February 2026

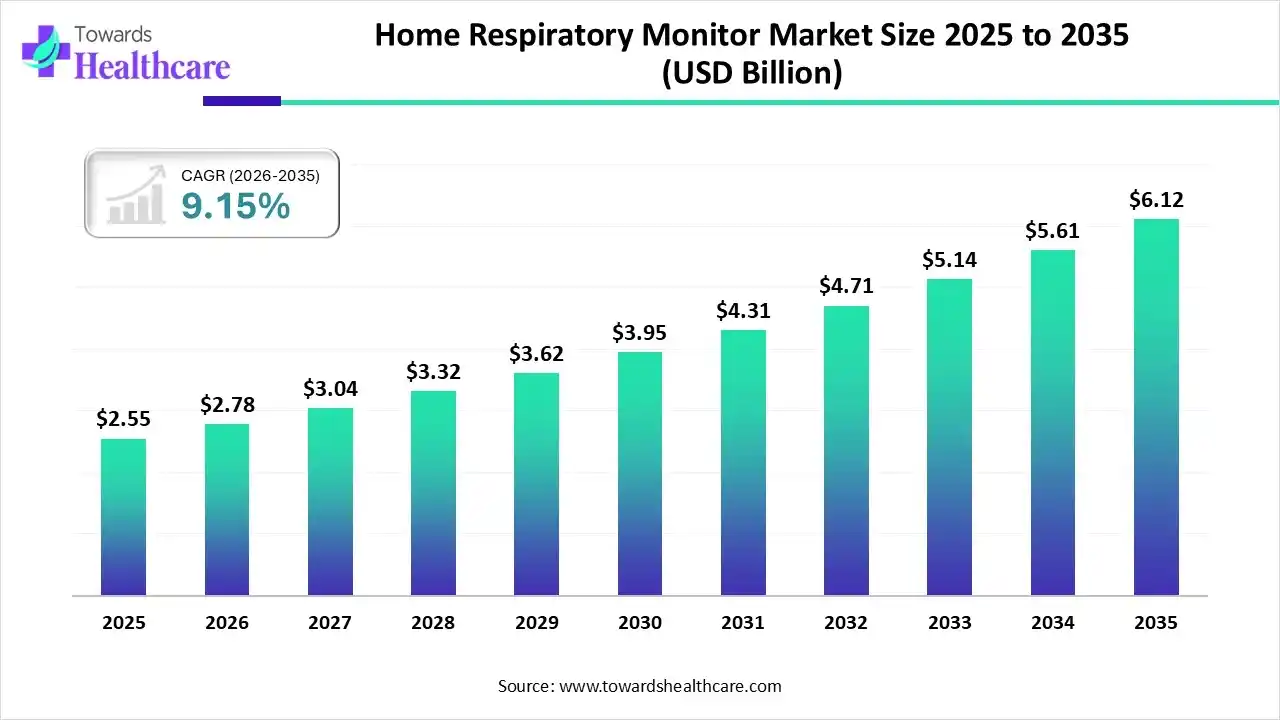

The global home respiratory monitor market size was estimated at USD 2.55 billion in 2025 and is predicted to increase from USD 2.78 billion in 2026 to approximately USD 6.12 billion by 2035, expanding at a CAGR of 9.15% from 2026 to 2035.

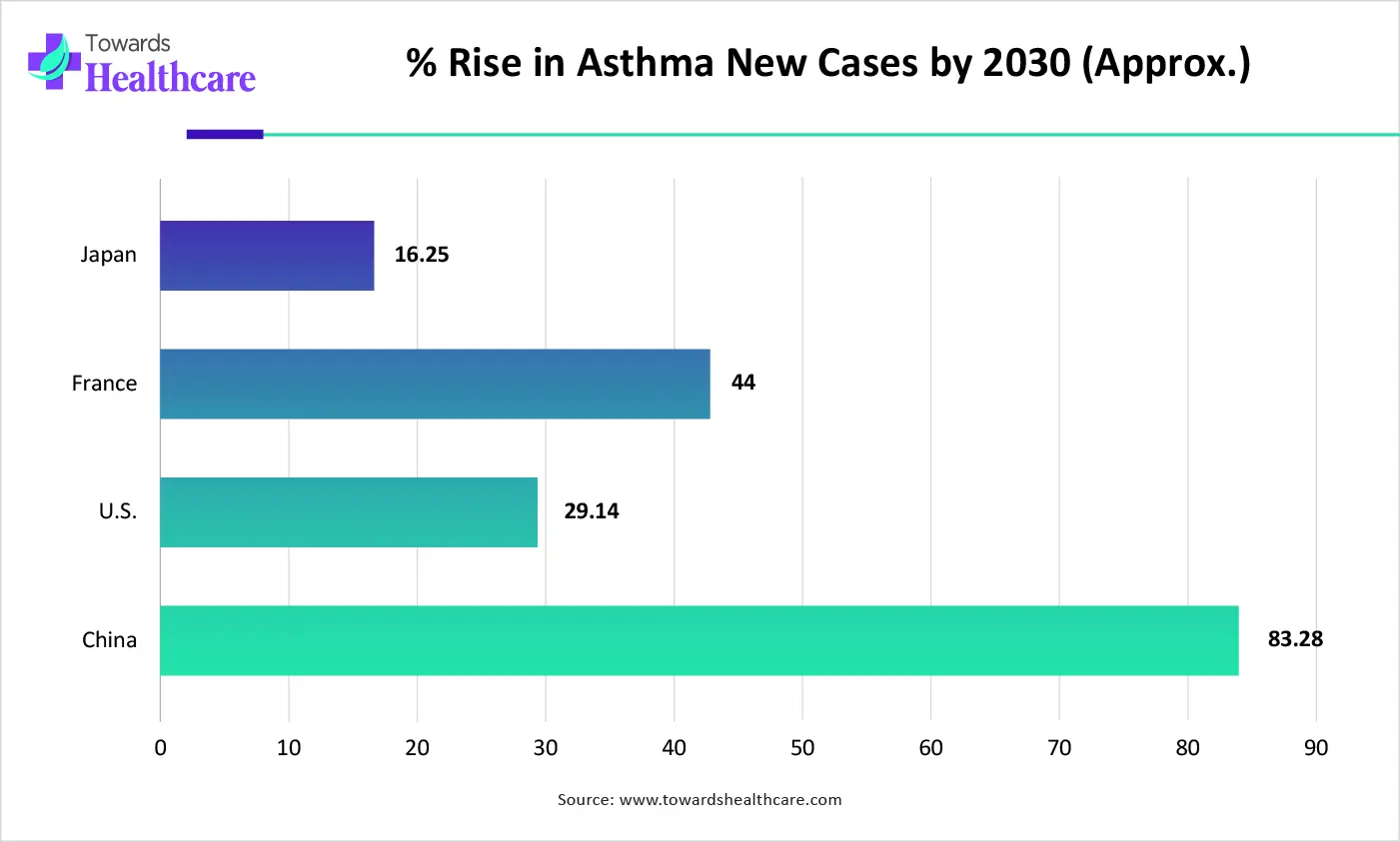

Day by day, the globe is facing a huge rise in COPD and asthma cases, which are demanding more sophisticated respiratory devices. Whereas leading firms are fostering the development of portable solutions, with the use of AI-enhanced approaches.

Primarily, the home respiratory monitor market has shifted from "clinical-only" use to a remote patient monitoring (RPM) standard, and this has been majorly fueled by the "Hospital-at-Home" movement. However, home respiratory monitors are now combined with AI-powered analytics that predict exacerbations in COPD and Asthma patients up to 48 hours before they occur. Moreover, the market has been transforming medical-grade wearable biosensors and patches to track respiratory rate & blood oxygen consistently.

A foremost step by leading companies is a greater emphasis on the development of non-contact sensing, smartphone-based diagnostics, and AI-assisted smart inhalers to manage conditions such as COPD, asthma, & sleep apnea. For example, the APNEAL App is a smartphone-based device that meets FDA/CE requirements and uses phone sensors, like an accelerometer, gyroscope, and microphone, to determine sleep apnea. Whereas the EU RESPIRE project explored a 34% reduction in asthma-related hospitalizations by utilizing machine learning models.

The globe has demonstrated that nearly 75% of devices are predicted to have smart connectivity, conveying data directly to providers for real-time monitoring, which enhances medication adherence by up to 50%.

Firms are emphasizing a combination of sensors to record chest and abdominal movements, i.e. dual breathing belts, to grab the entire data on breathing mechanics.

Researchers are investigating Frequency-Modulated Continuous-Wave (FMCW) radar to track respiration rates & patterns in infants and adults without any requirement of skin contact.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.78 Billion |

| Projected Market Size in 2035 | USD 6.12 Billion |

| CAGR (2026 - 2035) | 9.15% |

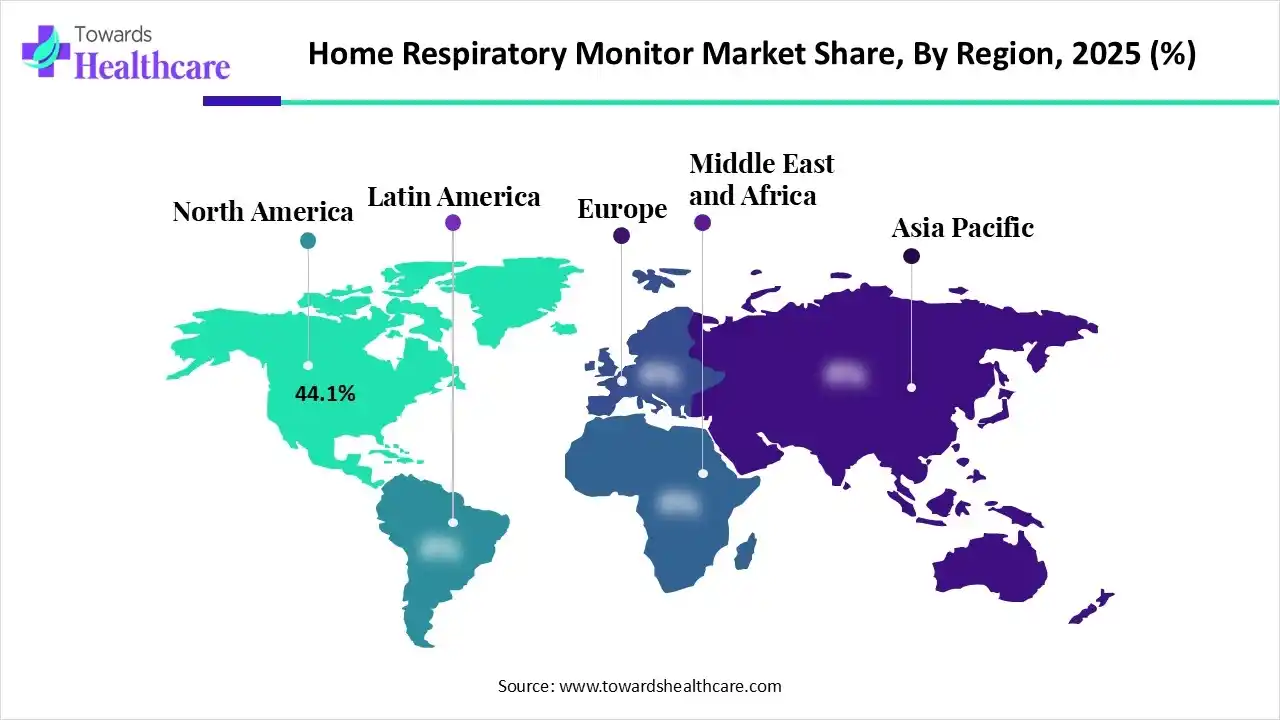

| Leading Region | North America by 44.1% |

| Market Segmentation | By Product Type, By Indication, By Technology, By Region |

| Top Key Players | ResMed Inc., Koninklijke Philips N.V., Medtronic plc, Masimo Corporation, Fisher & Paykel Healthcare, GE HealthCare, Propeller Health, Teva Pharmaceuticals (Digihaler), Vyaire Medical, Smiths Medical (ICU Medical) |

Which Product Type Led the Home Respiratory Monitor Market in 2025?

In 2025, the pulse oximeters segment held nearly 38.5% share of the market. This is driven by its crucial, non-invasive, & instant measurements of blood oxygen saturation and heart rate, which allow for early detection of hypoxemia and monitoring of chronic issues, including COPD, asthma, and COVID-19. Ongoing efforts are focusing on designing devices for persistent, overnight, or long-term monitoring to detect silent hypoxia. Zynex Medical NiCO employs laser technology to record four hemoglobin species for rigorous detection of hypoxia and hyperoxia.

Smart Inhalers

The smart inhalers segment is expected to grow at the fastest CAGR. Globally accelerating cases of asthma and COPD require consistent, long-term monitoring & optimized, accurate drug delivery, which is fueling demand for these inhalers. These devices are highly utilizing machine learning to assess inhaler usage patterns and anticipate asthma or COPD attacks up to five days in advance.

How did the COPD Segment Dominate the Market in 2025?

The COPD segment led with approximately 42.2% share of the home respiratory monitor market in 2025. As per a study, in 2025, there will be nearly 480 million cases of COPD across the world, which demands continuous, at-home, or affordable management of chronic exacerbations. Inogen Rove 6, Philips EverGo AI+, & CAIRE FreeStyle Comfort Smart are substantial, featuring adaptive algorithms that assist in adjusting oxygen flow based on movement & oxygen saturation (SpO₂) levels.

Asthma

The asthma segment is estimated to expand at a rapid CAGR during 2026-2035. A recent research study has shown the adoption of Respiratory-Responsive Vocal Biomarkers (RRVB) to find real-time changes in respiratory state & asthma exacerbations using smartphone apps. However, ADAMM (Automated Device for Asthma Monitoring and Management) also support tracking of cough, breathing patterns, heart rate, & temperature to facilitate tailored asthma management feedback.

Which Technology Led the Home Respiratory Monitor Market in 2025?

The portable/handheld segment captured an approximate 62.0% share of the market in 2025. This is mainly propelled by their daily monitoring of lung health, which enables early detection of changes in chronic concerns, such as COPD, asthma, and post-COVID recovery. Philips Respironics is one of the robust and sophisticated portable ventilators, which features AI-driven respiratory pattern detection, focused on escalating remote monitoring for both clinical and home use.

Wearable

Moreover, the wearable segment is predicted to expand at the highest CAGR during the forecast period. This mainly offers continuous, non-invasive monitoring of breathing patterns, lung sounds, and oxygen levels, which enable early detection of respiratory issues. A major transformation includes wearable, paper-based, & electrochemical sensors, like using polyaniline/Prussian blue nanolayers that are directly united into face masks to monitor hydrogen peroxide levels in exhaled breath.

With an approximate 44.1% share, North America registered dominance in the home respiratory monitor in 2025. The regional growth is propelled by a rise in the prevalence of asthma (25M+ Americans) & an advanced Medicare reimbursement structure for Remote Physiological Monitoring (RPM) & Remote Therapeutic Monitoring (RTM). Whereas, the Sleepiz One+ secured FDA approval for use in the US as a contactless, bedside device for monitoring breathing rates and heart rates, & it is a "wired-to-wireless" shift for home monitoring.

U.S. Market Trends

The U.S. held a major share of the market, as it focused on exploring AI-assisted diagnostics. TytoCare broadened the use of Tyto Insights for Wheeze Detection by employing AI in the analysis of lung sounds from a home stethoscope. Alongside, Makani Science acquired FDA 510(k) clearance for a wearable, non-invasive monitor to facilitate continuous, real-time respiratory data.

Asia Pacific is anticipated to witness rapid growth of approximately 10.2% in the home respiratory monitor market due to the rising instances of respiratory conditions, especially in China & India. Whereas Japan is emphasizing the progression of eldercare, non-contact monitoring, including Nemuri SCAN, a bed-placed sensor to record heart rate, respiratory rate, and body movements during sleep.

India Market Trends

India is promoting connected smart respiratory devices, which explore IoT-enabled solutions to enable data transmission directly to smartphones and healthcare providers. The latest advancement comprises Lupin Adhero, which is connected to a Metered Dose Inhaler (MDI) to monitor medication usage patterns.

| Company | Description |

| ResMed Inc. | This offers solutions that integrate medical devices with cloud-based software. |

| Koninklijke Philips N.V. | A firm explores solutions through its Philips Respironics brand and also facilitates diverse home respiratory monitoring & therapy solutions. |

| Medtronic plc | This usually focuses on continuous, non-invasive, and remote patient monitoring, especially through their Nellcor & Microstream product lines. |

| Masimo Corporation | A company executing its proprietary Signal Extraction Technology (SET). |

| Fisher & Paykel Healthcare | This emphasizes humidification and respiratory support devices. |

| GE HealthCare | Their offerings include advanced hospital-grade systems and combined remote patient monitoring (RPM) solutions. |

| Propeller Health | It offers a digital respiratory health platform using connected inhaler sensors & software to track and manage asthma and COPD from home |

| Teva Pharmaceuticals (Digihaler) | A company facilitates a series of FDA-cleared, Bluetooth-connected, breath-activated dry powder inhalers. |

| Vyaire Medical | It explores various portable, handheld devices for diagnostic, monitoring, & therapeutic use in homes, clinics, and during transport. |

| Smiths Medical (ICU Medical) | This usually promotes many home respiratory care products focused on bronchial hygiene, lung expansion, & tracheostomy care. |

By Product Type

By Indication

By Technology

By Region

February 2026

February 2026

February 2026

February 2026