March 2026

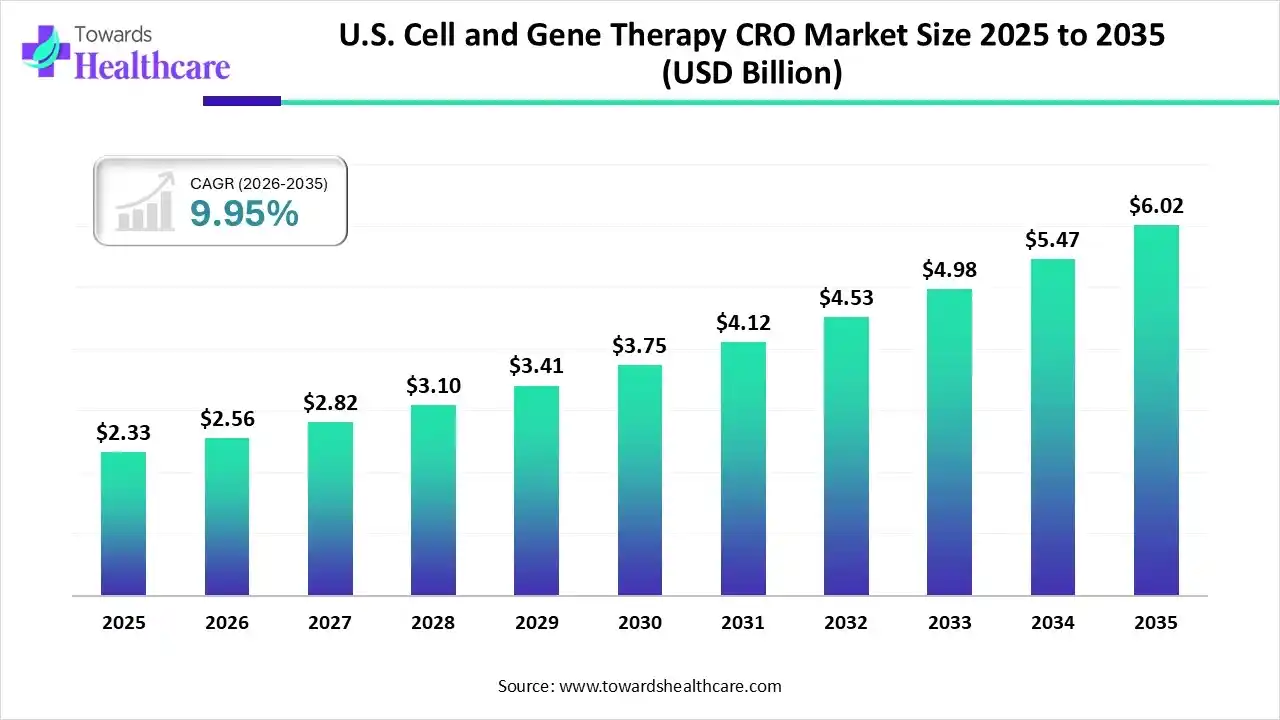

The U.S. cell and gene therapy CRO market size was estimated at USD 2.33 billion in 2025 and is predicted to increase from USD 2.56 billion in 2026 to approximately USD 6.02 billion by 2035, expanding at a CAGR of 9.95% from 2026 to 2035.

The growing incidence of various chronic diseases across the U.S. is increasing the demand for cell and gene therapies, ultimately encouraging the use of CRO services. The growing trial complexities and regulatory hurdles are also increasing their use, where AI technologies are also being utilized to support the development of cell and gene therapies. The increasing government initiatives and new launches are also promoting the market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.56 Billion |

| Projected Market Size in 2035 | USD 6.02 Billion |

| CAGR (2026 - 2035) | 9.95% |

| Market Segmentation | By Service Type, By Therapy Modality Supported, By Sponsor Type/End User, By Trial Phase/Activity |

| Top Key Players | IQVIA, LabCorp Drug Development, Thermo Fisher Scientific, Charles River Laboratories, Medpace, Syneos Health, ICON plc, Altasciences |

The U.S. cell and gene therapy CRO market is driven by the growing complexity of the therapies and the increasing volume of clinical trials. The U.S. cell and gene therapy CROs refer to the contract research organizations offering research, bioanalytical, regulatory, and clinical trial services, along with other specialized services, to support the development of cell and gene therapies across the U.S. These services help in streamlining the preclinical studies, manufacturing, and testing of the therapies, along with the management of clinical trials.

The use of AI in the U.S. cell and gene therapy CRO market is increasing for the discovery of drugs and their potential targets. It is also being used for the evaluation of the efficacy, safety, and adverse reactions of the products, where their integration with bioanalytical assays is also accelerating their analysis. They are also used for data management, trials, and manufacturing process optimization.

Different types of cell and gene therapies are being developed across the U.S., which is increasing the demand for CRO services, where their growing clinical trials are also increasing the use of their services.

The U.S. CROs provide advanced technologies that attract companies, where the growing investments are also driving the development and adoption of integrated platforms.

The growing number of cell and gene therapy innovations across the U.S. cell and gene therapy CRO market and institutions is increasing the demand for their skilled personnel, which is increasing the collaboration with the CROs to leverage their services.

Why Did the Clinical Operations & Site Management Segment Dominate in the Market in 2025?

The clinical operations & site management segment held the dominating share in the U.S. cell and gene therapy CRO market in 2025, due to complex cell and gene therapy clinical trials. This increased their demand for regulatory compliance and management of investigational sites. Moreover, the operation efficiency and affordability also increased their use.

Bioanalytics & Assay Development

The bioanalytics & assay development segment is expected to show the highest growth during the predicted time, due to growth in the cell and gene therapy development. They are also being used to identify the potency and mechanism of action of the therapies. Additionally, they also ensure regulatory compliance, which is increasing their adoption rates.

How Gene-Modified Cell Therapies Segment Dominated the Market in 2025?

The gene-modified cell therapies segment led the U.S. cell and gene therapy CRO market in 2025, driven by their wide range of applications. This increased their production rates, where their proven clinical efficacy also increased their use, increasing demand for CRO services. Additionally, the complex development also increased the collaboration with these CROs.

In-Vivo Gene Therapies

The in-vivo gene therapies segment is expected to show rapid growth during the predicted time, due to their direct delivery of therapeutic genes into the patient's body. Moreover, their broad range of targets is also increasing their R&D, which is encouraging the strategic partnerships with U.S. CROs to streamline their workflow.

Which Sponsor Type/End User Type Segment Held the Dominating Share of the Market in 2025?

The biotech & VC-backed innovators segment held the dominating share in the U.S. cell and gene therapy CRO market in 2025, due to growth in the R&D activities. Additionally, the funding also accelerated the development of various cutting-edge therapies, which increased the demand for CRO expertise, along with the use of other services.

Large Pharma

The large pharma segment is expected to show the highest growth during the upcoming years, due to the growing cell and gene therapy pipeline. This is increasing the demand for technical and specialized expertise, driving collaboration with U.S. cell and gene therapy CROs. Additionally, their affordability is also attracting the companies.

What Made Phase I/I–II the Dominant Segment in the Market in 2025?

The phase I/I–II segment led the U.S. cell and gene therapy CRO market in 2025, due to its focus on safety requirements. Additionally, this phase included the therapies in the early clinical development phase, where all these factors increased the reliance on the U.S. CRO services. Furthermore, the growth of outsourcing trends has also increased their demand.

Phase II & Pivotal

The phase II & pivotal segment is expected to show rapid growth during the upcoming years, due to the growing development of cell and gene therapies backed by investments. These phases also involve intensive safety and efficacy evaluation in a larger population, which increases the demand for cell and gene therapy expertise.

The U.S. cell and gene therapy CRO market is significantly growing due to the presence of large biotechnology and pharmaceutical industries, which are increasing the development of cell and gene therapies, driving the demand for their CRO services. The growth in the R&D investments and funding is accelerating their R&D and clinical trials. Furthermore, all these factors, along with regulatory complexities, are increasing the demand for cell and gene therapy CRO services, promoting the market growth.

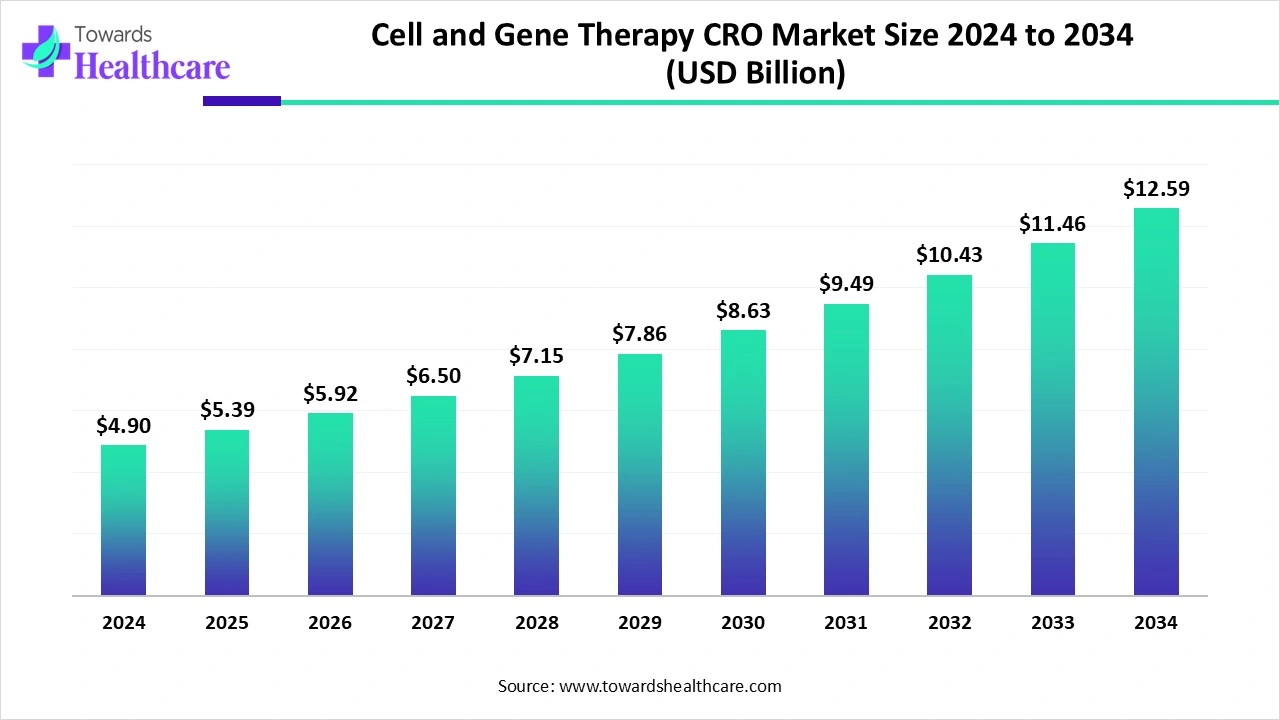

The global cell and gene therapy CRO market size is estimated at US$ 4.90 billion in 2024, is projected to grow to US$ 5.39 billion in 2025, and is expected to reach around US$ 12.59 billion by 2034. The market is projected to expand at a CAGR of 9.9% between 2025 and 2034.

| U.S. Cell and Gene Therapy CROs | Headquarters | Services |

| IQVIA | Durham, North Carolina | CGT trial design and patient recruitment |

| LabCorp Drug Development | Burlington, North Carolina | Specialized CGT development suite, companion diagnostics, nd central lab services |

| Thermo Fisher Scientific | Wilmington, North Carolina | End-to-end CGT clinical research and analytical services |

| Charles River Laboratories | Wilmington, Massachusetts | Preclinical genome editing and viral vector manufacturing services |

| Medpace | Cincinnati, Ohio | ClinTrak trial management and regulatory consulting |

| Syneos Health | Morrisville, North Carolina | Late-stage clinical trials and bioanalytical solutions |

| ICON plc | North Wales, Pennsylvania | Early phase CGT trials, decentralized clinical trials, and medical imaging platforms |

| Precision for Medicine | Bethesda, Maryland | Support biomarker-driven clinical research |

| Altasciences | Laval, Quebec | Preclinical to clinical services |

| Worldwide Clinical Trials | Research Triangle Park, North Carolina | Phase I-IV CGT trial and bioanalytical services |

By Service Type

By Therapy Modality Supported

By Sponsor Type/End User

By Trial Phase/Activity

March 2026

March 2026

March 2026

March 2026