January 2026

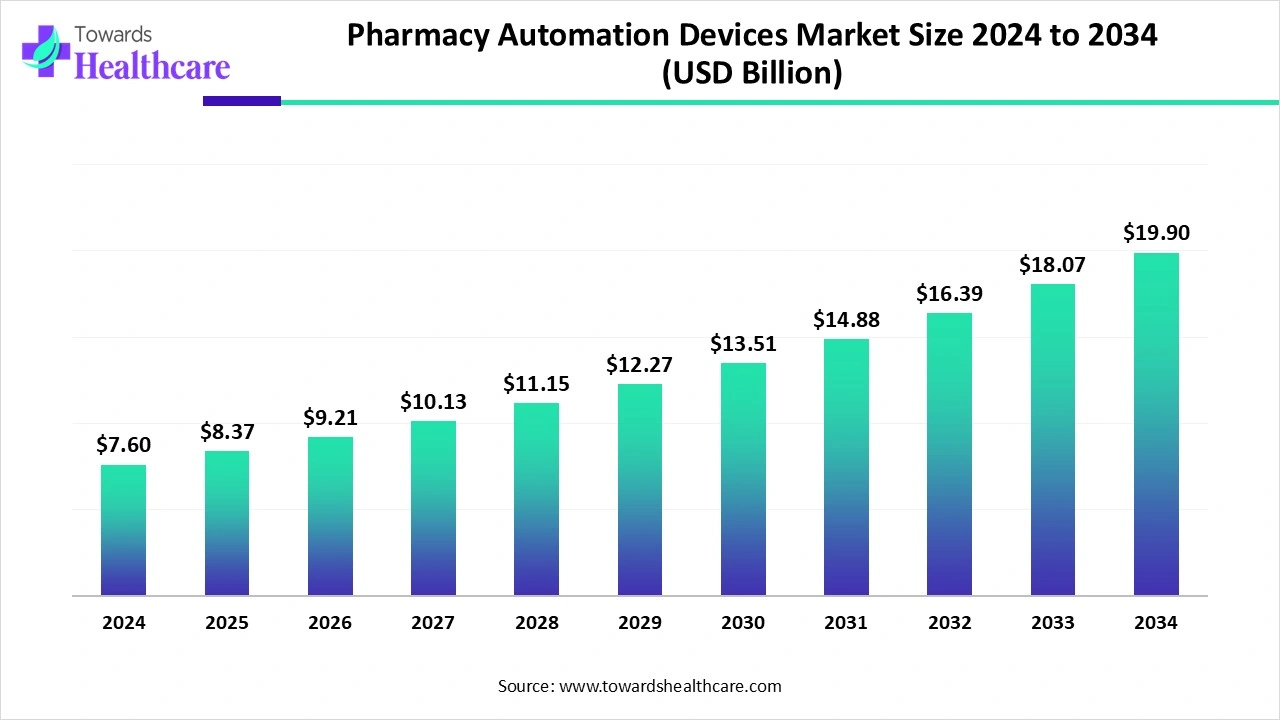

The global pharmacy automation devices market size is calculated at US$ 7.6 billion in 2024, grew to US$ 8.37 billion in 2025, and is projected to reach around US$ 19.9 billion by 2034. The market is expanding at a CAGR of 10.1% between 2025 and 2034.

In the expanding health facilities, there is lack of trained personnel is mainly driving the demand for advanced automation devices. The global pharmacy automation devices market encompasses the widespread use of automated dispensing systems, robotic automation, and barcode solutions. Alongside the development of centralized pharmacies, tele-pharmacy, and e-commerce healthcare platforms, these are influencing a wider adoption of numerous automation solutions. Innovations in inventory management are also fueling the demand for online platforms.

| Table | Scope |

| Market Size in 2025 | USD 8.37 Billion |

| Projected Market Size in 2034 | USD 19.9 Billion |

| CAGR (2025 - 2034) | 10.1% |

| Leading Region | North America |

| Market Segmentation | By Device Type, By Application, By End-User, By Distribution Channel, By Technology, By Region |

| Top Key Players | BD (Becton Dickinson), Capsa Healthcare, Cerner Corporation, Celesio AG, Durrer Group, EVE Automation, Famar Health, McKesson Corporation, Omnicell, Inc., Parata Systems, LLC, ScriptPro, Swisslog Healthcare, Talyst Systems, Werfen Life Group, MedDispense / Global Robotics Solutions |

The global pharmacy automation devices market refers to automated systems and equipment used in pharmacies, hospitals, and healthcare facilities to streamline medication management, dispensing, packaging, storage, and inventory control. These devices reduce human error, enhance operational efficiency, optimize workflow, and improve patient safety. Key technologies include robotic dispensers, automated storage and retrieval systems, pill counters, and integrated pharmacy management software.

Primarily, AI-enabled robots and automated systems precisely sort, count, and dispense medications, drastically lowering human labor and the likelihood of human error. In recent days, robots, such as those employed by Dr. Max with Brightpick technology, pick and consolidate orders in pharmacies and warehouses, enhancing order accuracy and delivery speed. Additionally, AI-driven inventory management that estimates demand and mitigates stockouts, smart software for the determination of drug interactions, and simplifying prescription management are also impacting the wider market expansion.

Limited Professionals and Other Improvements

Around the globe, a rise in digitalization is mainly boosting the new advancements in automation devices. The global pharmacy automation devices market is propelled by a lack of well-trained pharmacists and other healthcare professionals. Also, the ongoing breakthroughs in robotics, AI, predictive analytics, and advanced software are revolutionizing pharmacy operations, making processes quicker and more accurate. Whereas an inclusion of other improvements, especially automated storage and retrieval systems, integrated with barcode scanning and smart dashboards, facilitates better inventory control and minimizes waste, ultimately giving affordable solutions.

Concerns About ROI and Cyberattacks

These automated devices can store vast datasets, mainly sensitive patient and medication data, which eventually may be targeted by cyberattacks and data breaches. Alongside the developing issues regarding return on investment (ROI) for these systems, there are some pharmacies hesitant to adopt them.

Enhancements in Patient Monitoring and Tele-pharmacy

During 2025-2034, the global pharmacy automation devices market will have transforming opportunities, like boosting focus on personalization and precision medicine. As well as advancing digital health solutions and remote consultation platforms will accelerate robust patient monitoring, outcome monitoring, and offer remote patient counselling. Most of the time, this market aims for detailed integration with present systems for automating routine ordering and streamlining operations, while tele-pharmacy will also contribute to remote patient counselling and support in numerous healthcare settings.

In 2024, the automated dispensing cabinets (ADCs) segment accounted for the biggest revenue share of the pharmacy automation devices market. A broader range of usage of this computerized type of device in hospitals to store, track, and dispense medications at the point of care, imposing decentralized mini-warehouses, is driving the overall progression. Alongside, ADCs assist in simplifying medication dispensing processes, freeing up pharmacy staff to emphasis on other major tasks and expanding overall workflow.

Eventually, the robotic pharmacy dispensing systems segment is predicted to expand rapidly during 2025-2034. A wider benefits of these systems in secure storing, locating, and dispensing drugs, boosting storage capacity, and speeding up retrieval are supporting their widespread adoption. Moreover, other approaches are facilitating the selection of vials, applying labels, and filling prescriptions with greater accuracy. Also, the use of cloud-based solutions offers real-time updates, software updates, and data analysis for enhanced operations and compliance. The application of robots in the accurate preparation of sterile solutions, comprising toxic chemotherapy drugs, helps in the reduction of human exposure to hazardous substances.

The hospital pharmacy automation segment captured a dominant share of the market in 2024. The emergence of robotics, barcodes, and RFID technology is developing more sophisticated, precise, and user-friendly systems that escalate workflow and data management in these pharmacies. The exploration of pneumatic tube systems (PTSs) for the faster transport of drugs and samples around the hospital further lowers transport time and improves emergency response. For unit-dose level, robots are expanding repackaging and pick-and-dispense systems for patient therapies, while AI is also propelling features, particularly digital inventory visibility.

On the other hand, the retail pharmacy automation segment will grow rapidly. This segment encompasses real-time inventory tracking employing RFID and barcode technologies; the broader adoption of cloud-based systems for data sharing and remote access contributes to segment growth. Whereas the growing focus on tele-pharmacy and remote services to reach underserved areas is fueling the immersion of automation. Recently developed platforms like Teladoc and CVS Pharmacy's tele-pharmacy program are allowing remote pharmacist consultations for better patient access, mainly for underserved communities.

The hospitals & clinics segment led the pharmacy automation devices market in 2024. The major drivers, such as a rise in chronic illness cases, a huge growth in prescription volumes, and a stringent regulatory landscape, are fueling the overall segmental expansion. In 2024, innovations in automated dispensing systems, like Omnicell’s XT Automated Dispensing Cabinets and Intelligent Medication Dispensing Trolleys, such as the AMiS-PRO Smart Cart, are created to accelerate medication accuracy, minimize errors, and improve inventory management.

Moreover, the retail pharmacies segment is anticipated to expand fastest during 2025-2034. Nowadays, consumers are highly preferring retail pharmacies as they provide convenient, affordable, effective, and speedy services. Continuous automation, like RxSafe System, supports secure storing and retrieving prescription containers in their native packaging, while facilitating secure storage for up to 5,400 prescription containers in a small footprint. The widespread developments in digital health tools, mainly virtual pillboxes, mobile apps, and medication reminders, are assisting in patient adherence, particularly for chronic disease management.

In the pharmacy automation devices market, the direct sales segment held a major share in 2024. The segment is driven by ongoing advances, like barcode labeling software, like the m: Print system from Pearson Medical Technologies, and right-sized packaging systems to ensure compliance and effectiveness. Alongside, leading manufacturers, especially Omnicell and ScriptPro, are unveiling new robotic systems, like the Omnicell XR-100 and the ScriptPro MedStation, for automated pharmaceutical distribution.

Whereas the online/e-commerce platforms segment is estimated to witness rapid growth. The growing mobile penetration and online platforms are enabling the wider reach, with at-home delivery services, along with a rise in the demand for automated solutions for robust handling of complex logistics, acting as significant drivers. Highly developed approaches, like Square for pharmacies, help in the management of in-store and online transactions, and further integration with e-commerce platforms for inventory and sales tracking. Also, PharmEasy and Apollo Pharmacy are using innovative automation technologies to allow online ordering, rapid delivery, and a wide range of healthcare products.

The robotic automation segment captured the largest revenue share of the market in 2024. The accelerating need for operational efficiency and precision, a desire to lower medication errors, and enhancing emphasis on lowering labor expenses are propelling the overall market growth. Recent advances, like Steriline's Robotic Filling Machine, apply "zero friction" magnetically levitated systems for transporting containers, including vials and syringes, which ultimately reduces particle generation and improves sterile environments.

The AI & machine learning-based inventory management segment is predicted to expand rapidly. Majorly, AI automates inventory classification (like high-turnover vs. low-turnover items), which further optimizes organization and storage efficiency. The emergence of predictive models for antibiotic demand and use, AI-driven robots for automated picking in large warehouses, such as Dr. Max pharmacies, and AI systems that monitor and flag expiring medications in automated dispensing systems is transforming the automation solutions. The increasing use of AI software enables community pharmacists to predict future patient needs, handle stock levels, and even send tailored reminders to patients for their medications, enhancing patient adherence and satisfaction.

North America’s pharmacy automation devices market led with a major share in 2024. This region is focusing on chronic disease management, the use of AI algorithms in sorting, storing, and distributing medications, resulting in greater overall productivity, better space utilization, and accelerated speed in pharmacy operations. Recently, Swisslog Healthcare's ezCUT automated tablet cutter was introduced in an alliance with JVM Manufacturing, which device that accurately and automatically cuts oral solid medications for half-strength prescriptions, strengthening workflow efficiency.

In May 2025, Swisslog Healthcare, a player in pharmacy and transport automation solutions, unveiled the UC30 Automated Tablet Counter, a novel add-on feature for the AutoPack Automated Oral Solid Packager.

Canada’s pharmacy automation devices market is experiencing a major expansion due to the presence of leading players, like McKesson, ScriptPro, and evolving firms, including MedAvail Technologies and JFCRx are introducing and distributing advanced technologies in pharmacy.

For instance,

During 2025-2034, the Asia Pacific is anticipated to witness the fastest growth in the pharmacy automation devices market. As numerous ongoing investments and developments of healthcare infrastructure, such as hospitals and clinics, powered by governments, are bolstering the further adoption of automation devices in ASAP. These facilities are fostering the greater use of automated dispensing cabinets and storage systems to enhance patient safety and operational efficiency. ASAP’s market is shifting towards centralized pharmacy automation systems in large healthcare facilities, allowing more effective medication dispensing on a larger scale and minimizing overall expenditures.

In September 2025, Sin-Iron Innovation Technology Pte Ltd, a flagship bilateral investment project under the China-Singapore Suzhou Industrial Park and a Singapore-based healthcare innovation enterprise, reaffirmed its robust commitment to advancing smart healthcare solutions in Singapore and the broader ASEAN.

In February 2025, Hanmi Pharmaceutical launched Countmate, a fully automated vial dispensing machine evolved to meet the specific needs of the Canadian and US pharmaceutical markets.

Europe is experiencing a notable expansion in the pharmacy automation devices market. The rising developments of innovative and AI-enabled hardware and software solutions are making pharmacy automation more accessible and efficient, further fostering its adoption. Alongside, a crucial European initiative is underway to design a unified standard for pharmacy automation, making systems "plug-and-play" compliant to lower integration expenses and boosting flexibility.

For this market,

By Device Type

By Application

By End-User

By Distribution Channel

By Technology

By Region

January 2026

December 2025

December 2025

December 2025