January 2026

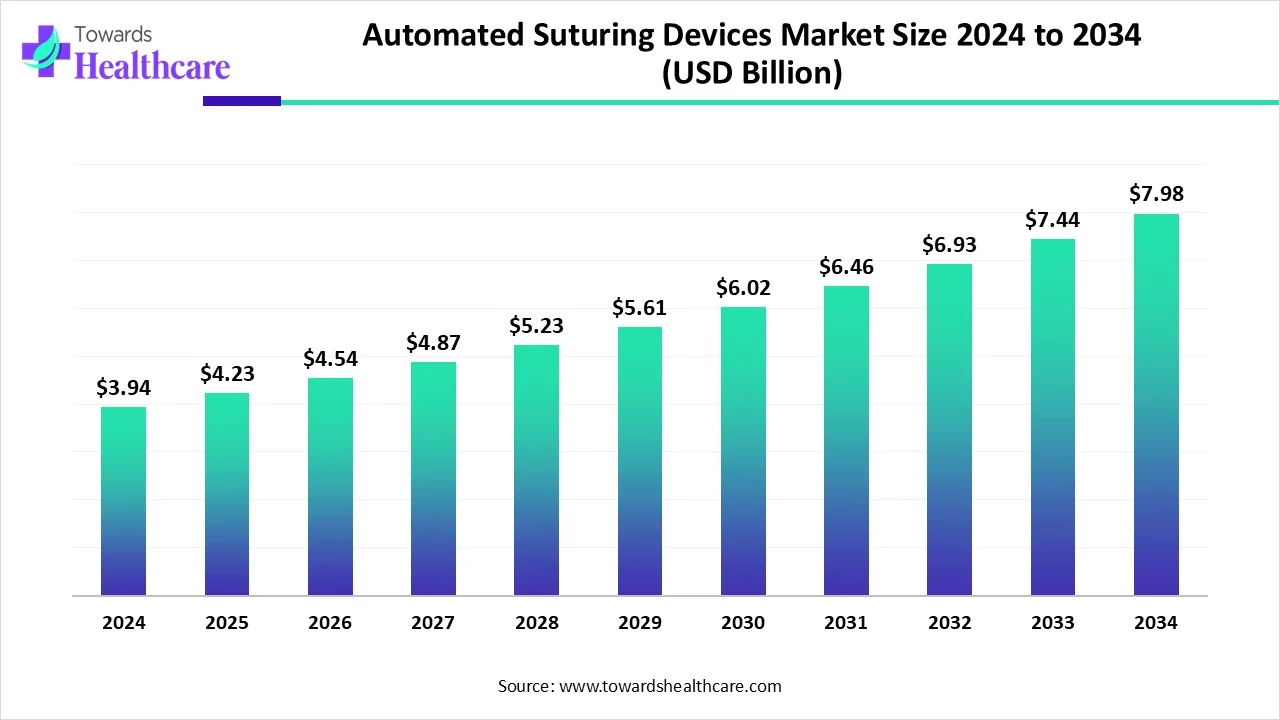

The global automated suturing devices market size is calculated at USD 3.94 in 2024, grew to USD 4.23 billion in 2025, and is projected to reach around USD 7.98 billion by 2034. The market is expanding at a CAGR of 7.34% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 4.23 Billion |

| Projected Market Size in 2034 | USD 7.98 Billion |

| CAGR (2025 - 2034) | 7.34% |

| Leading Region | North America |

| Market Segmentation | By Product, By Application, By End-use, By Region |

| Top Key Players | Medtronic, Smith & Nephew, Ethicon, Boston Scientific Corporation, CONMED, DemeTECH Corporation, 3M, Stryker, Teleflex, Zimmer Biomet, Meril Life Sciences, Olympus Corporation, Peters Surgical |

Automated suturing devices are medical devices that are employed to seal tissue layers of surgical approaches, possessing more accuracy and control. These devices are specially used in minimally invasive approaches. Also, they have automation aspects in the surgical procedures, probably resulting in increased efficiency, less tissue trauma, and enhanced surgical results. Due to the numerous factors, such as growing occurrences of chronic conditions like cardiac, orthopedic, and GI concerns, rising geriatric populations, and escalating preferences for minimally invasive surgeries, are impelling the growth of the market is growing.

In the respective market, AI has a major role as its algorithms assist in the analysis of surgical images and tissue features to guide the suturing procedures, which ensures adequate site and stress. Also, these AI-aided automated devices enable surgeons to do repetitive assignments, minimizing the time needed for suturing and freeing up surgeons' time. AI recognizes the progress of the personalized suturing devices and techniques customized to individual patient demands.

For instance,

Growing Geriatric Populations with Several Chronic Conditions

Globally, the rising aging population is a significant driver in the automated suturing devices market. These geriatric populations are facing a raised need for surgery, including cardiac, orthopedic, and spinal interventions, which often demand the use of automated suturing devices. Along with this, this population has chronic conditions such as cardiovascular diseases, diabetes, and obesity, which results in accelerated demand for bariatric and other surgical procedures.

Elevated Expenditure on Initial Investment and Maintenance

Automated suturing devices require a high initial investment and progressive expenses, which are a significant hurdle for healthcare facilities. Moreover, the insufficient number of skilled professionals, including surgeons and medical staff, who can operate and maintain these automated devices, is generating restrictions for this market growth.

Accelerating Technological Advancements and Surgical Volumes

In the automated suturing devices market, AI integrated with robotic surgery systems and other novel technologies is anticipated to boost the reliability, efficiency, and complete serviceability of these devices. Furthermore, rising surgical procedure numbers, especially in sectors like general surgery, orthopedics, and cardiovascular surgery, give robust support for market expansion.

By product, the reusable segment held the largest share in 2024. In this segment, the device frame and handle are contributing as reusable, and these are created to resist numerous sterilization cycles and remain functional. The reusable segment has several benefits, such as infection resistance, smooth sterilization, reasonable pricing, and approachability.

By product, the disposable segment is expected to grow at the fastest CAGR during the forecast period. Advantages of this segment in the automated suturing devices market are minimized risk of cross-contamination, withdrawal of sterilization procedures, and the rising adoption of minimally invasive approaches.

By application, the cardiac segment dominated the market in 2024. As there a rising instances of cardiovascular conditions and demand for surgical processes. Different cardiac surgeries, such as mitral valve repair and replacement, aortic valve replacement, and other procedures involving heart valve repair or replacement, in which automated surgeries are utilized. Although it is beneficial as it enhances accuracy and pace of suturing in cardiac processes, strongly minimizing surgical time and tissue trauma, resulting in improvement of patient outcomes, it is influencing the growth of the automated suturing devices market.

By application, the dental segment is expected to grow at the fastest CAGR in the projected timeframe. Dental surgeries such as dental implants, sinus augmentation, and implant osteomy are boosting the reliability and efficacy of these complex approaches by using automated suturing devices. As it possesses significant advantages like raised precision, less operating time, and robust, reasonable, it is driving the growth of the market.

By end-use, the hospitals segment led the market in 2024. Undoubtedly, hospitals are handling a massive number of surgeries, and many of them employ automated suturing devices for rapid and highly precise wound closure. Also, these hospitals comprise resources and infrastructure to assist the application of advanced technologies, including automated suturing devices, besides this, the training of professionals and required supplies. Also, the main site for emergency and trauma cases is the hospital, which is vital for closing wounds and preserving lives.

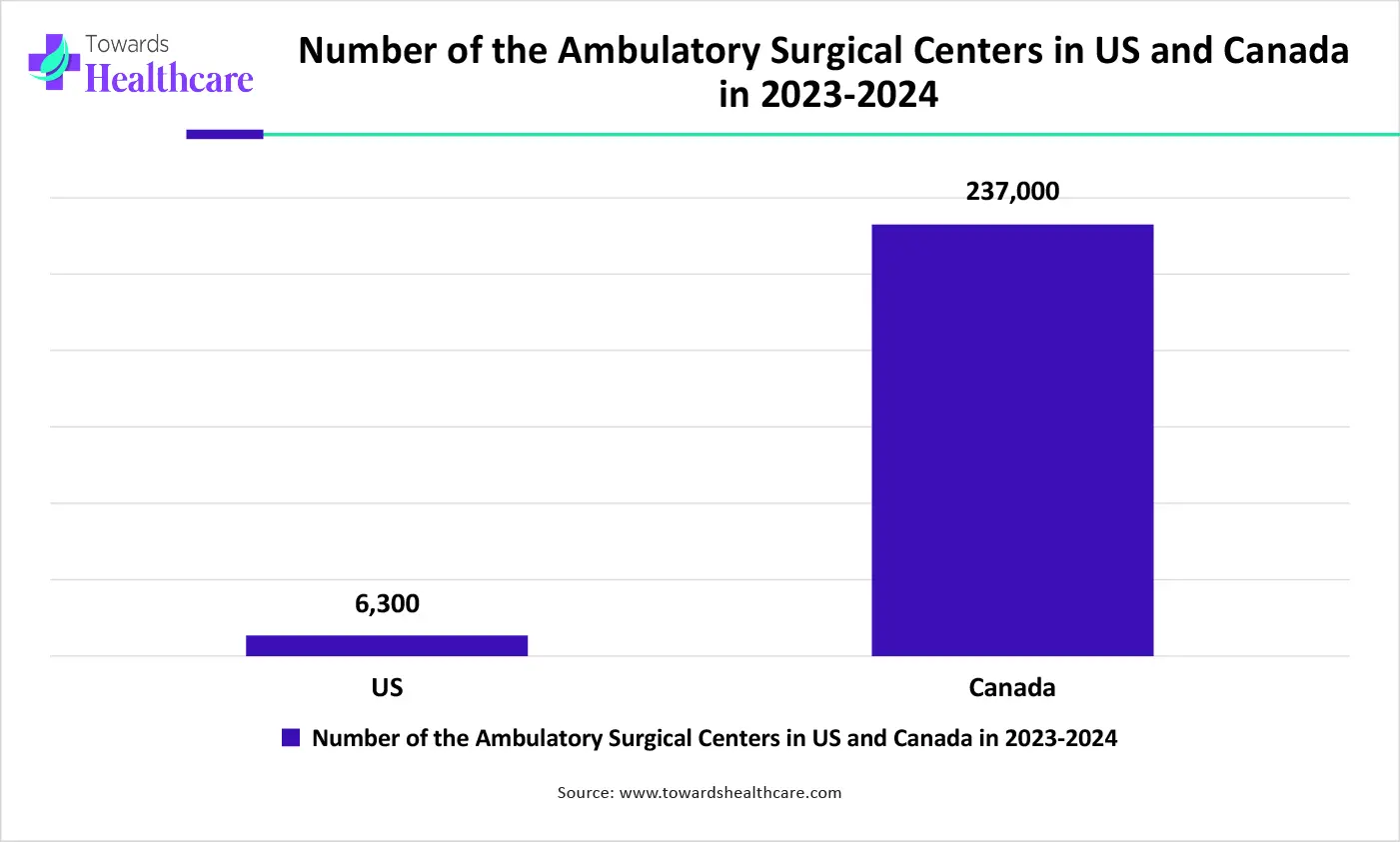

By end-use, the ambulatory surgical centers segment is expected to grow fastest over the projected period. Nowadays, in ambulatory surgical centers growing acquisition of automated suturing devices aims is increase efficiency, lessen processing time, and encourage faster patient recovery, because of which patients are looking for these kinds of centers.

North America led the market by capturing the largest revenue share in 2024. This dominancy has arisen by contributing several combined factors, like an increasing prevalence of chronic diseases like cardiac conditions, diabetes, and obesity, which are fueling the growth of the automated suturing devices market by accelerating automation in surgeries as well as the progressing healthcare infrastructure by adopting advanced surgical facilities and technologies, which is also contributing to the market expansion.

In the U.S., boosting a well-developed healthcare system, merged with reimbursement policies for advanced technologies, enables these devices to be efficient, approachable, and reasonable for healthcare facilities. Also, escalating novel creations in suture technology and integrated needles are generating automated suturing devices more inviting to surgeons.

For instance,

In Canada, the rising utilization of automated devices in surgeries to enhancing surgical outcomes by increasing precision, minimizing difficulties, and simplifying procedures. The market in Canada is driven by several factors, like the growing number of surgeries, advances in technology, and a focus on patient safety. As these devices provide advantages, lessen infection risk, and have rapid recovery times, they are contributing to the growth of the market.

Asia Pacific is expected to be the fastest-growing region in the upcoming years. In Asia Pacific, there is a growing number of chronic disease cases like diabetes, cardiovascular conditions, and cancer, resulting in a greater demand for surgical procedures, including those using automated suturing devices. Along with this, minimally invasive surgeries are becoming increasingly popular due to the advantages such as minimized recovery time and fewer complications, which are propelling demand for these devices in various sectors like general surgery, cardiology, and orthopedics.

In China, the rising geriatric population, increasing surgery cases, and boosting awareness of the advantages of automated suturing are fueling the growth of the market. Also, these devices are widely applied in different surgical processes, especially in minimally invasive and open surgeries, with accelerated outcomes compared to the conventional approaches.

In Japan, the increasing aging population results in an increase in surgical procedures, comprising those for GI and cardiac concerns, which are driving the growth of the market. As well as the use of robot-powered surgery, specifically in cardiac surgeries, is growing, and this trend is propelling the demand for automated suturing devices harmonious with the robotic platform. Furthermore, these well-suited individuals are highly employed in minimally invasive procedures and are also contributing to the expansion of the market.

For instance,

Highly developed Europe has been adopting more sophisticated new technologies like robotic-powered systems and computer-based devices, which are supporting infection control and surgical efficiency. Besides this, accelerating demand for surgical procedures over the different specializations like general surgery, orthopedics, and gynecology, fuels the need for robust and accurate suturing solutions.

The proceeding research and development in these devices, comprising surgical robots and else advanced technologies, are providing fuel to the market growth. Over this, the government organizations are embracing the development and acquisition of medical technologies, and along with this, a well-established healthcare system, allied with emerging healthcare providers and research institutions, assists in the adoption of novel devices like automated suturing devices.

The UK has been gaining grip in the market due to its promise to simplify surgical processes, enhance reliability, and lowering complications compared to conventional approaches. One of the leading UK-based medical research companies, Sutrue, is at the forefront of developing and executing these technologies, providing both portable and robotic suturing devices.

By Product

By Application

By End-use

By Region

January 2026

December 2025

December 2025

December 2025