February 2026

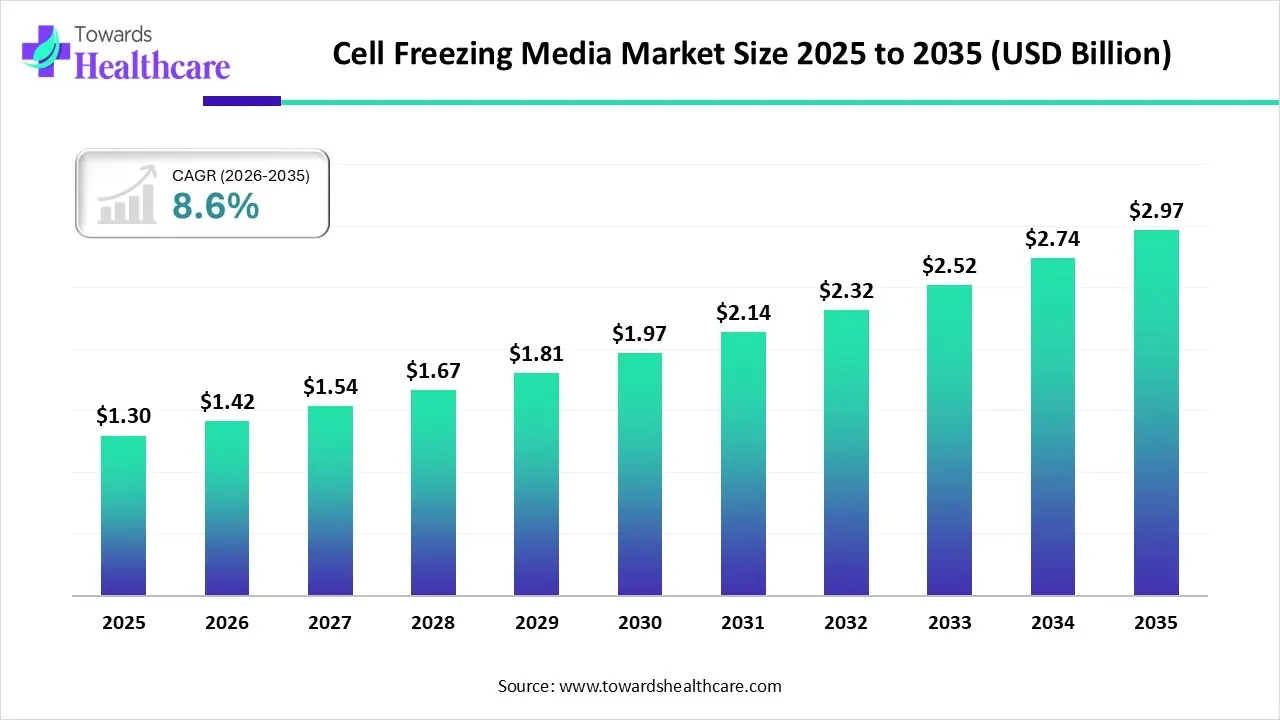

The global cell freezing media market size is calculated at US$ 1.30 in 2025, grew to US$ 1.42 billion in 2026, and is projected to reach around US$ 2.97 billion by 2035. The market is expanding at a CAGR of 8.6% between 2026 and 2035.

Due to growing demand for cryopreservation solutions for cell-based therapies, regenerative medicine, and biopharmaceutical research, the cell freezing media market is anticipated to expand quickly. There is a growing need for specialized freezing media formulations as these industries develop, especially in areas like gene therapy, regenerative medicine, and cell banking.

| Key Elements | Scope |

| Market Size in 2025 | USD 1.30 billion |

| Projected Market Size in 2035 | USD 2.97 billion |

| CAGR (2026 - 2035) | 8.6% |

| Leading Region | North America (40-46% Approx) |

| Market Segmentation | By Product/Type, By Application, By Formulation/Technology, By End User, By Distribution Channel, By Region |

| Top Key Players | Thermo Fisher Scientific, BioLife Solutions, Merck KGaA/MilliporeSigma, STEMCELL Technologies, Corning Life Sciences (including Axygen, Falcon consumables), Bio-Rad Laboratories, CTS Bio, HiMedia Laboratories, AMSBIO, BioGenuix MedSystems, Cryo-BioSystems, Lonza, VWR/Avantor, Sakura Finetek, StemCyte, BioLife, Fujifilm Wako/Toyo, Thermogenesis, CryoSafe |

Cell freezing (cryopreservation) media are specialized formulations used to preserve cells, tissues, gametes, and other biological materials at ultra-low temperatures (usually in liquid nitrogen or −80°C freezers). These media contain cryoprotectants (e.g., DMSO, glycerol), buffers, proteins/serum or serum-free alternatives, antioxidants, and other additives to minimise ice-crystal damage and preserve viability/function after thawing. Key end-users include biobanks, cell-therapy manufacturers, IVF/ART clinics, research labs, and pharmaceutical/CDMO quality control labs.

Automation and artificial intelligence (AI) are revolutionizing the market by improving quality control and formulation accuracy. Researchers and manufacturers are finding the best cryoprotectant compositions more quickly and effectively thanks to AI-driven data analytics tools. Furthermore, AI is essential for predictive modeling aimed at understanding cell viability and recovery after thawing, thereby enabling the development of specialized freezing media for various cell types.

Which Product/Type Segment Dominated the Market in 2024?

Cryopreservation/Cell-Freezing Media

The cryopreservation/cell-freezing media segment dominated the cell freezing media market in 2024, accounting for approximately 40-55% of revenue. The process of using extremely low temperatures to maintain structurally intact living cells is known as cryopreservation, or cell freezing. Because unprotected freezing kills cells, a specific protective cryopreservation medium is needed to accomplish this. Currently, liquid nitrogen is the most widely used technique for cell cryopreservation.

Serum-Free/Defined Freezing Media

The serum-free/defined freezing media segment is expected to grow at the fastest CAGR in the cell freezing media market during the forecast period because animal-derived ingredients are no longer necessary with serum-free formulations. Rather, they use synthetic or plant-based alternatives to shield cells from freezing and thawing. One of the main justifications for employing serum-free cell freezing media is to lower batch-to-batch variability and contamination risk.

Cryoprotectants

The cryoprotectants segment is expected to grow at a significant CAGR during the forecast period. During organ cooling, ice formation can cause freezing damage to biological tissue, which is why cryoprotectant agents are used to stop it. By raising the system's overall solute concentration, they lessen the formation of ice at any temperature. Cryoprotectants are important for both cell recovery with higher levels of appropriate functionality and cell processing for storage at deep cryogenic temperatures.

Why Stem Cells & Cell Therapy Dominated the Market in 2024?

The stem cells & cell therapy segment dominated the cell freezing media market in 2024, accounting for approximately 35-45% of revenue. As a regenerative medicine approach, cell-based therapy has proven to be a successful method for treating and, in some cases, curing a variety of illnesses and conditions. Additionally, two of the most cutting-edge medical procedures nowadays are stem cell therapy and regenerative medicine. They are revolutionizing the treatment of a wide range of diseases and injuries.

Drug Discovery/Pharma/CDMO

The drug discovery/pharma/CDMO use segment is expected to grow at the fastest CAGR in the cell freezing media market during the forecast period. Cryopreservation is very beneficial to pharma and biotech, especially in genetic engineering and drug development. Indefinite storage of microorganisms, cell lines, tissues, etc., used in drug development and research ensures the availability and stability of vital biological resources and permits long-term research and experimental reproducibility.

Biobanking & Research Samples

The biobanking & research samples segment is expected to grow at a significant CAGR during the forecast period. In order to gather, store, and handle biological samples, such as blood, cells, tissues, and DNA, for a variety of research applications, such as figuring out the genetic causes of illnesses, creating new medications, and finding biomarkers, biobanks are essential. It is now simpler to gather, store, and analyze vast amounts of biological data thanks to developments in data science and biotechnology. In addition to increasing demand for carefully selected, diverse biobanks, this has enabled researchers to extract more insight from biobank samples.

Why DSMO-Based Media Dominated the Cell Freezing Media Market in 2024?

The DMSO-based media segment accounted for the largest share of the market in 2024 because when temperatures drop, DMSO is essential for cell protection. Because DMSO prevents ice crystals from forming inside cells, it is a crucial tool in cell cryopreservation for biopharmaceutical research, development, and manufacturing. It functions as a cellular antifreeze, protecting cells during the freezing process.

DMSO-Free Alternatives

The DMSO-free alternatives segment is expected to grow at the fastest CAGR in the cell freezing media market during the forecast period. Because DMSO-free solutions can be safer and more effective, researchers and pharmaceutical companies are increasingly using them to address the problems caused by DMSO. For more delicate cell types, such as mesenchymal stem cells or iPSCs, DMSO-free freezing solutions may be helpful.

Vitrification Solutions

The vitrification solutions segment is expected to grow at a significant CAGR during the forecast period because vitrification removes mechanical damage from ice, the need to determine optimal cooling and warming rates, the significance of different optimal cooling and warming rates for cells in mixed cell type populations, the need to find a regularly imperfect compromise between solution effects injury and inside of cells ice formation, and the ability for cooling to be fast enough to "outrun" chilling injury, that it often simplifies and improves cryopreservation.

Which End-User Segment Dominated the Cell Freezing Media Market in 2024?

The biopharma & cell therapy manufacturers segment dominated the cell freezing media market in 2024, accounting for approximately 38-45% of revenue. To prevent damage to cells during freezing and storage, biopharma and cell therapy manufacturers use specialized cell-freezing media that mainly contain cryoprotectants like DMSO. Thermo Fisher Scientific, HiMedia Laboratories, Miltenyi Biotec, and BioLifeSolutions are some of the top producers and suppliers of this media.

Academic & CROs Research Labs

The academic & CRO research labs segment is expected to grow at the fastest CAGR in the cell freezing media market during the forecast period. These end users use cell-freezing media because they are involved in various cell-based clinical trials. These companies focus on developing cell therapies, regenerative medicine, drug discovery, cytotoxicity, etc.

IVF/ART Clinics

The IVF/ART clinics segment is expected to grow at a significant CAGR during the forecast period. Specialized cell freezing media called cryoprotectants are used in IVF and other Assisted Reproductive Technology (ART) clinics to preserve gametes (eggs and sperm) and embryos for later use. For ART treatments to be more safe and effective, this procedure is essential.

Which Distribution Channel Segment Dominated the Market in 2024?

The direct sales to institutions/OEM supply segment dominated the cell freezing media market in 2024 because, in terms of their services, the majority of labs, healthcare providers, pharmaceutical companies, and biotech businesses prioritize accuracy, consistency, and dependability. Therefore, many end users are looking to OEM manufacturing and direct sales as strategic, cost-effective solutions in today's highly competitive market.

Online B2B Platforms

The online B2B platforms segment is expected to grow at the fastest CAGR in the cell freezing media market during the forecast period. Additionally, hospitals, labs, institutions, and biotech and pharmaceutical companies are likely to seek better prices through supplier consolidation, stronger negotiations, and product selection as a result of rising costs and margin pressures. There are now a lot of B2B platforms that try to solve these problems.

Scientific Distributors & Wholesalers

The scientific distributors & wholesalers segment is expected to grow at a significant CAGR during the forecast period. Important cell freezing media made with cryoprotectants like DMSO are supplied by scientific distributors, guaranteeing dependable supply chains and high post-thaw cell viability for fruitful research and biobanking.

North America dominated the cell freezing media market in 2024 because developed economies, established supply chains, major players, and sophisticated healthcare infrastructure all contribute to driving the market. Furthermore, the biopharmaceutical sector is in a race to develop cutting-edge, effective treatments amid the prevalence of illnesses and an aging population. This has increased demand for cell-freezing media and is anticipated to continue making money in the future.

Cell freezing is a widely used process in the development of biopharmaceutical products, as various types of regular and genetically modified cells are used. The U.S. biopharmaceutical market is driven by rising demand for cancer vaccines, cell & gene therapies, and monoclonal antibodies, among other factors.

For instance,

Between 2015 and 2024, the FDA approved 495 new biopharmaceuticals, of which 45% came from established businesses, 24% from venture capital-backed startups, 20% from foreign businesses with no commercial presence in the US, and 8% from government or academic institutions.

Asia Pacific is estimated to host the fastest-growing cell freezing media market during the forecast period. Over the forecast period, the market is expected to see rapid demand growth in emerging nations such as South Korea, China, Brazil, India, Indonesia, and Japan. This is due to the growing emphasis on the pharmaceutical and biopharmaceutical industries for the development of stable, advanced products, as well as mounting government initiatives expected to increase market share in the region.

China is leading the cell-freezing media market in the Asia Pacific due to the rising number of clinical trials for developing cell therapies. Freezing cells is a very common practice in cell therapy development.

For instance,

Between 2014 and 2024, China conducted 206 cell therapy trials. The top three cell types are progenitor cells (4.9%, 10/206), stem cells (34.0%, 70/206), and T cells (51.4%, 106/206).

Europe is expected to grow at a significant CAGR in the cell freezing media market during the forecast period because of developments in biopharmaceuticals, regenerative medicine, and cell-based research. Notwithstanding the market's potential for expansion, barriers like legal restrictions, moral dilemmas, and safety worries about cryopreservation methods could prevent the European market from expanding. Regional market expansion may also be hampered by budgetary constraints in research funding and economic uncertainty.

In January 2025, the world's most thorough investigation of the proteins that circulate in our bodies will begin, according to UK Biobank, and it will revolutionize the study of illnesses and their cures. With the help of 600,000 samples—including those from half a million UK Biobank participants and 100,000 second samples obtained from these volunteers up to 15 years later—this unprecedented project hopes to measure up to 5,400 proteins in each sample.

South America is expected to grow significantly in the cell freezing media market during the forecast period. South America’s market is heating up, driven by rising investments in regenerative medicine and stem cell research. Brazil is a key player, witnessing a surge in biobanking activities for long-term preservation. Increased government focus on pharmaceutical innovation fuels this positive trajectory.

Brazil is accelerating its demand for cell freezing media, reflecting a powerful expansion in biopharma and R&D. The growing need for effective cryopreservation in cell therapies and drug discovery is boosting this sector. Adoption of advanced media formulations is rapidly increasing.

The Middle East and Africa are expected to grow at a lucrative CAGR in the cell freezing media market during the forecast period. The Middle East and Africa region presents a promising yet evolving landscape. Key markets like the UAE are pioneering growth, supported by substantial government investment in healthcare infrastructure. Increased awareness of personalized medicine applications is positively influencing demand.

The UAE stands out as the fastest-growing market in the MEA region for cell cryopreservation products. This robust expansion is fueled by rising biobanking and fertility preservation services. The UAE's strategic push for advanced life sciences establishes it as a major regional player.

Extensive research and development are needed to determine the optimal cooling rates and cryoprotectant concentrations (such as DMSO and glycerol) for cell freezing media in order to guarantee high cell viability after thawing.

Key Companies Include: Thermo Fisher Scientific, Merck KGaA, BioLife Solutions, Lonza, Corning Incorporated, Fujifilm Irvine Scientific, and Miltenyi Biotec

For cell freezing media used in therapeutic applications, regulatory approvals and clinical trials are essential. Before being approved for human use on the market, extensive testing is required to demonstrate safety and efficacy.

Key Companies Include: Merck KGaA, Thermo Fisher Scientific, BioLife Solutions, Lonza, Fujifilm Irvine Scientific, ReNeuron Group, and Patheon

Cell freezing media packaging and serialization procedures need to guarantee traceability and sterility. Proper packaging is essential for preserving the product's integrity during storage and transportation.

Key Companies Include: Peli BioThermal, Sonoco Thermasafe, CSafe, Va-Q-tec, Thermo Fisher Scientific, BioLife Solutions, and Antares Vision Group

Company Overview

Company Overview

| Company | Offerings | Contributions | Key products |

| BioLife Solutions | cryopreservation media and storage systems | standardizing protocols, enabling cell viability | cryo-bags and controlled-rate freezers for clinical workflows |

| STEMCELL Technologies | research media and cryopreservation reagents | advancing reproducibility and protocol guidance globally | freezing media kits, cryo-solutions, validated protocols |

| Corning Life Sciences | labware, cryovials, plates, and consumables | improving sample handling standards | Falcon tubes, Axygen vials, and specialized plastics globally |

| Bio-Rad Laboratories | quality control assays, cryo reagents | ensuring assay reliability and storage confidence | validation kits, cold chain monitoring tools |

| CTS Bio | custom cryopreservation solutions and services | supporting bespoke workflows for clinical research | tailored media, consultancy, on-demand support |

By Product/Type

By Application

By Formulation/Technology

By End User

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026