February 2026

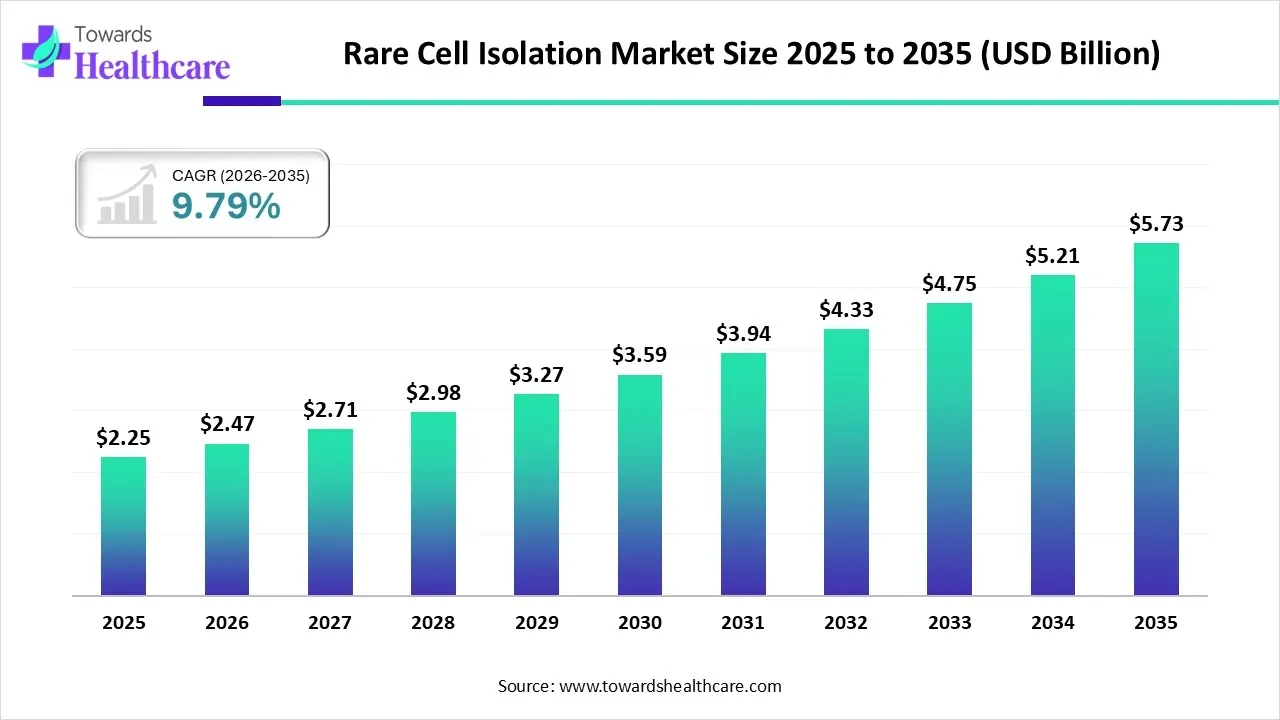

The global rare cell isolation market size is calculated at USD 2.25 billion in 2025, grew to USD 2.47 billion in 2026, and is projected to reach around USD 5.73 billion by 2035. The market is expanding at a CAGR of 9.79% between 2026 and 2035.

The rare cell isolation market is primarily driven by the increasing prevalence of genetic and rare disorders and the growing research and development activities. Researchers focus on developing novel diagnostics and therapeutics related to rare cells for personalized treatment. Government organizations launch initiatives and provide funding to support advanced biotech research. Artificial intelligence (AI) helps to isolate and analyze hidden cell types and streamline downstream sorting.

| Key Elements | Scope |

| Market Size in 2025 | USD 2.25 Billion |

| Projected Market Size in 2035 | USD 5.73 Billion |

| CAGR (2025 - 2035) | 9.79% |

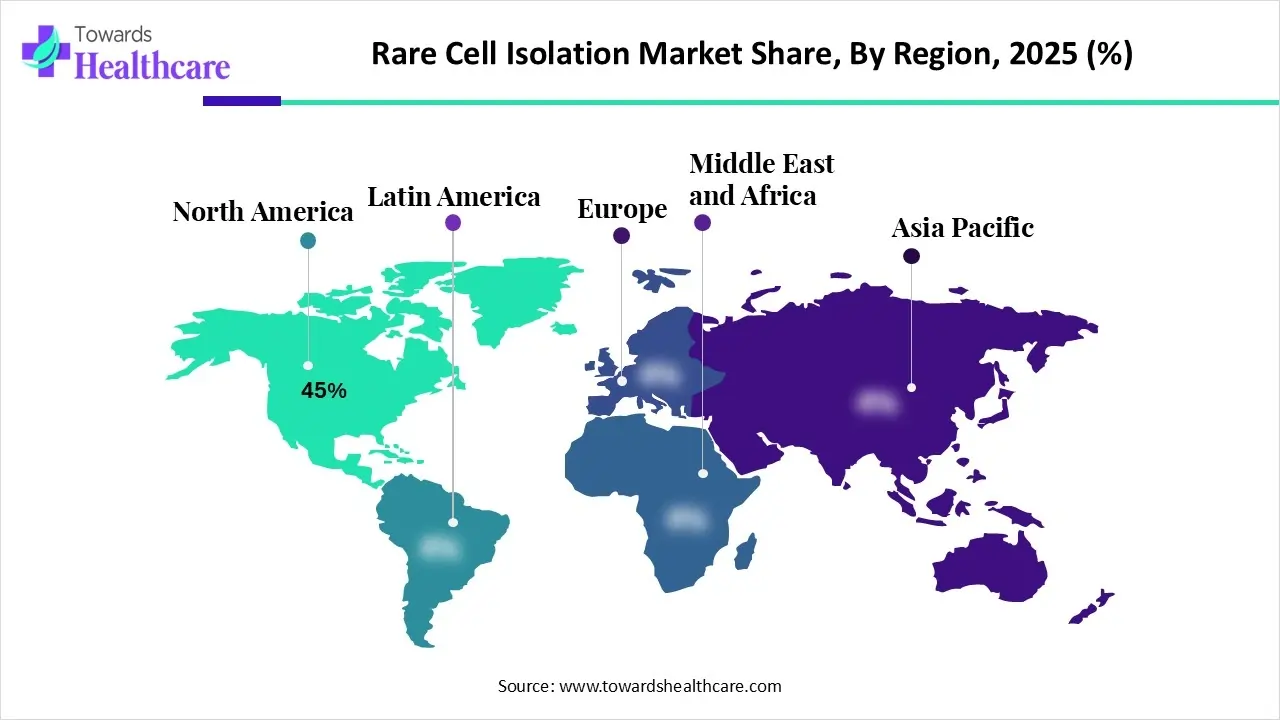

| Leading Region | North America by 45% |

| Market Segmentation | By Cell Type, By Technology, By Application, By Product Type, By End-User, By Region |

| Top Key Players | QIAGEN N.V., Bio-Rad Laboratories Inc., STEMCELL Technologies Inc., Menarini Silicon Biosystems, Akadeum Life Sciences, RareCyte Inc., Fluxion Biosciences Inc., Greiner Bio-One International, Veridex LLC (Johnson & Johnson), Precision for Medicine, Inc., Takara Bio Inc., Beckman Coulter (Danaher Corporation), Celsee Inc. (Bio-Rad), ScreenCell SAS, Clearbridge Biomedics, Corning Incorporated, NanoString Technologies Inc. |

The rare cell isolation market is fueled by advancements in microfluidics, magnetic-activated cell sorting (MACS), and flow cytometry, as well as the increasing use of liquid biopsies in precision oncology. It focuses on technologies, instruments, and consumables used to isolate, identify, and analyze rare cell populations such as circulating tumor cells (CTCs), circulating fetal cells, stem cells, and immune cells from complex biological samples like blood. These cells provide critical insights for cancer diagnostics, prenatal testing, regenerative medicine, and immunology research.

Integrating AI in microfluidics and single-cell sequencing technologies revolutionizes cell identification and sorting, enhancing accuracy and precision. AI leads to high-throughput, single-cell resolution, high integrity, and wide accessibility. AI and machine learning (ML) algorithms can process the multimodal datasets obtained from versatile microfluidics devices. They also streamline data augmentation and feature extraction, and use phenotypic data for prediction and pattern recognition, facilitating the development of a large number of applications.

| Countries | Regulatory Agencies | Approved Drugs (2024) |

| United States | Food and Drug Administration (FDA) | 26 |

| Europe | European Medicines Agency (EMA) | 16 |

| China | National Medical Products Administration (NMPA) | 27 |

Which Cell Type Segment Dominated the Rare Cell Isolation Market?

The circulating tumor cells (CTCs) segment held a dominant presence with a share of approximately 46% in the market in 2024, due to the rising prevalence of cancer and the growing awareness of liquid biopsy. CTCs are released from primary tumors and transported through the body via blood or lymphatic vessels. Innovative rare cell isolation techniques increase the sensitivity of CTC detection, offer greater clinical utility, and facilitate the isolation and cultivation of live CTCs. Technological advances in microfluidics and nanotechnology, as well as automation, boost the segment’s growth.

Stem Cells

The stem cells segment is expected to grow at the fastest CAGR in the market during the forecast period. The growing demand for personalized medicines and expanding applications in regenerative medicine and gene therapy augment the segment’s growth. Methods of isolation and culture depends on the source and lineage of stem cells. According to a 2024 review, 115 global clinical trials were reported involving 83 distinct pluripotent stem cell-derived products targeting indications in ophthalmology, neurology, and oncology.

Circulating Fetal Cells

The circulating fetal cells segment is expected to grow at a notable CAGR, due to the increasing awareness of prenatal testing. Isolating circulating fetal cells (CFCs) from maternal peripheral blood provides a superior strategy for non-invasive prenatal genetic diagnosis. It is estimated that about 2 million women in the U.S. undergo non-invasive prenatal testing annually. Technical advances in single-cell isolation and genetic analyses potentiate the segment’s growth.

How the Centrifugation Segment Dominated the Rare Cell Isolation Market?

The centrifugation segment held the largest revenue share of approximately 33% in the market in 2024, due to the ability of centrifugation to process large sample volumes and cost-effectiveness. Centrifugation helps to remove dead cells and debris in samples to isolate specific cells effectively. Researchers develop portable and more user-friendly devices. Automated devices enhance the efficiency and accuracy of sample processing.

Microfluidics-based Isolation

The microfluidics-based isolation segment is expected to grow with the highest CAGR in the market during the studied years. Microfluidics-based isolation offers higher sensitivity, automation, and compatibility with downstream single-cell analysis. Microfluidic devices can handle small volumes, facilitating the analysis of rare or expensive samples. Microfluidic-based isolation shows great promise, with some commercial devices available and improvements in new techniques.

Magnetic-Activated Cell Sorting (MACS)

The magnetic-activated cell sorting (MACS) segment is expected to grow in the coming years, due to ongoing innovations in nanotechnology. MACS is an affinity-based technique that uses magnetic nanoparticles to separate and purify specific cell populations. It is inexpensive and fast compared to conventional cell isolation technologies. Combining MACS with other methods, like FACS, provides synergistic methods, such as improving the purity of isolated cells.

Why Did the Cancer Research & Diagnostics Segment Dominate the Rare Cell Isolation Market?

The cancer research & diagnostics segment contributed the biggest revenue share of approximately 52% in the market in 2024, due to the growing need for early cancer detection. Cancer research & diagnosis are supported by the extensive use of CTC isolation and analysis in oncology drug development and liquid biopsy assays. Rare cancers are cancers that affect fewer than 6 newly diagnosed cases per 100,000 people annually. They account for about 25% of cancer diagnoses.

Non-invasive Prenatal Testing (NIPT)

The non-invasive prenatal testing (NIPT) segment is expected to expand rapidly in the market in the coming years. NIPT is a method used to screen for common fetal aneuploidies, reducing the risk of complications and enhancing patient convenience. The rising adoption of fetal cell isolation as a safer alternative to invasive methods propels the segment’s growth. Maternal blood is withdrawn to extract maternal and placental DNA. NIPT removes the chances of miscarriage associated with invasive procedures.

Stem Cell & Regenerative Medicine

The stem cell & regenerative medicine segment is expected to grow significantly, due to the increasing demand for regenerative medicines. Regenerative medicines are widely preferred due to rapidly changing demographics and the growing geriatric population. They offer superior advantages, such as accelerated healing, reduced inflammation, and healthier tissues. They treat a disease from its root cause, reducing the risk of disease recurrence.

What Made Instruments the Dominant Segment in the Rare Cell Isolation Market?

The instruments segment accounted for the highest revenue share of approximately 48% in the market in 2024, due to the integration of AI/ML technologies and the availability of portable systems. Instruments, such as flow cytometers, magnetic separators, microfluidic devices, and automated cell sorters, are modified to improve their functionality. Key players develop user-friendly devices that perform multiple functions. Increasing investments by government and private organizations facilitate researchers to adopt novel instruments for cell isolation processes.

Reagents & Kits

The reagents & kits segment is expected to witness the fastest growth in the market over the forecast period. Segmental growth is supported by recurring use and the increasing demand for assay-specific isolation reagents. They are affordable and are highly preferred during small-scale research applications. Researchers can fulfill research requirements with the availability of suitable reagents from different companies.

Consumables

The consumables segment is expected to show lucrative growth, driven by high-maintenance equipment and the availability of environmentally-friendly consumables. Consumables, such as pipes, tubes, filters, chips, and columns, are essential components for rare cell isolation. Timely maintenance of instruments enhances the shelf life of the equipment, saving the costs of researchers.

Which End-User Segment Led the Rare Cell Isolation Market?

The academic & research institutes segment led the market with a share of approximately 42% in 2024, due to growing research activities and the presence of favorable infrastructure. Academic & research institutes conduct research activities related to cancer, stem cells, and biomarker discovery at a smaller scale. This is supported by sufficient funding from the government and private bodies. Academic researchers collaborate with other researchers around the globe to benefit from their expertise and infrastructure.

Clinical & Diagnostic Laboratories

The clinical & diagnostic laboratories segment is expected to show the fastest growth over the forecast period. Clinical & diagnostic laboratories have favorable infrastructure and suitable capital investments to leverage advanced diagnostics. They have skilled professionals to provide personalized care. Patients prefer visiting clinical & diagnostic laboratories for precision diagnosis of a variety of diseases.

Biotechnology & Pharmaceutical Companies

The biotechnology & pharmaceutical companies segment is expected to grow in the upcoming years, due to increasing commercial research activities and the rising number of patents. Biotechnology & pharmaceutical companies possess a fwide range of products and technologies, from large-scale instrumentation and reagents to advanced platforms. They generate more revenue by providing cell isolation services.

North America dominated the global market with a share of approximately 45% in 2024. The availability of a strong research infrastructure, high adoption of precision oncology, and the presence of key players are the major factors that govern market growth in North America. The market is fueled by advances in microfluidics and flow cytometry techniques. The growing demand for personalized medicines and new drug discovery research fosters market growth. Favorable regulatory policies also drive the market.

Key players, such as Akadeum Life Sciences, Bio-Techne Corporation, and Thermo Fisher Scientific, are the major contributors to the market in the U.S. The U.S. Food and Drug Administration (FDA) regulates novel drugs for a variety of diseases. It approved 18 new personalized medicines in 2024, representing 38% of all newly approved drugs. The shifting trend towards orphan drugs also bolsters market growth.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The increasing R&D investments and the rising biotech clusters in China, Japan, and India propel the market. Government organizations support cancer genomics and cell therapy research through funding and local and national initiatives. The growing R&D activities and the burgeoning biotech sector contribute to market growth.

China is emerging as a global biotech hub. Government organizations are constantly making efforts to surpass China ahead of the U.S. in the biotech race. China’s innovation capabilities have already surpassed Europe in most biotech areas. Public funding for biotech research was approximately CNY 20 billion (EUR 2.6 billion) in 2023. Private players draw capital from overseas investors to accelerate private sector-led growth.

Europe is expected to grow at a notable CAGR in the foreseeable future. The rising prevalence of rare and genetic disorders and favorable government support augment market growth. The European Medicines Agency (EMA) regulates the approval of precision diagnostics and therapeutics. People are becoming aware of personalized medicines and advanced cancer diagnosis. Increasing investments and collaborations among key players facilitate the development of innovative rare cell isolation techniques in Europe.

Currently, 3.5 million people in the UK are living with a rare condition. Also, about 1 in 17 people are affected by a rare condition at some point in their lives. The UK government’s “England Rare Diseases Action Plan 2025” aims to improve the lives of people with rare diseases in 2025. The National Institute of Health and Care Research (NIHR) announced an investment of £14 million over 5 years (2023-2028) to support rare disease research.

By Cell Type

By Technology

By Application

By Product Type

By End-User

By Region

February 2026

February 2026

February 2026

February 2026