February 2026

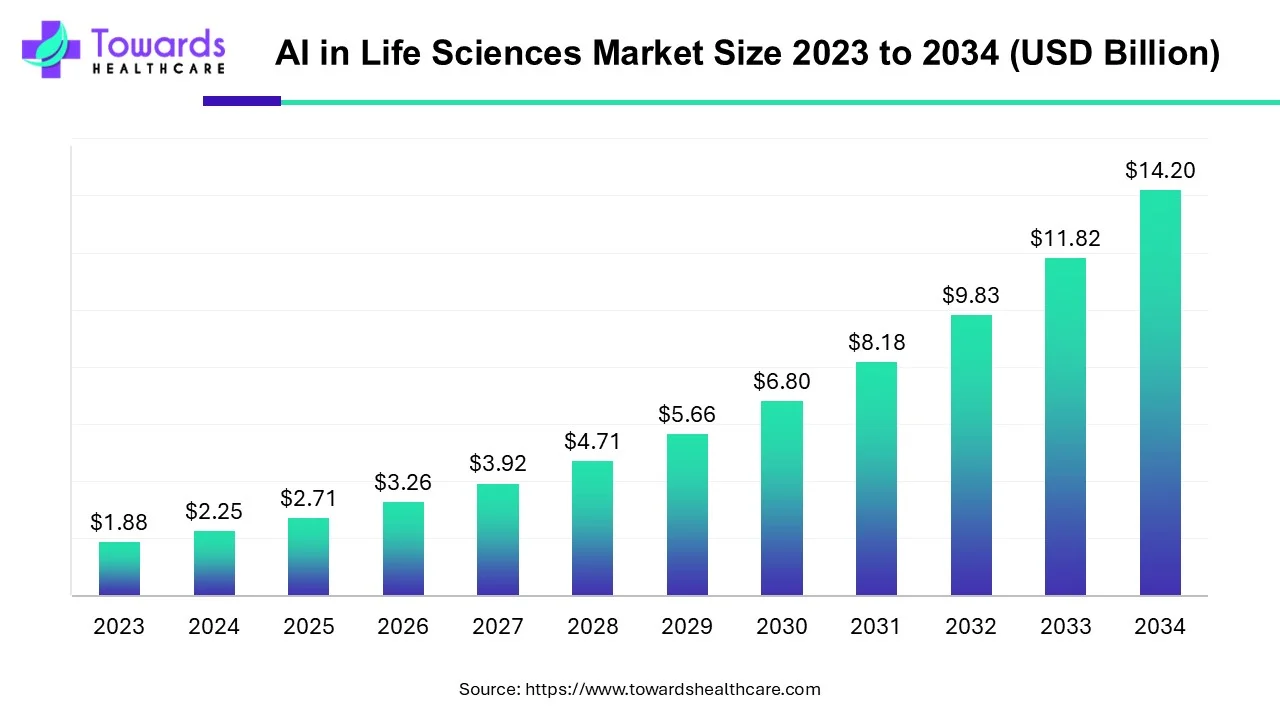

The global artificial intelligence in life sciences market size was calculated at USD 2.71 billion in 2025, to reach USD 3.26 billion in 2026 is expected to be worth USD 17.08 billion by 2035, expanding at a CAGR of 20.21% from 2026 to 2035. Technological advancements and growing demand for enhanced patient care are the major growth factors of the market.

AI, or artificial intelligence, is increasingly being used in the life science industry to accelerate drug discovery and development, improve clinical trials, and personalize patient care. By leveraging AI technologies, companies are able to analyze vast amounts of data and identify patterns and insights that were previously difficult or impossible to detect. This can lead to faster and more efficient drug development, more accurate diagnoses, and more effective treatment plans.

In drug discovery, AI is being used to help researchers identify new drug targets, predict the efficacy and safety of potential drug candidates, and optimize clinical trial design. By using machine learning algorithms to analyze large datasets, AI can help researchers identify patterns and relationships that may be missed by traditional methods.

In clinical trials, AI is being used to help improve patient recruitment, reduce trial timelines, and improve patient outcomes. AI-powered analytics tools can help identify potential study participants more quickly and accurately, and AI-powered predictive models can help identify patients who are most likely to benefit from a particular treatment.

In inpatient care, AI is being used to personalize treatment plans based on individual patient characteristics and medical history. By analyzing large datasets of patient data, AI can help identify the most effective treatments for individual patients and predict the likelihood of adverse events or treatment failure.

| Key Elements | Scope |

| Market Size in 2026 | USD 3.26 Billion |

| Projected Market Size in 2035 | USD 17.08 Billion |

| CAGR (2026 - 2035) | 20.21% |

| Leading Region | North America |

| Market Segmentation | By Offering, By Deployment, By Application, By Region |

| Top Key Players | IBM Corporation, Atomwise, Inc., Nuance Communications, Inc., NuMedii, Inc., AiCure LLC., APIXIO, Inc., Insilico Medicine, Inc., Enlitic, Inc., Sensely, Inc., Zebra Medical Vision |

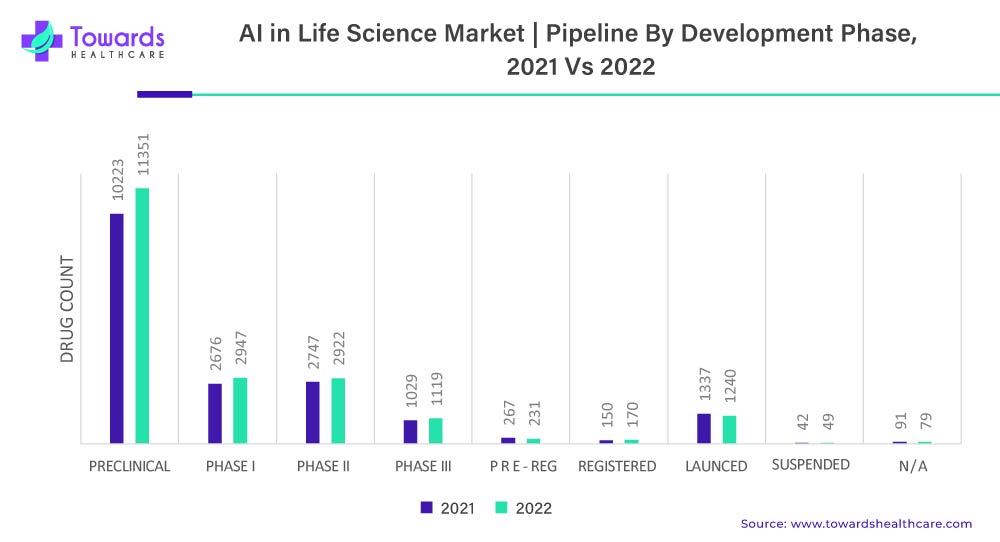

AI is transforming the life sciences industry by enabling next-generation clinical trials. AI technologies are being used to analyze vast amounts of data from various sources, including electronic health records, genomics, wearables, and clinical trial data. By combining these data sources and analyzing them using advanced machine learning algorithms, AI can help identify patient populations, predict patient responses to treatment, and optimize clinical trial designs. In addition, the overall increase in clinical trials leading to increasing demand for AI tools is projected to bolster the growth of AI in the life science market.

AI-powered clinical trials can help pharmaceutical companies save both time and money in drug development. By using AI algorithms to identify promising drug candidates earlier in the development process, companies can avoid wasting resources on drugs that are unlikely to succeed. Additionally, AI can be used to optimize trial designs, reducing the time and cost required to recruit patients and conduct the trial. Overall, AI can help streamline the drug development process and improve the chances of success for new treatments.

| Sr. No. | Company | Number of Drugs in Pipeline 2022 | Number of Originated Drugs 2022 |

| 1 | Novartis | 213 | 129 |

| 2 | Roche | 200 | 120 |

| 3 | Takeda | 184 | 68 |

| 4 | Bristol Mayer Squibb | 168 | 98 |

| 5 | Pfizer | 168 | 101 |

| 6 | AstraZeneca | 161 | 89 |

| 7 | Merck & Co | 158 | 77 |

| 8 | Johnson& Johnson | 157 | 86 |

| 9 | Sanofi | 151 | 87 |

| 10 | Eli Lilly | 142 | 76 |

| 11 | GSK | 131 | 67 |

| 12 | Abbvie | 121 | 44 |

| 13 | Boehringer Ingelhelium | 108 | 79 |

| 14 | Bayer | 105 | 76 |

| 15 | Otsuka Holdings | 93 | 46 |

| 16 | Jiangsu Hengrui Pharmaceuticals | 89 | 80 |

| 17 | Amgen | 83 | 64 |

| 18 | Eisai | 80 | 41 |

| 19 | Astellas Pharma | 75 | 43 |

| 20 | Daiichi Sankyo | 75 | 40 |

| 21 | Gilead Sciences | 72 | 45 |

| 22 | Regeneron | 68 | 41 |

| 23 | Shanghai Fusion Pharmaceutical | 68 | 48 |

| 24 | Biogen | 66 | 19 |

| 25 | Sumitomo Dainippo Pharma | 66 | 47 |

AI can also help improve patient outcomes by enabling personalized medicine. By analyzing patient data, including genetics and health records, AI can help predict patient responses to treatment and identify patients who are most likely to benefit from a particular therapy. This personalized approach can improve the effectiveness of treatments and reduce the likelihood of adverse reactions. Thus, AI-powered clinical trials offer significant potential for transforming the life sciences industry by improving drug development, reducing costs, and improving patient outcomes.

Predictive analytics is a rapidly growing field in the life science industry that has the potential to revolutionize the way we approach drug discovery, clinical trials, and patient care. By leveraging data and machine learning algorithms, predictive analytics can provide insights into complex biological systems, helping researchers identify new drug targets and develop more effective treatments.

One of the major applications of predictive analytics in the life science industry is in drug discovery. By analyzing large datasets, such as molecular structures and genetic information, machine learning algorithms can identify potential drug candidates with higher success rates, allowing researchers to focus their efforts on the most promising leads. This can significantly reduce the time and cost involved in bringing new drugs to market.

In clinical trials, predictive analytics can be used to identify patient populations that are most likely to benefit from a particular treatment, improving the efficiency and efficacy of the trial. Predictive analytics can also be used to predict the likelihood of adverse events, enabling researchers to take proactive measures to minimize risks to patients.

In inpatient care, predictive analytics can be used to identify patients who are at high risk of developing certain conditions, such as diabetes or heart disease, allowing healthcare providers to take preventive measures. Predictive analytics can also be used to personalize treatment plans, taking into account individual patient characteristics such as age, gender, and medical history.

The potential of predictive analytics in the life science industry is vast. As the amount of data generated in the industry continues to grow, the use of predictive analytics is likely to become even more prevalent, unlocking new insights and accelerating the pace of research and development.

The rising investments in drug discovery and development, along with the surging demand for advanced and innovative therapeutics for chronic diseases, are driving the dominance of the drug discovery segment in the global market.

On the other hand, the clinical trials segment is expected to be the most opportunistic during the forecast period due to the increasing number of drug discovery activities and the generation of huge volumes of data. The availability of these data on public domains is accelerating the adoption of AI-based software among various academic and research institutions. This will lead to the rapid traction of the clinical trials segment in the coming years.

By offering, the software segment held a dominant presence in the market in 2024. This segment dominated because of the availability of user-friendly software. Software eliminates the need for a specialized infrastructure to adopt in a healthcare organization. Several companies provide cost-effective subscription models. Software enables companies to store and access data from anywhere and at any time. Advancements in internet connectivity technologies facilitate the use of cloud-based platforms.

By offering, the services segment is expected to grow at the fastest CAGR in the market during the forecast period. Services offer relevant expertise to healthcare organizations. Companies provide tailored solutions to common problems in healthcare organizations. Some companies operate through a centralized system, enabling them to scale up their operations and manage workflows of multiple organizations from a single location.

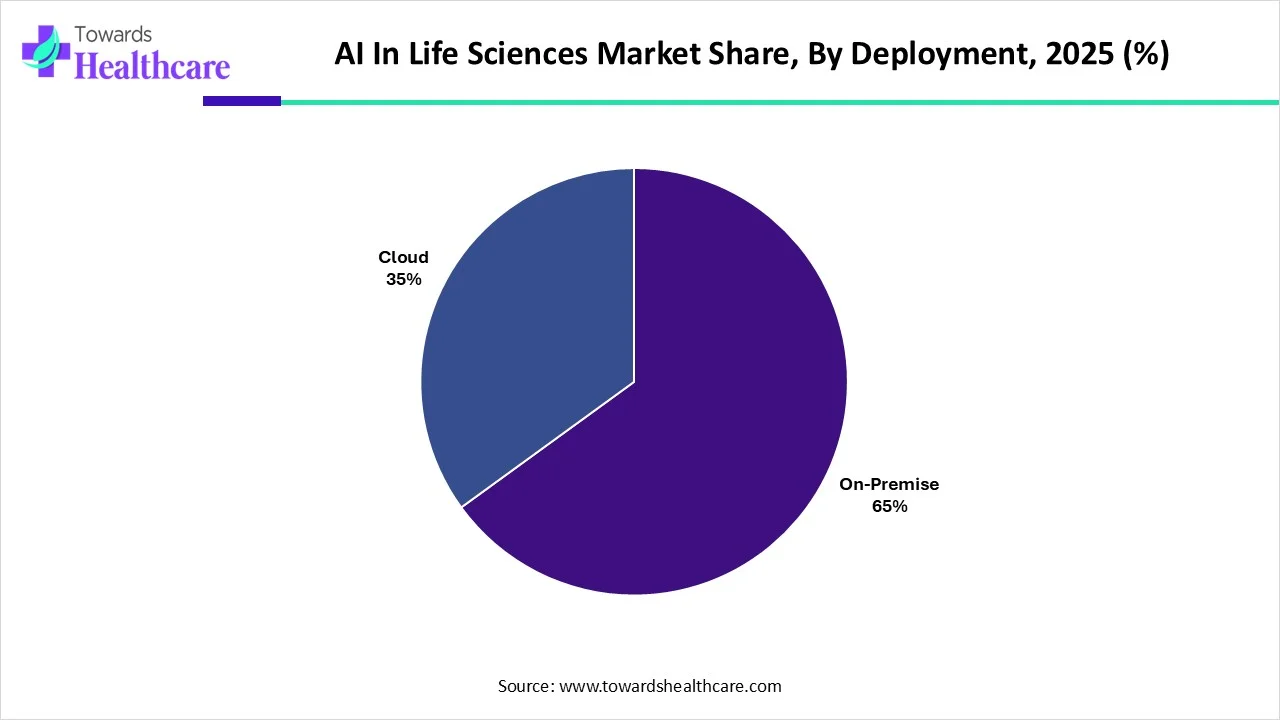

By deployment, the cloud segment led the global market in 2024. Cloud-based platforms are in high demand as they can store vast amounts of data in a single place. Healthcare professionals can access data from anywhere and at any time. Cloud platforms reduce infrastructure and maintenance costs and enhance workflows. They enable scaling up and offer professionals to pay only for the limited storage that is required. They have a backup option for easier and faster data recovery.

By deployment, the on-premise segment is expected to grow with a significant CAGR in the market during the studied years. On-premise platforms offer complete control over the data, as well as privacy to access confidential health data. They reduce the chance of data leakage and cybersecurity threats. They do not require consistent internet connectivity and run within the enterprise only. These platforms are mostly used in large companies due to the presence of favorable infrastructure.

By application, the drug discovery segment held the largest revenue share of the market in 2024. The segmental growth is attributed to the rising prevalence of chronic disorders and growing research and development activities. AI in drug discovery enables researchers to save time and cost compared to a conventional drug discovery process. Novel drugs are developed to address issues related to chronic disorders. The increasing use of antimicrobials for infectious diseases is potentiating the risk of antimicrobial resistance. This enables researchers to develop novel molecules.

By application, the clinical trials segment is expected to expand rapidly in the market in the coming years. The increasing number of clinical trials across the globe favors the use of AI in clinical trials. As of July 14, 2025, about 544,730 clinical trials are registered on the clinicaltrials.gov website. (Source: https://clinicaltrials.gov/search) Integrating AI in clinical trials offers widespread advantages from patient selection to data analysis. Moreover, AI can significantly reduce the timeline of the trial, allowing healthcare organizations to accelerate time to market approval of a drug.

North America dominated the market in 2024. The availability of a robust healthcare infrastructure, increasing investments, and the presence of key players are the major growth factors of the market in North America. Government agencies support healthcare organizations to adopt advanced technologies in the life sciences sector. A strong presence of pharmaceutical and biotechnology companies offers immense potential for AI in life sciences.

U.S. Market Trends

The National Institute of Health (NIH) supports the use of AI in biomedical research through several programs to accelerate discovery and encourage partnerships. The NIH invests approximately $48 billion annually for research purposes. The Food and Drug Administration (FDA) also approves AI/ML-based medical devices, with 1,247 such devices approved as of July 10, 2025.

Canada Market Trends

Canada is home to more than 2,000 life science companies. In 2023, $25.9 billion was invested in 175 companies. The Canadian government announced an investment of $2 billion over five years, starting from 2024-25, to launch new initiatives for AI tools. The Canadian Embassy hosted the “Canadian AI in life sciences innovation R&D partnering delegation to South Korea”. (Source: Government of Canada)

Asia-Pacific is expected to grow at the fastest CAGR in the AI in life science market during the forecast period. The rapidly expanding life science sector and the rising adoption of advanced technologies boost the market. Government and private organizations conduct seminars, workshops, and conferences to raise awareness about the application of AI in the life sciences sector. These programs also train individuals about the functions of AI tools.

China Market Trends

There are more than 3,000 life science companies in China, with around 189 life sciences tech startups. China accounted for 8% of the global venture capital funding for life sciences in the fourth quarter of 2024. Shanghai and Beijing ranked sixth and tenth in venture capital investment, accounting for $1.7 billion in 2024.

India Market Trends

The number of biotech startups in India rose from 5,365 to 8,531 between 2021 and 2023, an increase of 59%. It is estimated that the number of startups will reach 35,460 by 2030. India is recognized as the third-largest startup ecosystem in the world, with over 1.59 lakh startups in various fields.

Europe is expected to grow at a considerable CAGR in the AI in life science market in the upcoming period. The presence of advanced healthcare infrastructure and favorable government support augments market growth. Government organizations encourage the use of AI in different fields to position Europe and European countries as global leaders. Numerous companies adopt AI tools for their operations to strengthen their market position.

Germany Market Trends

Germany takes necessary measures to build a robust policy and legal foundation for the use of AI in healthcare. The Federal Ministry of Research, Technology, and Space (BMTFR) launched the AI action plan to ensure research and skill basis for Germany and the implementation of measurable economic successes.

UK Market Trends

The UK government actively supports innovation in the life sciences field and the use of AI. It invested £82 million to support UK-based projects in using AI to design new treatment models and therapeutics for diseases, such as Alzheimer’s and cancer. In 2023, an AI White Paper was published outlining a regulatory framework to strengthen the UK’s position as a global leader in AI.

Anthony Costello, CEO of Medidata, commented that Medidata is at the forefront of a critical shift in the life sciences sector. By harnessing AI-powered solutions and partnering with visionaries, the company is accelerating and improving clinical studies and driving a lasting impact on patients’ lives beyond the trial. (Source: Dassault Systems)

By Offering

By Deployment

By Application

By Region

February 2026

February 2026

February 2026

February 2026