February 2026

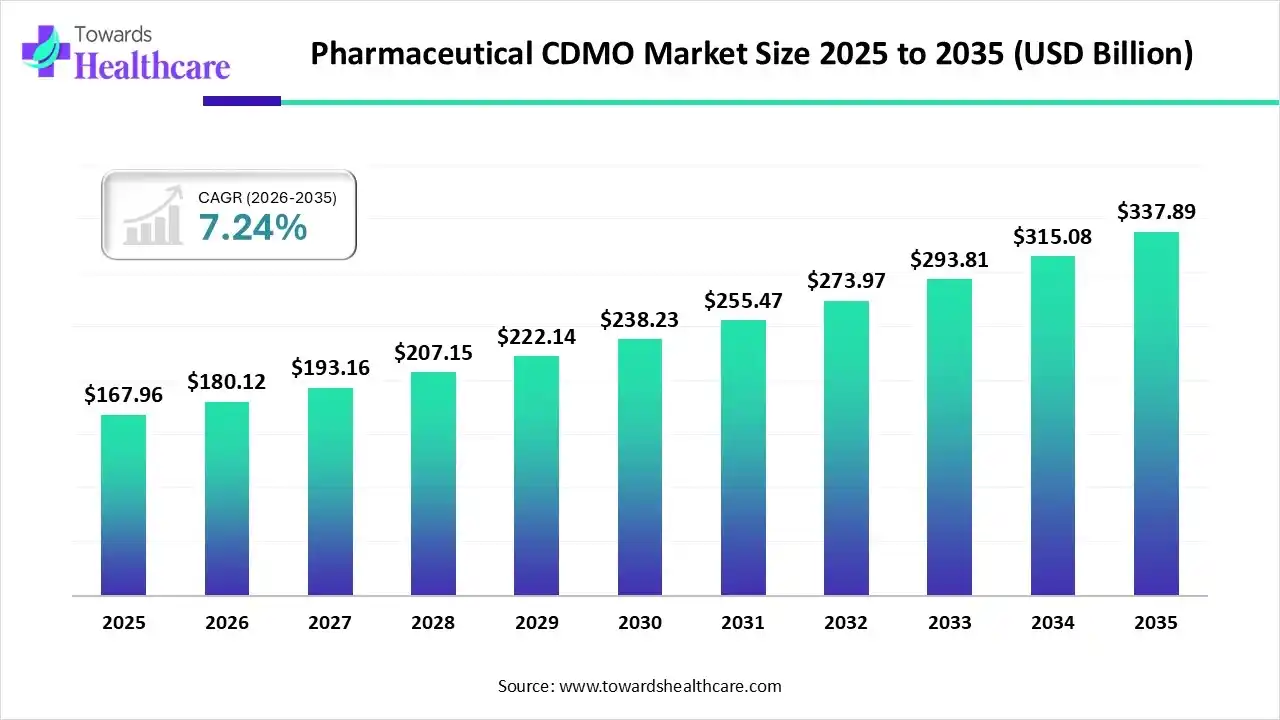

The global pharmaceutical CDMO market size was estimated at US$ 167.96 billion in 2025 and is projected to grow to US$ 337.89 billion by 2035, rising at a compound annual growth rate (CAGR) of 7.24% from 2026 to 2035. The pharmaceutical CDMOs are growing due to the growing demand for pharmaceutical products.

| Key Elements | Scope |

| Market Size in 2026 | USD 180.12 Billion |

| Projected Market Size in 2035 | USD 337.89 Billion |

| CAGR (2026 - 2035) | 7.24% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Product, By Workflow, By Application, By End-use, By Region |

| Top Key Players | Veranova, Sterling, Fareva, Pfizer Centre One, AjiBio, Uquifa, Farmhispania, Carbogen Amcis, Evonik, FIS - Fabbrica Italiana Sintetici S.p.A., Almac, Dottikon, Curia, CordenPharma International, Piramal Pharma Solutions, Samsung Biologics, WuXi AppTec, Inc., Siegfried Holding AG, Cambrex Corporation, Bushu Pharmaceuticals Ltd., EuroAPI, Laboratory Corporation of America Holdings (LabCorp), Sequens, Hovione, Nipro Corporation, Catalent, Inc., Thermo Fisher Scientific, Inc., Recipharm AB, Axplora, Lonza |

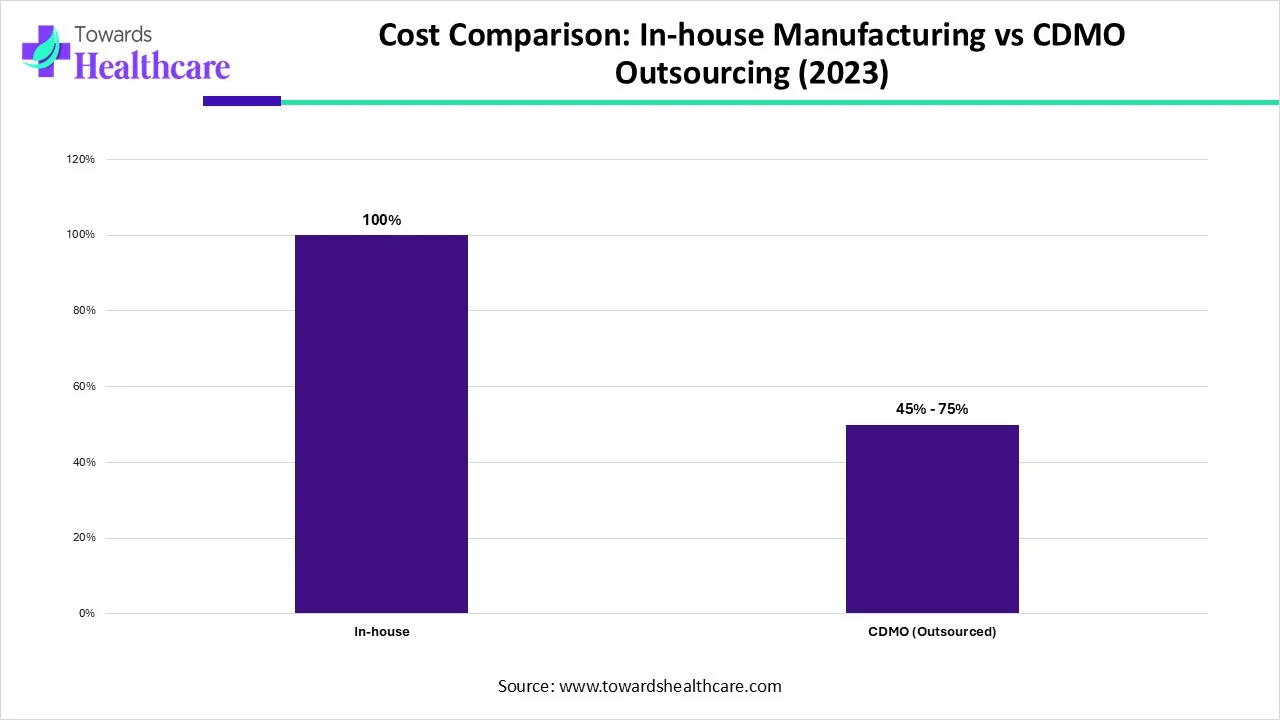

During the lengthy and intricate procedures required to research and manufacture novel therapeutic ingredients, pharmaceutical businesses encounter several hurdles. Bringing novel pharmaceutical products to market can be facilitated by partnering with the appropriate contract development and manufacturing organization (CDMO), which can save costs and offer scalability and expertise. Because pharmaceutical businesses need access to capacity or technological skills beyond what they have in-house and want to reduce risk by outsourcing to a secondary supplier, they contract drug manufacturers to CDMOs or CMOs.

| Manufacturing Model | Cost Differential (%) |

| In-house | 100% |

| CDMO (Outsourced) | 50% |

In the upcoming years, the market is anticipated to be driven by the growing need for customized treatment. However, this need cannot be satisfied by traditional production methods. Consequently, it is crucial to collaborate with a contract manufacturing organization (CMO) that possesses sufficient knowledge to intentionally carry out small-scale complicated projects while preserving efficacy, safety, and reliability.

The fierce competition in the pharmaceutical CDMO sector is anticipated to provide a challenge to the worldwide business. Because several competitors are fighting for the same pool of possible customers. Additionally, because medication researchers must also consider making money in the long term, pharmaceutical corporations are looking for solution suppliers who give the best prices. Price wars between CDMOs result from this, which restricts the industry's ability to develop.

Pharmaceutical CDMO Market Size, By Product (USD Billion)

| Year | API | Drug Product |

| 2024 | 86.1 | 70.5 |

| 2025 | 92.0 | 75.9 |

| 2026 | 98.3 | 81.8 |

| 2027 | 105.1 | 88.1 |

| 2028 | 112.3 | 94.9 |

| 2029 | 120.0 | 102.2 |

| 2030 | 128.2 | 110.1 |

| 2031 | 136.9 | 118.5 |

| 2032 | 146.3 | 127.7 |

| 2033 | 156.3 | 137.5 |

| 2034 | 167.0 | 148.1 |

Why Did the API Segment Dominate in the Pharmaceutical CDMO Market in 2025?

By product, the API segment held the largest share of the market and is anticipated to grow at the fastest CAGR during the forecast period. Pharmaceutical businesses can benefit from a strategic advantage in API contract manufacturing, which enables them to focus on their core business operations, save costs, and make use of specialized knowledge. API contract manufacturing is expected to become more and more important in determining the direction of the pharmaceutical business as it develops.

How Commercial Segment Dominated the Pharmaceutical CDMO Market in 2025?

By workflow, the commercial segment dominated the market in 2025. CDMOs play a crucial role in the commercial production of pharmaceuticals. Large, medium, and small companies use CDMO services to ensure that the resources needed for the production of final products are provided on time and of high quality. The commercial segment is growing strongly due to the growing demand for generic medicine and personalized medicines.

Which Application Type Segment Held the Dominating Share of the Pharmaceutical CDMO Market in 2025?

By application, the oncology segment led the market in 2025. The development of effective cancer treatments is just the beginning of the quickly evolving discipline of oncology. CDMOs are essential because they provide a connection that guarantees the safe, effective, and scalable manufacture of cancer medications. From the initial stages to large-scale production, Oncology CDMO services are responsible for a variety of tasks.

What Made Large Pharmaceutical Companies the Dominant Segment in the Pharmaceutical CDMO Market in 2025?

By end-use, the large pharmaceutical companies segment held the largest share of the market and is anticipated to grow at the fastest rate during the forecast period. Size has always been important in the CDMO industry, with bigger businesses controlling the market thanks to their greater margins, first dibs on new ideas, and strong resources to keep rivals at bay. Businesses may better plan for the changes and difficulties that will occur in 2024 and beyond by comprehending and using these important trends.

This increase may be ascribed to a number of variables, including better insurance plans and better regional economic situations that enable individuals to cover their own prescription drug expenses. Countries like China, India, and Japan have emerged as significant participants in the pharmaceutical sector in recent years due to their growing production capacities. In 2023, the pharmaceutical CDMO market in China held the highest share because of the expanding collaboration agreements between pharmaceutical firms and CDMO, which complemented the expansion of the Chinese pharmaceutical CDMO market.

The demand for pharmaceutical contract development and manufacturing services has increased as a result of pharmaceutical firms' increasing expenditure on the research and development of new pharmaceuticals. One of the main drivers of market expansion is the expansion of the pharmaceutical industries in the United States and Canada. Clinical trials and the significant presence of major market competitors are also expected to propel market expansion. Furthermore, CDMOs are a desirable alternative for overcoming regulatory obstacles because of the strict regulatory standards, especially in the U.S. and Canada, which call for specific knowledge and compliance skills.

US Pharmaceutical CDMO Market Trends

In 2023, the biggest share was held by the pharmaceutical CDMO market in the United States. In order to cut expenses, shorten time-to-market, and get access to specialist knowledge, pharmaceutical firms are increasingly contracting with CDMOs to handle their research and manufacturing tasks. As CDMOs develop to accommodate the rising demand for outsourced services, this trend is driving market expansion in the U.S.

Europe is expected to grow significantly in the pharmaceutical CDMO market during the forecast period, due to the presence of robust industries. At the same time, the growth in the outsourcing trend, biologics development, and stringent regulations also contributed to the increased collaboration with the CDMOs.

UK Pharmaceutical CDMO Market Trends

The growing R&D activities and rising demand for biologics are increasing the demand for pharmaceutical CDMO services. Moreover, the expansion of manufacturing facilities and outsourcing trends are also increasing their use to accelerate innovations.

South America is expected to show lucrative growth in the pharmaceutical CDMO market during the forecast period, due to the expanding pharmaceutical manufacturing base. At the same time, the growing development of biosimilars and increasing outsourcing trends are also enhancing the market growth.

Brazil Pharmaceutical CDMO Market Trends

The growing demand for generics and biosimilars in Brazil is increasing the collaborations with pharmaceutical CDMOS to enhance their production rates. The expanding industries, stringent regulations, and outsourcing trends are also increasing the dependence on them.

North America and Europe - Innovation and Quality Focus

Strong regulatory frameworks and advanced R&D make regions like the US, UK, Germany, and Switzerland hubs for high-quality drug development and specialized manufacturing.

Key players: Pfizer CentreOne, Catalent, Lonza, Recipharm, Thermo Fisher Scientific.

Asia - Pacific - Cost Efficiency and Scale

Countries like India, China, and South Korea are driving large-scale manufacturing due to cost advantages and expanding biologics capacity. Companies such as WuXi AppTec, Samsung Biologics, Piramal Pharma Solutions, and Bushu Pharmaceuticals Ltd. are leading the charge.

Biologics and Specialty Drugs Growth

Rising demand for biologics and complex APIs is pushing CDMOs like Evonik, Siegfried, EUROAPI, and Janet (CordenPharma) to expand capabilities.

Strategic Partnerships and Consolidation

Mergers, acquisitions, and collaborations are accelerating global reach, with companies such as Veranova, Sterling, FAREVA, CARBOGEN AMCIS, Almac Group, and Curia expanding their footprints.

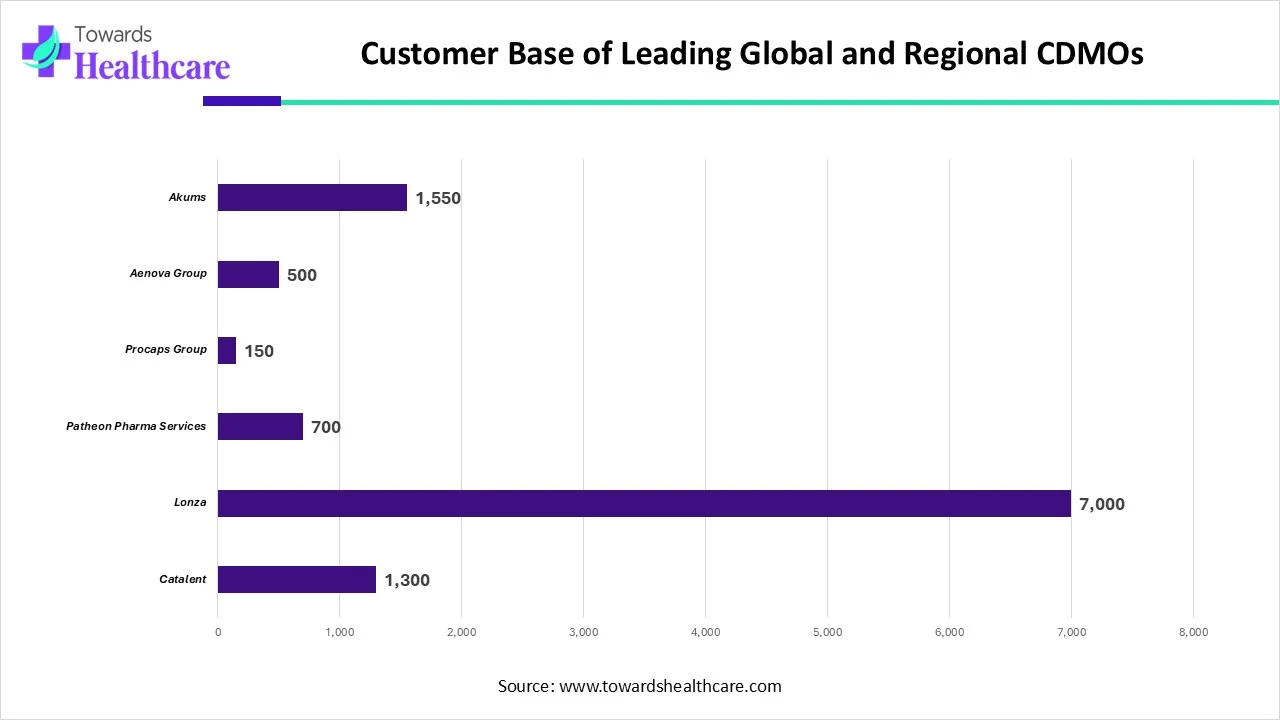

| Name | No. of Customers |

| Catalent | 1,300 |

| Lonza | 7,000 |

| Patheon Pharma Services | 700 |

| Procaps Group | 150 |

| Aenova Group | 500 |

| Akums | 1,550 |

In October 2023, the whole pharmaceutical supply chain and more than 40,000 executives are expected to attend CPHI Barcelona, which will be held at Fira Barcelona from October 24 to 26. In addition to being a top business show, this event, which is essential to the pharmaceutical industry, has developed into a crucial forum for conversations on outsourcing and the pharmaceutical and biotech sectors.

By Product

By Workflow

By Application

By End-use

By Region

February 2026

February 2026

February 2026

February 2026