February 2026

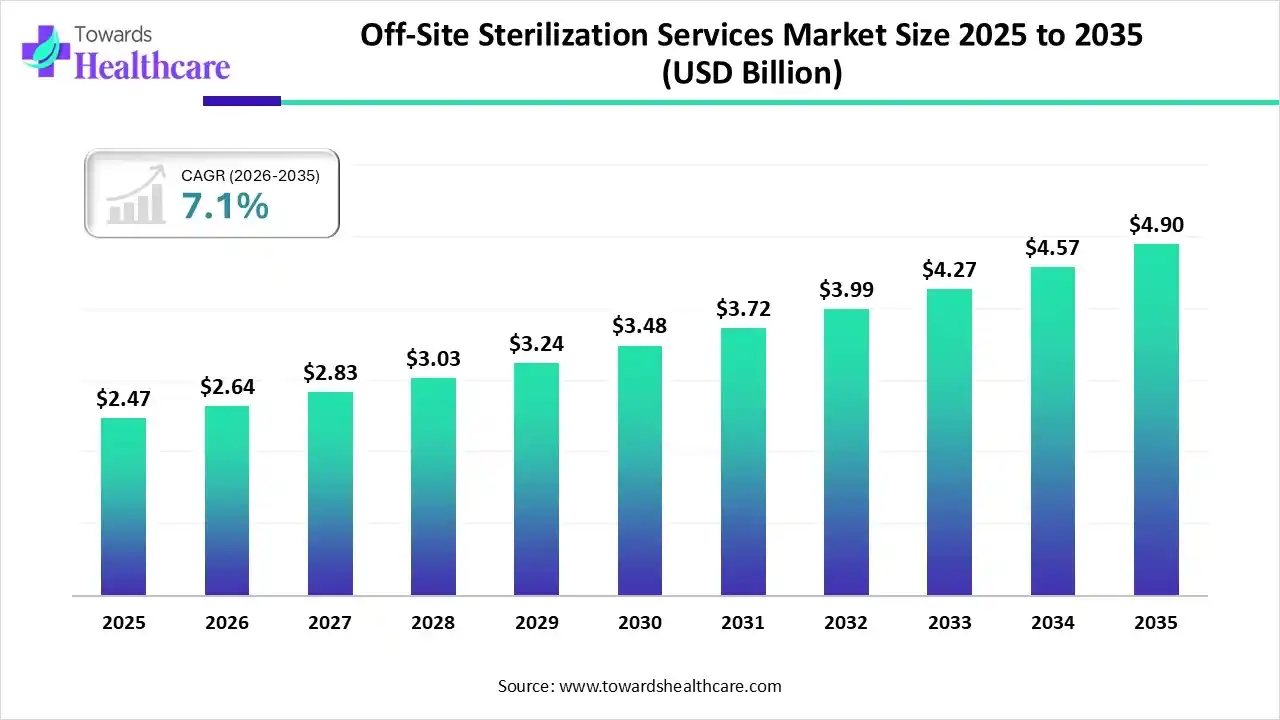

The global off-site sterilization services market size was estimated at USD 2.47 billion in 2025 and is predicted to increase from USD 2.64 billion in 2026 to approximately USD 4.9 billion by 2035, expanding at a CAGR of 7.1% from 2026 to 2035.

Globally rising instances of surgeries, hospital-acquired infections, and the inclusion of stricter regulatory demands are promoting major developments in the respective market. For this, numerous leaders have expanded their sterilization facilities in different regions, with substantial advances in various types of novel sterilization methods, like e-beam and gamma sterilization.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.64 Billion |

| Projected Market Size in 2035 | USD 4.9 Billion |

| CAGR (2026 - 2035) | 7.1% |

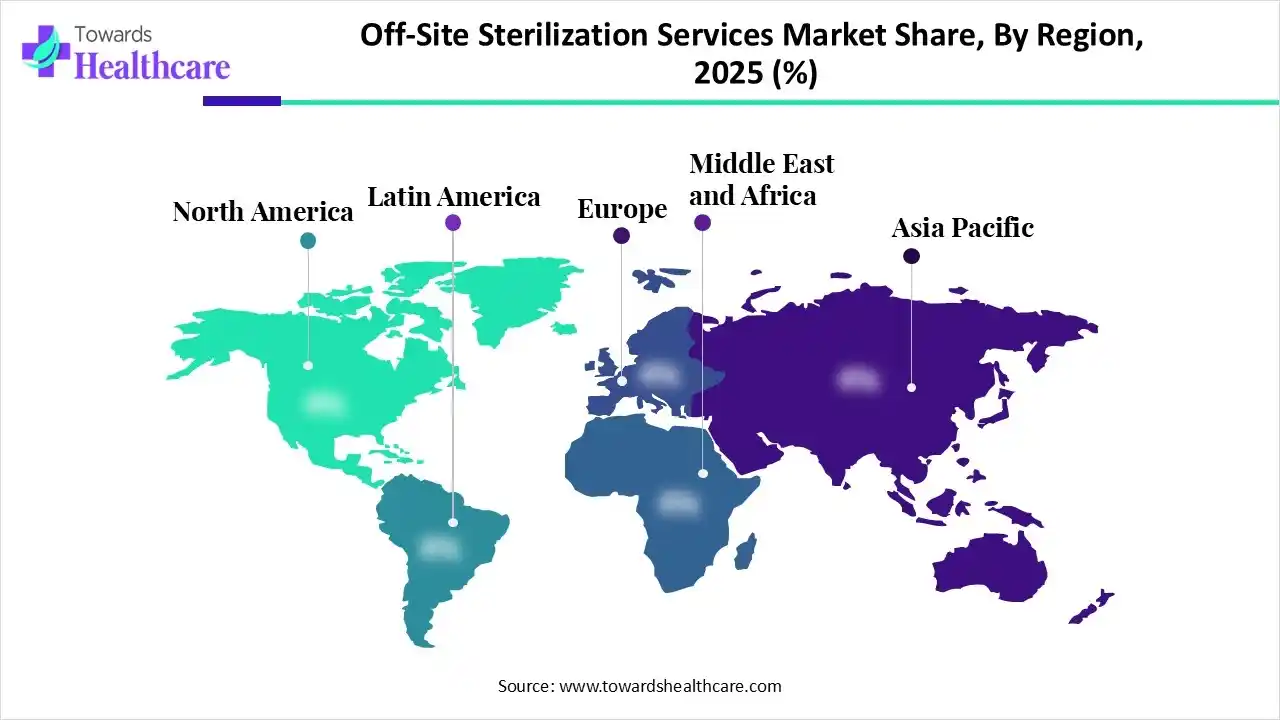

| Leading Region | North America |

| Market Segmentation | By Service, By End-use, By Region |

| Top Key Players | Steris Plc, Sotera Health, Cretex Medical, Scapa Healthcare, BGS Beta-Gamma-Service GmbH & Co. KG, E-BEAM Services, Inc., Medistri SA, Midwest Sterilization Corporation (MSC), Microtrol Sterilization Services, ClorDiSys Solutions, Inc. |

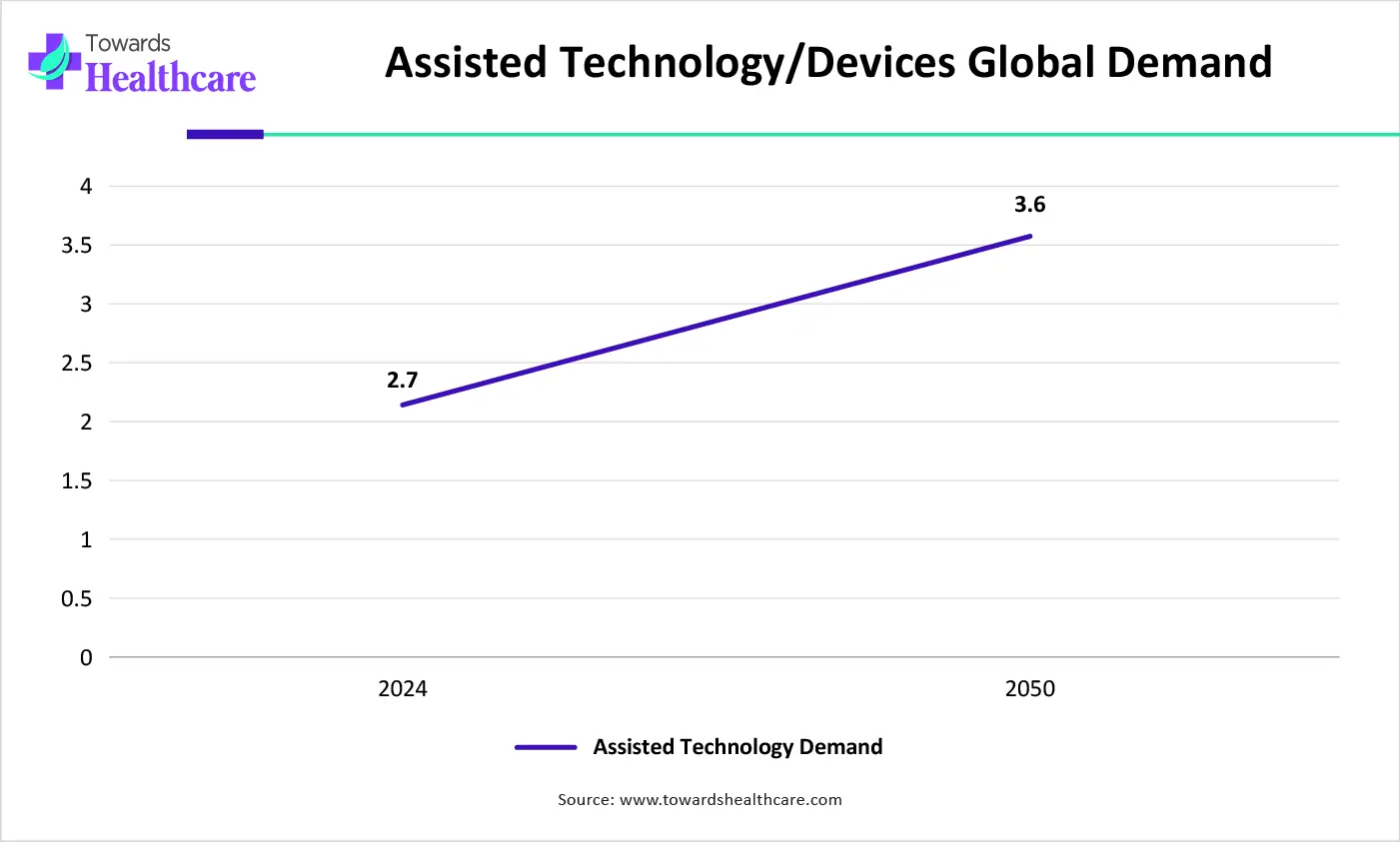

The presence of specialized third-party facilities for cleaning, disinfecting, and sterilizing reusable medical device and instruments , especially in hospitals, clinics, and surgery centers, and also further transporting them via controlled logistics to ensure safety and compliance, is referred to as the off-site sterilization services market. The overall expansion of the market is fueled by a rise in demand for advanced tech (EtO, gamma, steam), outsourcing trends by medical/pharma companies , and the need for affordable solutions with economies of scale. Recently, ANVISA (Brazil's health authority) made a regulatory change by mandating correct licensing and authorization for ETO sterilization facilities before operation, which shows rising global regulatory scrutiny.

The ongoing, persistent adoption of AI and related solutions, such as AI-enabled robotics, is supporting tasks like loading and unloading sterilizers, instrument assembly, and inventory transport via autonomous guided vehicles (AGVs). Moreover, AI algorithms are further bolstering supply chain management with the anticipation of demand patterns, simplifying logistics, and ensuring proper traceability of instruments through RFID or barcode technology.

For instance,

Day by day, the market leaders are moving towards advanced methods, particularly Vaporized Hydrogen Peroxide (VHP) and Electron Beam (E-beam) for managing heat-sensitive & complex medical devices, instead of traditional EtO.

Specifically, the globe is focusing on environmentally friendly solutions by encouraging research activities in greener approaches, like expanded hydrogen peroxide gas plasma and optional methods with minimal environmental impact.

In the prospects, the players will emphasise the analysis of inexpensiveness and effectiveness of off-site versus on-site sterilization in diverse healthcare contexts, mainly for clinics and outpatient centers, which may not have essential infrastructure in-house.

Which Service Dominated the Off-Site Sterilization Services Market in 2025?

In 2025, the ethylene oxide sterilization segment captured the biggest revenue share of the market. A prominent characteristic is its efficient penetration in packaging and also sterilizes complex, heat-sensitive devices, such as implants and electronics, where other methods have limitations. The latest update includes major inclusion by EPA, i.e., it has set minimum maximum EtO concentrations, like 600mg/L for new cycles by 2035, which fosters investment in advanced systems.

Gamma Sterilization

The gamma sterilization segment is anticipated to expand rapidly in the coming era. Primarily, it is highly advantageous for large batches of pre-packaged, disposable medical devices (catheters, gloves, syringes) and complex products to be rapidly and efficiently. A study in 2025 has showcased the use of more sophisticated solutions, including the Monte Carlo simulation to model and enhance gamma radiation parameters for particular materials, like medical plastics, which probably lowers sterilization times and reduces material degradation.

Which End-Use Led the Off-Site Sterilization Services Market in 2025?

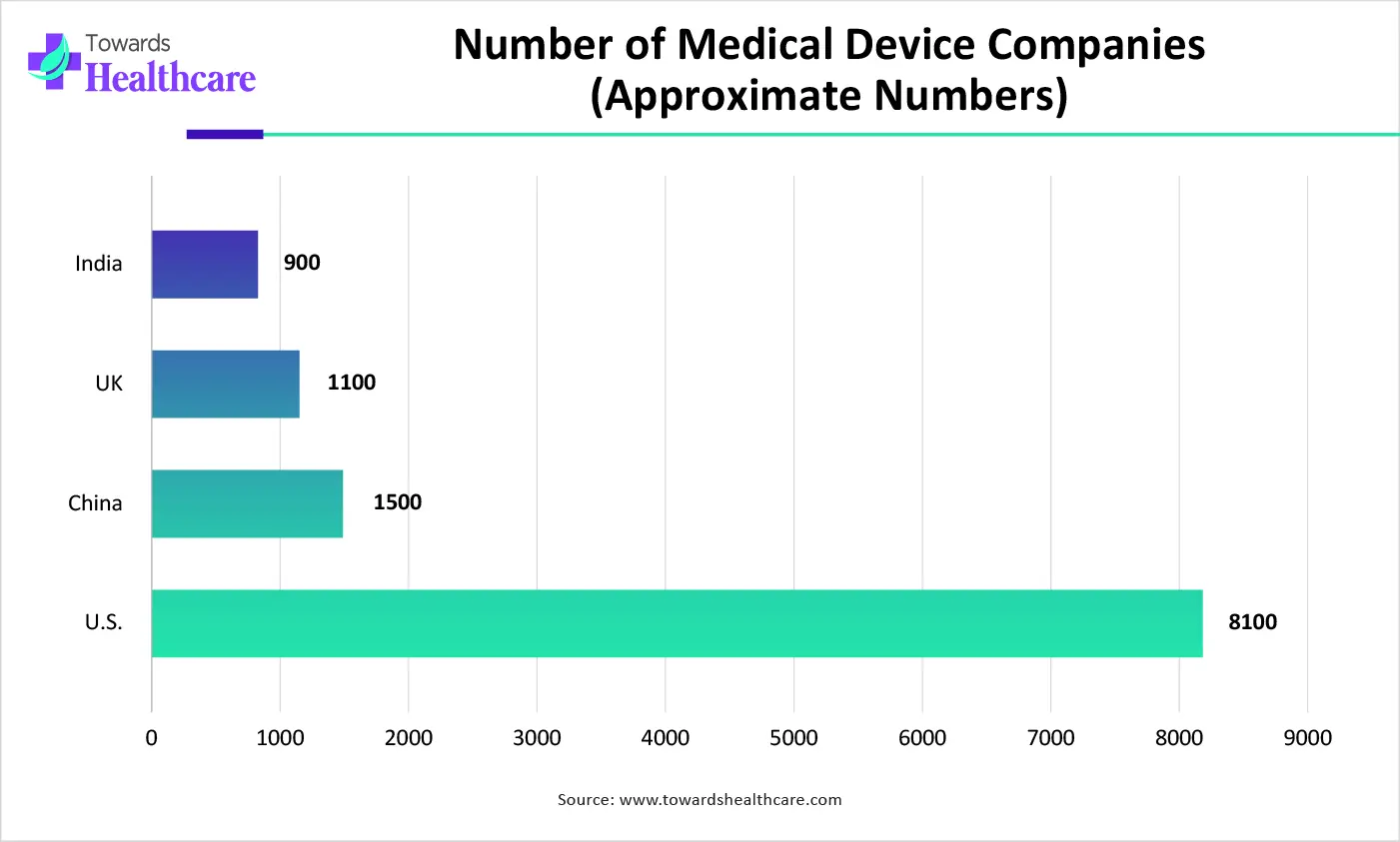

The medical device companies segment held the dominating share of the market in 2025. This mainly comprises numerous service providers, such as STERIS, Sterigenics (Sotera Health), E-BEAM Services, BGS, Medistri SA, Microtrol, Scapa Healthcare, and Noxilizer. Alongside, the increasing surgical volumes and novel, minimally invasive tools and implants are promoting the need for specific, validated sterilization methods.

Pharmaceutical Companies

During 2026-2035, the pharmaceutical companies segment is anticipated to expand at the fastest CAGR. These firms are prominently using sterilization services in packing, vials, or components for sterile drug production. As well as, they have extensive adoption in certain finished drug products or drug-device combinations. In the mid of 2025, BGS introduced its first U.S. facility in Imperial, Pennsylvania (near Pittsburgh) about 100,000 sq. ft. site that features fully automated electron beam (E-beam) irradiation technology.

North America led the market in 2025, due to the accelerating threat of hospital-acquired infections (HAIs), huge surgical volumes, & stringent regulatory demands (FDA/ISO). Whereas, the recent developments include the expanded Sterigenics' new X-ray plant in NC, and the broader adoption of advanced tech (e-beam, X-ray, NO₂).

For instance,

However, the off-site sterilization services market in the U.S. is promoting a variety of solutions, especially X-ray, E-beam, and Vaporized Hydrogen Peroxide (VHP) to supplement EtO. Additionally, the widespread companies in the U.S. are leveraging the rising application of robotics, automation, and real-time monitoring for better process control, accuracy, and regulatory compliance.

Particularly, the Asia Pacific will expand fastest in the off-site sterilization services market in the coming era, as many APAC countries are strengthening awareness and strict regulations for the prevention of Hospital-Acquired Infections (HAIs), which fosters healthcare facilities to outsource to specialized centers. Besides this, APAC is exploring a production center for medical devices and pharmaceuticals, which necessitates high-volume, outsourced sterilization methods.

For instance,

While Futeng Irradiation became the first player in mainland China to locate a dual-beam system, which offers real-time switching between electron beam (E-beam) and X-ray sterilization. Also, they have updated digital systems for data integrity, traceability, and lifecycle management, which assist service providers in adopting intelligent solutions.

During 2026-2035, Europe will expand notably in the off-site sterilization services market, as many companies are increasingly investing in novel or widening capabilities. For example, Medistri established a newer Hungarian site for Central Europe, and planned acquisitions, as Ionisos's E-beam facility buy from Studer Cables AG is impacting the ultimate growth of the regional market progression.

Recently, STERIS announced that its South Marston, UK laboratory has been relocated to Swindon, UK, which mainly helps in meeting the accelerating demand in volume and complexity of medical devices and pharmaceuticals in the region.

| Company | Description |

| Steris Plc | This mainly facilitates comprehensive off-site sterilization services (ORS- Offsite Reprocessing Centers) for healthcare facilities, like full sterile processing (decontamination, washing, assembly, sterilization), logistics (pick-up/delivery), inventory management, and other services. |

| Sotera Health | It offers services to medical devices, pharma, and food, by using Gamma Irradiation, Ethylene Oxide (EO) processing, Electron Beam (E-beam), and X-ray. |

| Cretex Medical | This specifically leverages a proprietary, pre-validated EO cycle called QSTERILE. |

| Scapa Healthcare | It has explored a Cobalt 60 gamma irradiator at its facility in Gargrave, UK, to operate sterilization for various medical devices and pharmaceutical products. |

| BGS Beta-Gamma-Service GmbH & Co. KG | This is a significant European provider specializing in off-site industrial sterilization using ionizing radiation. |

| E-BEAM Services, Inc. | A company prominently offers off-site contract electron beam (e-beam) sterilization and decontamination services. |

| Medistri SA | It mainly focuses on Ethylene Oxide (EO) and Steam (Autoclave) solutions for medical devices, implants, pharma vials, surgical kits, and combination products. |

| Midwest Sterilization Corporation (MSC) | A firm that specialises solely in Ethylene Oxide (EO) processing. |

| Microtrol Sterilization Services | It provides Ethylene Oxide (EtO), Gamma Radiation, and natural Steam Sterilization for a variety of purposes. |

| ClorDiSys Solutions, Inc. | This explores off-site contract sterilization using their specialized chlorine dioxide (ClO2) gas technology. |

Specifically, the management of the pick-up, transport, processing, and return of instruments needs strong and effective logistics management. Delivery delays can collide with surgical schedules, mainly in vital or emergencies.

By Service

By End-use

By Region

February 2026

February 2026

January 2026

January 2026