February 2026

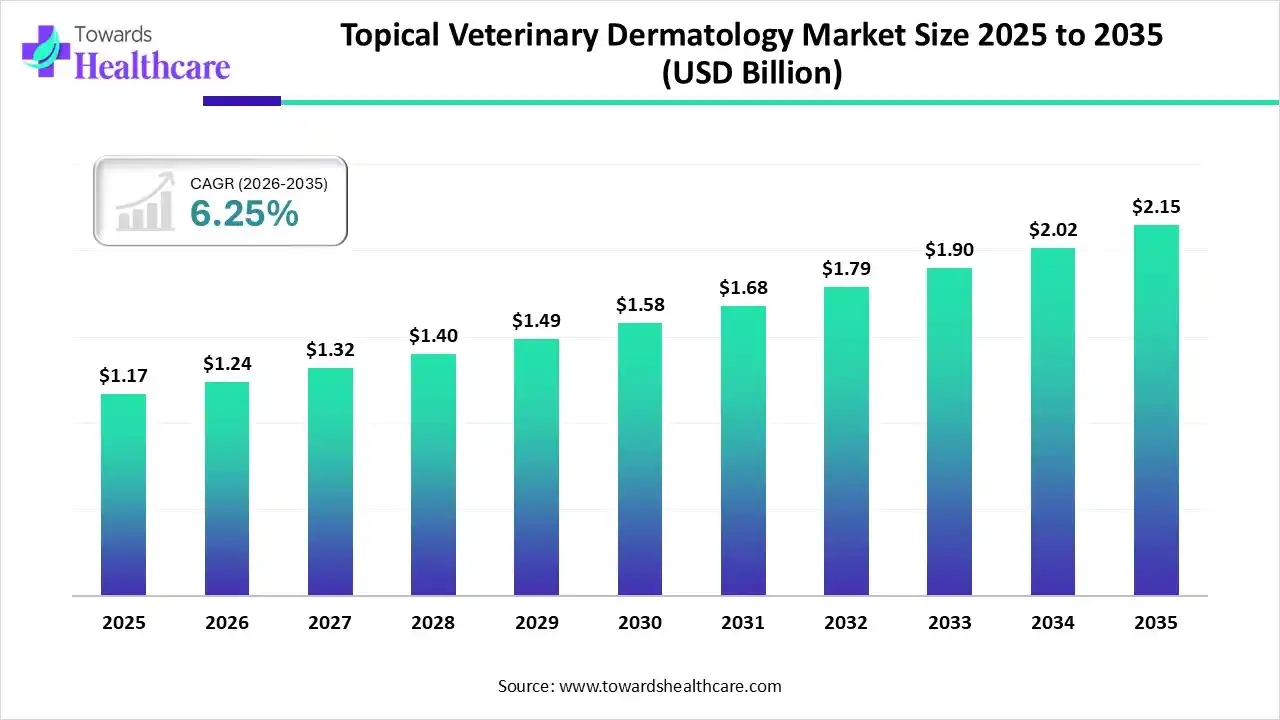

The global topical veterinary dermatology market size was estimated at USD 1.17 billion in 2025 and is predicted to increase from USD 1.24 billion in 2026 to approximately USD 2.15 billion by 2035, expanding at a CAGR of 6.25% from 2026 to 2035.

The topical veterinary dermatology market is increasing because topical treatment is a significant part of veterinary dermatology. It is recognized as a crucial component of managing bacterial and yeast growth.

The topical veterinary dermatology market is expanding due to topical therapy, and its efficiency is tremendous when facing the surge in antimicrobial resistance in small animal practice and the need for alternative ways to manage infections caused by multi-resistant bacteria. Topical therapy is symptomatic and complimentary, and therefore often used together with as a substitute to systemic treatments. Topical therapy is often applied in mild cases of superficial pyoderma to lower the cutaneous bacterial population but also to eradicate tissue debris, enabling direct contact of the active ingredient with the skin and promoting removal of the exudate.

Integration of AI-driven technology in topical veterinary dermatology drives the growth of the market, as AI-based apparatuses support dermatologists in diagnosing and treating different conditions, from psoriasis and acne to ulcers and dermatitis. AI-based role extends to oncology, where it enhanced skin cancer detection via image analysis and histopathological assessment. AI in dermatology involves developments in vision-language models, merged learning, and precision medicine strategies which drive the growth of the market.

Recent developments in formulation technology have led to the advancement of innovative delivery systems like hydrogels, nanoparticles, and liposomes. These systems provide enhanced drug stability, precise release, and improved skin penetration.

Topical therapies are recommended for many reasons; however, most commonly they are used to manage cutaneous infections, control pruritus, eliminate allergens, eliminate cutaneous parasites, and for the management of seborrheic conditions.

The novel technological advancements in delivery through the topical route have been transformed because of a deeper understanding of the molecular-level structure of the stratum corneum and the permeation pathways via the skin.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.17 Billion |

| Projected Market Size in 2035 | USD 2.15 Billion |

| CAGR (2026 - 2035) | 6.25% |

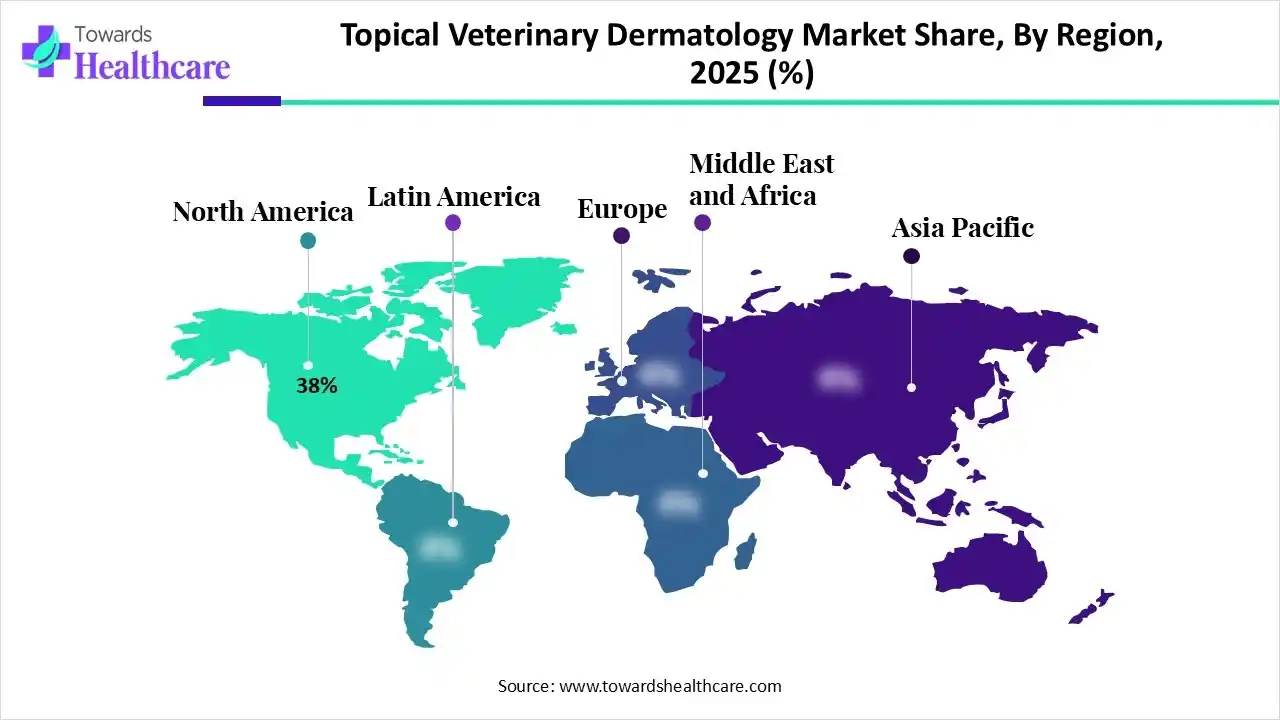

| Leading Region | North America by 38% |

| Market Segmentation | By Product Type, By Animal Type, By Indication, By Distribution Channel, By Region |

| Top Key Players | Zoetis Inc., Boehringer Ingelheim Animal Health, Elanco Animal Health Incorporated, Merck & Co., Inc., Virbac S.A., Dechra Pharmaceuticals PLC |

Which Product Led the Topical Veterinary Dermatology Market in 2025?

In 2025, the antibacterial & antifungal agents segment held the dominant market share of approximately 38%, as topical antibacterial agents play a significant role in antimicrobial therapy. Their major applications include prophylaxis of infection in compromised skin and management of primary and secondary pyodermas. Topical antimicrobial agents target home-grown areas. Benefit of topical antimicrobials include a lower incidence of antimicrobial resistance, the capability to administer higher concentrations, and fewer systemic side effects.

Antiparasitic Topicals

Whereas the antiparasitic topicals segment is the fastest-growing in the market, as antiparasitics are drugs that lower parasite burdens to an acceptable level by killing parasites or preventing their growth. The role of ivermectin as an antiparasitic agent is thought to plays an supplementary role in the treatment of rosacea by lowering Demodex mite infestation and offering symptomatic relief.

Why did the Companion Animals Segment Dominate the Market in 2025?

The companion animals segment is dominant with a revenue of approximately 72% and is the fastest-growing in the topical veterinary dermatology market in 2025, as topical therapy and its efficiency are marvelous when facing the surge in antimicrobial resistance in small animal practice and the need for alternative ways to treat infections caused by multi-resistant bacteria. It removes allergens, microbes, and debris from the skin to simplify the release of symptoms from skin infections and allergies.

Why did the Parasitic Infections Segment Dominate the Market in 2025?

The parasitic infections segment is dominant in the topical veterinary dermatology market in 2025, with a revenue of approximately 46%, as parasitic infections are any illnesses or conditions caused by parasites living and reproducing in the body. Parasites are organisms that require another living thing to get the nutrients they require to survive. Parasitic infections often cause colonic illness, with symptoms such as vomiting and diarrhea.

Allergic Infections

Whereas the allergic infections segment is the fastest-growing in the market, as an allergic reaction to proteins found in an animal's skin cells, urine, or saliva. Major symptoms of pet allergy involve those common to hay fever, like a runny nose and sneezing. An animal allergy occurs when patients come into contact with proteins in pet dander, saliva, or urine. Allergies have several effects on pets' skin, causing a wide range of symptoms and challenges.

Why did the Hospital Pharmacies/Clinics Segment Dominate the Market in 2025?

The hospital pharmacies/clinics segment is dominant in the topical veterinary dermatology market in 2025, with a revenue of approximately 62%. Hospital pharmacy offers advantages compared to retail. It increased collaboration with prescribers and other health specialists. Greater input in prescribing decisions related to medicine and administration.

E-commerce/Online Retail

Whereas the e-commerce/online retail segment is the fastest-growing in the market, as it provides competitive pricing, discounts, and generic substitutes, leading to lower investment expenses for patients. This affordability is especially relevant for those with long term conditions needs long-term medicine. Online pharmacies are available 24/7, and for resolving enquiries concerning medicines, 24/7 online consumer supports are available.

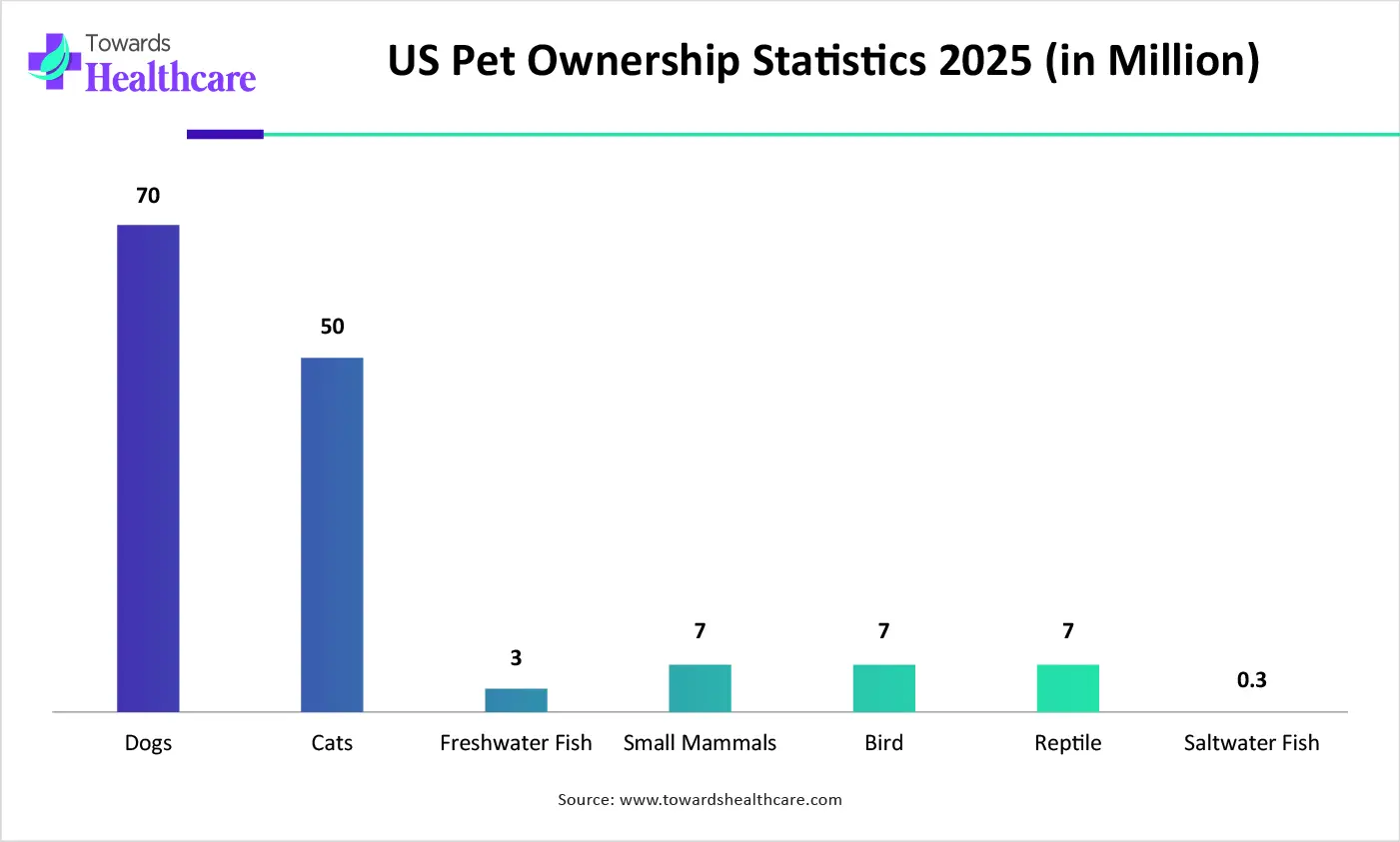

In 2025, North America dominated the topical veterinary dermatology market, driven by increased disease diagnoses, greater awareness of pet skin health, and other factors boosting demand for veterinary treatments. As reported in APPA's 2025 State of the Industry, the 2025 APPA National Pet Owners Survey indicates that 94 million U.S. households own pets, which contributes to the growth of the market.

U.S. Market Trends

In the U.S., pet insurance reduces financial barriers associated with costly treatments, encouraging owners to pursue specialized care for their pets. Veterinary dermatology primarily involves diagnosing and treating coat, skin, ear, and nail issues in animals, which are among the most common health problems encountered in veterinary clinics.

Asia Pacific is expected to see rapid growth in the topical veterinary dermatology market, driven by urbanization, pollution, and smog exposure, which weaken pets' skin immunity and increase vulnerability to dermatitis. Demographic shifts and rising incomes have led more people to adopt pets, fueling market growth.

India Market Trends

In India, rising middle-class disposable income encourages investment in premium veterinary dermatology care over basic treatments. There is a growing number of veterinary clinics and specialized, high-end care options in Indian cities. Greater availability of both international and local brands simplifies access to treatments. As pet health awareness increases, owners are moving from reactive treatments to proactive and preventive care.

Europe is significantly growing in the topical veterinary dermatology market, due to increasing infestation prevalence, which has been reported in southern European countries like Spain, Italy, Greece, and Cyprus, which drives the growth of the market. The European Medicines Agency's (EMA) Veterinary Medicines Division supervises veterinary medicines through their lifecycle, which contributes to the growth of the market.

| Company | Headquarters | Latest Update |

| Zoetis Inc. | United States | In November 2025, Zoetis Inc. announced the acquisition of Veterinary Pathology Group (VPG), a leading veterinary diagnostic laboratory group with many locations across the UK and Ireland. |

| Boehringer Ingelheim Animal Health | United States | Boehringer Ingelheim is a leading research-driven biopharmaceutical company. |

| Elanco Animal Health Incorporated | United States | In July 2025, Elanco Animal Health Incorporated announced that Zenrelia had received approval from the European Commission. |

| Merck & Co., Inc. | United States | In June 2025, Merck Animal Health, known as MSD Animal Health outside of the United States and Canada, a division of Merck & Co., Inc., Rahway, N.J., USA, announced that the European Medicines Agency’s Committee for Veterinary Medicinal Products issued a positive opinion for NUMELVI Tablets for Dogs. |

| Virbac S.A. | France | Virbac S.A. continues to hold a strong position in the worldwide veterinary dermatology. |

| Dechra Pharmaceuticals PLC | United Kingdom | In November 2025, Dechra announced its status as the novel Human-Animal Bond Certified Company. Dechra has made a key commitment to helping human-animal bond education for veterinary professionals. |

By Product Type

By Animal Type

By Indication

By Distribution Channel

By Region

February 2026

October 2025

October 2025

October 2025