December 2025

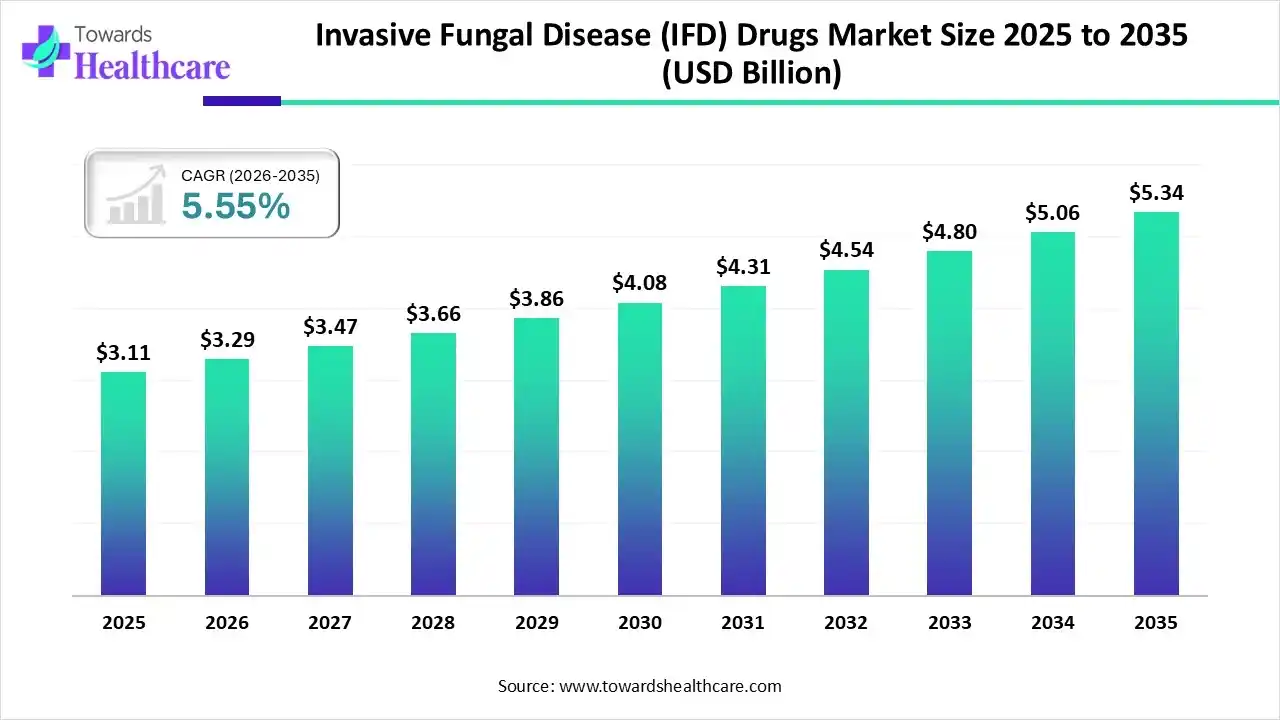

The global invasive fungal disease (IFD) drugs market size was estimated at USD 3.11 billion in 2025 and is predicted to increase from USD 3.29 billion in 2026 to approximately USD 5.34 billion by 2035, expanding at a CAGR of 5.55% from 2026 to 2035.

The globe is promoting the development of novel agents against diverse pathogen types, like candidiasis, aspergillosis, etc. Researchers are putting efforts into designing new drug delivery solutions and the greater adoption of advanced AI algorithms to find antifungal properties.

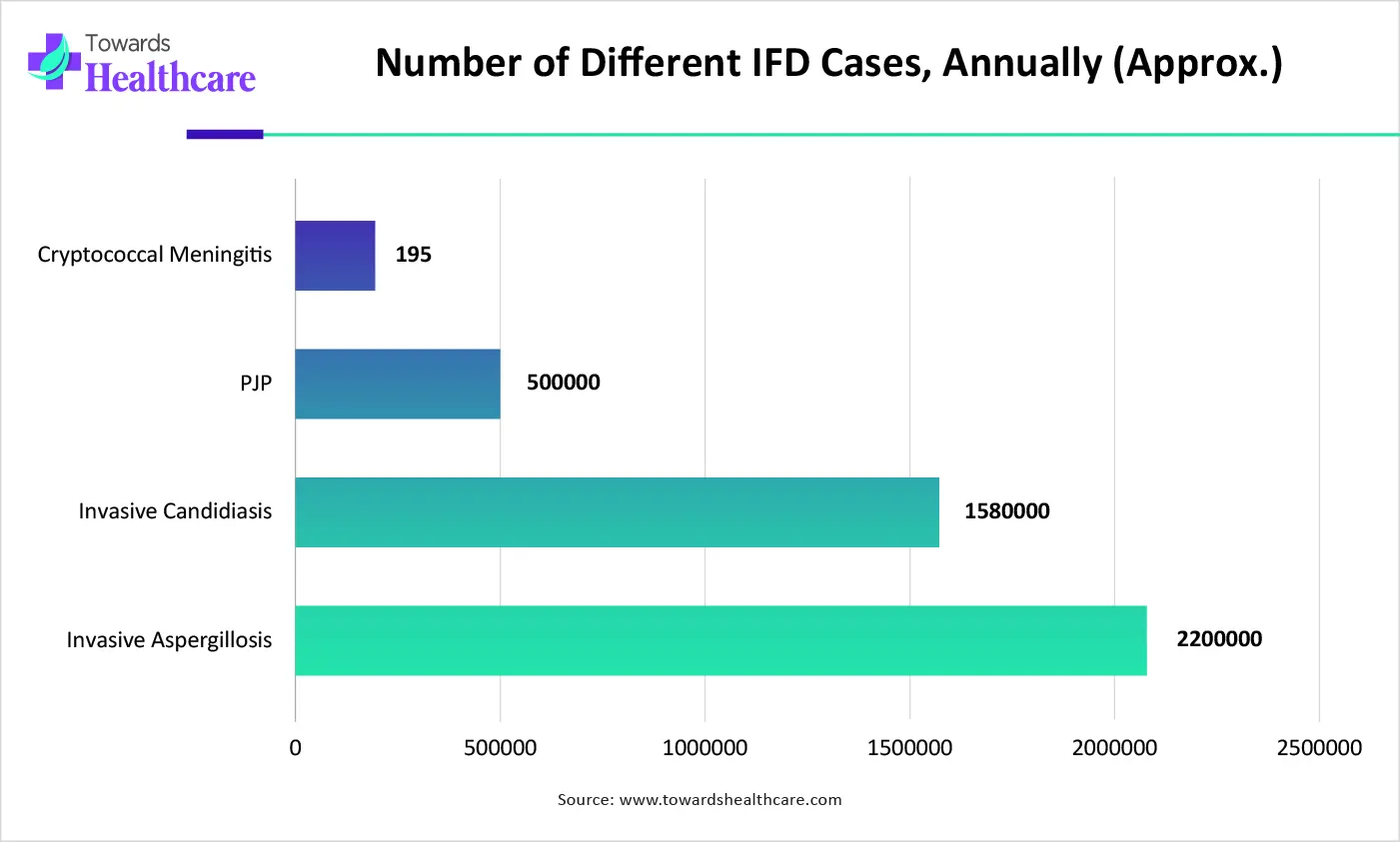

Primarily, the invasive fungal disease (IFD) drugs market covers diverse specialized antifungal agents to treat severe, systemic infections caused by pathogens, such as Candida, Aspergillus, and Mucorales, especially in immunocompromised patients. The adoption of these more efficacious drugs is propelled by the growing pool of immunocompromised individuals, the evolution of resistant strains, and rising healthcare-associated infections. To overcome these concerns, researchers are putting efforts into developing new, broad-spectrum agents with ideal mechanisms of action, long-acting formulations, & advanced drug delivery systems.

Particularly, robust AI models, such as generative adversarial networks (GANs) & diffusion models, are evolving new molecular structures with antifungal properties. Alongside, an innovative step in diffusion-based AI platform, like MolDiffusion, is also revolutionizing the market by targeting five different fungal proteins, with 50% of generated candidates having in vitro activity.

The globe is facing a burden of advanced infections, which support shifting towards the use of mold-active prophylactic agents in high-risk patients, such as AML and transplant recipients.

The market is rigorously innovating alternative drug delivery systems, especially nanoparticles & liposomal formulations, to raise efficiency and lower toxicity.

Key players are emphasizing exploration of rapid, non-culture-based diagnostics, like PCR and lateral flow assays, to find fungal species and determine resistance markers early.

| Key Elements | Scope |

| Market Size in 2026 | USD 3.29 Billion |

| Projected Market Size in 2035 | USD 5.34 Billion |

| CAGR (2026 - 2035) | 5.55% |

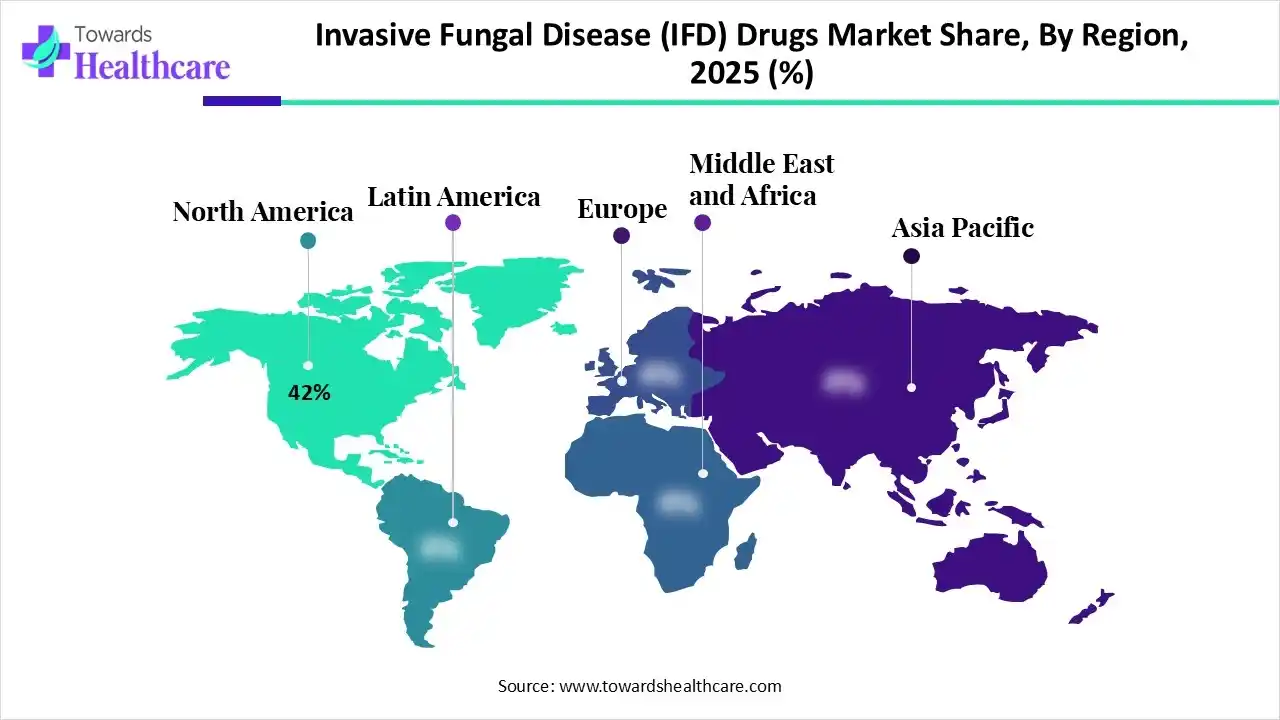

| Leading Region | North America by 42% |

| Market Segmentation | By Drug Class, By Pathogen Type, By Route, By End-User, By Region |

| Top Key Players | Pfizer Inc., Merck & Co. (MSD), Gilead Sciences, Inc., Astellas Pharma Inc., Basilea Pharmaceutica,Cidara Therapeutics, Scynexis, Inc., F2G Ltd., Viatris (Mylan/Upjohn), Novartis (Sandoz) |

Which Drug Class Led the Invasive Fungal Disease (IFD) Drugs Market in 2025?

In 2025, the azoles segment captured approximately 48.5% share of the market. A key driver is the adoption of the latest triazoles, like voriconazole, which have immersive activity against diverse fungi, like Candida species, Aspergillus species, Cryptococcus, & endemic fungi. Ongoing developments are promoting the use of a polymer matrix in itraconazole to raise & resolve variable absorption to treat endemic fungi.

Echinocandins

Moreover, the echinocandins segment will expand at nearly 6.8% CAGR. They have rigorous activity in patients those undergoing chemotherapy, organ transplants, or living with HIV/AIDS. Specifically, they have greater effects against C. albicans, C. glabrata, and C. tropicalis. Whereas, Phase III trials (ReSPECT) are assessing rezafungin to mitigate invasive fungal disease in patients with bone marrow transplantation.

How did the Candidiasis Segment Dominate the Market in 2025?

The candidiasis segment held approximately 40.5% share of the invasive fungal disease (IFD) drugs market in 2025. Specifically, C. albicans causes numerous infections, while other species, including C. glabrata, C. tropicalis, C. parapsilosis, and C. krusei results in infections in immunocompromised or hospitalized patients. A recent study comprises Fosmanogepix (Manogepix), a first-in-class, broad-spectrum, oral & intravenous antifungal, which has increased efficacy against multi-drug resistant C. auris & is in Phase III trials.

Aspergillosis

The aspergillosis segment will expand fastest at nearly 7.1% CAGR. The Aspergillus genus, Aspergillus fumigatus, & other species, like A. flavus, A. terreus, A. niger, A. nidulans, and A. latus causes illness. The market is fostering voriconazole and isavuconazole as the first-line, standard-of-care treatments for invasive aspergillosis (IA), & posaconazole for prophylaxis. However, Itraconazole is widely used for Chronic Pulmonary Aspergillosis (CPA), with SUBA-itraconazole.

Which Route Led the Invasive Fungal Disease (IFD) Drugs Market in 2025?

In 2025, the intravenous (IV) segment dominated with an approximate 58.0% share of the market. Increased instances of Candida bloodstream infections (candidemia) in ICUs, linked with catheters & broad-spectrum antibiotics, are demanding immediate IV solutions. Recently developed Rezafungin enables once-weekly IV dosing rather than daily to treat candidemia and invasive candidiasis in adults.

Oral

Whereas the oral segment will expand nearly 12.5% CAGR. Besides easier administration, it has step-down treatment (shifting from IV) & long-term prophylactic management in patients with high-risk conditions. However, azoles, like fluconazole, voriconazole, and posaconazole) and their availability in oral forms is assisting their role in treating different systemic and invasive fungal infections.

Why did the Hospital Pharmacies Segment Dominate the Market in 2025?

The hospital pharmacies segment captured nearly 65.0% share of the invasive fungal disease (IFD) drugs market in 2025. They act as a prominent repository for potent, often restricted antifungal agents, like echinocandins and amphotericin B, which are essential in life-threatening systemic infections. Pharmacists offer improvements in antifungal therapy by demonstrating drug utilization reviews, monitoring for resistance, and confirming proper use of expensive drugs.

Specialty Clinics

Moreover, the specialty clinics segment will expand rapidly. These clinics are facilitating diagnosis and management of IFDs, especially for patient populations that are immunocompromised due to chemotherapy, organ transplants, or HIV. Alongside, patients in ICUs are at high risk for catheter-related candidemia, are impacting hospital-based prophylactic & therapeutic antifungal usage, acting as a vital catalyst.

By capturing approximately 42% share, North America registered dominance in the invasive fungal disease (IFD) drugs market. This is propelled by the increasing prevalence of nosocomial (hospital-acquired) infections and the world's most advanced oncology/transplant infrastructure.

For instance,

U.S. Market Trends

However, the U.S. market has implemented phase 3 trials for new, broad-spectrum, and, in a few cases, oral agents. Recently, Basilea Pharmaceutical began FORWARD-IM, a Phase 3 study for invasive mold infections, such as Aspergillus, Fusarium, and Mucorales.

Asia Pacific is anticipated to witness rapid expansion in the invasive fungal disease (IFD) drugs market. Impactful drivers include a rise in ICU admissions, extended use of catheters, and invasive medical procedures, which demands for systemic antifungal drugs. Moreover, the NMPA has been preferring advanced therapies, with many new antifungals, which target cell walls or membrane integrity.

India Market Trends

Whereas, in India, the National Centre for Disease Control (NCDC) has united Antimicrobial Resistance (AMR) surveillance for fungal pathogens into NARS-Net in March 2025. Also, the CDSCO has approved various novel drugs, such as those for complex, high-technology products.

| Companies | Description |

| Pfizer Inc. | Its offerings include a long-standing, major portfolio and pipeline in treating invasive fungal diseases (IFD), with an emphasis on triazoles & echinocandins |

| Merck & Co. (MSD) | This unveiled Cancidas (caspofungin acetate), Noxafil (posaconazole), and other aspects. |

| Gilead Sciences, Inc. | A firm explored a liposomal formulation of Amphotericin B, called AmBisome. |

| Astellas Pharma Inc | Its R&D activities focus on Oncology, Ophthalmology, Urology, and Immunology. |

| Basilea Pharmaceutica | This emphasizes the commercialization of the azole antifungal Cresemba (isavuconazole) & the progression of a clinical-stage pipeline featuring fosmanogepix & BAL2062. |

| Cidara Therapeutics | Its prominent offering is Rezafungin, branded as REZZAYO |

| Scynexis, Inc. | A company specializes in a new class of antifungals, called triterpenoids or fungerps. |

| F2G Ltd. | It explores discovery & the development of novel therapies for life-threatening and invasive fungal infections. |

| Viatris (Mylan/Upjohn) | It has a vital portfolio of anti-infective drugs, which mainly target IFD. |

| Novartis (Sandoz) | A firm focus on crucial anti-infectives to eliminate antimicrobial resistance (AMR) and widen access to life-saving treatment. |

By Drug Class

By Pathogen Type

By Route

By End-User

By Region

December 2025

December 2025

November 2025

November 2025