February 2026

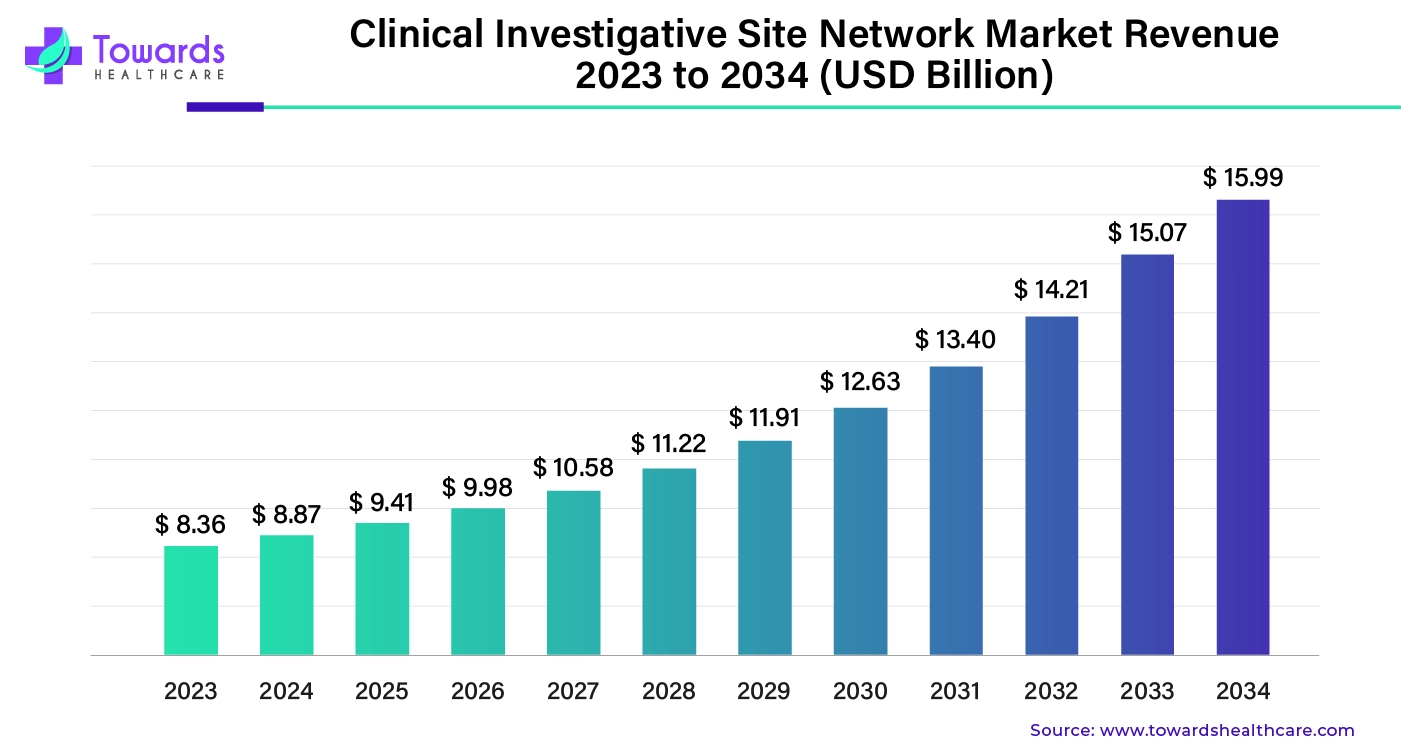

The clinical trial investigative site network market was estimated at US$ 8.36 billion in 2023 and is projected to grow to US$ 15.99 billion by 2034, rising at a compound annual growth rate (CAGR) of 6.07% from 2024 to 2034.

The role of a clinical investigative site network organization is to enable the successful completion of a clinical trial carried out in large numbers. Such organizations allow clinical trial site identification and a central administrative department. The administrative department looks after the financial, regulatory, data management, safety, business processes, and quality assurance. This enables the biotech or pharma company to stay in contact with a single organization instead of a network of clinical sites. This helps to reduce the number of contacts, streamlines study communication and reduces the time associated with each task. These organizations enable and streamline investigation from start to completion by centralizing site feasibility, finances, and contracts, which can substantially cut study startup times. Hence, they aid in improving patient centricity and delivering therapies to the market safely and effectively while resolving long-standing process and workflow difficulties by utilizing a standardized, seamless integration between sites, sponsors, and CROs.

Advanced technologies like artificial intelligence (AI) in clinical trials transform the way clinical trials are conducted. Clinical trials are a lengthy, time-consuming, and costly process and require large amounts of the patient population. To simplify such a complex process, many organizations leverage AI, enabling faster and better outcomes. AI in clinical site network organizations can efficiently process massive datasets and seamlessly integrate, interrogate, and interpret large datasets from diverse sources to gain actionable insights, especially in the decentralized clinical trial process. AI can also aid in identifying appropriate sites and potential investigators based on the topic and criteria of a research study. Apart from site and investigator identification, AI can also enable the recruitment of subjects to participate in the clinical trial. Additionally, AI can help in clinical research studies by monitoring the patients, analyzing results, optimizing doses, and enabling decision-making.

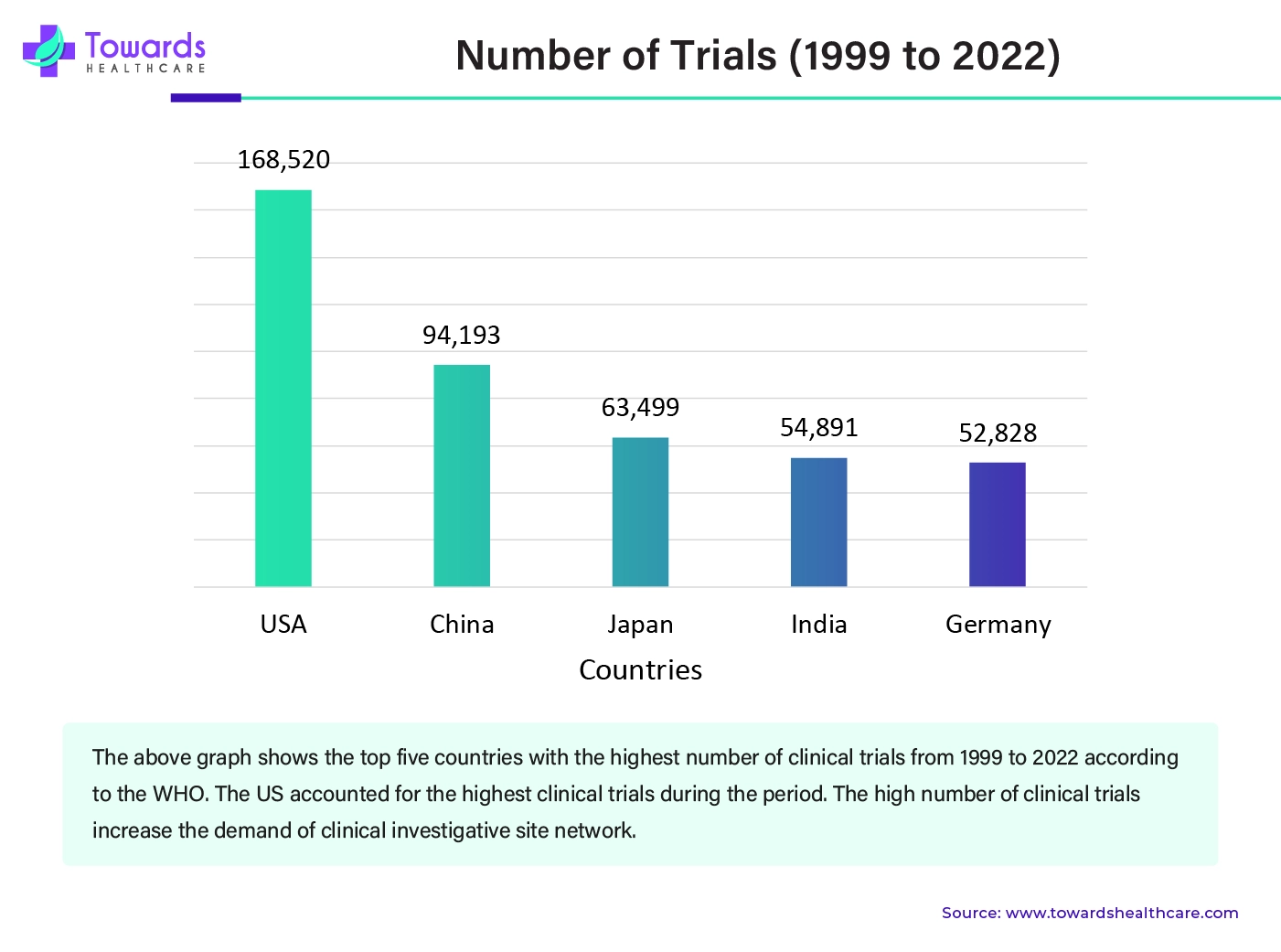

The increasing incidences of several acute and chronic disorders demand research for early detection and efficient treatment of a disease. Pharmaceutical & biotechnology companies conduct clinical trials for various purposes. Several global regulatory agencies like the US FDA, EMA, CDSCO, and TGA demand clinical trial study data for the approval of a new drug or device or process in the market. The growing research and development activities globally in various fields increase the number of clinical trials. Clinical trials provide safety, tolerability, efficacy, pharmacokinetics, and pharmacodynamics data of a product in humans before its market approval. According to the WHO International Clinical Trials Registry Platform (ICTRP), the USA, China, Japan, India, and Germany are the top five countries with the highest number of clinical trials from 1999 to 2022. The other five countries are the UK, France, Iran, Canada, and Spain.

A clinical investigative site network is more expensive than a single-site model. The high expense could be due to clinical networks' higher per-patient and study initiation fees to offset central administrative costs. Such high costs limit the affordability of a sponsor or CRO to opt for a clinical site network service. Additionally, the patient recruitment criteria involving patient eligibility and consent hamper the market. Furthermore, a lack of trained professionals to meet high-quality standards, Good Clinical Practice guidelines, and local and international regulations poses a significant challenge to the network.

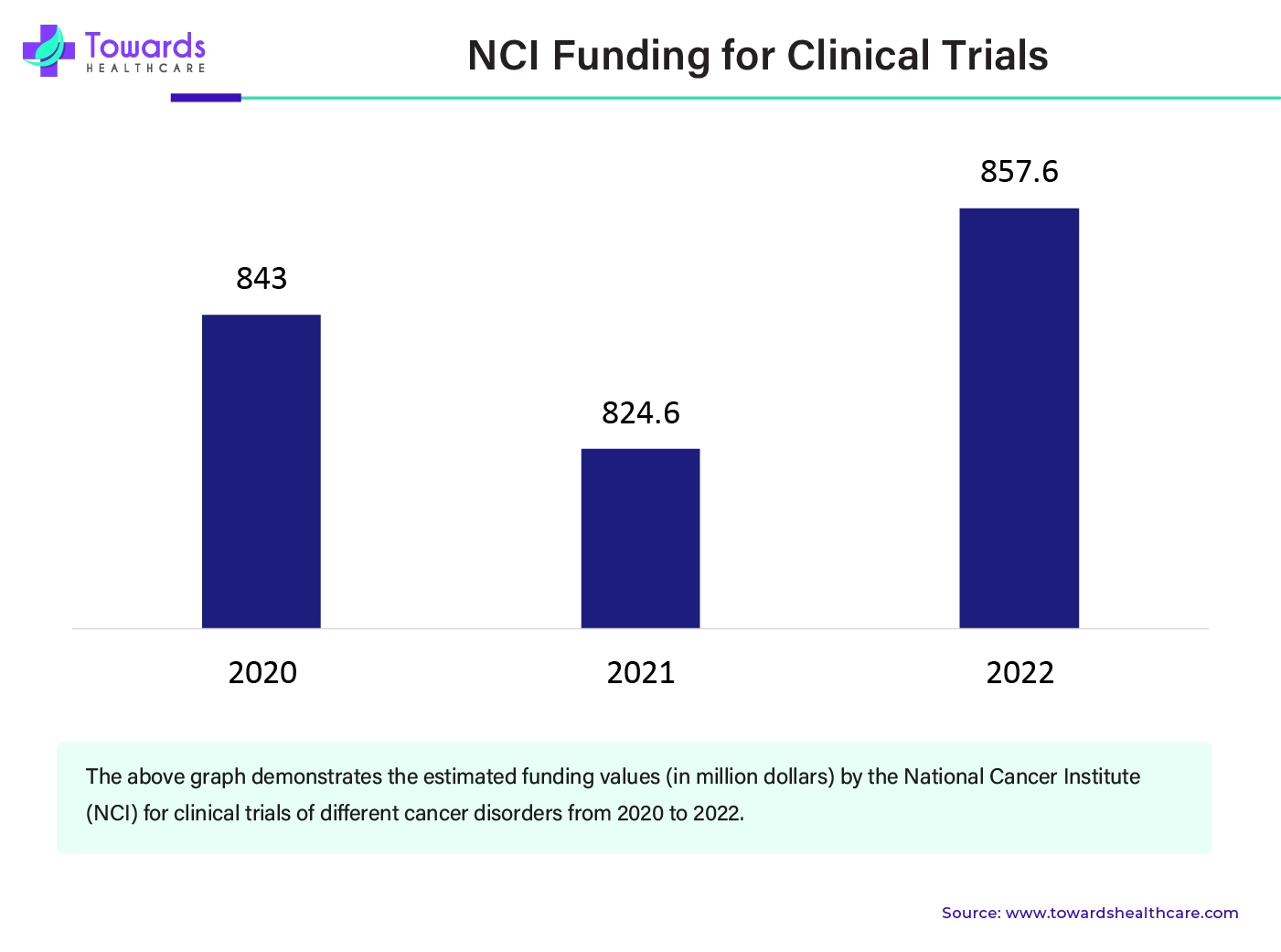

Adequate funding is required for the successful completion of clinical research. A clinical trial takes several years to complete, comprising different phases from pre-market approval to post-market approval. According to a 2022 WHO study, the average cost for a new drug development ranges from US $43.4 million to US $4.2 billion. Several government organizations and private companies invest millions and billions of dollars in research and conducting clinical trials. The National Institute of Health (NIH) is the biggest funding organization globally.

Under the National Health and Medical Research Council’s (NHMRC) clinical trials and cohort studies grant scheme, 25 research teams will receive funding worth $77 million to improve the health and well-being of Australians.

The ongoing clinical research is mainly focused on treating rare disorders, Alzheimer’s disease, cancer, and cardiovascular disorders. Additionally, the treatment regimen tested includes novel drugs, drug formulations, drug delivery systems, medical devices, cell and gene therapy, and personalized medicines. All these research topics and supportive funding potentiate the clinical trial study, thereby augmenting the clinical trial investigative site network market.

The oncology segment held a dominant presence in the market share by by 35% in 2023. The rising incidences of cancer, the demand for early detection and new drug development, and the increasing number of clinical trials boost the market. According to the GLOBOCAN report, approximately 20 million new cancer cases were reported in 2022, with 9.7 million deaths. The number of cancer cases increases the frequency of clinical trials to evaluate the safety and efficacy of new and existing drugs and medical devices. The growing research and development activities in the fields of cell and gene therapy, precision medicine, and combination therapy increase the number of clinical trials, driving the clinical trial investigative site network market. According to the clinicaltrials.gov, 32,447 clinical trials are ongoing as of September 2024.

For instance,

The pain management segment is expected to grow at a significant rate in the clinical trial investigative site network market during the forecast period of 2024 to 2034. Analgesics or painkillers are used in several acute and chronic disorders, from headaches to injuries to arthritis. They are the most widely used drugs for any type of disorder. Several analgesics used for pain management include over-the-counter NSAIDS, opioid analgesics, and some corticosteroids. To avoid the use of opioid analgesics and corticosteroids due to their severe adverse effects, researchers are investigating new drugs for pain relief. The clinical trials are conducted to advance the discovery and validation of several biomarkers for pain research and treatment. Pain management also aids in developing improved diagnostic and treatment tools for pain, prioritizing personalized therapies. All these aspects potentiate the market.

The phase III segment accounted for a considerable share of the clinical trial investigative site network market by 55% in 2023. Phase III trials are conducted at multiple centers in different geographical locations with several hundred or thousand patients. Phase III trials are usually performed on 300 to 3000 participants. Phase III often takes years and years from the discussion of the idea to the starting line of its execution. Hence, to cater to the diverse requirements of multiple sites and the complexity of dealing with each site individually, a clinical investigative site network is essential. The network can effortlessly aid multiple sites and investigators and seamlessly operate with those multiple sites. Hence, the complex phase III clinical trial process becomes easy with the help of a clinical investigative site network.

For instance,

The phase I segment is projected to expand rapidly in the market in the coming years. The Phase I trials are conducted at limited places and with less number of participants. These trials not only involve patients but also involve healthy volunteers. Hence, the recruitment of volunteers catering to the research requirements is essential. Additionally, a clinical investigative site network can also guide early-phase clinical trial design and the types of drug candidates to be investigated, ensuring ethical, medical, regulatory, and quality standards.

The sponsor segment registered its dominance over the global clinical trial investigative site network market share by 65% in 2023. Sponsors play a crucial role in the design, conduct, and outcome of a clinical trial study. They are part of the process from the beginning and provide the necessary financial resources. Sponsors of a clinical trial are generally pharmaceutical and biotechnology companies. The growing research and development activities and the necessity to evaluate the product or process in humans to check the safety and efficacy accelerate the market growth.

The CRO segment will gain a significant share of the clinical trial investigative site network market over the studied period of 2024 to 2034. Clinical Research Organizations (CROs) work on a contract basis with pharmaceutical, biotechnology, or medical device manufacturing companies to manage clinical research studies and other services. These organizations provide specialist knowledge and assistance to ensure effective trial administration and adherence to regulations. The clinical investigative site network simplifies the process of both sponsors & CROs by providing access to member sites as well as streamlining and accelerating the site selection process, meeting the highest standards of quality and productivity, thereby facilitating market growth.

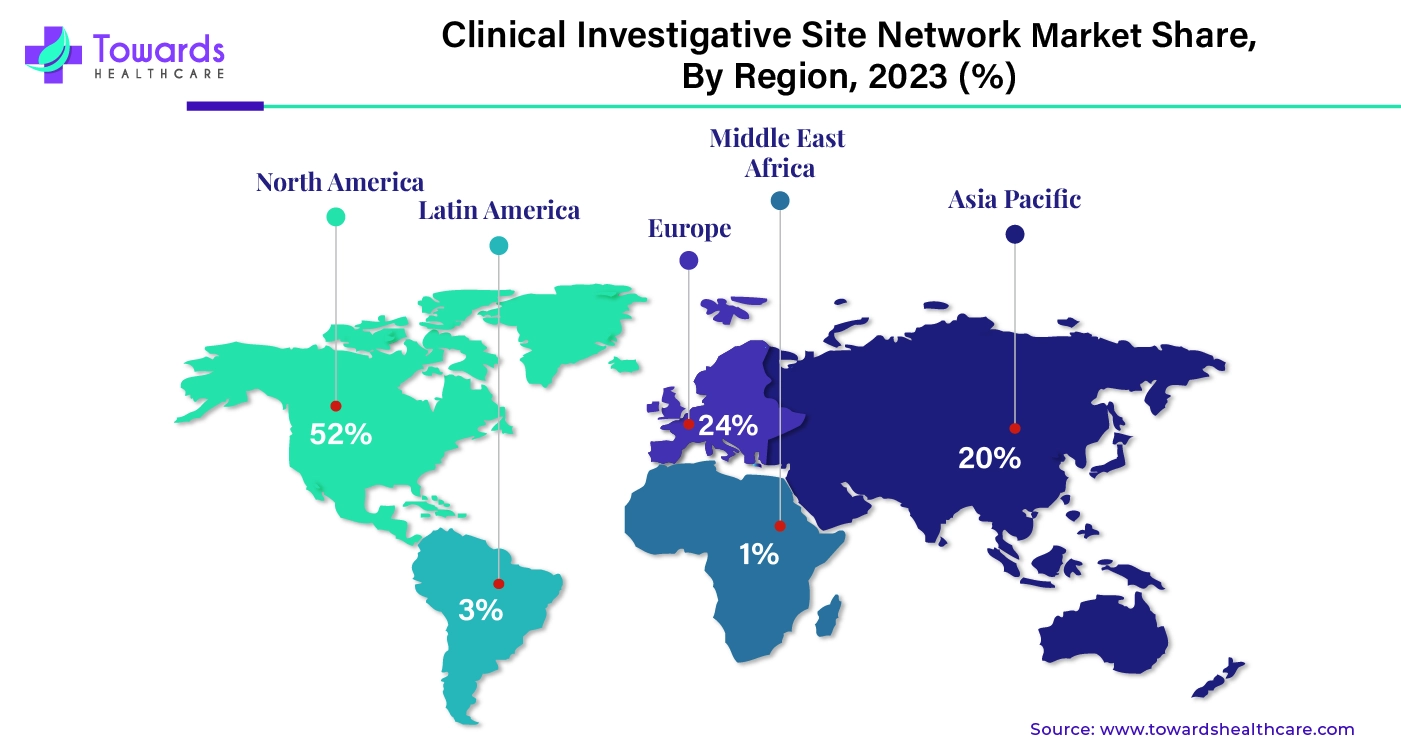

North America dominated the global clinical trial investigative site network market share by 52% in 2023. The state-of-the-art research and development activities, advanced healthcare infrastructure, increasing investments, and increasing pharmaceutical companies drive the market. The market is also driven by the higher number of clinical trials in the region. According to the WHO International Clinical Trials Registry Platform (ICTRP), the number of trials conducted in the US from 1999 to 2022 was found to be 168,520, whereas that in Canada was found to be 34,041. The US conducts the highest number of clinical trials in the world, while Canada captures 4% of the global clinical trials and lies fourth in the number of clinical trial sites. Additionally, favorable government policies and funding policies augment the market. The National Institute of Health (NIH) invested around $45 billion in research seeking to enhance life and reduce illness and disability.

For instance,

Asia-Pacific is anticipated to grow at the fastest rate of 6.09% CAGR during the forecast period. The increasing geriatric population, rising incidences of chronic disorders, and sedentary lifestyles have led to the development of effective drugs for the treatment of several disorders. China reported more than 300 million patients with chronic disorders, accounting for 86.6% of the total causes of death.

According to a recent study in Japan, 90% of adults aged 75 or older have at least one chronic disease, out of which approximately 80% have multiple chronic disorders. The growing research and development of new drugs and medical devices increases the need for clinical trials in the region. According to the WHO International Clinical Trials Registry Platform (ICTRP), China, Japan, and India ranked second, third, and fourth in conducting clinical trials from 1999 to 2022, respectively. The market is also driven by increasing investments and collaborations, pharmaceutical & biotechnological companies, and favorable government policies to conduct clinical trials.

Europe is expected to grow at a notable rate in the foreseeable future. The increasing number of clinical trials and the growing investments in clinical research are the major growth factors of the market in Europe. Favorable government support and the rising adoption of advanced technologies boost the market. The increasing number of CROs/CDMOs plays a vital role in providing outsourcing services to small- and large-scale biopharma companies. The burgeoning pharmaceutical and biotechnology sector and the growing number of startups promote the market. Stringent regulations by several regulatory agencies necessitate companies to conduct clinical trials for their novel products.

Germany Market Trends

A total of 26,702 clinical trials are registered on the clinicaltrials.gov website as of May 2025. The German government recently passed the “Medical Research Act” as part of a larger national strategy to incentivize pharmaceutical and medical device research and production in Germany.

UK Market Trends

The UK conducts the highest number of clinical trials in the European region. As of May 2025, about 26,776 clinical trials are registered on the clinicaltrials.gov website. In December 2024, the UK government announced an investment of £100 million to set up 20 research hubs in the UK. The hubs will provide greater access to cutting-edge treatments and clinical trials.

| Company Name | Alcanza Clinical Research |

| Headquarters | Methuen, Massachusetts, United States |

| Recent Developments | In July 2024, Alcanza Clinical Research announced its affiliation with The Society of Clinical Research Sites (SCRS) as a Global Impact Partner. The affiliation will drive the mission of SCRS to ensure site sustainability through advocacy, thought leadership, event participation, and education. |

| Company Name | PPD, Inc. |

| Headquarters | Wilmington, North Carolina, United States |

| Recent Developments | In October 2022, PPD Inc., a subsidiary of Thermo Fisher Scientific, launched the PPD DCT Network to support international investigators and research sites that take part in decentralized clinical trials (DCT) for biotech and pharma customers. The network will aid in a DCT eLearning certification program for investigators. |

By Therapeutic Area

By Phase

By End-Use

By Geography

February 2026

February 2026

January 2026

January 2026