February 2026

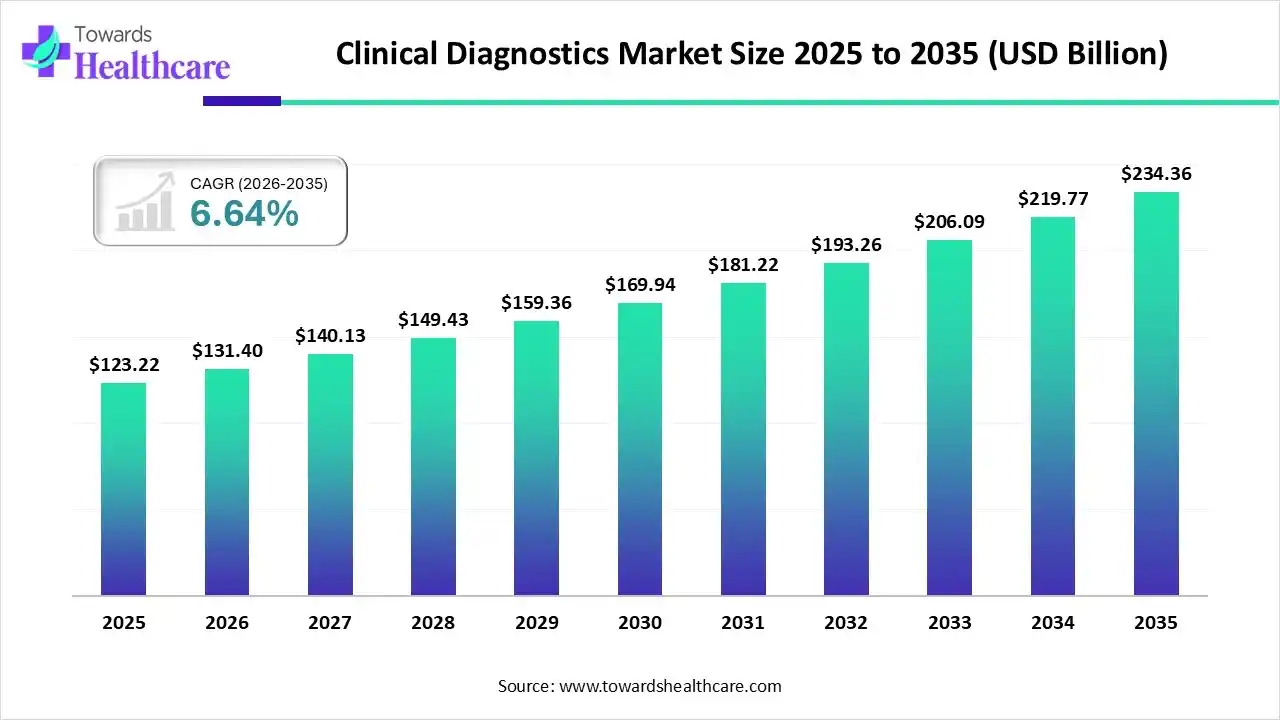

The global clinical diagnostics market size was estimated at USD 123.22 billion in 2025 and is predicted to increase from USD 131.4 billion in 2026 to approximately USD 234.36 billion by 2035, expanding at a CAGR of 6.64% from 2026 to 2035.

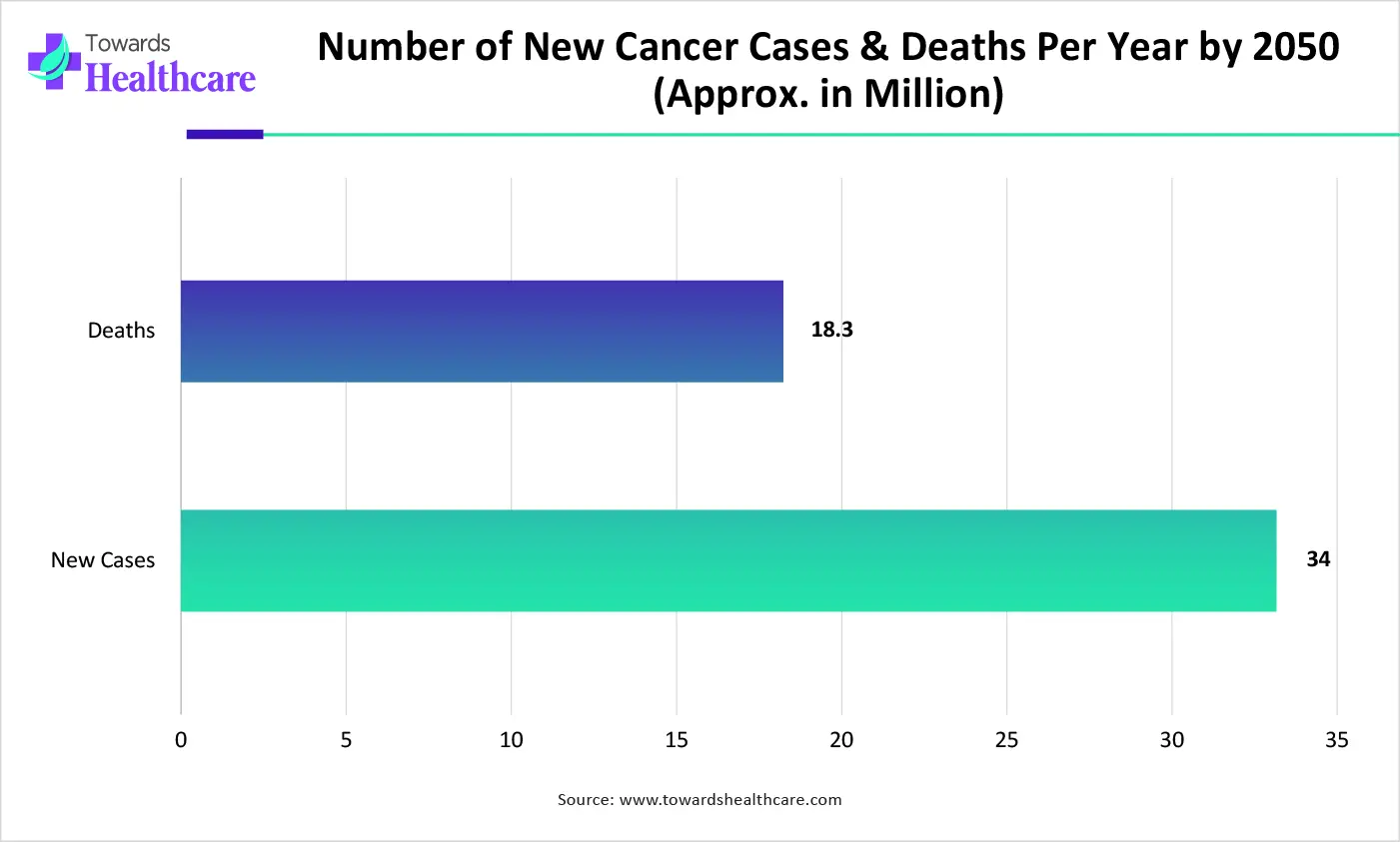

The era is experiencing a significant rise in various infectious diseases and different cancer cases, which fosters demand for advanced diagnosis for early detection. Alongside, the leading companies are putting efforts into developing AI-powered diagnostic solutions, wearable sensors, and home care approaches.

The accelerating cases of diverse chronic diseases, like cancer, diabetes and infectious conditions, are fueling the need for early detection through this diagnosis process. The market is bolstering due to the development of non-invasive blood tests for early-stage cancer detection, supporting liquid biopsy progressing. Alongside, the leading firms are exploring quicker, at-home molecular tests & wearables, which enhance proactive health management.

Nowadays, AI algorithms are widely employed in the analysis of CT scans, X-rays, & MRIs, with tools to highlight tumours and anomalies early. Alongside, AI is extensively fostering the pathology area through the robust scanning of whole slide images to determine cancer cells. Recently, Noul’s AI has showcased advances in the study of blood cell morphology for faster diagnosis in under-resourced areas.

The market is increasingly promoting Companion Diagnostics (CDx) and multi-omics to personalize treatments based on an individual's genetic profile & environment.

Nowadays, the globe is strongly expanding testing for conditions, such as hepatitis B, diabetes, & cardiovascular diseases, and also developed emphasis on neurodegenerative diseases.

Day by day, leaders are focusing on implementing robotics, AI, and IoT (Internet of Things) to manage accelerating test volumes, ensure quality control, and optimise operational effectiveness.

| Key Elements | Scope |

| Market Size in 2026 | USD 131.4 Billion |

| Projected Market Size in 2035 | USD 234.36 Billion |

| CAGR (2026 - 2035) | 6.64% |

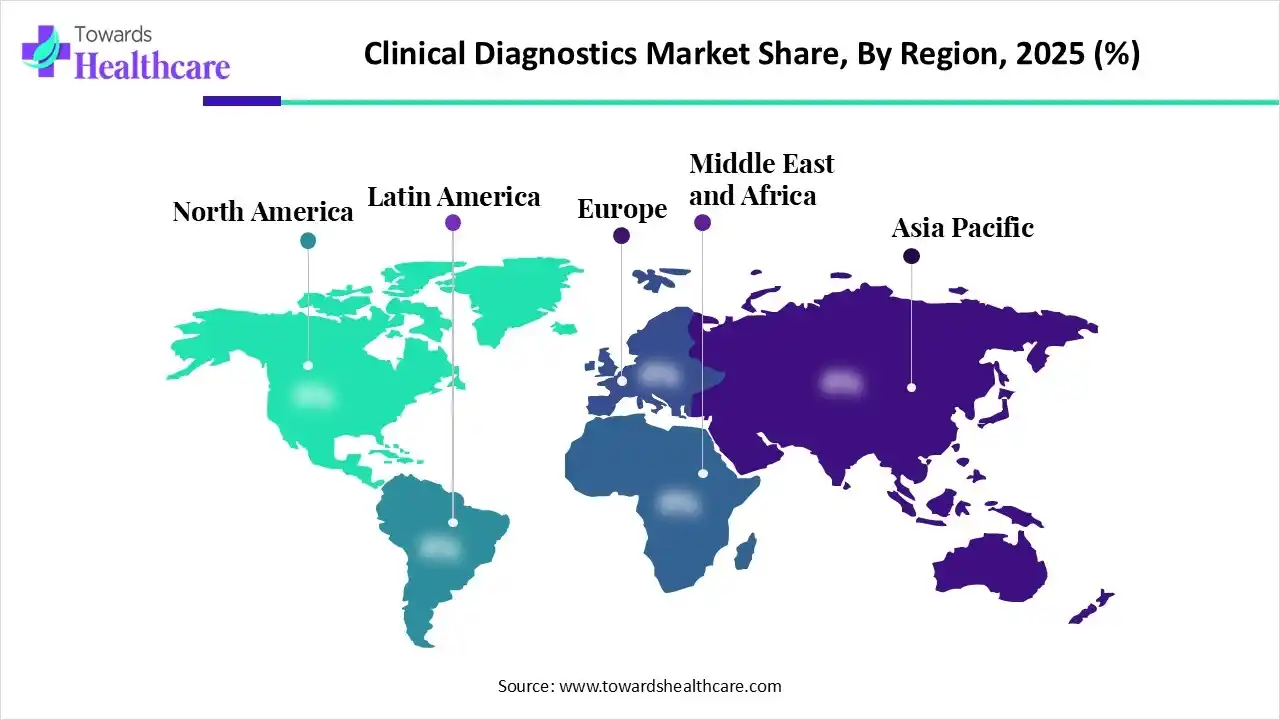

| Leading Region | North America |

| Market Segmentation | By Product, By Application, By End Use, By Region |

| Top Key Players | Abbott, bioMérieux SA, QuidelOrtho Corporation, Siemens Healthineers AG, Bio-Rad Laboratories, Inc.,Qiagen, Charles River Laboratories, Agilent Technologies, Inc. |

Which Product Dominated the Clinical Diagnostics Market in 2025?

In 2025, the instrument segment captured a major revenue share of the market. This involves different kinds of analyzers for chemistry, hematology, and molecular diagnostics, which show rapid, more accurate, and reliable test results in the booming chronic conditions. PCR machines, mass spectrometers, and imaging systems are substantial instruments widely used. However, the key advances include exploration of AI solutions, sophisticated POCT, lab automation and the widespread adoption of LC-MS.

Software And Services

Moreover, the software and services segment is anticipated to expand fastest. Software has a major role in sampling, monitoring, data management, and automated reporting. Advanced companies are fostering cloud-bases solution to execute rigorous data storage, remote access, and analysis. The latest innovation comprises Tempus (Tempus ONE), a tailored medicine platform to combine genomic sequencing with clinical data and further provide AI-enabled therapy recommendations, especially in oncology, neurology and cardiology.

How did the Infectious Diseases Segment Lead the Market in 2025?

The infectious diseases segment dominated with the largest share of the clinical diagnostics market in 2025. Key drivers are a rise in instances of influenza, hepatitis, and HIV, as well as new threats like Zika, Ebola and significant developments in molecular diagnostics. For these cases, the market has shown robustness of AI-assisted smartphone readers for lateral-flow assays (LFAs) to convert qualitative, visual tests into semi-quantitative, digital results, which lowers false negatives in earlier infection stages.

Oncology

On the other hand, the oncology segment will expand rapidly. A huge burden of cancer cases is driven by the rising geriatric population, environmental factors, and lifestyle changes. This is further demanding novel precision treatments and sophisticated molecular diagnostics, like liquid biopsy. Recently evolved AI-powered platforms, such as ComPath AI & Prov-GigaPath, are assisting in the analysis of whole-slide images to detect tumor patterns and biomarkers.

Which End Use Dominated the Clinical Diagnostics Market in 2025?

The hospitals and clinics segment registered dominance in the market in 2025. Globally escalating requirement for early detection to lower long-term treatment spending and raise patient outcomes is propelling the segmental growth. They are highly adopting on-site, immediate, or decentralized tests to accelerate diagnosis. The era is booming with efforts into "phygital", i.e. physical + digital solutions, encouraging AI-enabled automation, and strengthening point-of-care testing (POCT).

Home Care Settings

Moreover, the home care settings segment will witness rapid expansion. Day by day, the world is demanding immediate, user-friendly, and independent testing, alongside rising healthcare expenditures, which are fueling the progression of home-based care solutions. The latest groundbreakings include AI integration into home testing kits and wearables, extensive wearable sensors, and at-home molecular testing, like PCR.

North America was dominant in the clinical diagnostics market due to the presence of a well-established healthcare infrastructure and broader adoption of molecular diagnostics. Furthermore, the region is emphasizing the development of over-the-counter (OTC) molecular tests, including at-home COVID-19/flu kits. Whereas, hospitals in Ontario, especially London Health Sciences Centre, are locating digital navigators to support patients in navigating virtual care platforms & clarifying digital health data.

U.S. Market Trends

However, the U.S. held the biggest share of this region, due to the growing advances in liquid biopsies, rapid POCT molecular diagnostics for infectious diseases, and other immersive AI-enhanced approaches.

For instance,

Asia Pacific is anticipated to expand rapidly in the clinical diagnostics market, due to certain major countries, like China, India, and Japan, which are facing a greater burden of a geriatric population, who are highly prone to an increase in severe health issues. Besides this, continuous breakthroughs in molecular diagnostics, POCT, & next-generation sequencing are transforming to make tests quicker, more accurate, & more accessible. Recently, in Singapore, Synapxe executed "Russel GPT" to abridge patient data & support in clinical decisions.

India Market Trends

India’s significant firms are broadly promoting preventive and genomic medicine, such as Agilus Diagnostics, fostering specialized & genomics-led testing for tailored medicine. However, MapmyGenome & Med Genome are exploring modern genetic testing to develop a precision treatment strategy.

In January 2026, Biopeak raised USD 2.7 million in its latest funding round, empowered by repeat investor Nikhil Kamath to establish structured, preventive & longevity-focused clinical care models in India.

| Company | Description |

| Abbott | A company specializes in core laboratory, molecular, point-of-care, rapid diagnostics, and transfusion medicine. |

| bioMérieux SA | It mainly focuses on in vitro diagnostics in infectious diseases, cardiovascular emergencies, & cancer diagnostics. |

| QuidelOrtho Corporation | This facilitates a complete portfolio of in vitro diagnostics, characterizing in immunoassay, molecular testing, clinical chemistry, & transfusion medicine. |

| Siemens Healthineers AG | A firm explores solutions for immunoassays, chemistry, hematology, molecular, and urinalysis testing. |

| Bio-Rad Laboratories, Inc. | Its offering includes a comprehensive portfolio of systems, software, & reagents for in-vitro diagnostics. |

| Qiagen | A company’s portfolio offers diagnostics in oncology, infectious diseases, and immune monitoring. |

| Sysmex Corporation | This firm specializes in in vitro diagnostics (IVD) & in the development and production of analyzers, reagents, and software for clinical laboratories. |

| Charles River Laboratories | It usually provides bioanalytical services, biomarker testing, and specialized pathology for clinical trials (Phase I-III). |

| Quest Diagnostics Incorporated | This provides over 3,500 tests for cancer, cardiovascular disease, infectious diseases, and neurological disorders. |

| Agilent Technologies, Inc. | A company emphasizes a complete set of clinical diagnostics, including pathology, genomics, and companion diagnostics. |

By Product

By Application

By End Use

By Region

February 2026

February 2026

February 2026

February 2026