January 2026

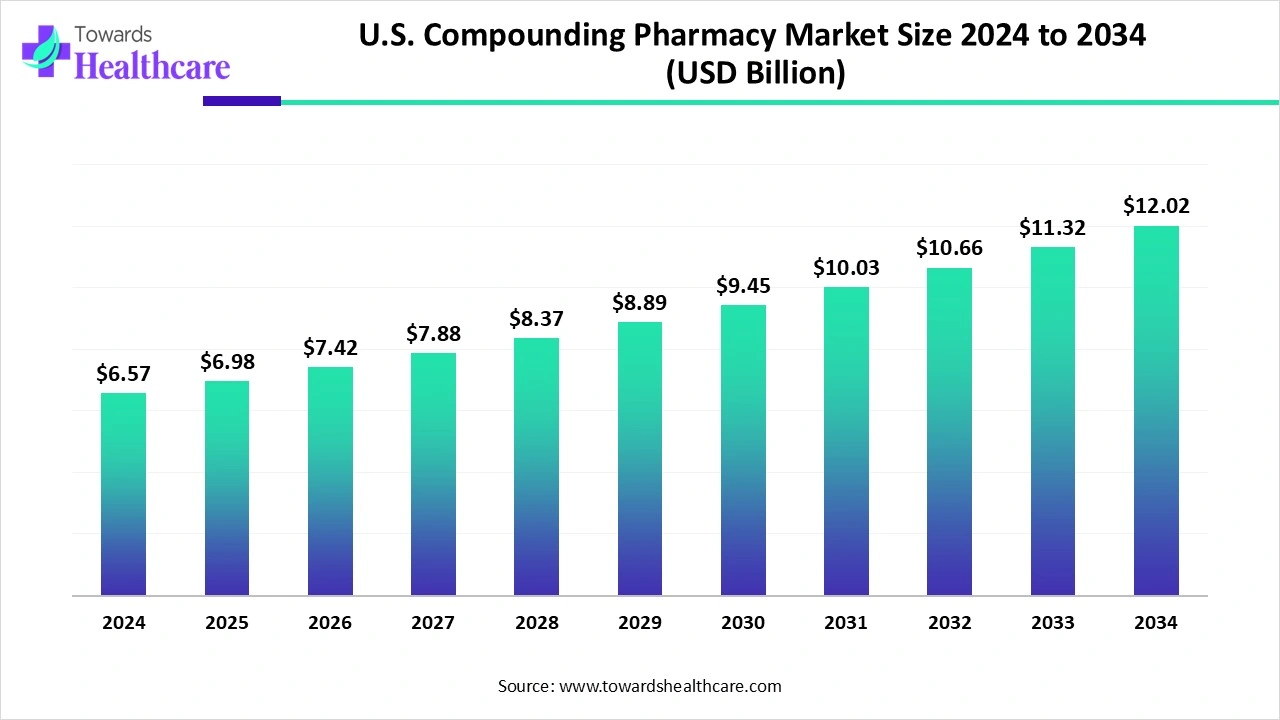

The U.S. compounding pharmacy market size in 2024 was US$ 6.57 billion, expected to grow to US$ 6.98 billion in 2025 and further to US$ 12.02 billion by 2034, backed by a robust CAGR of 6.24% between 2025 and 2034.

The U.S. compounding pharmacy market is expanding due to growing demand for personalized medications tailored to individual patient needs, including unique dosages, allergen-free formulations, and alternative delivery methods. Factors driving growth include the rising prevalence of chronic diseases, an aging population, and ongoing drug shortages, which increase reliance on compounded alternatives. Technological advancements in drug formulation and automation, along with regulatory support under the Drug Quality and Security Act, further enhance market efficiency. Patient-centered care approaches continue to boost market adoption.

| Table | Scope |

| Market Size in 2025 | USD 6.98 Billion |

| Projected Market Size in 2034 | USD 12.02 Billion |

| CAGR (2025 - 2034) | 6.24% |

| Market Segmentation | By Pharmacy Type, By Product Type, By End User, By Distribution Channel, By Region |

| Top Key Players | PCCA (Professional Compounding Centers of America), B. Braun Medical Inc., Medisca Inc., Fagron Inc, Wedgewood Pharmacy, Avella Specialty Pharmacy, NuVision Pharmacy, Diamond Pharmacy, Belmar Pharmacy, The Compounding Pharmacy of America, RXCrossroads (McKesson), PharMEDium (Fresenius Kabi), Central Pharmacy, CustomMed Pharmacy, BioMatrix Specialty Pharmacy, Epic Pharmacy, HealthLink Compounding Pharmacy, National Pharmaceutical Services (NPS), Kane Compounding Pharmacy, Sage Specialty Pharmacy |

A compounding pharmacy is a specialized type of pharmacy that prepares customized medications to meet the unique needs of individual patients, rather than providing standard, mass-produced drugs. These pharmacies create formulations tailored to dosage, strength, flavor, or delivery method, making medications more suitable for patients who cannot use commercially available products, such as children, the elderly, or those with allergies. Compounding pharmacies can produce creams, gels, capsules, liquids, or injectables, often combining multiple active ingredients into a single medication. They play a critical role during drug shortages, offering alternatives when standard drugs are unavailable. Regulated under the Drug Quality and Security Act, compounding pharmacies ensure safety, quality, and precision while supporting patient-centered care and personalized medicine approaches.

Investment and funding initiatives are pivotal in propelling the growth of the market by enhancing operational capabilities, expanding service offerings, and fostering innovation. In 2025, notable developments underscore this trend:

Adopting inorganic growth strategies, such as mergers and acquisitions, has significantly propelled the U.S. compounding pharmacy market by enhancing service capabilities, expanding geographic reach, and integrating advanced technologies. These strategies enable companies to quickly scale operations, diversify service offerings, and access new patient populations, thereby accelerating market growth.

In January 2025, Revelation Pharma, a leading national network of 503A and 503B compounding pharmacies, acquired Cascade Specialty Pharmacy, a Washington-based provider specializing in ENT and animal health compounding. This acquisition not only expanded Revelation's service portfolio but also strengthened its nationwide presence, allowing for enhanced patient care and broader access to specialized compounded medications.

Integration of artificial intelligence (AI) can significantly enhance the market by improving precision, efficiency, and patient safety. AI-powered systems can assist in formulation optimization, predicting the most effective dosages and ingredient combinations for individualized medications. Automation through AI reduces human errors in compounding processes, ensures regulatory compliance, and streamlines workflow management. Additionally, AI can analyze patient data to forecast demand, manage inventory, and identify emerging trends in therapy needs. By enabling faster, more accurate, and personalized medication preparation, AI integration strengthens operational efficiency, enhances patient outcomes, and positions compounding pharmacies as innovative leaders in the healthcare sector.

Regulatory Support

Regulatory support plays a pivotal role in fostering the growth of the U.S. compounding pharmacy market by ensuring safety, enhancing public trust, and facilitating market expansion. Legislative measures not only address immediate healthcare needs but also establish a framework for sustainable growth in the compounding pharmacy sector. By aligning regulatory policies with market demands, these initiatives bolster the industry's capacity to deliver personalized and timely pharmaceutical solutions.

In 2025, significant legislative actions underscored this impact. The introduction of the Drug Shortage Compounding Patient Access Act of 2025 (H.R. 5316), supported by the Alliance for Pharmacy Compounding (APC), Congresswoman Diana Harshbarger, and Congressman Buddy Carter, aims to empower compounding pharmacies to address drug shortages effectively. This bipartisan initiative seeks to expand the scope of compounded medications during shortages, ensuring patient access to essential therapies.

Quality and Safety Concerns & Competition from Standardized Pharmaceuticals

Past incidents of contamination and improper practices have raised concerns about the safety of compounded drugs, leading to stricter oversight and reduced trust. Availability of FDA-approved drugs often reduces reliance on compounded alternatives, especially when shortages ease.

Patient-Centric Approach

A shift toward patient-centric care models significantly enhances growth prospects for U.S. compounding pharmacies by aligning services more closely with individual patient needs and improving access, satisfaction, and outcomes. Under such models, pharmacies can offer tailored formulations altering active ingredient concentrations, excluding allergens, or changing delivery modes to better suit patients with specific health conditions, allergies, or lifestyle preferences. Focusing on patient-centric access (affordability, legal, certified compounds) strengthens trust in compounded therapies and drives demand. By putting patient experience at the core through personalized care, telehealth integration, and service flexibility, the compounding pharmacy market can grow more rapidly and sustainably.

In 2024, Hypermedica launched an initiative in partnership with certified compounding pharmacies and telehealth platforms to ensure continuous access to affordable compounded GLP-1 medications amid branded shortages and price surges.

The hospital-based compounding pharmacies segment dominates the market due to its ability to prepare sterile and complex formulations required for critical care, oncology, and surgical procedures. Hospitals ensure high safety standards, regulatory compliance, and immediate availability of customized drugs. Growing demand for parenteral nutrition, pain management, and chemotherapy preparations further strengthens their dominance in the healthcare ecosystem.

The outsourced/third-party compounding pharmacies segment is anticipated to be the fastest-growing in the U.S. compounding pharmacy market due to rising reliance on hospitals and clinics to meet the increasing demand for sterile and complex medications. By outsourcing, healthcare providers reduce internal workload, operational risks, and compliance challenges, while ensuring timely access to high-quality compounded drugs. The strict regulatory oversight of 503B outsourcing facilities under CGMP standards enhances safety and trust.

The sterile compounded medications segment dominates the market because they are essential for critical treatments such as intravenous infusions, chemotherapy, ophthalmic preparations, and total parenteral nutrition. Hospitals and clinics rely heavily on sterile compounding to ensure patient safety and efficacy in sensitive therapies. Stringent regulations like USP <797> and FDA oversight of 503B facilities enhance credibility and quality assurance. Rising demand for injectable and infusible drugs, coupled with drug shortages, further strengthens the dominance of sterile compounded medications.

The nutraceutical & hormone replacement therapy (HRT) products segment is estimated to be fastest fastest-growing segment in the U.S. compounding pharmacy market due to rising awareness of hormonal imbalances such as menopause, andropause, and thyroid disorders, along with the growing preference for natural and preventive health solutions. Compounded bioidentical hormone therapies allow customized dosages and formulations tailored to patient needs, while nutraceuticals meet demand for wellness and disease prevention. The flexibility of compounding pharmacies, combined with easier access through telehealth and online platforms, further fuels the rapid growth of this segment.

The hospitals & clinics segment dominates the U.S. compounding pharmacy market because of their high reliance on customized medications for critical care, including sterile preparations, oncology drugs, pain management, and parenteral nutrition. These facilities require timely access to safe and effective compounded therapies that meet stringent regulatory and safety standards. The presence of in-house or outsourced compounding ensures a continuous supply during drug shortages. Additionally, the rising number of complex surgical procedures and chronic disease treatments further strengthens hospitals and clinics as the leading end-use segment.

The individual patients segment is anticipated to be the fastest-growing in the U.S. compounding pharmacy market due to rising demand for personalized medicines tailored to unique health needs. Patients increasingly seek customized dosages, allergen-free formulations, and alternative delivery methods not available in commercial drugs. Growth in chronic illnesses, pediatric requirements, and geriatric care supports this trend. Moreover, increasing awareness of bioidentical hormones, wellness products, and telehealth access further accelerates adoption, making individual patients a key driver of compounding pharmacy expansion.

The direct-to-pharmacy/hospital segment is the dominant distribution channel in the U.S. compounding pharmacy market because it ensures faster, safer, and more reliable delivery of compounded medications directly to healthcare providers. This channel supports timely access to critical sterile preparations, oncology drugs, and customized therapies essential for patient care. Hospitals and pharmacies prefer direct procurement as it reduces dependency on intermediaries, minimizes supply delays, and maintains regulatory compliance.

The online/mail-order services segment is estimated to be the fastest-growing in the U.S. compounding pharmacy market due to the rising preference for convenience, accessibility, and privacy in obtaining customized medications. Patients increasingly turn to digital platforms for refills and consultations, especially for therapies like hormone replacement, nutraceuticals, dermatology solutions, and pediatric formulations. Telehealth integration further enhances this channel by enabling virtual consultations and direct prescription fulfillment. Mail-order services are particularly valuable for patients in remote or underserved areas, ensuring timely access to medications.

The South U.S. is the dominant region in the U.S. compounding pharmacy market due to its large population base, higher prevalence of chronic diseases, and significant demand for customized therapies. The region hosts a strong network of hospitals, specialty clinics, and compounding facilities that cater to rising healthcare needs. Favorable demographics, including a growing elderly population, further drive demand for personalized medications. Additionally, the South has seen increased investment in advanced compounding infrastructure, supporting sterile preparations and hormone replacement therapies, which reinforce its leading market position.

The Midwest U.S. is the fastest-growing region in the U.S. compounding pharmacy market due to increasing awareness and adoption of personalized medicine, coupled with a rising patient population requiring specialized treatments. The region faces a growing prevalence of chronic diseases, pediatric needs, and geriatric care, all fueling demand for customized formulations. Expanding healthcare infrastructure and investments in sterile compounding facilities also support growth.

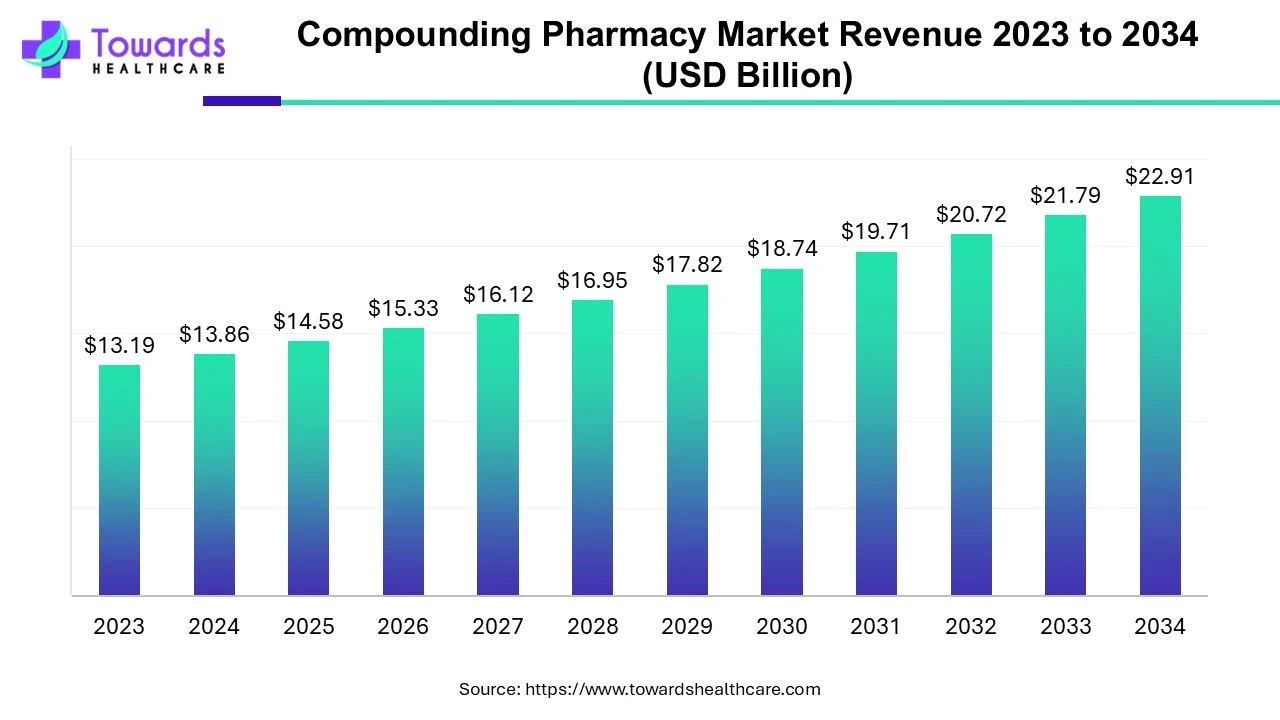

The global compounding pharmacy market was valued at approximately US$ 13.19 billion in 2023 and is expected to reach around US$ 22.91 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.15% between 2024 and 2034.

Focus on developing novel formulations, delivery systems, and bioidentical therapies tailored to patient needs. Activities include stability studies, safety profiling, and compatibility testing of active pharmaceutical ingredients (APIs).

Organizations: Compounding pharmacies’ in-house R&D units, academic research centers, pharmaceutical ingredient suppliers, and technology partners working on automated compounding systems.

While compounded drugs are not FDA-approved like commercial drugs, they must comply with USP standards (USP <795>, <797>, <800>) and FDA oversight for 503A and 503B pharmacies. Quality assurance involves sterility testing, batch testing, and adherence to Current Good Manufacturing Practices (CGMP) in outsourcing facilities.

Organizations: U.S. Food and Drug Administration (FDA), United States Pharmacopeia (USP), state pharmacy boards, and 503B outsourcing facilities.

Services include customized dosage adjustments, allergen-free formulations, telehealth consultations, and direct-to-patient or hospital delivery. Pharmacies provide ongoing patient education, refill reminders, therapy monitoring, and adverse event reporting to ensure safety and adherence.

Organizations: Compounding pharmacies (503A and 503B), hospitals, specialty clinics, telehealth providers, and patient advocacy groups supporting awareness of personalized therapies.

In May 2025, the Chairman and CEO of LifeMD, stated that LifeMD, Inc., a leading virtual primary care provider has announced a special US$299 introductory bundle for new self-pay patients who are prescribed Wegovy (semaglutide). This bundle includes both the prescription drugs and the ability to use LifeMD's online weight-loss program. In light of April, LifeMD announced a partnership with Novo Nordisk to offer Wegovy at a discounted price of US$199. An extra US$100 will cover LifeMD's clinical care, onboarding, and maintenance.

By Pharmacy Type

By Product Type

By End User

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026