February 2026

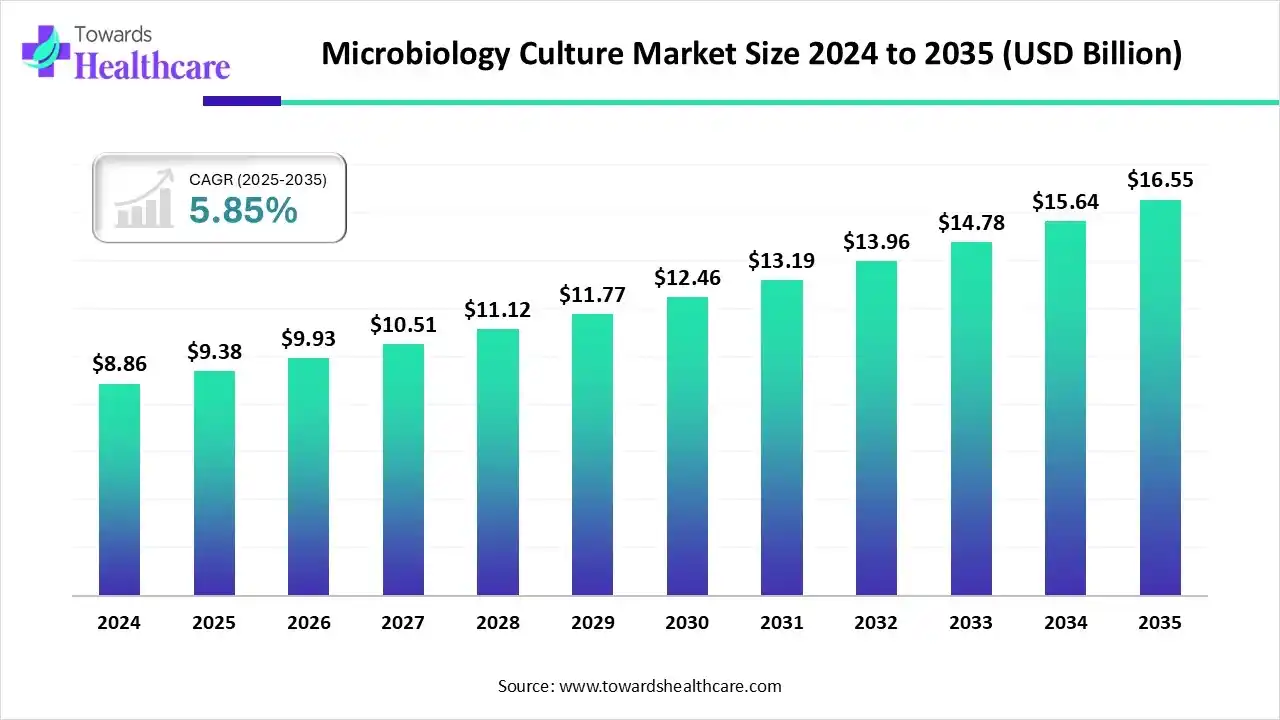

The global microbiology culture market size is calculated at US$ 9.38 billion in 2025, grew to US$ 9.93 billion in 2026, and is projected to reach around US$ 16.55 billion by 2035. The market is expanding at a CAGR of 5.85% between 2026 and 2035.

Applications in environmental testing, food testing, pharmaceuticals, and clinical diagnostics are driving stability in the microbiology culture market. Demand for various culture techniques has increased as a result of a focus on R&D and an increasing emphasis on pathogen detection and contamination prevention.

| Table | Scope |

| Market Size in 2025 | USD 9.38 Billion |

| Projected Market Size in 2035 | USD 16.55 Billion |

| CAGR (2026 - 2035) | 5.85% |

| Leading Region | North America |

| Market Segmentation | By Product, By Type, By Application, By Region |

| Top Key Players | Thermo Fisher Scientific Inc., Merck KGaA, bioMérieux SA, BD, Bio-Rad Laboratories, Inc., Neogen Corporation, HiMedia Laboratories, Hardy Diagnostics, Amerigo Scientific. |

The growing need for pharmaceutical development, research, and diagnostic testing has made the microbiology culture market an essential sector of the biotechnology and healthcare sectors. The market includes a broad variety of culture media, tools, and associated services for the cultivation, identification, and research of microorganisms. The market is expected to grow significantly due to biotechnology advancements and an increase in the prevalence of infectious diseases. The future is being shaped by strategic investments and innovations, which makes it a crucial area of focus for stakeholders looking to improve research capabilities and diagnostic accuracy globally.

From complex datasets such as whole-genome sequencing, mass spectrometry, and clinical laboratory reports, ML and DL enable rapid and precise identification of microbial pathogens. By boosting pathogen detection, anticipating antibiotic resistance, and enhancing clinical decision-making, artificial intelligence is transforming medical microbiology. Colony identification and antimicrobial susceptibility testing are made faster and more accurate by AI's ability to automate image analysis for culture-based diagnostics. Antimicrobial resistance (AMR) surveillance is among the most significant uses of AI.

How did the Culture Media Dominate the Microbiology Culture Market in 2024?

The culture media segment accounted for the largest share of the market in 2024 because the majority of microbiological tests depend on culture media to produce pure cultures, grow and count microbial cells, and cultivate and select microorganisms. Achieving precise, repeatable, and reproducible microbiological test results is less likely in the absence of high-quality media.

Reagents & Consumables

The reagents & consumables segment is estimated to be the fastest-growing during the forecast period due to their importance in microbial culture and further steps. These reagents and consumables are essential for obtaining accurate results, and without them, researchers, scientists, and lab technicians cannot conduct experiments, tests, etc.

Instruments

The instruments segment is expected to grow significantly in the microbiology culture market during 2025-2034, as microbiology labs depend on a variety of specialized tools to conduct precise experiments and analyses. Microbiology labs its important in scientific research and the study of microorganisms. Numerous tools for identifying, culturing, and analyzing microorganisms are available in these labs.

What Made the Bacterial Segment Dominant in the Market in 2024?

The bacterial segment accounted for the largest share of the market in 2024 due to the usage of bacterial culture for various purposes. Bacterial culture is used in medical diagnosis, scientific research, industrial products, and food safety. Apart from this, bacterial culture is also used in the development of vaccines and therapeutics.

Viral

The viral segment is expected to grow at the fastest CAGR during the forecast period. The primary goals of virus culture are to produce viruses for vaccine development, study viral biology and host cell effects, and isolate and identify viruses from clinical samples for diagnostic purposes. Testing a virus's resistance to antiviral medications is another use for culture.

Fungal & yeast

The fungal & yeast segment is expected to grow significantly in the microbiology culture market during 2025-2034 due to several reasons. Fungal and yeast cultures are used in the production of various pharmaceutical products. They are also part of developing GMOs for producing superfoods or various biopharma products. Apart from this, they are also responsible for various infections, due to which their microbial testing is conducted.

Which Application Dominated the Microbiology Culture Market in 2024?

The pharmaceutical & biopharmaceutical production segment accounted for the largest share of the microbiology culture market in 2024. The pharmaceutical and biopharmaceutical industries face a significant risk of pharmaceutical product contamination by undesirable microorganisms, which can compromise patient safety and product integrity. Licensed pharmaceutical and biopharma manufacturing companies worldwide must follow stringent guidelines and robust quality control protocols issued by their respective government agencies to avoid contamination events.

Diagnostics

The diagnostics segment is expected to grow at the fastest CAGR during the forecast period because diagnostics are at the forefront of healthcare, whether it be for infectious diseases, cancer, diabetes, or major health threats, and begin and depend on them. Using diagnostics, medical professionals can obtain the exact data they need to support early disease detection, prevention, and monitoring.

Food & Water Testing

The food & water testing segment is expected to grow significantly in the microbiology culture market during 2025-2034, because there will be a greater need for wholesome, safe, and high-quality food and water in 2025. Because of climate change, changing food safety laws, and growing public awareness, it is now imperative for all food and beverage businesses to ensure compliance.

North America dominated the microbiology culture market in 2024 primarily because of its sophisticated healthcare system, significant investment in R&D, and strong regulatory oversight. Many of the best pharmaceutical companies, diagnostic labs, and research institutes in the area frequently use microbial culture methods.

Because of agencies like the FDA, CDC, HHS, and others, the U.S. dominates the market. By altering the trajectory of antibiotic resistance, the U.S. government will take coordinated, strategic steps over the next five years to improve the health and well-being of all Americans, as outlined in the National Action Plan for Combating Antibiotic-Resistant Bacteria (CARB), 2020–2025.

In 2024, respiratory infections dominated US Point-of-Care (POC) testing. The CDC reported over 12 million dengue cases globally in 2024, leading to increased local transmission risk in US states like Florida. NIH announced a $30 million investment in primary care research in June 2024.

Asia Pacific is estimated to host the fastest-growing microbiology culture market during the forecast period. The Asia-Pacific region's fast urbanization and industrialization in China, India, and Southeast Asian nations has raised demand for microbiological culture products in a number of sectors, including as healthcare, food and beverage, and pharmaceuticals. Additionally, the region's food industry is experiencing a surge in demand for microbiological testing and quality control methods due to growing awareness of hygiene and food safety requirements, which is speeding up market expansion.

The microbiology culture market is gaining momentum in India due to the rising incidence of infectious diseases. The Indian Council of Medical Research (ICMR) reported that the transmission of infectious illnesses increased from 10.7% in the first quarter of 2025 to 11.5% in the second quarter.

According to the ICMR's Virus Research and Diagnostic Laboratories (VRDL) network, 24,502 (10.7%) of 2,28,856 samples tested positive for pathogens between January and March 2025, and 26,055 (11.5%) of 2,26,095 samples tested positive between April and June 2025. As a result, the infection rate increased by 0.8 percentage points from the previous quarter, indicating that infection trends need to be closely monitored.

An ICMR study in 2025 found that 1 in 9 persons tested positive for an infectious disease; the infection rate rose by 0.8 percentage points in Q2 2025. The top pathogens detected were Influenza A, Dengue virus, and Hepatitis A, signaling seasonal disease risk.

Europe is expected to grow at a significant CAGR in the microbiology culture market during the forecast period. Strict regulatory systems that support microbiological product safety and quality benefit the region. The European Food Safety Authority (EFSA) is essential in creating regulations that promote innovation and safeguard consumers, which propels market expansion.

With £2.3 billion in capital investment, the UK government will establish 160 community diagnostic centers (CDCs) a year ahead of schedule, according to Health and Social Care Secretary Steve Barclay. In order to expedite access to potentially life-saving examinations and diagnostics, all CDCs were opened by March 2024. In order to decrease hospital visits and assist patients in receiving care much sooner, CDCs seek to provide patients with a wider range of diagnostic tests closer to their homes as well as more options for where and how they are treated.

The UK Health Security Agency (UKHSA) reported that infectious diseases caused over 20% of hospital bed usage in 2023-2024. Provisional 2024 data showed a 13% further increase in Tuberculosis (TB) cases. The new RSV vaccine led to a 30% reduction in hospital admissions among 75–79-year-olds.

South America is expected to grow significantly in the microbiology culture market during the forecast period. The broader South American market is growing due to infectious disease prevalence and biopharma quality control. International companies, like bioMérieux, acquired local firms in late 2025 to enhance regional microbiological data analytics capabilities.

Brazil's microbiology culture market expansion is fueled by compliance with Law 13,123/2015 for genetic resources. This legislation, focusing on biodiversity and pathogen access, compels research institutes to prioritize rigorous, traceable microbial culture practices.

Brazil reported a total of 3,468,229 confirmed dengue cases in 2025 (as of October 27). This public health crisis has led to declared states of emergency in several states. All four dengue serotypes (DENV-1, 2, 3, 4) were reported, highlighting widespread viral circulation.

The Middle East and Africa are expected to grow at a lucrative CAGR in the microbiology culture market during the forecast period. Local and regional suppliers, such as HiMedia Laboratories, play a crucial role in MEA by offering a wide range of cost-effective, high-quality dehydrated and prepared media. Their presence is significant in general testing and academic research, focusing on providing comprehensive formulations, including specialized Animal-Free Media.

In the UAE, the emphasis on high-throughput diagnostics and environmental monitoring elevates the need for high-end, selective media. Premium brands like Merck MilliporeSigma and Thermo Fisher's Oxoid are vital for pharmaceutical sterility testing and cleanroom monitoring, alongside specialized chromogenic media for rapid identification.

Government funding for healthcare reached $1.36 billion in 2024. The high rate of cardiovascular disease, which accounts for 40% of Emirati mortality, fuels demand for high-complexity IVD tests. The estimated undiagnosed Hepatitis B cases are near two-thirds of an 18,000-patient pool.

The five "I"s of microorganisms, inoculation, incubation, isolation, inspection, and identification, are the focus of research and development (R&D) in microbiology culture. R&D efforts are concentrated on creating new media, automation, and methods for cultivating picky or uncultivated microbes.

Top Companies Include: Thermo Fisher Scientific, Merck KGaA, and BioMérieux

Clinical trials include preclinical research, ethical committee and regulatory (e.g., FDA, CDSCO) approvals, Phase I, II, and III human trials, market authorization/NDA submission, and post-market surveillance.

Key companies Include: Charles River Laboratories, Abbott, Thermo Fisher Scientific, IQVIA, and Parexel, among others.

In order to guarantee product integrity and quality, microbiology culture medium must be manufactured (by Thermo Fisher Scientific, BD, and Merck), packaged under precise circumstances (temperature control, sterility), and transported via a controlled supply chain to hospitals and clinics.

Company Overview: A global leader in scientific services, offering a vast array of instruments, consumables, reagents, and services for research, clinical diagnostics, and applied markets. Its microbiology culture portfolio is primarily handled by the Specialty Diagnostics Segment and the Life Sciences Solutions Segment.

Corporate Information (Headquarters, Year Founded, Ownership Type):

History and Background:

History and Background: Formed through the merger of Thermo Electron Corporation and Fisher Scientific International in 2006. The company's microbiology expertise stems from its acquisition of companies like Remel and Oxoid, providing a foundational and global presence in culture media and microbial identification.

Key Milestones/Timeline:

Business Overview:

Business Overview: Provides a seamless workflow across research, diagnostics, and production. In microbiology, the focus is on end-to-end solutions, from sample collection to identification, susceptibility testing, and food/water safety testing. Annual Revenue (FY 2024 estimate): Approximately $42.86 Billion.

Business Segments/Divisions:

Geographic Presence:

Geographic Presence: Global presence with major operations in North America, Europe, and Asia-Pacific. North America holds the largest market share in microbiology culture (approx. 38.27% of the global market in 2024), where Thermo Fisher is a dominant player.

Key Offerings:

End-Use Industries Served:

End-Use Industries Served: Clinical Diagnostics/Hospitals, Pharmaceutical & Biopharmaceutical Production (largest application segment, accounting for approx. 36.76% of the market in 2024), Food & Beverage Testing, Academic and Research Institutes, and Environmental Testing.

Key Developments and Strategic Initiatives:

Focused on integrating the large acquisition of PPD (2021) to offer end-to-end clinical trial services, which often require extensive microbiology QC.

Ongoing collaborations with biopharma companies to supply custom, high-quality media for vaccine and biologic production.

Launch of new Thermo Scientific Spectra Chromogenic Media for rapid pathogen detection (e.g., MRSA, VRE, ESBL).

Introduction of the Applied Biosystems QuantStudio 5 Food Safety Real-Time PCR System for high-performance microbial testing in food.

Continuous investment in manufacturing capacity for high-demand bioproduction materials, including specialized media for cell and gene therapy, which often requires ultra-pure microbial QC.

Ongoing focus on securing necessary CE-IVD and US FDA 510(k) clearances for diagnostic and clinical microbiology products.

Distribution channel strategy: A Direct sales force model combined with an extensive global distributor network. Strong emphasis on its e-commerce platform for lab consumables. Also leverages a Tailored Delivery Solution (TDS) for prepared media to boost lab efficiency and inventory management.

Technological Capabilities/R&D Focus: Focused on Digital Integration of diagnostic instruments, Rapid Molecular Methods (PCR) for quick results, and Advanced Media Formulations (chromogenic, selective, and animal-free media) to fight AMR and improve bioproduction yields.

Core Technologies/Patents:

Research & Development Infrastructure:

Research & Development Infrastructure: Global R&D centers dedicated to life sciences, diagnostics, and bioproduction technologies, ensuring its culture media and systems remain compatible with the latest automation and molecular platforms.

Innovation Focus Areas:

Innovation Focus Areas: Antimicrobial Resistance (AMR) detection, high-throughput automated microbiology systems, development of animal-free and chemically defined media for biopharma, and integration of AI/ML for diagnostic data analysis.

Competitive Positioning:

SWOT Analysis:

Recent News and Updates:

Company Overview: A global medical technology company that is a critical provider of medical devices, instrument systems, and reagents. Its microbiology culture business is a core part of its BD Integrated Diagnostic Solutions (IDS) segment.

Corporate Information (Headquarters, Year Founded, Ownership Type):

History and Background:

History and Background: Founded over a century ago, BD has a long history in medical devices. It entered the microbiology field in the 1950s, leading to innovations in sterile disposables and diagnostic medicine. The company has maintained a leadership position through its foundational BD Difco and BD BBL brands of culture media.

Key Milestones/Timeline:

Business Overview:

Business Overview: Focuses on improving medical discovery, diagnostics, and the delivery of care. The microbiology culture business is essential for clinical diagnosis and is highly integrated with its automated instrument platforms. Annual Revenue (FY 2024 estimate): Approximately $20.4 billion.

Business Segments/Divisions:

Geographic Presence:

Geographic Presence: Operates in virtually every country globally. Strong foothold in North America and Europe, with increasing investments and market penetration in the Asia-Pacific (APAC) and emerging markets.

Key Offerings:

End-Use Industries Served:

End-Use Industries Served: Hospitals and Diagnostic Laboratories (a dominant end-user segment, processing the largest volume of patient samples), Pharmaceutical and Biotechnology Quality Control, and Academic Research.

Key Developments and Strategic Initiatives:

Focused on divestitures of non-core businesses to streamline and focus on diagnostics, intervention, and smart medical devices.

Capacity Expansions/Investments:

Continued investment in manufacturing for its proprietary culture media brands and automated diagnostic systems.

Regulatory Approvals:

February 2025: BD received FDA 510(k) clearance and CE-IVDR certification for high-throughput enteric bacterial panels on the BD COR™ System.

Distribution Channel Strategy:

Distribution channel strategy: A mature, multi-channel strategy utilizing direct sales for capital equipment (e.g., BD Kiestra, BD Phoenix) and a mix of direct and distributor sales for high-volume consumables like culture media and specimen collection tubes.

Technological Capabilities/R&D Focus:

Technological Capabilities/R&D Focus: Focus on Total Lab Automation to minimize hands-on time, Rapid Diagnostics (faster time-to-result for ID/AST), and Digital Health/Informatics (e.g., BD Synapsys Informatics) to leverage diagnostic data. R&D in new media formulations optimized for automation.

Core Technologies/Patents:

Research & Development Infrastructure:

Research & Development Infrastructure: Global R&D centers dedicated to infectious disease diagnostics and life science research, focusing heavily on integrating culture media and reagents into automated platforms.

Innovation Focus Areas:

Innovation Focus Areas: Combating AMR through faster and more accurate AST, developing new culture media for emerging pathogens, and integrating diagnostics with informatics to provide actionable clinical insights.

Competitive Positioning:

SWOT Analysis:

Recent News and Updates:

| Company | Core Market Focus | Key Culture Media Offerings | Automation/Technology Contribution | Primary End-Use Segments |

| Merck KGaA | Industrial QC, Biopharma, Lab Solutions | MilliporeSigma Brands: Dehydrated & Ready-to-Use (RTU) media, MC-Media Pads, media for Environmental Monitoring. | Steritest™ filtration systems, M-Trace® data tracking for QC. | Pharmaceutical QC (Sterility, Bioburden), Food/Beverage, Water Testing. |

| bioMérieux SA | Clinical Diagnostics, Lab Automation | Ready-to-Use media, IDEA™ STEC Agar, MASTERCLAVE® media preparators. | BACT/ALERT® Blood Culture, VITEK® ID/AST systems, WASPLab® automation (via Copan). | Clinical Laboratories (ID/AST, Sepsis), Pharma QC, Food Safety. |

| Bio-Rad Laboratories | Clinical, Life Science Research, Food Safety | An extensive range of Chromogenic Media (e.g., Select series), AST disks, and Standard culture media. | Molecular Detection Systems (PCR), Automated Serotyping, Rapid ID tests. | Clinical Bacteriology, Food Pathogen Detection, Academic Research. |

| Neogen Corporation | Food Safety, Industrial QC | Neogen® Culture Media (DCM, RTU), Harlequin® chromogenic agars, One Broth One Plate workflow. | Rapid Microbiology (e.g., Soleris), Molecular Detection Systems (MDS) for pathogens. | Food & Beverage Safety, Animal Health, Water Testing, Veterinary Diagnostics. |

| HiMedia Laboratories | Global Research, Academia, Affordable Solutions | Extensive portfolio of Dehydrated Culture Media (DCM), Animal-Free Media (HiVeg), and supplements. | Antimicrobial Susceptibility Systems, Chromogenic media, Reference Culture Distribution (ATCC in India). | Academia/Research, General Microbiology Labs, Developing Markets, Pharma QC. |

By Product

By Type

By Application

By Region

February 2026

February 2026

February 2026

February 2026