temperature. Alongside, AI has been explored for novelty, like dense, stamp-sized (25 mm × 15 mm) sensors to use in simultaneous monitoring of temperature, skin conductance, & heart rate, where AI normalizing this data to facilitate an accurate stress or fever reading.

This technology is booming with its higher speed, accuracy, and ability to mitigate cross-infection in hospitals and high-traffic areas.

Researchers are evolving IoT systems by combining with hospital HVAC systems to manage constant temperature & humidity in major areas, like the Central Sterile Supply Department (CSSD) and operating rooms.

Nowadays, the market is surging with automated, Bluetooth, & Wi-Fi-enabled sensors to offer real-time alerts for, and logging of, temperature, humidity, and environmental issues.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.48 Billion |

| Projected Market Size in 2035 | USD 2.91 Billion |

| CAGR (2026 - 2035) | 7.84% |

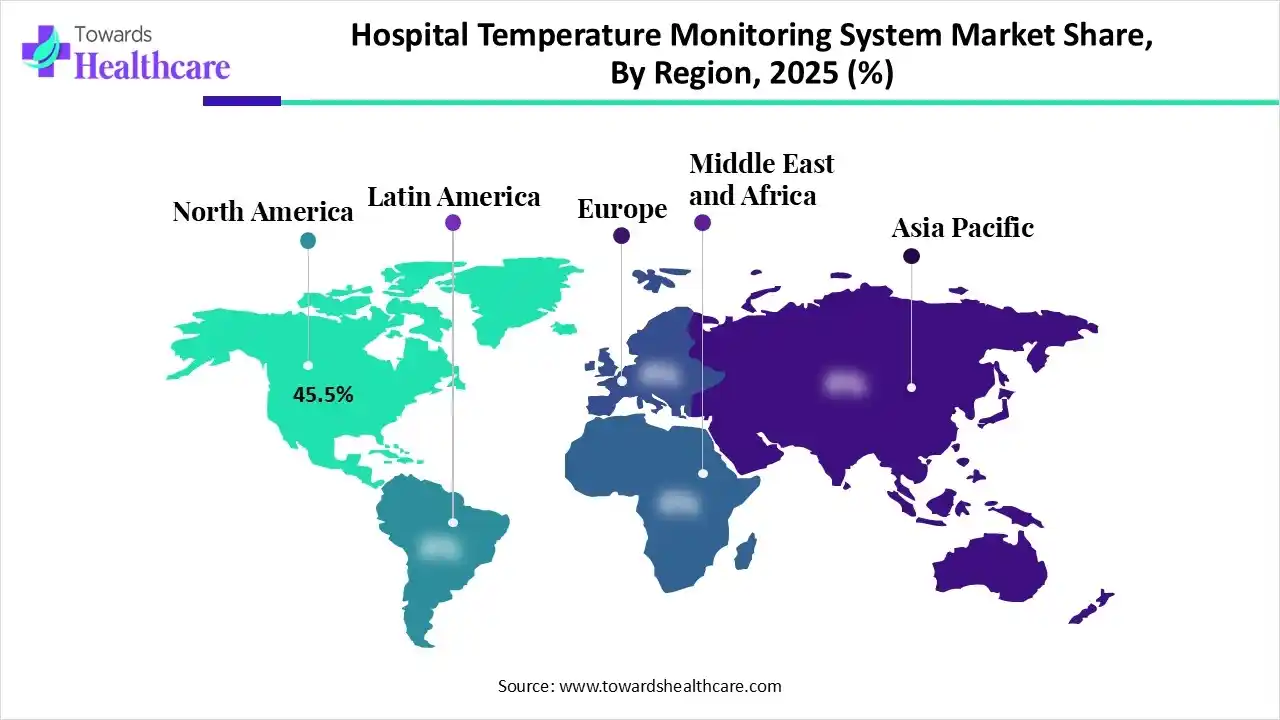

| Leading Region | North America by 45.5% |

| Market Segmentation | By Product Type, By Technology, By Application, By Region |

| Top Key Players | Koninklijke Philips N.V., GE HealthCare, Medtronic, Cardinal Health, Baxter International (Hillrom), 3M Company, Drägerwerk AG & Co. KGaA, Honeywell International Inc., Nihon Kohden Corporation, Mindray Medical International |

Which Product Type Led the Hospital Temperature Monitoring System Market in 2025?

In 2025, the digital temperature monitoring devices segment dominated 71% share of the market. Specifically, infrared thermometers are driven by their rapid, non-contact screening, mainly in high-traffic areas to lower infection spread. Whereas digital thermometers are offering faster, more precise, battery-operated, with flexible-tip readings. Recent examples include Masimo Radius T°, Kinsa Smart Thermometers, and Contactless Kiosks, etc.

Smart Temperature Monitoring Patches

The smart temperature monitoring patches segment will show the fastest growth. Its demand is propelled by the accelerating need for remote patient monitoring (RPM), minimal nursing workload, & post-surgical surveillance. Ongoing innovations are promoting AI integration into patches to find fever episodes an average of 1.13 to 4.3 hours earlier than conventional clinical assessments by detecting clear temperature fluctuations. MT100D by thynC is developed for real-time monitoring of neutropenic risk in cancer patients, to facilitate continuous data with an accuracy of $pm$0.1°C.

How did the Non-Contact Based Systems Segment Dominate the Market in 2025?

The non-contact based systems segment captured nearly 66% share of the hospital temperature monitoring system market in 2025. The rising need to lower cross-infection risk in hospitals is driving the adoption of touch-free, non-contact infrared thermometers (NCIT) & scanning stations. One of the prominent developments, the TRITEMP (TriMedika) is a clinical-grade, non-contact, infrared thermometer personalized for hospital environments (NICU, ED), to offer core-equivalent readings on the forehead, skipping protective covers.

Infrared & Thermal Imaging

Moreover, the infrared & thermal imaging segment is anticipated to expand rapidly. A Key driver is the use of AI-powered thermal imaging, which allows for predictive diagnostics, especially monitoring temperature for early intervention, instead of just reacting to fever. The latest advancement encompasses phasor thermography, which is a highly resolved, multi-parametric imaging that assists in detecting fever, as well as tracking respiration and heart rate passively contactless. However, IRTI (Infrared Thermal Imaging) facilitates accountable, objective data on body temperature & facial inflammation patterns.

Which Application Led the Hospital Temperature Monitoring System Market in 2025?

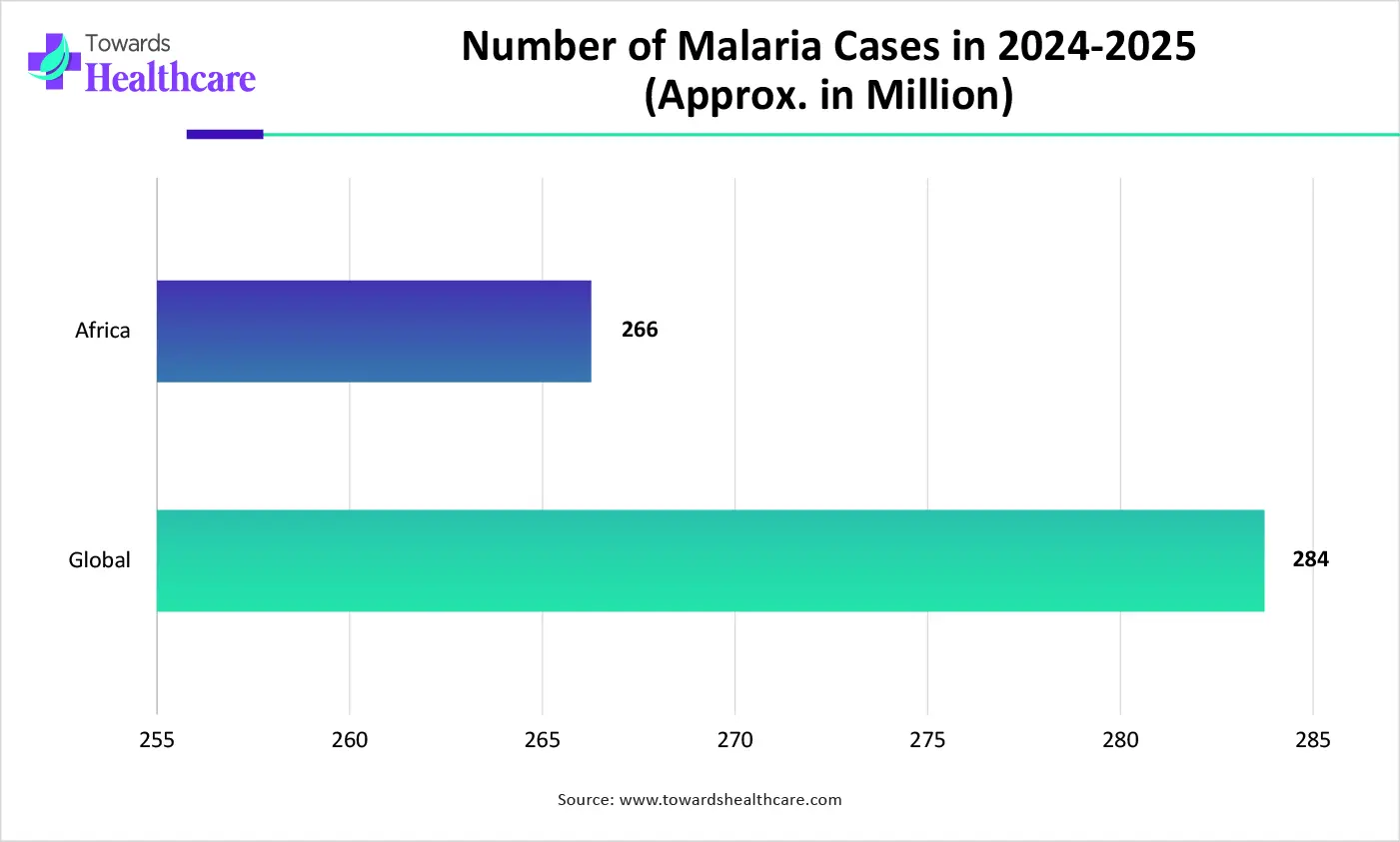

In 2025, the pyrexia/fever monitoring segment held nearly 32% revenue share of the market. The globally growing prevalence of malaria, COVID-19, and influenza is demanding quicker, more accurate fever screening & continuous monitoring. The market is implementing machine learning to distinguish between infectious and non-infectious causes of fever & ultimately lowers unnecessary antibiotic use.

Cold Chain & Storage Monitoring

The cold chain & storage monitoring segment will expand rapidly. The worldwide accelerating demand for vaccines, biologics, and tailored medicine is fostering demand for these kinds of monitoring solutions, often with a condition of −18∘C to −25∘C. Current developments are Sensitech Lynx FacTOR, which automates end-to-end product release, evaluating temperature, batch stability, and also DATOMS IoT Platform, which offers 24/7 environmental monitoring for blood banks (1°C to 6°C), vaccine storage, & laboratory samples.

In 2025, North America held approximately 45.5% revenue share of the market, due to the coverage of advanced healthcare infrastructure and stringent regulatory requirements for patient safety and medical cold chains. Alongside, leading firms are promoting cloud-based or IoT-enabled solutions, such as GAO Tek Inc., which explores advanced IoT healthcare monitoring systems by using Bluetooth Low Energy (BLE), LoRaWAN, and Cellular IoT, mainly to Canadian healthcare requirements.

U.S. Market Trends

Whereas the U.S. led the market due to the expanding efforts into wearable patches to enable continuous temperature monitoring through invasive solutions. However, the execution of 5G-driven IoT systems is allowing numerous devices to function in a hospital at a greater pace, and to secure data transmission to central dashboards.

During the prospective period, the Asia Pacific is predicted to expand fastest, as certain countries are experiencing a rise in the number of surgeries and the requirement for targeted temperature management in ICUs. Moreover, in Chinese & Indian hospitals, they are shifting towards upgraded IoT sensors to handle ultra-cold storage (-80°C to -60°C) for vaccines and biologics.

India Market Trends

India is strengthening automated, AI-driven, and IoT-enabled predictive systems, including a recent use of ESP32 microcontrollers & IoT sensors, such as MAX30100/DHT22, to track body temperature, heart rate, and SpO2 in real-time. Also, they established advanced medical refrigeration monitoring for prevention of spoilage and power failures, emphasized particularly among paediatricians and hospital pharmacy labs to ensure vaccine potency.

Europe is estimated to witness lucrative growth due to the strengthening steps in progressive adoption of smart patches, rings, & wristbands for continuous, non-invasive patient body temperature monitoring. Alongside, the region is encouraging novel technologies, like chipless sensors made from flexible material.

UK Market Trends

In the UK, the NHS recently published a new procurement tender for a wireless electronic temperature monitoring system, especially requesting 24/7 automated, remote monitoring for pathology, blood transfusion, & mortuary areas. Besides this, firms, including EasyLog, are offering advanced data loggers with hot-swappable probes to allow continuous monitoring in compliance with UKAS calibration standards for vaccines and pharmaceuticals.

| Company | Description |

| Koninklijke Philips N.V. | They usually offer hardware modules, consumable probes, and enterprise-level software. |

| GE HealthCare | Its offerings include CARESCAPE series, CARESCAPE V100 and Portrait VSM monitors, etc. |

| Medtronic | This mainly unveiled a comprehensive suite of Mon-a-therm temperature monitoring products for high-acuity, perioperative, and ICU settings. |

| Cardinal Health | It explores diversity from patient-focused thermometers to environmental lab monitoring. |

| Baxter International (Hillrom) | A firm emphasizes normothermia maintenance utilizing conductive technology and clinical vital signs monitoring through the Welch Allyn brand. |

| 3M Company | This offers different temperature monitoring solutions under the 3M Bair Hugger brand. |

| Drägerwerk AG & Co. KGaA | It specializes from advanced non-invasive core temperature sensors to united patient monitors & specialized neonatal thermoregulation systems. |

| Honeywell International Inc. | This facilitates sophisticated solutions for real-time tracking of patient body temperature and other crucial vitals. |

| Nihon Kohden Corporation | It offers various rigorous multiparameter patient monitors. |

| Mindray Medical International | It has introduced BeneVision N-Series, ePM Series, uMEC Series, etc. |

By Product Type

By Technology

By Application

By Region

January 2026

January 2026

December 2025

December 2025