February 2026

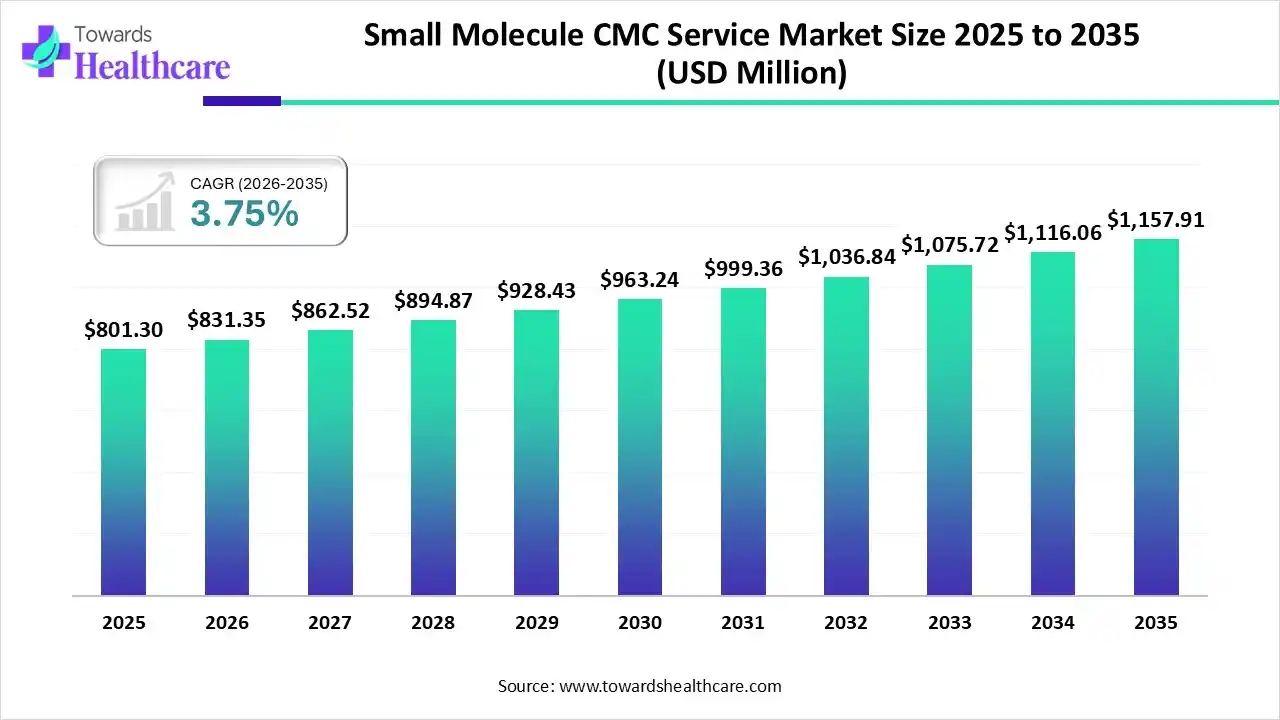

The global small molecule CMC service market size was estimated at USD 801.3 million in 2025 and is predicted to increase from USD 831.35 million in 2026 to approximately USD 1157.91 million by 2035, expanding at a CAGR of 3.75% from 2026 to 2035.

The small molecule CMC service market is growing as it includes major services such as contract synthesis, analytical test, development of manufacturing process, and development of analytical methods.

The small molecule CMC service market is increasing because small molecules continue to be the backbone of modern therapeutics, showing the majority of FDA-approved drugs and active development pipelines. CMC Pharma emphasizes the advancement of small-molecule drug products. The small molecule CMC services team specializes in process feasibility, optimization, advancement, validation, method transfer, and sample analysis. The most significant purpose of CMC activities is to appropriately define the manufacturing process for various types of therapeutic products to ensure product safety and lot-to-lot reliability.

Integration of AI-driven technology in small molecule CMC service drives the growth of the market, as AI-driven advancement in early-stage drug development could signify a massive potential. Using machine learning algorithms allowed it to be used to analyse historical data, new results, and molecular characteristics in order to offer the most optimal courses of action. The AI-driven technology has the potential to automatically extract, arrange, and validate the data originating from numerous sources, lowering the number of mistakes and accelerating the process of giving approvals.

Increasing demand of high potency active pharmaceutical ingredients (HPAPIs) as they are significant in oncology, enabling the manufacturing of targeted cancer therapies.

Advanced CMC approaches ensure ADC quality, from conjugation and linker design to production and analytical characterization. Modern CMC providers are integrating analytical solutions directly with production.

CMC is biodegradable, degrading into the non-toxic components in soil and aqueous environments within 28 days, making it an eco-friendly substitute to synthetic polymers.

| Key Elements | Scope |

| Market Size in 2026 | USD 831.35 Billion |

| Projected Market Size in 2035 | USD 1157.91 Million |

| CAGR (2026 - 2035) | 3.75% |

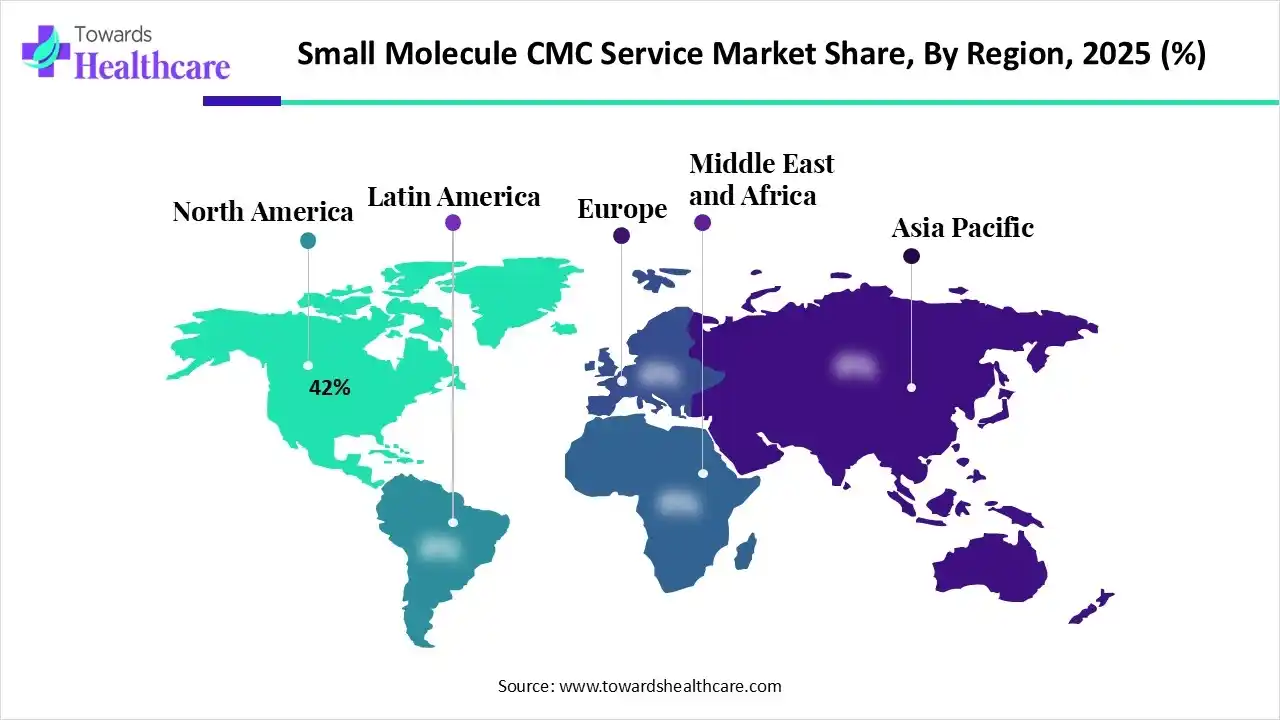

| Leading Region | North America by 42% |

| Market Segmentation | By Service Type, By Development Stage, By Molecule Type, By Therapeutic Area, Regional Outlook |

| Top Key Players | Lonza, Thermo Fisher Scientific, B. Braun SE, WuXi AppTec, Catalent, CordenPharma |

Which Service Type Led the Small Molecule CMC Service Market in 2025?

In 2025, the API development & manufacturing segment held the dominant market share with approximately 48% share in 2025, as APIs automate these procedures, freeing up time and resources. API development solutions take the guesswork out of repetitive business technology. API manufacturing provides various benefits, including lowered costs, access to progressive technology, and amplified production elasticity.

Analytical & Quality Control Services

Whereas the analytical & quality control services segment is the fastest-growing in the market, as analytics in healthcare is significant for combating growing expenses and for supporting clinicians in providing quality care tailored to patients' requirements. Quality control and assurance protect patients and help staff, upholding trust. They are significant in medical care, as they reduce death and challenges by avoiding healthcare errors. They increase effectiveness by cutting waste in diagnostics.

Why did the Commercial Stage Segment Dominate the Market in 2025?

The commercial stage segment is dominant in the small molecule CMC service market, with approximately 55% share in 2025, as commercial manufacturing is essential to bring safe, efficient, and advanced-quality drugs. It is the large-scale manufacturing of pharmaceutical products, produced once they have successfully passed clinical trials and received government approval. Utilizing particular contract manufacturing organizations (CMOs) allows faster time-to-market, access to advanced technology, and reduced capital spending in healthcare infrastructure.

Preclinical

Whereas the preclinical segment is the fastest-growing in the market, as preclinical testing aids as the foundation for medicine advancement, leading to assessing the safety and efficacy of a potential novel treatment before continuing to clinical trials. Preclinical research demonstrates a favourable risk-benefit profile; the therapeutic candidate progresses to clinical trials involving human subjects.

Why did the Innovative Small Molecules Segment Dominate the Market in 2025?

The innovative small molecules segment is dominant in the small molecule CMC service market with approximately 62% share in 2025, as small molecules are often orally available, simple to produce, and more affordable than biologics. Small molecules provide benefits such as enhanced tissue permeability, longer half-lives, and lower production expenses. Small molecules derive advantages from advanced patient convenience, broad therapeutic potential, lower manufacturing challenges, and clearer government pathways.

Generic Small Molecules

Whereas the generic small molecules segment is the fastest-growing in the market, as generic small molecules provide various benefits such as improved tissue permeability, longer half-lives, and reduced production expenses. A generic drug is a drug created to be the same as an already marketed brand-name drug in dosage form, strength, safety, route of administration, quality, performance characteristics, and designed use.

Why did the Oncology Segment Dominate the Market in 2025?

The oncology segment is dominant in the small molecule CMC service market with approximately 53% share in 2025. Small molecule medicines offer greater flexibility and convenience for medical care providers, patients, and their caregivers, enhancing treatment adherence. Small molecule medicines offer greater flexibility and convenience for medical care providers, patients, and their caregivers, enhancing treatment adherence.

Cardiovascular Diseases

Whereas the cardiovascular diseases segment is the fastest-growing in the market, as small molecules provide various benefits in drug advancement, revolutionizing treatment precision, accessibility, and healthcare. Small-molecule therapeutics play a significant role in the management of cardiovascular disease. They enable targeting different aspects of cardiovascular physiology, containing blood pressure regulation, cardiac rhythm stabilization, thromboprophylaxis, and lipid metabolism.

In 2025, North America dominated the small molecule CMC service market with approximately 42% share, as increasing demand for challenging therapeutics and increasing biotechnology novel platforms allowed specialized API manufacturing collaboration. Medical care guidelines and standards are set by the central government, that goal to offer simple healthcare accessibility to each resident in the country. Government providing healthcare services and insurance coverage, which contributes to the growth of the market.

For Instance,

U.S. Market Trends

In the U.S., APIs are at the forefront of this innovation, as they enable the development of novel drug formulations and delivery processes, and major organizations are investing in research and development to create advanced APIs that drive ground-breaking drug development. A small innovator organization works in collaboration with contract organizations for the initial non-clinical, clinical, and CMC features of drug advancement.

Asia Pacific is expected to see rapid growth in the small molecule CMC service market, driven by outsourcing to CDMOs in the Asia Pacific region save healthcare organizations 30-50% on drug development and manufacturing expenses, which drives the demand for small molecule CMC services. Huge spending in healthcare modernization, local production, and policy-driven novelty, which drives the growth of the market.

China Market Trends

China has aggressively expanded capacity across multiple chemical value chains. China's industrial chemical sourcing strategy sets novel morals for competitiveness and sustainability. China's medical care sector is experiencing rapid growth, driven by increasing incomes, growing health awareness, and an aging population.

Europe is significantly growing in the small molecule CMC service market, due to the adoption of technical developments such as telemedicine and digital health platforms to improve healthcare services. The European Medicines Agency (EMA) is the government body of the European Union responsible for the systematic evaluation and supervision of drugs. European pharmaceutical providers are renowned for their severe adherence to Good Manufacturing Practice (GMP) values, which drives the growth of the market.

UK Market Trends

The UK small molecule CMC services market is growing, driven by increased R&D, post-Brexit manufacturing investment, and specialized CDMO demand. Growth is supported by advanced analytical testing for complex APIs, clinical trial infrastructure, and regulatory support for local production.

| Company | Headquarters | Latest Update |

| Lonza | Switzerland | Lonza expects a healthy level of contract signings in technologies and sites within its CDMO business. |

| Thermo Fisher Scientific | United States | Thermo Fisher Scientific is retaining an enhanced platform technology and a new CHO K-1 cell line that can reduce timelines to Investigational New Drug (IND) filing. |

| B. Braun SE | Germany | In December 2025, B. Braun Medical Inc. announced the launch of its Supply Assurance Program, a first-of-its-kind initiative intended to reinforce supply chain resiliency and protect patient care from disruption in the healthcare tools and pharmaceutical field. |

| WuXi AppTec | China | In June 2025, WuXi supports more than 3,400 small-molecule CDMO projects, with an increasing share of Phase III and commercial-stage drugs. |

| Catalent | Switzerland | Catalent delivers end-to-end pharma solutions as a trusted CDMO, progressing drug development and manufacturing globally. |

| CordenPharma | Switzerland | CordenPharma is a leading CDMO for cGMP development & manufacturing of APIs, lipid excipients, medicinal products, injectables, peptides, LNPs, oligos, & osd. |

By Service Type

By Development Stage

By Molecule Type

By Therapeutic Area

By Region

February 2026

February 2026

January 2026

January 2026