February 2026

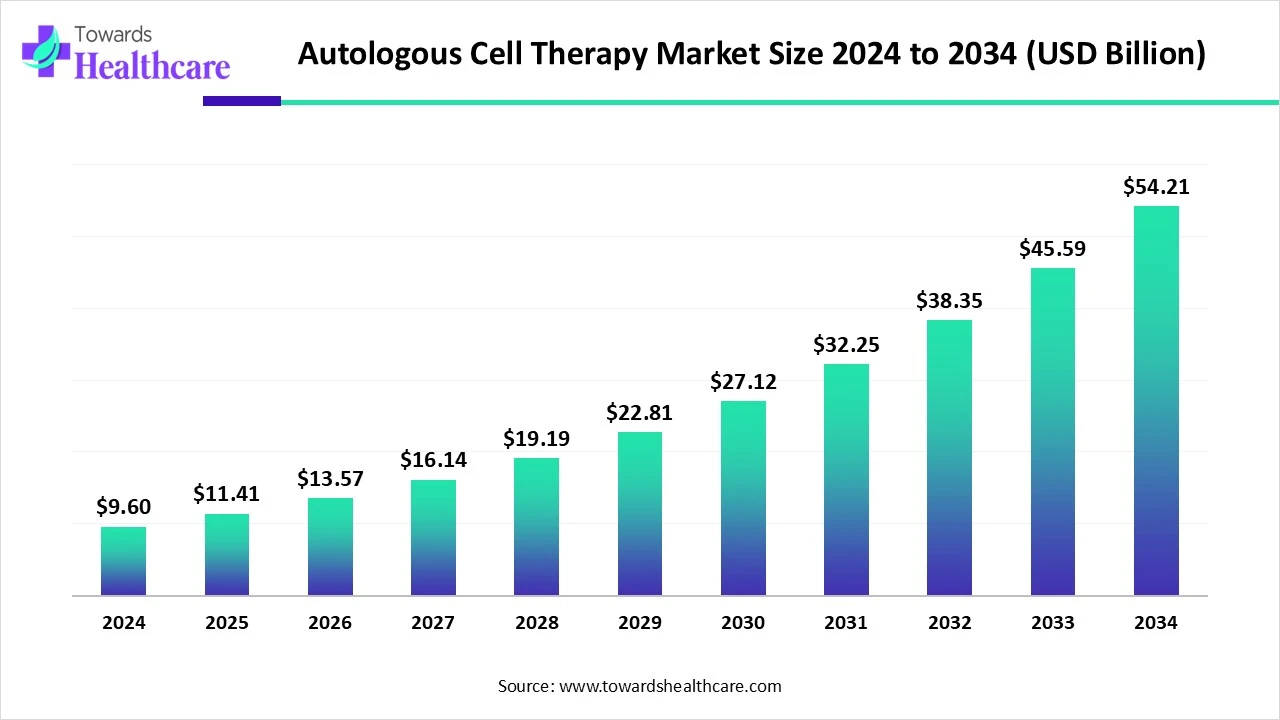

The global autologous cell therapy market size is calculated at US$ 9.6 in 2024, grew to US$ 11.41 billion in 2025, and is projected to reach around US$ 54.21 billion by 2034. The market is expanding at a CAGR of 18.9% between 2025 and 2034.

The autologous cell therapy market is experiencing significant growth, driven by improvements in regenerative medicine, a growing number of chronic and degenerative diseases, and the growing use of personalized healthcare. These treatments, which employ the patient's cells, are appealing for ailments like cancer, orthopedic disorders, and neurodegenerative diseases because they have long-term efficacy and a low risk of immunological rejection. Market expansion is being further accelerated by favorable regulatory support, growing investments from biotech companies, and technological advancements in cell processing. Complex manufacturing procedures and exorbitant treatment costs are still major obstacles, though.

| Table | Scope |

| Market Size in 2025 | USD 11.41 Billion |

| Projected Market Size in 2034 | USD 54.21 Billion |

| CAGR (2025 - 2034) | 18.9% |

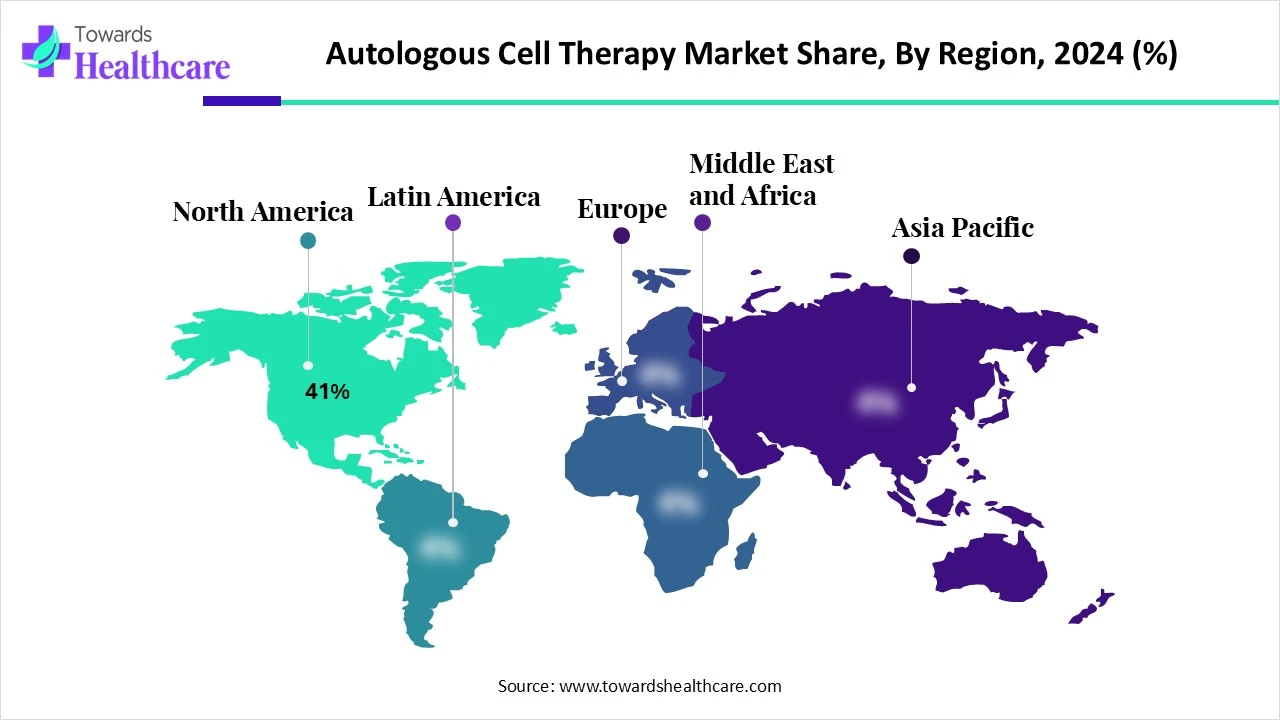

| Leading Region | North America Share 41% |

| Market Segmentation | By Therapy Type, By Application, By End User, By Technology, By Region |

| Top Key Players | Novartis AG, Gilead Sciences, Inc. (Kite Pharma), Bristol Myers Squibb, Bluebird Bio, Inc., Vericel Corporation, Adaptimmune Therapeutics plc, Autolus Therapeutics plc, BrainStorm Cell Therapeutics Inc., Sangamo Therapeutics, Inc., Lineage Cell Therapeutics, Inc., Athersys, Inc., Iovance Biotherapeutics, Inc., Celyad Oncology SA, Orchard Therapeutics plc, Fibrocell Science, Inc. (Castle Creek Biosciences), Cynata Therapeutics Limited, Pluristem Therapeutics Inc., Tmunity Therapeutics , Cellular Biomedicine Group, Inc., Poseida Therapeutics, Inc. |

The autologous cell therapy market comprises therapeutic approaches in which a patient’s cells are collected, modified, and reintroduced to treat diseases, reducing risks of immune rejection and improving compatibility. These therapies include stem cell-based, non-stem cell-based, and gene-modified autologous treatments, widely applied in oncology, orthopaedics, neurology, cardiovascular diseases, wound healing, and rare disorders. They leverage personalized medicine principles, ensuring high specificity and reduced adverse reactions compared to allogeneic therapies. Market growth is driven by advancements in cell engineering, minimally invasive collection processes, and increasing regulatory approvals.

AI is increasingly being integrated into the autologous cell therapy market to optimize manufacturing, reduce costs, and improve scalability. Automating cell culture using predictive analytics for process control and continuously monitoring quality are all being done with AI-powered systems. CAR-T and iPSC-based autologous therapies can be manufactured adaptively thanks to platforms like digital twins and reinforcement learning algorithms, which improve consistency and turnaround times. Because each batch of personalized therapies is unique to the patient, automation and AI-driven decision-making are crucial for improving reproducibility, minimizing human error, and cutting production costs from tens of thousands to a fraction of that amount. This integration has a particularly significant impact in these settings.

Rising Demand for Personalized Medicine

Developed from a patient's cells, autologous cell therapies offer unparalleled biological compatibility and significantly reduce the risk of immune rejection in comparison to donor-based approaches. By minimizing off-target effects and offering precise targeting, the therapies enhance patient outcomes. These therapies blend in well with changing clinical models as healthcare systems move toward precision medicine. Payers are starting to understand the long-term cost savings linked to improved efficacy and fewer adverse events, and patient awareness of tailored minimally invasive solutions is rising.

High Manufacturing and Treatment Costs

Autologous cell therapies are among the priciest medical procedures available today; each patient's cost can range from $ 300,000 to $ 500,000. High raw material costs, labor-intensive complicated manufacturing processes, and the requirement for highly specialized facilities are the main causes of this. Each treatment is created for a single patient, negating economies of scale in contrast to mass-produced medications. This financial burden raises serious issues with reimbursement in even the most developed healthcare markets and restricts access, especially in low- and middle-income nations.

Expanding Into New Therapeutic Areas

Beyond cancer, autologous cell therapies are demonstrating promise in rare genetic disorders, dermatology, ophthalmology, orthopedic regeneration, and cardiovascular repair. Clinical trials are looking into uses like treating hereditary metabolic disorders, corneal regeneration, and chronic wound healing. In addition to addressing significant unmet medical needs in non-oncological segments, a successful entry into these markets will diversify revenue streams and lessen reliance on cancer indications.

Why did the CAR-T Cell Therapy Segment Dominate the Market in 2024?

The CAR-T cell therapy segment led the autologous cell therapy market in 2024 because it has a high clinical success rate in treating hematologic cancers like diffuse large B-cell lymphoma and acute lymphoblastic leukemia. These treatments have been quickly incorporated into oncology treatment protocols due to their high remission rates, even in patients with relapsed or refractory disease. The gold standard in the autologous field has been reaffirmed by established regulatory agency approvals, mounting empirical data, and expanding manufacturing capabilities.

The gene-edited stem cells segment is estimated to be the highest growing during 2025-2034, driven by developments in CRISPR and other technologies for gene modification. These therapies have the potential to replace or repair damaged genetic material, opening up curative treatment options for degenerative diseases, rare genetic disorders, and some types of cancer. This market is positioned for exponential growth over the next ten years, thanks to increased investment in early-stage trials and better delivery methods.

The oncology segment led the autologous cell therapy market in 2024. Under this segment, the hematologic malignancies sub-segment remains the leading application area for autologous cell therapies, accounting for the majority of approved products and clinical activity. High unmet need, robust clinical trial data, and favorable reimbursement for life-saving treatments have driven strong adoption in this segment. Therapies targeting blood cancers demonstrate rapid and durable patient responses, making them a priority focus for both clinicians and biopharmaceutical developers.

Under oncology, the solid tumors sub-segment is estimated to be growing at the fastest rate as studies overcome long-standing obstacles such as antigen heterogeneity and the tumor microenvironment. Glioblastoma, pancreatic cancer, and melanoma are among the hard-to-treat cancers for which new approaches, such as dual-targeting CAR constructs and combination regimens with checkpoint inhibitors, are improving efficacy. Investment and clinical activity in this area are rapidly increasing as early-phase trials show promising results.

The hospitals segment dominated the autologous cell therapy market in 2024 due to its ability to handle the intricate logistics of autologous cell therapy delivery, its highly qualified multidisciplinary teams, and sophisticated infrastructure. Concentrated hospital-based cell therapy facilities frequently act as hubs for both collection and treatment, guaranteeing regulatory compliance and quality control. Their leadership in this segment is further supported by their capacity to manage unfavorable outcomes like cytokine release syndrome.

The specialty clinics segment is expected to witness rapid growth in the market, driven by the decentralization of cell therapy services and improvements in closed-system manufacturing. These clinics can offer more localized, patient-centric care while reducing the need for hospital stays. As manufacturing becomes more portable and point-of-care processing gains traction, specialty clinics are expected to play an increasingly significant role in expanding access to autologous treatments.

The genetic modification techniques segment was the dominant technology in the autologous cell therapy market, underpinning the success of CAR-T cells, TCR therapies, and gene-corrected stem cells. Advances in viral vector design, non-viral delivery platforms, and precision gene-editing tools have enhanced both the safety and efficacy of these treatments. This technological backbone is critical for tailoring cells to target specific disease-associated antigens with high accuracy.

The cell expansion & culture systems segment is estimated to be growing at the highest rate due to manufacturers' aim to increase autologous therapy production yield consistency and scalability. Production time is being shortened while preserving cell quality thanks to innovations like AI-driven process control, microcarrier-based cultures, and automated bioreactors. These developments are a crucial component of market expansion since they are necessary to satisfy growing demand and reduce expenses.

North America dominated the autologous cell therapy market share by 41% in 2024, backed by a robust clinical research environment, substantial healthcare expenditures, and advantageous regulatory pathways such as the FDA's RMAT designation. Rapid innovation and commercialization are facilitated by the region's abundance of top biotech companies, cutting-edge manufacturing facilities, and academic research centers. High U. S. adoption rates. A. are additionally strengthened by well-established reimbursement schemes for authorized treatments.

The U.S. autologous cell therapy market is expanding rapidly, propelled by robust regulatory support from FDA initiatives such as RMAT, an extensive clinical trial network, and cutting-edge medical facilities. Simplified production procedures and consistent investments from top biotech firms are improving accessibility and efficiency, solidifying the nation's position as the market leader and one of the fastest-growing for these highly customized treatments.

Canada’s autologous cell therapy market is gaining momentum, encouraged by forward-thinking laws, rising regenerative medicine funding, and solid cooperation between academic institutions and biotech firms. Faster clinical translation from research to patient care is made possible by health authorities' simplification of the approval procedures for novel treatments. The quality and scalability of treatments are being improved by expanding cell processing infrastructure and improvements in manufacturing technologies. This encouraging environment is stimulating innovation and setting up the market for long-term expansion in patient-specific customized cell therapies.

Asia-Pacific is estimated to be the fastest-growing regional autologous cell therapy market during the forecast period, driven by increasing government investment in regenerative medicine, expanding clinical trial activity, and growing healthcare infrastructure. Accelerated regulatory approvals, expanding manufacturing capacity, and rising awareness of advanced treatment options are fueling adoption across multiple therapy areas.

China’s autologous cell therapy market is evolving rapidly, encouraged by robust government programs, rising biotechnology investment, and a quickly growing network of specialized research facilities. In order to expedite the conversion of clinical research into approved treatments, regulatory bodies are simplifying the approval processes for sophisticated therapies. Modern facilities are being built to facilitate the large-scale production of patient-specific cell products, further enhancing the nation's manufacturing capabilities. While partnerships between academic institutions and biotech companies are speeding up innovation and commercialization, hospitals' growing use of CAR-T and other autologous treatments is also propelling market penetration.

India's autologous cell therapy market is gaining momentum, fueled by a growing pool of talented scientists, encouraging regulatory changes, and rising private investment. The emergence of new biotechnology companies creating affordable stem cell and CAR-T therapies is increasing patient access to cutting-edge treatments. To increase clinical trial capacity and raise manufacturing standards for cell-based products, research institutions are collaborating with industry. Demand is also being driven by growing patient and healthcare provider awareness of regenerative medicine, and government-sponsored programs are assisting in the development of the infrastructure required to enable the production of high-quality, scalable autologous therapies.

Autologous cell therapy R&D involves several key steps cell sourcing, cell processing, and cell delivery. These steps include cell collection, expansion, genetic modification, purification, formulation, and cryopreservation, all while ensuring product safety and efficacy.

Key players include: Bristol-Myers Squibb, Novartis, and Vericel, as well as emerging companies such as Iovance Biotherapeutics and CARsgen Therapeutics.

Key steps include establishing Institutional Review Board (IRB) approval, obtaining necessary regulatory approvals (like IND in the US or CTA in Singapore), conducting preclinical and clinical trials, and ultimately, securing a Biologics License Application (BLA) for commercialization.

Key players include: Bristol-Myers Squibb, Johnson & Johnson, Vericel Corporation, Novartis, and JW Therapeutics.

Key patient support and services in autologous cell therapy focus on navigating the complex process, managing treatment side effects, and addressing the financial and logistical challenges. This includes education, access to clinical trials, insurance navigation, financial assistance, transportation, and comprehensive care coordination.

Key players include: Gilead Sciences, Bristol Myers Squibb, and Novartis.

By Therapy Type

By Application

By End User

By Technology

By Region

February 2026

February 2026

February 2026

February 2026