February 2026

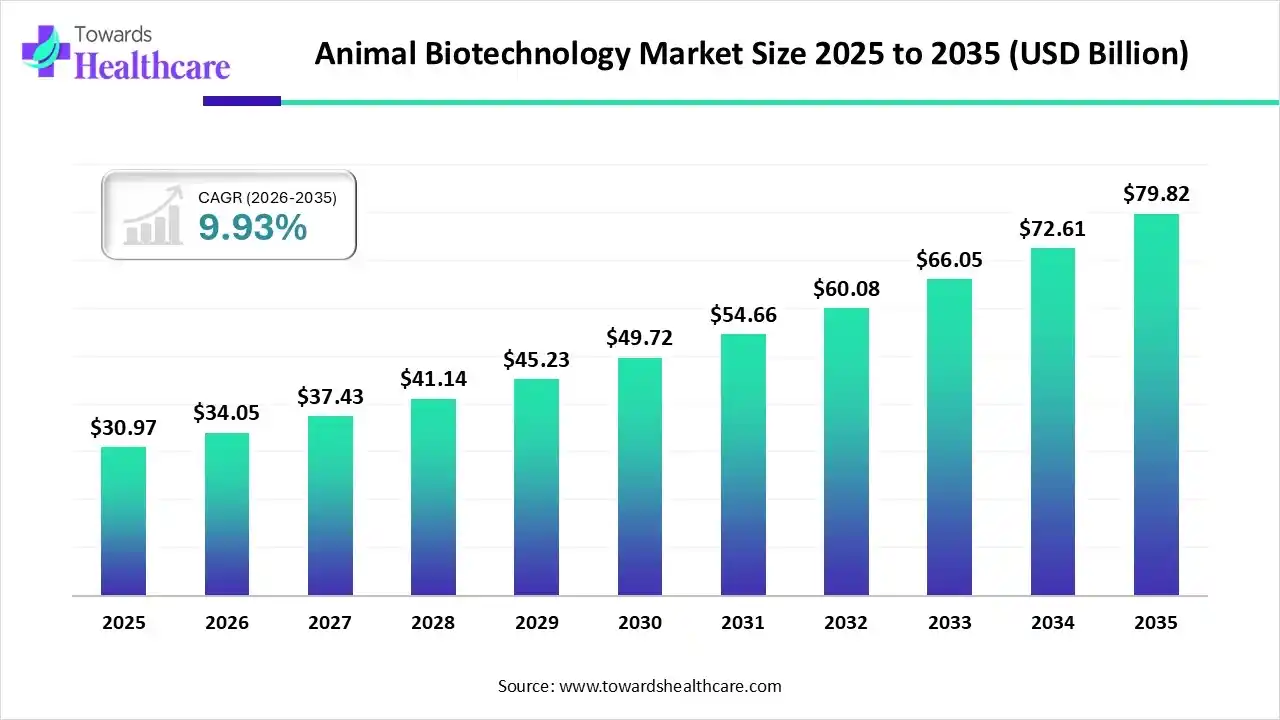

The global animal biotechnology market size is calculated at US$ 30.97 billion in 2025, grew to US$ 34.05 billion in 2026, and is projected to reach around US$ 79.82 billion by 2035. The market is expanding at a CAGR of 9.93% between 2026 and 2035.

Growing emphasis on environmental and ethical issues is a defining feature of the global animal biotechnology industry, propelling the adoption of sustainable and animal-friendly methods. Industry participants are investing in biotechnological solutions that improve food safety, lessen their impact on the environment, and increase animal welfare as a result of consumers' growing demands for accountability and transparency in animal production systems. Animal biotechnology has the potential to transform veterinary care, animal agriculture, and biomedical research as it develops further, supporting efforts for public health, animal welfare, and global food security.

| Metric | Details |

| Market Size in 2026 | USD 34.05 Billion |

| Projected Market Size in 2035 | USD 79.82 Billion |

| CAGR (2026 - 2035) | 9.93% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Application, By Animal Type, By End User, By Technology, By Region |

| Top Key Players | Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, Bayer Animal Health (Now part of Elanco), Virbac, Vetoquinol, Idexx Laboratories, Thermo Fisher Scientific, IDEXX BioAnalytics, Genus PLC, Neogen Corporation, BioChek, Bio-Rad Laboratories, Recombinetics Inc., Trans Ova Genetics, INGENASA (Eurofins Technologies), ImmuCell Corporation, Creative Biolabs |

Animal biotechnology refers to the application of molecular biology and genetic engineering techniques to improve the productivity, health, and well-being of animals. It includes genetically modified animals, cloning, marker-assisted breeding, vaccine development, and diagnostics aimed at enhancing livestock production, animal health, and veterinary care. The market encompasses various tools and technologies used for disease resistance, reproduction enhancement, nutritional efficiency, and the development of transgenic animals for pharmaceutical production.

Animal biotechnology is undergoing a revolution due to the combination of machine learning (ML) and artificial intelligence (AI), especially in developing nations where livestock and agriculture are important economic sectors. Productivity and sustainability are enhanced in fields such as genetic optimization, disease prediction, and animal management, thanks to the capacity of AI and ML to analyze data more effectively. As data becomes increasingly available, AI-driven models can handle vast amounts of data from multiple sources, including genetic markers, environmental factors, and medical records, providing more accurate insights than conventional techniques. AI-powered diagnostic tools for identifying and controlling disease outbreaks are recent developments that enable quicker reaction times and more focused treatments, thereby lowering financial losses.

Rising Demand for Animal Products

Due to the expanding global population, there is a sharp increase in the need for animal protein in both developed and developing nations. The livestock sector is expanding as a result of people consuming more meat, eggs, and dairy products as global incomes rise. The productivity and output of animals reared for meat, milk, and eggs are being increased with the use of animal biotechnology methods and instruments in order to meet the growing protein demands of the world's expanding population.

Ethical Concerns

Ethical concerns arise when animals are genetically modified. The first is scientific integrity, which emphasizes the integrity of the research method and scientific fraud. The second is about potential risks or damages to those who are directly impacted by the research. The duty to act as a protector of the public interest falls under the last category.

Precision Breeding & Gene Editing in the Animal Biotechnology Market

The industry for animal biotechnology is booming thanks to the development of precision breeding and gene editing methods like CRISPR-Cas9. With the use of these technologies, it is now feasible to alter certain genes in order to produce animals with desired features or qualities, such as increased nutritional value, improved growth rate, or resistance to illness. Precision breeding has great promise for mitigating the environmental effects of animal agriculture and addressing issues related to global food security.

By product type, the vaccines segment dominated the animal biotechnology market in 2024. Food security, environmental sustainability, and global health all depend heavily on animal health. Immuno-castration is one of the additional uses of immunization in animal productivity and welfare that have emerged in recent years. The creation of innovative vaccination technology enhances vaccine safety and effectiveness while lowering production costs and times.

By product type, the genetic engineering segment is estimated to grow at the highest CAGR during the upcoming period. Animal genetic engineering has grown dramatically in the last several years. There are an increasing number of useful advantages to using genetic engineering in animal production, including the creation of disease-resistant transgenic animals, increased animal output, the treatment of genetic abnormalities, and the creation of vaccinations. Numerous biomedical applications that would be nearly impossible without this technology will be made possible.

By application, the animal health segment led the animal biotechnology market in 2024. With the introduction of cutting-edge biotechnologies, the field of animal health is undergoing a revolutionary change. This editorial examines the important developments in stem cell research, genetic engineering, cloning, and diagnostic technologies that are transforming the health and well-being of animals. To increase disease resistance, boost cattle productivity, and aid in animal conservation, innovations such as CRISPR for precise genetic modifications, regenerative treatments utilizing stem cells, and advanced molecular diagnostics are already being employed.

By application, the transgenic animal research segment is expected to grow at the highest CAGR during 2025-2034. Over the past few decades, a variety of techniques for creating transgenic animals have been discovered. Greater prolificacy and reproductive performance, increased feed consumption and growth rate, improved carcass composition, improved milk output and/or composition, and enhanced disease resistance are a few real-world applications of transgenesis in animal husbandry.

By animal type, the livestock segment held the major share of the animal biotechnology market in 2024. In several facets of the livestock sector, biotechnology is being used to speed up breed development for better animal health and welfare, increased reproduction, and improved food safety and nutritional quality obtained from animals. Numerous biotechnology techniques are employed to enhance the animal breeding stock. In-vitro fertilization (IVF), embryo transfer (ET), artificial insemination (AI), somatic cell nuclear transfer, and the new technique in somatic cell nuclear transfer are among them.

By animal type, the aquaculture segment is estimated to witness the highest growth rate during the forecast period. The use of biotechnology in aquaculture has had a substantial impact. Among the most promising places for increasing fish output is this one. More biotechnology is being used in aquaculture, which not only transforms the industry but also strategically raises the nation's foreign exchange revenues.

By end-user, the veterinary clinics segment was dominant in the animal biotechnology market in 2024. Veterinary care is significantly impacted by biotechnology, which enhances animal nutrition, health, and genetics. Biotechnology breakthroughs have led to the development of remarkable genetically modified animals for food production and scientific research. In veterinary medicine, biotechnology tools include sterile insect techniques, gene editing, gene therapy, genetic engineering, and bioinformatics. Biotechnology has been applied to enhance animal health in several areas, including molecular diagnostics, DNA vaccine technologies, and virus-vectored immunizations.

By end-user, the biopharmaceutical companies segment is expected to witness the fastest growth in the predicted timeframe. Animal biotechnology is being used by several pharmaceutical companies, including Boehringer Ingelheim, GSK, Merck, Amgen, Novo Nordisk, Pfizer, and Virbac. These companies develop and produce a range of products for companion and livestock animals, such as genetic solutions, drugs, vaccines, and diagnostics, using biotechnology. Some companies, like Zoetis, have even broken away from major pharmaceutical companies (Pfizer) to focus only on animal health.

By technology, the genetic engineering segment led the animal biotechnology market in 2024. Animal genetic engineering has revolutionized research, medicine, disease treatment, agriculture (i.e., livestock management), and the pharmaceutical industry. Transgenic animals are increasingly being used to produce therapeutic proteins, and genetically engineered pigs are being produced for organ transplantation into humans. By studying animal engineering, scientists can gain a better understanding of genetic diseases and the creation of new medications.

By technology, the recombinant DNA technology segment is expected to grow at the highest CAGR during the predicted period. Numerous genetic processes can be used to enhance or reduce an animal's existing characteristics. They can also be used to produce new desirable traits like increased food output, faster growth, or resistance to disease. Animal recombinant DNA technology seems to have a promising future. Ongoing research aims to enhance gene editing techniques like CRISPR-Cas9 to allow for more precise changes with fewer adverse effects.

North America dominated the animal biotechnology market in 2024. The potential of the sector in this area is anticipated to develop due to the availability of healthcare programs and the rise in activities aimed at enhancing animal health. Furthermore, it is anticipated that significant R&D investments in the area would expand the North American animal biotechnology industry. Elanco Animal Health invested over USD 130 million in August 2024 to expand its Kansas, U.S. factory by 25,000 square feet and subsequently increase the capability for producing veterinary biologics.

The U.S. is growing significantly due to government support. Organizations like the FDA and USDA conduct various programs to improve animal health and contribute to animal biotechnology. For instance, in order to guarantee a safe and productive food supply, the USDA started national programs for animal production and protection in 2024 with the goal of enhancing the efficiency, health, and well-being of cattle, poultry, and aquatic food animals.

In Canada, more than 28 million pets may need medical care at various points in their lives. In Canada, there are over 6,080 companies in the veterinary industry, including veterinary clinics, animal hospitals, testing facilities, and livestock-related services. Veterinary practices make up 3,825 of the total veterinary industry enterprises. It is anticipated that there will be 5,000 new positions available for veterans between 2022 and 2031.

Asia Pacific is estimated to host the fastest-growing animal biotechnology market during the forecast period. Numerous significant factors, including the growth of middle-class households, increased disposable income, the acceptance of companion animals, new product launches, and high demand for animal proteins, are expected to contribute to the development of the animal biotechnology market in the region. A brand-new ELISA test kit that can detect antibodies in a range of animal species was unveiled in July 2024 by Ringbio, a well-known Chinese veterinary company. The primary objective of this kit is to identify various strains of Brucella infection, a highly contagious zoonotic disease that can infect both cattle and humans.

To ensure food safety in China, marine aquaculture is a crucial sector. China has made great strides in marine aquaculture during the last four decades. According to the China Fisheries Statistical Yearbook (Bureau of Fisheries 2024), China's per capita share of aquatic products grew from 1.65 kg in 1950 to 50.48 kg in 2023. Marine aquaculture is a vital source of aquatic products for the country's food supply. In 2023, China produced 23.95 million tons of marine aquaculture.

India has the largest cattle population in the world, and its animal husbandry sector supports approximately two-thirds of the rural population, primarily comprising small and marginal farmers. The Animal Biotechnology Decision Unit's objective is to develop better techniques and technologies to increase animal production and productivity. The following applied fields are receiving funding for research and development projects: transgenic animal development, animal reproduction, genome and genetic characterization of native breeds, animal nutrition, creation of new livestock by-products, development of animal vaccines and diagnostics, creation of therapeutics, technology for sexing bovine sperm, and transgenesis-based biopharmaceuticals.

Europe is expected to grow significantly in the animal biotechnology market during the forecast period. Supported by strong government laws, research institutes, and an emphasis on animal welfare, Europe is a well-established market for animal biotechnology. In this regard, nations like France, Germany, and the United Kingdom own a sizable portion of the market. Adaptation to biotechnology solutions is fueled by the region's prevailing emphasis on animal health and sustainable agriculture.

In Germany, the veterinary administration and laws protect the health of animals. Since animal illnesses transcend national boundaries, the Federal Ministry consistently collaborates with the veterinary authorities of third-world and other Member States. All animal keepers, including those in the private sector, are required to adhere to animal care standards. Germany's agricultural industry relies heavily on the management and breeding of animals.

In May 2025, the UK announced £10 million in fresh funding for monitoring programs, stepping up the fight against illnesses and pests that may cost the country billions of pounds. The Animal and Plant Health Agency's Genomics for Animal and Plant Disease Consortium (GAP-DC) project will conduct surveillance in animal, plant, and aquatic environments using cutting-edge genome sequencing technologies, which read a living organism's entire genetic code, including that of bacteria, fungi, viruses, and animals, to precisely detect, identify, and track pathogens.

Latin America is expected to grow at a considerable CAGR in the upcoming period. The increasing adoption of pets and growing awareness of disease prevention, diagnosis, and treatment in animals augment the market. Developers are continuously leveraging advanced technologies to support biotech innovation. The increasing collaborations, mergers & acquisitions, and public-private partnerships also foster market growth.

Buenos Aires has the largest number of pet owners per capita in the world. Public opinion surveys have reported pets in over 80% of the city’s homes. The city is home to 493,600 dogs compared to 460,600 children under the age of 14. Moreover, Argentinian researchers are developing genetically engineered animals for the production of pharmaceutical products.

The Middle East & Africa are expected to grow at a notable CAGR in the animal biotechnology market in the foreseeable future. The rising adoption of advanced technologies and the burgeoning biotech sector are major growth factors of the market. The growing need for improved livestock productivity, food security, and disease management results in a biotech revolution in the region. Government organizations launch initiatives and provide funding to support technological advancements in animal biotechnology.

In November 2025, the Chairman of the Arab Authority for Agricultural Investment and Development (AAAID) and the CEO of the Middle East for Vaccines (MEVAC) focused on potential avenues for collaboration in the production and development of veterinary vaccines and supporting livestock immunization initiatives across Arab countries.

In May 2024, according to Michael Florea, PhD, co-founder and CEO of Olden Labs, animal research is essential for the creation of treatments, but has not gotten much attention or innovation from the scientific community. Many of the techniques still in use date back to the 1960s. Animal research is often conducted manually, and the results are recorded on paper, despite biologists regularly accessing gigabytes of digital data in areas such as genetics and imaging. It was obvious that society would be significantly impacted by closing this technological divide. (Source - Synbiobeta)

By Product Type

By Application

By Animal Type

By End User

By Technology

By Region

February 2026

February 2026

February 2026

February 2026