February 2026

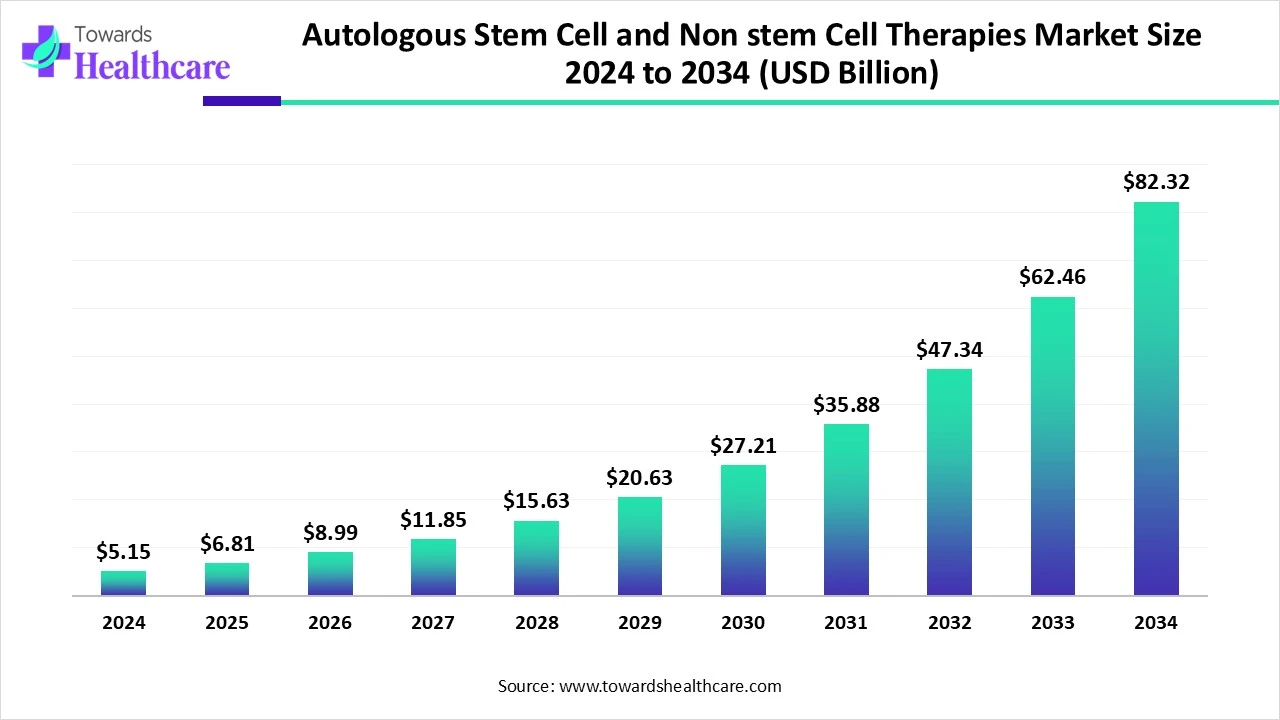

The global autologous stem cell & non-stem cell therapies market size is calculated at US$ 5.15 billion in 2024, grew to US$ 6.81 billion in 2025, and is projected to reach around US$ 82.32 billion by 2034. The market is expanding at a CAGR of 32.26% between 2025 and 2034.

The market for autologous stem cell and non-stem cell treatments is now quite innovative. This is because novel treatment cell types, including iPSCs and CAR-T cells, are made possible by technical breakthroughs. These cell types target particular antigens found in cancer cells and allow for mass cell synthesis, which offers considerable benefits over old approaches. These treatments are effective and economical because to improvements in manufacturing techniques. Over the past several years, the sector has experienced substantial geographical expansion, with North America, Europe, and Asia-Pacific being main growth areas.

| Table | Scope |

| Market Size in 2025 | USD 6.81 Billion |

| Projected Market Size in 2034 | USD 82.32 Billion |

| CAGR (2025 - 2034) | 32.26% |

| Leading Region | North America |

| Market Segmentation | By Therapy Type, By Indication/Clinical Use Case, By Product/Offering, By Workflow/Manufacturing Model, By Regulatory/Reimbursement Status, By End-User, By Region |

| Top Key Players | Gilead Sciences/Kite Pharm, Novartis, Bristol-Myers Squibb, Vericel Corporation, Dendreon (PROVENGE), Mesoblast, Gamida Cell, Takeda/TiGenix, Terumo BCT, Arthrex, RegenLab/RegenMed Systems, Zimmer Biomet, Lonza, Catalent/Emergent CDMO services, Cytori, Adaptimmune/Iovance, Bluebird bio, Vericel |

The autologous stem-cell & non-stem-cell therapies market covers clinical and commercial interventions that use a patient’s own biological material, including autologous stem cells (e.g., mesenchymal stem cells, autologous cultured chondrocytes), autologous immune-cell products (CAR-T and other modified T cells when produced from the patient), and autologous non-stem products (platelet-rich plasma, autologous serum, microfat/adipose grafts, autologous cartilage implants). The market includes reagents, devices/kits for point-of-care preparation, CDMO/manufacturing services, clinical delivery (hospital/clinic), and finished autologous biologic products and procedures.

Rising Investment in CAR-T Cell Therapies: One of the major trends in the autologous stem cell & non-stem cell therapies market is rising investment in CAR-T cell therapies. It is majorly due to the rising cases of cancer. CAR-T cell therapies can provide personalized treatment leading to better healthcare outcomes.

For instance,

AI is transforming the autologous stem cell & non-stem cell therapies market by becoming an essential part of various steps. Because of the integration of advanced technologies like automation, artificial intelligence (AI), and machine learning, the sector has a lot of promise. In order to reduce the likelihood of human error and improve consistency and reproducibility, automated systems and robotic platforms may simplify and standardise the complex processes needed for cell separation, expansion, and manipulation. Artificial intelligence (AI) and machine learning approaches can be used to optimise cell culture conditions, anticipate cell activity, and customise therapeutic regimens for individual patients.

Rising Need for Autologous Stem & Non-Stem Cell Therapies in Rare Diseases

Autologous stem & non-stem cell therapies are becoming an integral part of treating rare diseases, due to which the autologous stem-cell & non-stem-cell therapies market is growing. It has been demonstrated that autologous cell therapy can either cure uncommon illnesses or greatly improve clinical outcomes for patients. The patient provides their own cells as the beginning material for autologous treatments. As a therapeutic intervention, these cells are then reintroduced into the patient after being cultivated, grown, and altered ex vivo, or outside the body. Autologous goods cannot be given to other people since they are specifically made for the patient. Graft versus host disease and other harmful autoimmune problems after transplantation are also unlikely because autologous treatment is obtained from the patient.

Legal and Regulatory Challenges

Developers and healthcare providers must take into account the complicated regulatory issues and approval procedures related to autologous cell stem cell and non-stem cell treatments. The FDA and other regulatory agencies manage issues related to production, patient eligibility, follow-up, and striking a balance between access and oversight in order to guarantee the safety and effectiveness of therapies. To minimise surprises, developers must make sure they interact with regulatory authorities frequently because it's not always evident which key qualities to examine.

Rising Advances in Regenerative Medicine

The rising advances in regenerative medicine are promoting the growth of the autologous stem cell & non-stem cell therapies market. Significant progress has been achieved in regenerative medicine, which is propelling the creation and marketing of autologous treatments. The safety and efficacy of stem cell-based treatments have been improved by novel techniques for cell isolation, proliferation, and differentiation. Furthermore, advancements in non-stem cell-based therapies like PRP and exosome treatments increase the range of therapeutic options. Together with the growing number of regulatory entity approvals, more clinical studies may boost market expansion.

By therapy type, the autologous non-stem biologics/procedures segment held the major share of the autologous stem cell & non-stem cell therapies market in 2024. When patients come with a wide range of illnesses, accidents, and ailments, autologous biologic products, which are made by gathering and concentrating naturally existing cells from the patient's own body, offer doctors additional alternatives. Compared to other choices, autologous biologics have a far lower risk of immunological reaction or rejection since they are made from the patient's own cells.

By therapy type, the autologous immune-cell therapies segment is estimated to experience the highest CAGR in the autologous stem cell & non-stem cell therapies market during the forecast period. Using a patient's own immune cells to treat an illness is known as autologous immune-cell therapy. After being extracted from the patient, these cells—typically T cells or other immune cells are altered in a laboratory to improve their capacity to identify and eliminate sick cells before being reintroduced into the patient's body. This strategy seeks to combat ailments like cancer or autoimmune illnesses by using the body's own immune system.

By indication/clinical use case, the orthopedic & sports medicine segment was dominant in the autologous stem cell & non-stem cell therapies market in 2024. A paradigm change in orthopaedic medicine, stem cell treatment provides regenerative remedies for a variety of sports injuries and musculoskeletal disorders. Stem cell treatment provides innovative answers to long-standing problems, from improving sports performance and rehabilitation to repairing damaged tissues. Stem cell technologies have the potential to improve patient outcomes, lower healthcare costs, and meet unmet clinical requirements in the treatment of musculoskeletal problems when incorporated into orthopaedic practice.

By indication/clinical use case, the oncology segment is anticipated to be the fastest-growing in the autologous stem cell & non-stem cell therapies market during 2025-2034. The treatment of cancer is among the most intriguing uses of autologous cell therapy. Clinical studies of CAR T cell treatment have yielded impressive results. Some people have had total remission from their disease, even if they were previously resistant to conventional therapy. This strategy is being repeated and extended to additional cell types, such as dendritic cells, natural killer (NK), and macrophages.

By product/offering, the point-of-care devices & kits segment led the autologous stem cell & non-stem cell therapies market in 2024. Compared to laboratory testing, POCT offers a quicker turnaround time for test findings, perhaps producing a result soon enough to administer the right therapy and enhance clinical or economic outcomes. POCT has undergone a revolution thanks to technological advancements including enhanced instrumentation and electronics miniaturisation, which have made it possible to create devices that are more precise and smaller.

By product/offering, the CDMO/GMP manufacturing services for the autologous products segment are anticipated to witness the fastest growth in the autologous stem cell & non-stem cell therapies market during the forecast period. Pharmaceutical and biotech firms might benefit greatly from CDMOs (Contract Development and Manufacturing Organisations) that specialise in GMP (Good Manufacturing Practice) services for autologous goods. These include lower risk and expense, scalability, quicker time to market, and access to specialised knowledge and tools. Businesses can use a CDMO's current infrastructure and experience to outsource production while concentrating on essential skills like clinical research and drug discovery.

By workflow/manufacturing model, the decentralized/point-of-care segment held the largest revenue of the autologous stem cell & non-stem cell therapies market in 2024. The decentralised manufacturing approach is the key to breaking down barriers and increasing the availability of life-saving therapies by facilitating better patient access. Decentralisation moves the production of cell therapies closer to the patients, resulting in a more dispersed process. Introducing point-of-care facilities with the necessary infrastructure to support manufacturing is one strategy to shorten turnaround times. Decentralising autologous cell treatments can therefore eventually provide quicker and more widespread access to care, which will enhance patient outcomes.

By workflow/manufacturing model, the centralized manufacturing segment is estimated to achieve the fastest CAGR in the autologous stem cell & non-stem cell therapies market during the predicted timeframe. The advantages of centralisation include minimising overheads by distributing business costs across large production volumes, decreasing interactions with important suppliers and customers, and mitigating the effects of local demand peaks and troughs by redistributing resources across a range of products rather than holding onto idle resources.

By regulatory/reimbursement status, the marketed & reimbursed autologous products segment captured the major share of the autologous stem cell & non-stem cell therapies market in 2024. As autologous products have become more established as a drug modality and more and more products are making the transition from bench to market, regulatory bodies worldwide have responded by proposing more precise regulations and methods to shorten the time needed for development. To enable quicker access to these medicines for serious illnesses such blood malignancies and genetic abnormalities, regulatory bodies worldwide have put in place frameworks. These regulations have been widely embraced and accepted, and it has been demonstrated that they hasten the commercialisation of autologous goods.

By regulatory/reimbursement status, the clinical-level procedures billed as services segment is anticipated to be the fastest-growing in the autologous stem cell & non-stem cell therapies market during the forecast period. A number of variables, such as the expanding complexity of medical treatment, the move towards value-based care models, and the need to fairly reward clinicians for the care they give, are contributing to the rise in clinical-level procedures billed as services. In order to guarantee proper compensation and prevent under-coding, this trend also shows a stronger emphasis on thorough documentation and coding.

By end-user, the orthopedic/sports-medicine clinics segment led the autologous stem-cell & non-stem-cell therapies market in 2024. Orthopaedic clinics can treat chronic illnesses, rehabilitation, and musculoskeletal infections or deformities. Orthopaedic clinics can also offer pain management injections and diagnostic services. A number of reasons have contributed to the growing popularity of sports medicine clinics. These clinics have grown as a result of the increased need for specialised medical treatment for athletes and sports participants in recent years. Sports medicine clinics, which offer thorough and customised medical care especially for athletes, have become an essential part of the healthcare sector.

By end-user, the hospitals & cancer centers segment is estimated to grow at the highest rate in the autologous stem cell & non-stem cell therapies market during the forecast period. Access to specialised knowledge, cutting-edge equipment, all-inclusive care, and a comprehensive approach to treatment are just a few benefits of selecting a hospital with a dedicated cancer centre. Better results, a more positive patient experience, and a more effective course of therapy can result from this.

North America dominated the autologous stem cell & non-stem cell therapies market in 2024. The growing prevalence of chronic illnesses and the expansion of clinical research initiatives are two factors that are anticipated to support the market's expansion in the area over the course of the projected year. The market is expanding as a result of the growing prevalence of chronic illnesses in North America, including cancer, diabetes, orthopaedic conditions, and chronic renal diseases. These conditions increase demand for treatments based on autologous stem cells and non-stem cells. The region's market is anticipated to rise as a result of recent initiatives to create innovative technologies based on autologous stem cell therapy.

Scientists, doctors, professionals, and patient advocates working in gene and cell therapy are primarily members of the American Society of Gene + Cell Therapy (ASGCT). 505 clinical studies were being carried out at U.S. facilities in 2020, and there were 512 firms in the U.S. working on cell and gene treatments. In North America, there were 1,230 developers by 2024, and 981 clinical studies were still in progress. The FDA has issued important regulatory clearances as a result of this clinical trial supremacy.

In order to provide safe and efficient next-generation therapies, the Canadian government is putting out great effort to strengthen the country's biomanufacturing and life sciences industries. Canada will boost its involvement in global value chains by partnering with OmniaBio to build its facility to produce gene and cell treatments and offer manufacturing services to businesses worldwide. The management of many serious illnesses might be completely transformed by cell and gene treatments.

Asia Pacific is estimated to host the fastest-growing autologous stem cell & non-stem cell therapies market during the forecast period. mostly due to the vigourous policy pressures from China, India, and Japan. By virtue of the Act on the Safety of Regenerative Medicine, the Pharmaceuticals and Medical Devices Agency of Japan provides fast approvals for regenerative treatments, including conditional commercialisation after preliminary clinical studies. China is involved in stem cell-based regeneration projects in wound healing, neurology, and cardiology through the Ministry of Science and Technology.

Autologous regeneration possibilities are supported in India by the Department of Biotechnology (DBT) and the Indian Council of Medical Research (ICMR), with the help of public sector funding and national consortia, as well as AIIMS and THSTI. In order to increase access to autologous treatment, South Korea and Singapore are constructing national biobanks and cell therapy production facilities. The market expansion and uptake of customised regenerative treatments in that region are being driven by government-sponsored initiatives and advances in translational research.

Research and development for autologous stem and non-stem cell therapies include a multi-phase procedure that includes cell sourcing, alteration, and expansion before administration or transplantation.

Kye players include: BrainStorm Cell Therapeutics, Vericel Corporation, Dendreon Pharmaceuticals, and Novartis.

The process of conducting clinical trials and obtaining regulatory clearances for autologous stem cell and non-stem cell treatments is a multi-step one that begins with preclinical research and continues through clinical trial phases and regulatory assessment.

Key players include: Bristol-Myers Squibb, Johnson & Johnson, Vericel Corporation, Novartis AG, Iovance Biotherapeutics, and CARsgen Therapeutics Holdings Limited.

These procedures handle logistical and financial issues while covering a range of topics, such as patient identification, cell collection, manufacturing supervision, and post-infusion care.

Key players include: Novartis, Gilead Sciences, and Vericel Corporation

In February 2024, we can now cost-effectively expand our BNT211 programme into trials for several cancer indications thanks to our partnership with Autolus. In addition to our current U.S. supply network and the continuous growth of our site in Gaithersburg, Maryland, Autolus' state-of-the-art manufacturing facilities set up for clinical and commercial supply will strengthen our own capacities, stated Prof. Ugur Sahin, M.D., CEO and Co-Founder of BioNTech. Additionally, this partnership gives us access to Autolus' accurate cell targeting capabilities, which we can use to help BioNTech create antibody-drug combination candidates for in vivo cell treatment.

By Therapy Type

By Indication/Clinical Use Case

By Product/Offering

By Workflow/Manufacturing Model

By Regulatory/Reimbursement Status

By End-User

By Region

February 2026

February 2026

February 2026

February 2026