March 2026

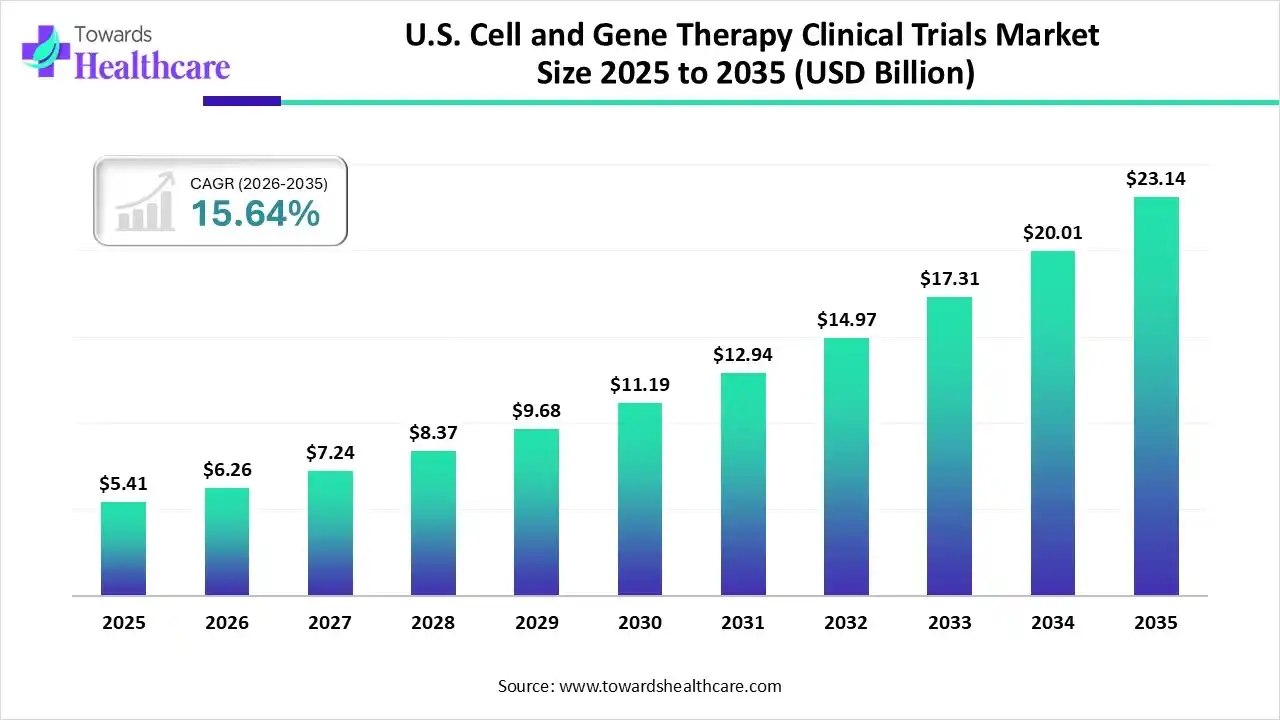

The U.S. cell and gene therapy clinical trials market size was estimated at USD 5.41 billion in 2025 and is predicted to increase from USD 6.26 billion in 2026 to approximately USD 23.14 billion by 2035, expanding at a CAGR of 15.64% from 2026 to 2035.

The market is experiencing strong growth due to rising investment in advanced biologics increasing prevalence of cancer and rare genetic disorders, and an active biotechnology ecosystem. Supportive FDA regulatory pathways, growing academic–industry collaborations, and advances in viral vectors and gene-editing technologies continue to accelerate clinical trial activity across the country.

| Key Elements | Scope |

| Market Size in 2026 | USD 6.26 Billion |

| Projected Market Size in 2035 | USD 23.14 Billion |

| CAGR (2026 - 2035) | 15.64% |

| Leading Region | North America |

| Market Segmentation | By Phase, By Indication |

| Top Key Players | IQVIA Holdings, Inc., LabCorp, Medpace Holdings, Inc, Novotech Pty Ltd., PAREXEL International Corp, Syneos Health, Inc, Thermo Fisher Scientific, Inc., Veristat, LLC |

U.S. cell and gene therapy clinical trials are FDA-regulated studies conducted in the United States to test the safety and effectiveness of therapies that use genes or living cells to treat or prevent diseases. The U.S. cell and gene therapy clinical trials market is growing due to rising demand for treatments targeting cancer and rare diseases, strong biotech innovation, increased R&D investment, supportive FDA regulatory frameworks, and advancements in gene-editing and cell-based technologies that accelerate trial development and commercialization.

AI can revolutionize the U.S. cell and gene therapy clinical trials market by accelerating patient recruitment, optimizing trial design, and predicting treatment responses through advanced data analytics. Machine learning enables faster biomarker identification, real-time monitoring of patient safety, and improved trial efficiency. These capabilities reduce development timelines, lower costs, and increase the success rate of complex cell and gene therapy trials.

Why did the phase III Segment Dominate in the Market in 2025?

The phase III segment held the largest U.S. cell and gene therapy clinical trials market share because these trials are essential for validating safety, efficacy, and optimal dosing before regulatory approval. They involve large patient populations, extended study durations, and complex trial design, leading to significantly higher costs and resource requirements. Additionally, the increasing number of cell and gene therapy candidates progressing into late-stage development and nearing commercialization further strengthens the dominance of phase III trials.

For instance,

Phase I

The phase I segment is expected to grow at the fastest CAGR during the forecast period due to the rising number of early-stage cell and gene therapy candidates entering clinical development. Increased biotech startup activity, strong venture funding, and advancements in gene editing and cell engineering are accelerating first-in-human studies. Additionally, growing research focus on novel indications and rare diseases is driving demand for early-phase safety and dosing trials.

How Does the Oncology Segment Dominate the Market in 2025?

The oncology led the U.S. cell and gene therapy clinical trials market due to the high prevalence of cancer and strong demand for targeted, long-lasting treatments. Advances in CAR-T cell therapies, gene-editing technologies, and tumor-specific biomarkers have driven extensive clinical research. Additionally, significant funding, robust clinical pipelines, and expedited FDA pathways for cancer therapies continue to support the dominance of oncology-focused trials. The National Cancer Institute (NCI) estimates that in 2025, the U.S. will see around 2.04 million new cancer cases and approximately 618,000 cancer-related deaths.

In September 2024, Poseida Therapeutics received the FDA’s RMAT designation for P-BCMA-ALLO1, an allogeneic CAR-T therapy using stem cell memory T cells for relapsed/refractory multiple myeloma. The therapy also earned Orphan Drug Designation in March 2024.

Cardiology

The cardiology segment is expected to grow at the fastest CAGR during the forecast period due to the rising burden of cardiovascular diseases and the limited effectiveness of conventional treatments for advanced heart conditions. Growing research into gene therapies for inherited cardiac disorders and regenerative cell therapies for heart failure is accelerating clinical trial activity. Additionally, increasing investment, technological advances in cardiac gene delivery, and expanding precision medicine approaches are supporting rapid growth in cardiology-focused trials.

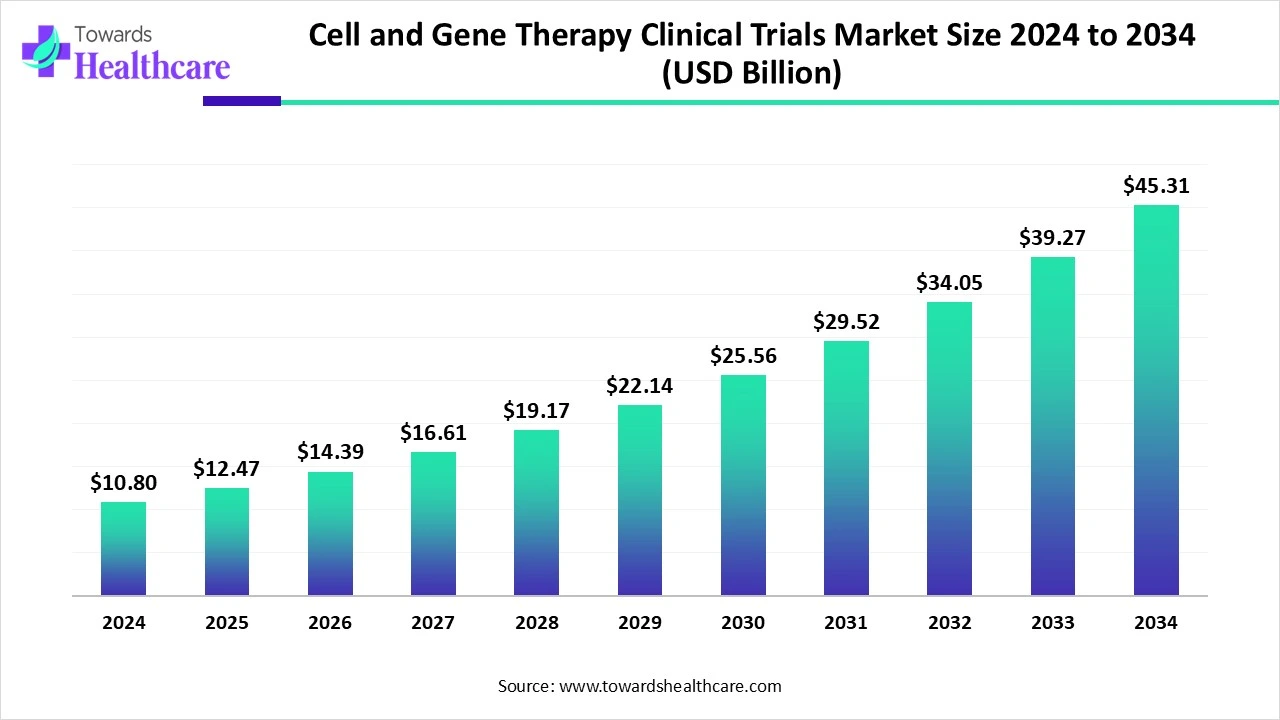

The global cell and gene therapy clinical trials market size reached USD 10.8 billion in 2024, grew to USD 12.47 billion in 2025, and is projected to hit around USD 45.31 billion by 2034, expanding at a CAGR of 15.43% during the forecast period from 2025 to 2034.

| Companies | Headquarters | Offerings |

| IQVIA Holdings, Inc. | North Carolina, USA | A leading global CRO and technology provider offering clinical trial management, advanced analytics, regulatory support, real-world evidence, data management, and patient recruitment services across all trial phases. |

| Labcorp | North Carolina, USA | Provides central laboratory testing, drug development support, bioanalysis, clinical sample management, and integrated lab services for complex clinical studies. |

| Medpace Holdings, Inc | Ohio, USA | Full-service CRO specializing in phase I-IV clinical development, central and bioanalytical labs, imaging and ECG core labs, and integrated clinical operations for biotech and pharmaceutical sponsors. |

| Novotech Pty Ltd. | Sydney Australia | Offers clinical operations, medical/regulatory consulting, patient recruitment, site management, data handling, and lab services supporting biotech and pharmaceutical trials worldwide. |

| PAREXEL International Corp | North Carolina, USA | A major global CRO providing phase I-IV clinical development services, regulatory and data consulting, pharmacovigilance, biostatistics, and patient-centric trial solutions. |

| Syneos Health, Inc | North Carolina, USA | Integrates clinical research and commercial services, offering end-to-end trials execution, biostatistics, consulting, and commercialization support for pharmaceutical and biotech products. |

| Thermo Fisher Scientific, Inc | Massachusetts, USA | Life Science and CRO services provider offering laboratory instruments, reagents, drug discovery support, clinical development services, and clinical trial management tools. |

| Veristat, LLC | Massachusetts, USA | A science-focused full-service CRO delivering clinical development services such as regulatory strategy, biostatistics, medical writing, data management, clinical monitoring, and strategic consulting. |

By Phase

By Indication

March 2026

March 2026

March 2026

March 2026