January 2026

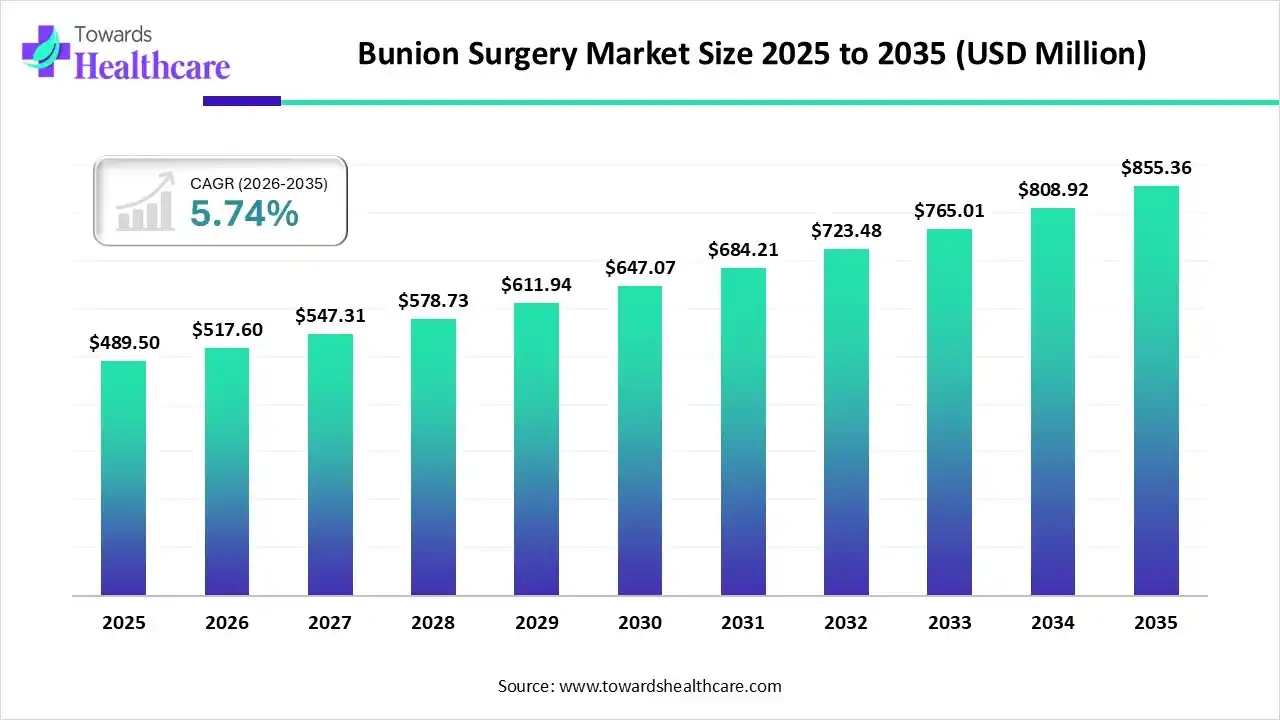

The global bunion surgery market size was estimated at USD 489.5 million in 2025 and is predicted to increase from USD 517.6 million in 2026 to approximately USD 855.36 million by 2035, expanding at a CAGR of 5.74% from 2026 to 2035.

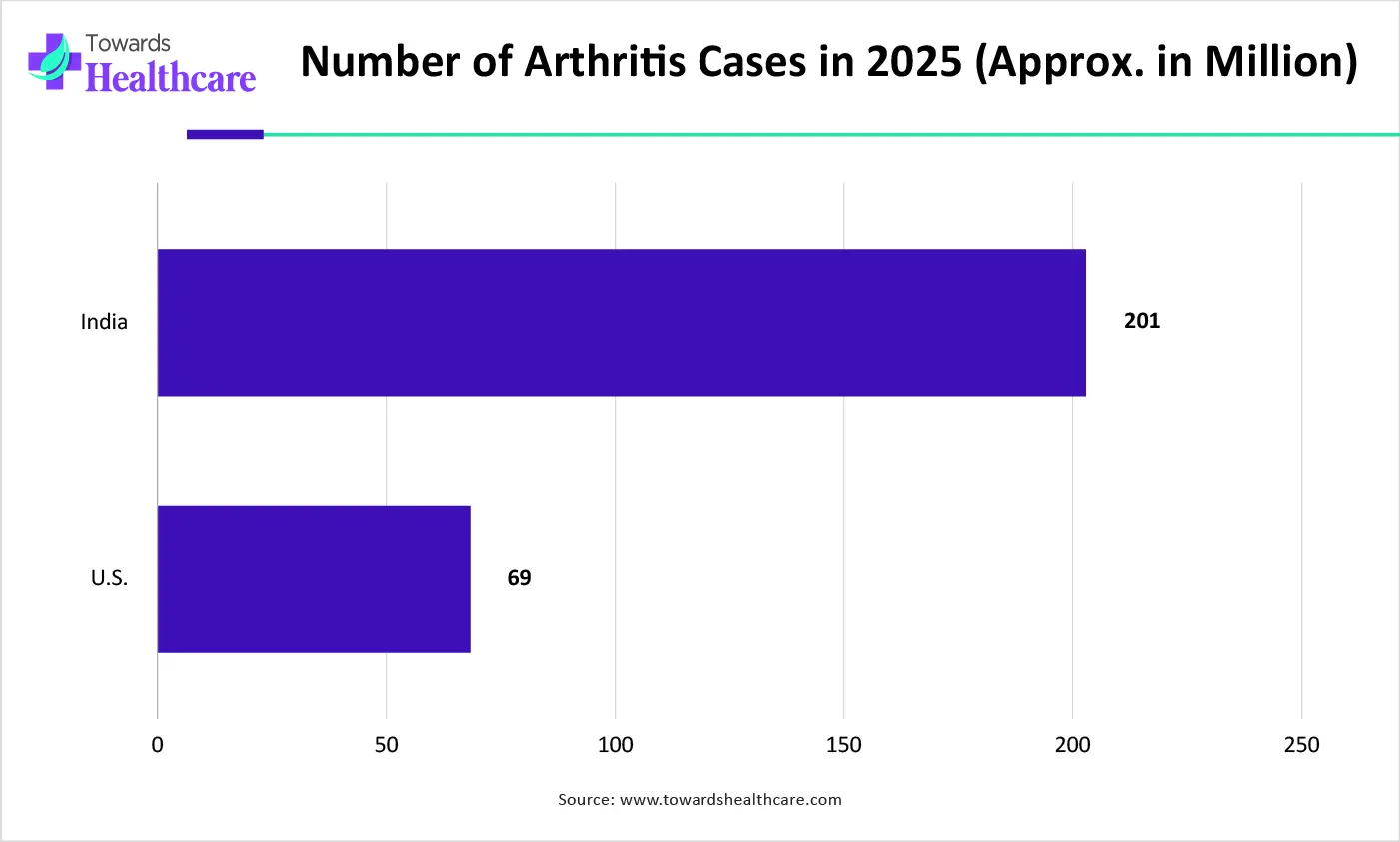

Globally rising cases of the geriatric population, sports injuries, and other associated incidences, such as arthritis. For these cases, the healthcare professionals are fostering rigorous solutions, like minimally invasive surgery, and advanced AI-powered approaches.

| Key Elements | Scope |

| Market Size in 2026 | USD 517.6 Million |

| Projected Market Size in 2035 | USD 855.36 Million |

| CAGR (2026 - 2035) | 5.74% |

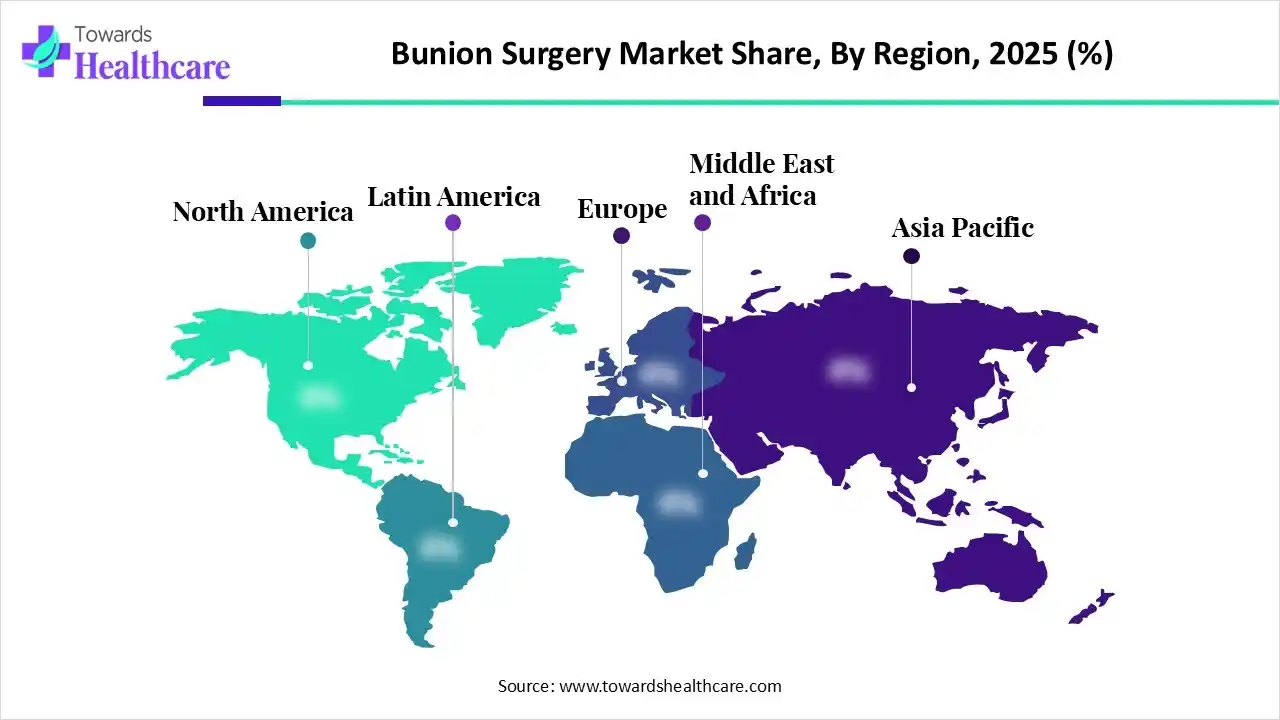

| Leading Region | North America |

| Market Segmentation | By Product Type, By Patient Type, By Surgery Type, By End-User, By Region |

| Top Key Players | Stryker Corporation, Johnson & Johnson Services, Inc., Zimmer Biomet Holdings, Inc., Smith & Nephew plc, Paragon 28, Inc., CONMED Corporation, Enovis Corporation, Medartis AG, Orthofix Medical Inc, Exactech, Inc. |

Firstly, the bunion surgery market covers a procedure that corrects a hallux valgus deformity, i.e. a bony bump at the base of the big toe. This significant procedure and overall market expansion are driven by a rise in the geriatric population, accelerating bunion cases, which are associated with footwear/lifestyle/sports, and ongoing breakthroughs in implants and minimally invasive techniques (MIS). However, healthcare professionals are leveraging 3D surgical planning and correction, such as Lapiplasty, which considers the bunion as a 3D deformity by correcting the unstable joint at the base of the big toe instead of just removing the visible bump.

The respective market has been bolstering the adoption of AI algorithms through the strengthening of pre-operative planning software, patient-matched surgical guides, and robotic assistance, which ensures higher precision and potentially rapid recovery times. Recently, Johnson & Johnson MedTech introduced the VIRTUGUIDE system. This patient-matched solution utilises AI software for the selection of the most appropriate, patient-specific Virtual Alignment and Correction (VAC) Guide for a Lapidus procedure (a type of bunion surgery).

The era is increasingly demanding for customized solutions, including the development of 3D models for surgeons to practice and establish patient-specific surgical guides or implants.

Innovative methods, such as extra-articular transverse osteotomies, are allowing multi-directional correction with stable fixation.

The globe is immensely stepping into the promotion of robotic-assisted surgery, which enables more intricate movements with raised precision, potentially resulting in minimal complications.

Which Product Type Led the Bunion Surgery Market in 2025?

In 2025, the correction systems segment captured the dominating share of the market. It has significant advantages, like highlighting the root cause of the deformity, enhanced stability, quicker recovery, and a reduced chance of the bunion returning. Globally rising adoption of Lapiplasty procedures, which leverages specialized, single or dual low-profile titanium plates for accurate rotation and stabilization of the first metatarsal bone into its correct anatomical position. The latest advanced Percuplasty Percutaneous 3D bunions correction system facilitates precise 3D correction with cosmetically appealing incisions.

Implants & Accessories

Moreover, the implants & accessories segment is anticipated to expand fastest. Instead of traditional implants, surgeons are encouraging "smart" implants coupled with sensors to transmit real-time data on mechanical stress, movement, and healing growth. The market is transforming utilization of biomaterials, especially magnesium alloys, which are naturally dissolvable in the body after the bone has healed, and also combats the need for a second hardware removal surgery.

How did the Adults Patients Segment Dominate the Bunion Surgery Market in 2025?

Primarily, the adults patients segment held the biggest share of the market in 2025. Specifically, 18-65+ aged people are suffering from bunions, which is fueled by diverse lifestyle factors, sports injuries, joint degeneration and age-related conditions, including arthritis. However, they are broadly demanding advanced minimally invasive techniques, sophisticated fixation devices, and the use of robotic-assisted technology.

Pediatric Patients

The pediatric patients segment will expand notably. The worldwide increase in congenital/developmental concerns, sports injuries, improper footwear, and rising awareness are propelling the growth of bunion surgery. A key solution comprises a transverse extra-articular metatarsal osteotomy using two cannulated screws united with an Akin osteotomy. Whereas, DePuy Synthes unveiled the TriLEAP Lower Extremity Anatomic Plating System for bunionectomies and osteotomies in complex pediatric foot fractures and deformities.

Which Surgery Type Led the Bunion Surgery Market in 2025?

In 2025, the traditional surgery segment registered dominance in the market. This surgical type is well-developed and widely successful for correcting severe or complex bunion deformities where MIS might not satisfy. This often includes an osteotomy, which needs a larger incision (inches long) to access the joint, discard the bony prominence, i.e. exostectomy, and reposition the misaligned bones.

Minimally Invasive Surgery

Whereas the minimally invasive surgery segment is predicted to witness rapid expansion. Modernized MIS emphasises raising precision, boosting recovery, and lowering recurrence rates through sophisticated instrumentation, 3D planning technologies, and refined surgical methods. The leading firms are putting efforts into progressing procedure-specific hardware and tools, like the PROstep MIS Lapidus by Stryker, and specialized burrs, which accelerate the safety and efficiency of minimally invasive procedures.

Why did the Hospitals Segment Lead the Market in 2025?

The hospitals segment captured the largest share of the bunion surgery market in 2025. These are prominent end-users, which provide skilled surgeons and the availability of different techniques, such as exostectomy, osteotomy, and arthrodesis for correction. Alongside, they are focusing on improvements in post-operative care, with the adoption of multimodal pain management and strengthened rehabilitation programs that support early mobilization.

Orthopaedic Clinics

In the future, the orthopaedic clinics segment is anticipated to expand at a rapid CAGR. A rise in the burden of deformities, demand for better outcomes, and broadening awareness are assisting the expansion of these clinics. Additionally, clinics are fostering the use of next-gen implants, surgical tools, and AI-driven strategies. Also, they are shifting towards a single, dual-zone neutral pitch screw construct, which offers extensive stability for healing, with a streamlined procedure.

North America held the largest share of the market in 2025, due to the ongoing breakthrough in surgical techniques, such as MIS, robust implants, and escalating instances of related issues, especially arthritis. Furthermore, the region is embedding novel "same-day" protocols that often enable patients to initiate gentle range-of-motion exercises within days and return to light activity in 4–6 weeks.

U.S. Market Trends

However, the U.S. was a major contributor to the market, as it is promoting cloud-driven platforms and pre-operative software, for example, Johnson & Johnson's Virtue Guide system, which is employed in digital planning of surgeries and monitoring post-operative progress, ultimately allowing tailored care and raising patient involvement.

Asia Pacific is estimated to expand fastest in the bunion surgery market, as the region is experiencing the expedited expansion of medical infrastructure, accelerating healthcare spending, primarily in Japan, South Korea, and Southeast Asia. Besides this, APAC is widening the use of AI in pre-operative evaluation and surgical planning. Whereas, AI-enabled solutions are exploring the analysis of patient-specific data from imaging to implement proper surgical techniques.

Japan Market Trends

Japan is predicted to expand at a rapid CAGR with substantial advancements in the surgical area. They have robust healthcare facilities, such as Foot Clinic Omotesando, The Clinical and Research Institute for Foot & Ankle Surgery, and Marugame Orthopedic Clinic. They are executing diverse approaches, particularly innovation in advanced, cutting-edge minimally invasive orthopedic treatments.

| Company | Description |

| Stryker Corporation | They highly specialise in PROstep Minimally Invasive Surgery (MIS). |

| Johnson & Johnson Services, Inc | Its prominent offerings include the VIRTUGUIDE System, MINIBUNION 3D System, etc. |

| Zimmer Biomet Holdings, Inc. | This explores many products through its foot and ankle portfolio. |

| Smith & Nephew plc | A firm mainly offers plating systems for bone fixation and bioinductive implants for soft tissue repair. |

| Paragon 28, Inc | It has unveiled the PRECISION MIS Bunion System. |

| CONMED Corporation | It facilitates different products through its CoLink & NeoSpan product families. |

| Enovis Corporation | This emphasizes minimally invasive surgery (MIS) techniques and products for traditional open procedures and post-operative care. |

| Medartis AG | It offers various high-precision implant systems for bunion surgery. |

| Orthofix Medical Inc. | This specializes in implants and fixation systems through its vast portfolio of limb reconstruction and orthopedic solutions. |

| Exactech, Inc | Its offering encompasses its comprehensive EPIC Extremity Reconstruction System. |

By Product Type

By Patient Type

By Surgery Type

By End-User

By Region

January 2026

January 2026

January 2026

January 2026