January 2026

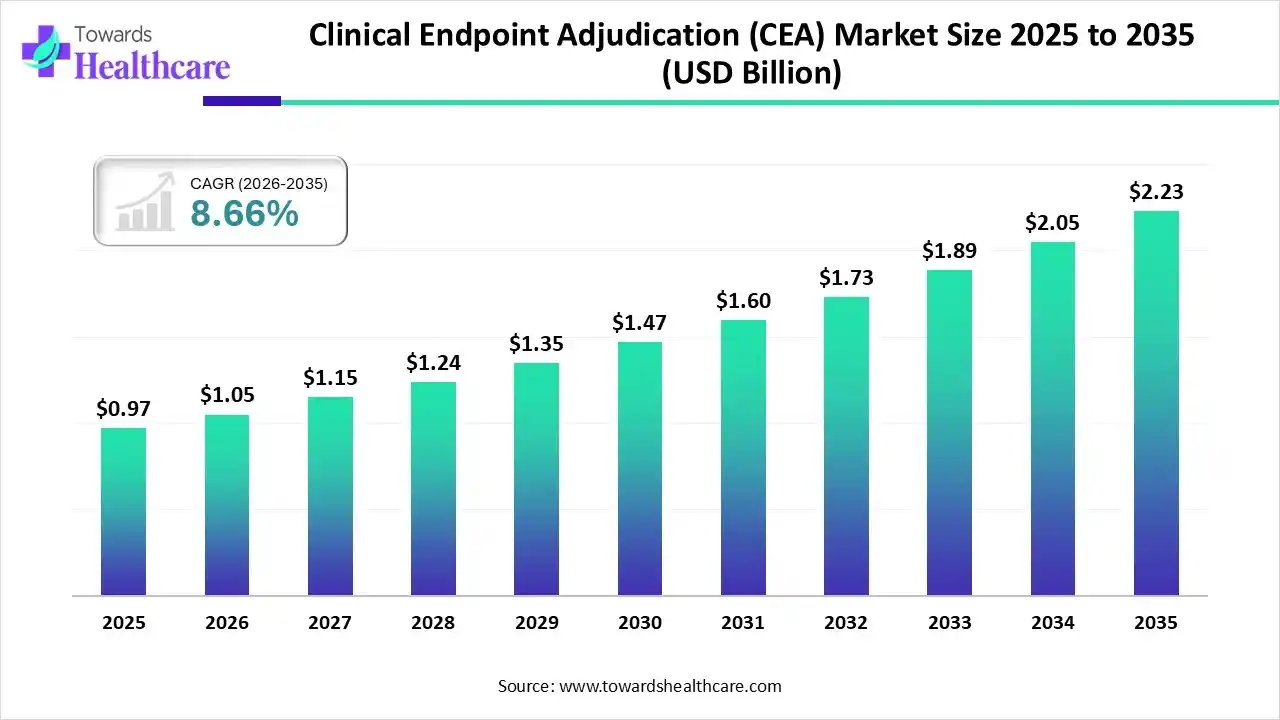

The global clinical endpoint adjudication (CEA) market size was estimated at USD 0.97 billion in 2025 and is predicted to increase from USD 1.05 billion in 2026 to approximately USD 2.23 billion by 2035, expanding at a CAGR of 8.66% from 2026 to 2035.

The clinical endpoint adjudication (CEA) market is growing as it has lower challenges of variation in significant clinical trial outcome events for submission to government agencies.

The clinical endpoint adjudication (CEA) market is growing as it plays a significant role in major clinical trials with the goal of achieving consistency and precision of the research outcomes by applying independent and blinded evaluation of suspected clinical trials reported by researchers. Adjudication is progressively important in the therapeutic region with multifaceted inclusion/exclusion standards. The applications of advanced technologies helps streamlined adjudication processes and are significant to improve the speed and accuracy of endpoint adjudication. Instigating a reliable clinical endpoint adjudication software such as eAdjudication greatly enhances the overall effectiveness of the adjudication workflow.

Integration of AI-driven technology in clinical endpoint adjudication (CEA) drives the growth of the market. AI-based technology provides promising opportunities for enhancing performance in clinical trials with clinical endpoint adjudication. Applying AI-based processes in clinical endpoint adjudication has the benefits of being able to handle varied and complex datasets. Clinical trials often contain a diversity of variables and assessments, which are hard to combine in all expressive ways for a human commentator. AI-driven algorithms rapidly and effectively process this data, make many comparisons, find meaningful features, and expose hidden relations. It also supports standardizing the adjudication process in the various trials and research sites.

Advancement in a robust and dynamic adjudication platform with automated features yields long-term advantages via easier visualization and analysis.

RRCTs are embedded in the huge population-driven registries or smaller single-site registries to offer timely answers at a lower expense compared with traditional randomised controlled trials.

Incorporation of PROs directly in the adjudication platforms to offer a more holistic view of treatment effectiveness.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.05 Billion |

| Projected Market Size in 2035 | USD 2.23 Billion |

| CAGR (2026 - 2035) | 8.66% |

| Leading Region | North America |

| Market Segmentation | By Service Type, By Application, By Therapeutic Area, By End User, By Region |

| Top Key Players | ICON plc, Medidata, Clario, WCG, Advarra, Ethical GmbH |

Which Service Type Led the Clinical Endpoint Adjudication (CEA) Market in 2025?

In 2025, the software/platforms segment held the dominant market share with approximately 68% share in 2025, as this platform reduces bias and variability, thus increasing the power of detection of a difference between the two treatments or between active and placebo. A cloud-driven, real-time EA platform enables all stakeholders to manage the full process effectively and with high quality at a reduced expense by offering the adjudication committee members with precise, clean, and complete data as soon as it becomes available, nevertheless of their location.

Professional Management Services

Whereas the professional management services segment is the fastest-growing in the market, as these services confirm that the outcomes of clinical trials are consistent, precise, and unbiased. Professional management accelerates the process from event submission to final decision, lowering the overall time-to-result.

Why did the Clinical Trials Segment Dominate the Market in 2025?

The clinical trials segment is dominant and fastest-growing in tissue regenerative therapy, with approximately 72% share in 2025, as clinical endpoint adjudication ensures accurate and unbiased evaluation of clinical trial data by providing the expertise of an independent medical professional. Clinical trial adjudication is essential to certify that the outcomes of a clinical trial are accurate, reliable, and unbiased.

Post-Marketing Surveillance

Whereas the post-marketing surveillance segment is the fastest-growing in the market, clinical endpoint adjudication in post-marketing studies depends on the study objectives and the practicality of a central adjudication process. Endpoint adjudication supports reducing the challenges of variation in significant clinical trial outcome events for submission to regulatory interventions. It improves safety monitoring by offering independent, standardized, and blinded expertise.

Why did the Cardiology Segment Dominate the Market in 2025?

The cardiology segment is dominant in the clinical endpoint adjudication (CEA) market with approximately 32% share in 2025, as clinical endpoint adjudication in clinical trial conduct reduces subjectivity by safeguarding systematic and consistent application of pre-specified endpoints. This is specifically significant for non-fatal events that have diagnostic uncertainty and are potentially extra subjective.

Oncology

Whereas the oncology segment is the fastest-growing in the market, as CEA reduces variability in how various investigators interpret multifaceted results, confirming that all sites apply identical, pre-specified standards to assess tumor progression or security events. Many oncology endpoints, like Progression-Free Survival (PFS) or Tumor Response Rate, necessitate nuanced healthcare judgment.

Why did the Pharmaceutical & Biotech Companies Segment Dominate the Market in 2025?

The pharmaceutical & biotech companies segment is dominant in the clinical endpoint adjudication (CEA) market with approximately 44% share in 2025, as clinical endpoint adjudication (CEA) is a consistent process for assessment of safety and effectiveness of pharmacologic or healthcare device therapies in clinical trials conducted by major pharmaceutical & biotech companies.

Contract Research Organizations (CROs)

Whereas the contract research organizations (CROs) segment is the fastest-growing in the market, as a contract research organization (CRO) provides many advantages for drug developers seeking to conduct clinical trials. Partnering with a CRO supports drug companies in reducing the challenges related to clinical trials. CROs are experienced teams of experts which well-versed in dealing with the difficulties of clinical trials, with risk management.

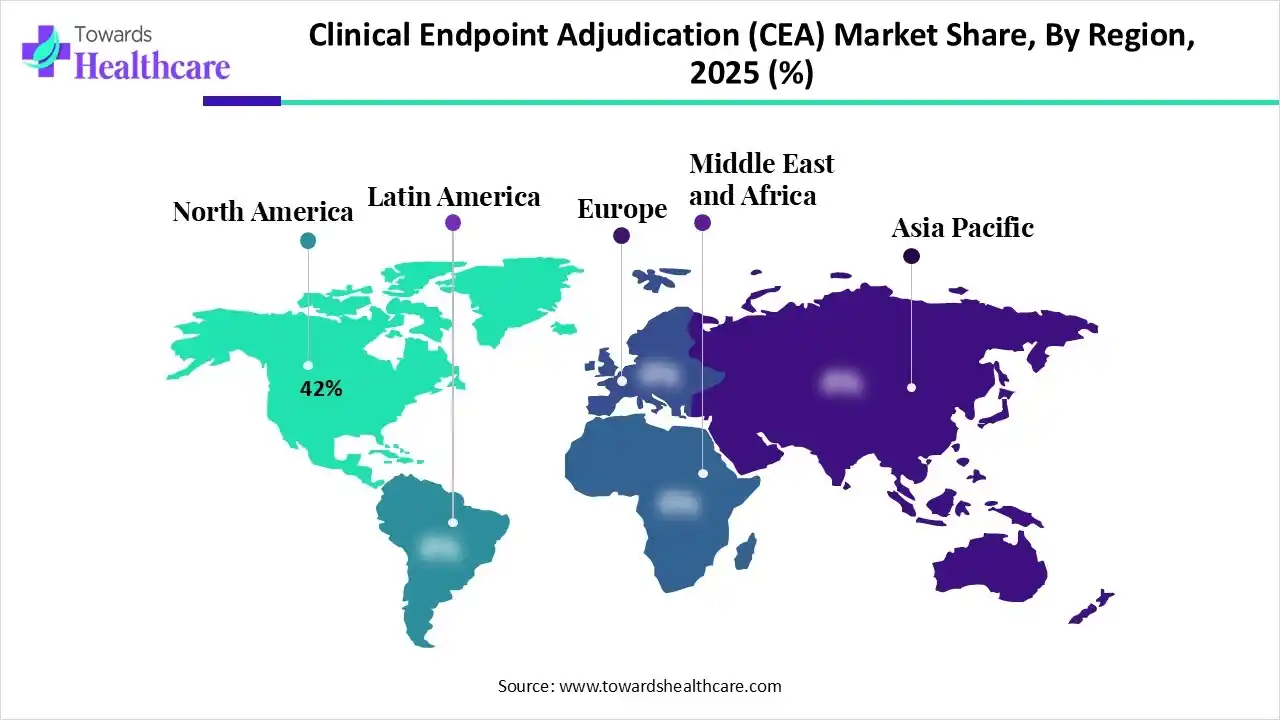

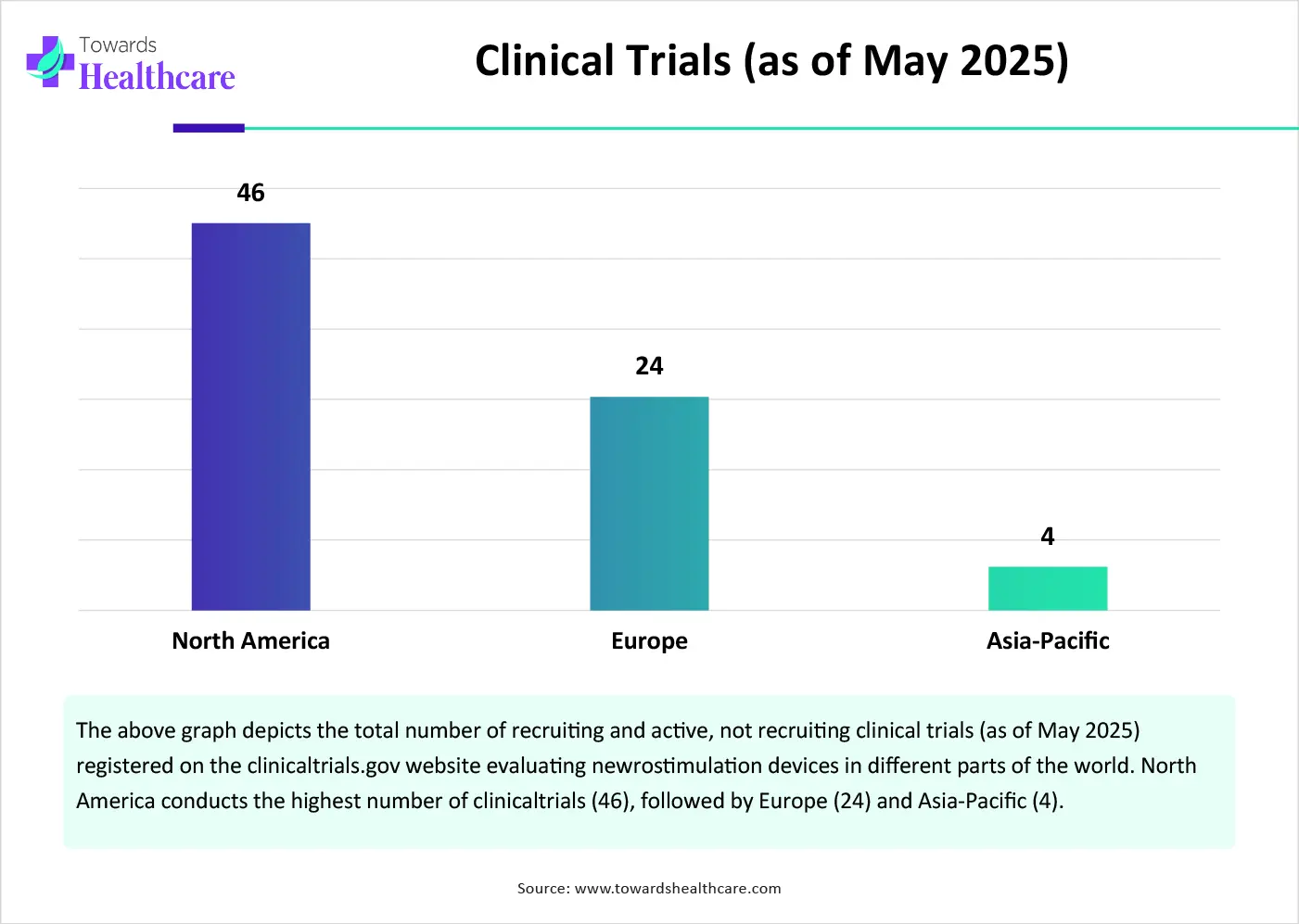

In 2025, North America dominated the clinical endpoint adjudication (CEA) market with approximately 42% share, as this is the most preferred region to conduct clinical trials due to the presence of advanced technology. North America is also the location of 45% of worldwide trials. It is a global leader in scientific and technological development in medical care. Advances in scientific development, medical service delivery, and targeted care are predictable as significant components of high-quality medical systems, which contributes the growth of the market.

For Instance,

U.S. Market Trends

The United States ranked 7th in healthcare services, a result of outstanding scientific development (1st), good quality (14th), and moderate choice (6th). These are some important drivers of the market. Such rankings indicate the nation’s comparative strength in research and development, along with its struggle to control increasing investment in medical care.

Asia Pacific is expected to experience rapid growth in the clinical endpoint adjudication (CEA) market, driven by the increasing number of active control trials in APAC because of the presence of diverse patient populations, reduced trial costs, and the growing pharmaceutical sector. The region provides a clinical trial environment that adheres to worldwide standards, precisely the International Council for Harmonisation (ICH) and Good Clinical Practice (GCP) strategies. The scientific and clinical research landscape in the Asia Pacific is increasing rapidly, driven by this increasing support, which has made the region a main destination for clinical research.

India Market Trends

India has situated itself as a hub in clinical research, with affordability and a massive patient population drawing sponsors worldwide. By 2025, the nation already be ranked in the top five destinations for worldwide studies. Increasing propelling growth is a combination of regulatory reform, administration incentives, and skilled workforce development. India’s expansion relies heavily on trained professionals

Europe is significantly growing in the clinical endpoint adjudication (CEA) market, due to Europe being an advanced healthcare technology shift, and growing regulatory landscapes, such as the implementation of the European Union Clinical Trials Regulation (CTR). Medical care systems should provide fair and inclusive access to high-quality, acceptable, sustainable medical care. The European Observatory on health systems and policies helps and encourages evidence-based medical policy-making via comprehensive and rigorous analysis.

In January 2025, there are 3,213 trials planned, including 823 in Phase I and 1,102 in Phase II.

| Clinical Trial Phase | No. of Trials |

| Phase I | 823 |

| Phase II | 1,102 |

| Company | Headquarters | Latest Update |

| ICON plc | Ireland | In January 2026, ICON plc announced a significant expansion of oncology research capabilities within its Accellacare Site Network through the opening of the Brian Moran Cancer Institute at Duly Health and Care in Illinois. |

| Medidata | United States | Medidata Showcases AI-driven Innovations Reshaping Clinical Research and Development at NEXT Shanghai 2025. |

| Clario | United States | Clario generates the richest clinical evidence by fusing our deep scientific expertise and global scale into the broadest endpoint technology platform. |

| WCG | United States | It enhances the quality and efficiency of clinical trials, helping biopharmaceutical companies, CROs, and institutions facilitate the development of new. |

| Advarra | United States | Advarra's Site Technology Optimization & Scaling services provide strategic guidance and expert resources to best align technology with site workflows |

| Ethical GmbH | Switzerland | Ethical's Cloud-based clinical endpoints adjudication management software, eAdjudication, helps drug manufacturers simplify assessment processes. |

By Service Type

By Application

By Therapeutic Area

By End User

By Region

January 2026

December 2025

December 2025

December 2025