December 2025

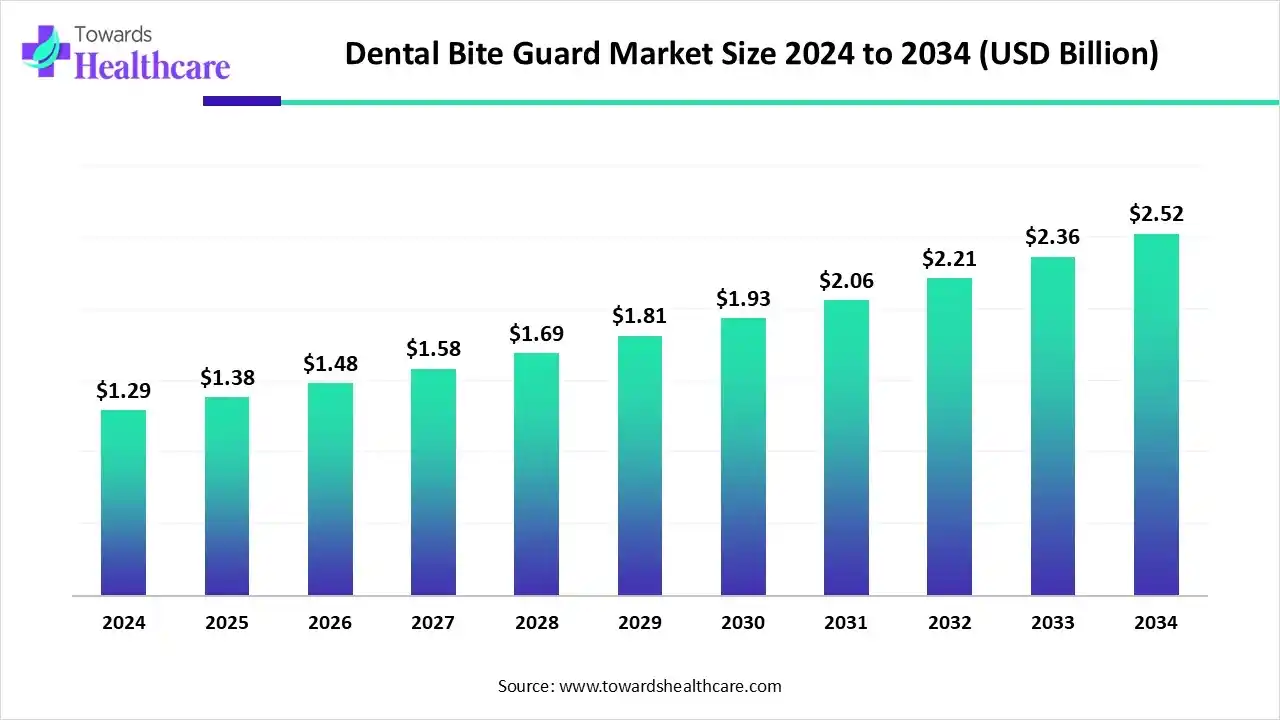

The global dental bite guard market size is calculated at US$ 1.38 billion in 2025, grew to US$ 1.48 billion in 2026, and is projected to reach around US$ 2.70 billion by 2035. The market is expanding at a CAGR of 6.95% between 2026 and 2035.

The growing incidence of dental issues and their awareness are increasing the demand for dental bite guards. At the same time, growing sports culture is also increasing its use to protect the teeth from any injuries. AI technologies are being used to enhance their features and applications, where growing innovations, dental disorders, and digitalization are also increasing their use across various regions. Moreover, companies are collaborating and launching new products, promoting market growth.

| Table | Scope |

| Market Size in 2025 | USD 1.38 Billion |

| Projected Market Size in 2035 | USD 2.70 Bilion |

| CAGR (2026 - 2035) | 6.95% |

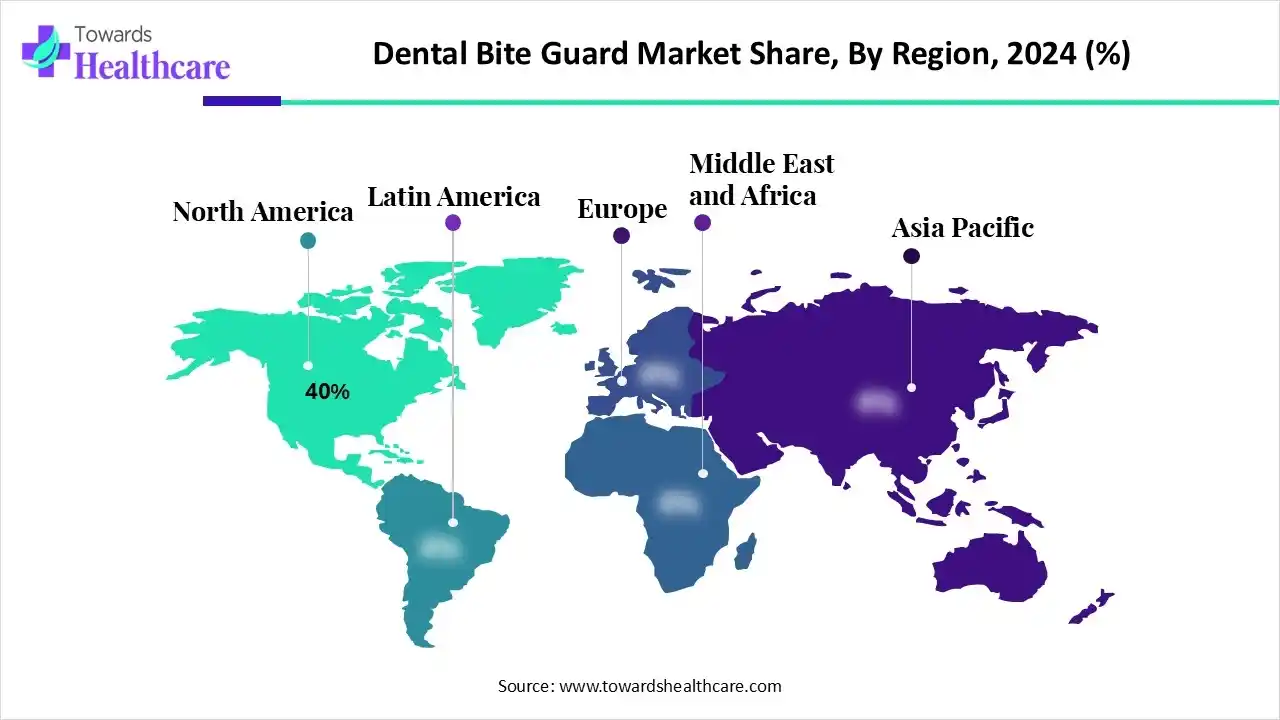

| Leading Region | North America by 40% |

| Market Segmentation | By Product, By Material, By End User, By Application, By Distribution Channel, By Region |

| Top Key Players | Dentsply Sirona, Pro Teeth Guard, DenMat Holdings, 3M Company, Panthera Dental, Ultradent Products, Keystone Industries, Henry Schein, Great Lakes Dental Technologies, Oral Health Group, Planmeca, Dental Innovations, Smile Brilliant |

The dental bite guard market is driven by growing incidences of conditions such as temporomandibular joint disorder (TMD) and bruxism (teeth grinding), as well as due to increasing oral health awareness. Dental bite guards are protective devices worn over the teeth to prevent damage caused by teeth grinding (bruxism), clenching, or other dental issues. They are used in clinical, sports, and home settings to protect dental structures, reduce jaw pain, and improve overall oral health.

The use of AI in the market is increasing as it helps in the detection of dental issues and promotes the development of customizable dental bite guards. Optimized dental bite guards, with appropriate thickness and comfort, are developed as per the patient's needs. Additionally, AI can detect errors and suggest suitable material during its development as per the patient's needs. Moreover, sensors are also being used to detect dental issues, promoting the development of smart dental bite guards.

For instance,

Why Did the Custom-Fit Bite Guards Segment Dominate in the Dental Bite Guard Market in 2024?

The custom-fit bite guards segment led the market with a 50% share in 2024, due to their enhanced protection. Moreover, they provided comfort to the users with better retention properties. Additionally, the growth in the awareness of bruxism has also increased its use.

Boil-and-Bite Bite Guards

The boil-and-bite bite guards segment is expected to show the highest growth with a CAGR of 8.5% during the predicted time. These products are easy to use and are affordable, which is increasing their use at home. Furthermore, they are also being used for various applications, which is increasing their demand.

How EVA (Ethylene Vinyl Acetate) Segment Dominated the Dental Bite Guard Market in 2024?

The EVA (ethylene vinyl acetate) segment held the largest share of 45% in the market in 2024, driven by its enhanced shock absorption properties. This, in turn, increased its use to prevent dental injuries in sports. Additionally, its flexibility and durability increased its use.

Polyurethane

The polyurethane segment is expected to show the fastest growth rate with a CAGR of 8.5% during the predicted time. This material helps in resisting the wear and tear of the bite guard and provides protection to the teeth, enhancing comfort. Moreover, their customization and affordable manufacturing are increasing their use.

What Made Clinics & Dental Practices the Dominant Segment in the Dental Bite Guard Market in 2024?

The clinics & dental practices segment led the global market with a 50% share in 2024, due to high patient volume. This, in turn, increased the use of dental bite guards to deal with various dental injuries and disorders. Moreover, they also offer personalized dental bite guards, which enhance patient outcomes.

Sports Users

The sports users segment is expected to show the highest growth with a CAGR of 8.5% during the predicted time. The increasing sports activities and awareness are increasing the use of dental bite guards. This is increasing their innovations to develop more protective and comfortable dental bite guards.

Which Application Type Segment Held the Dominating Share of the Dental Bite Guard Market in 2024?

The bruxism management segment held the dominating share of 55% in the market in 2024, due to a growth in its incidence rates. This increased the damage to the teeth and jaw pain, which enhanced the use of dental bite guards. Additionally, they were preferred for their chronic management.

Sports Protection

The sports protection segment is expected to show the fastest growth rate with a CAGR of 8.5% during the upcoming years. The growth in participation in various sports activities is increasing the use of dental bite guards to provide protection. Moreover, they are also being considered mandatory during high-impact sports.

Why the Dental Clinics & Hospitals Segment Dominated the Dental Bite Guard Market?

The dental clinics & hospitals segment led the market with a 50% share in 2024, driven by their personalized services. At the same time, the dental bite guards were used in the treatment of various dental disorders and injuries. This, in turn, helped in enhancing the patient outcomes.

Online Retail

The online retail segment is expected to show the highest growth with a CAGR of 9.0% during the upcoming years. These platforms are providing a wide range of options to the patients along with discounts, which is increasing their use. Additionally, their product review and home delivery are attracting the patients.

North America dominated the dental bite guard market with 40% in 2024, due to the presence of a well-developed healthcare infrastructure, which increased the use of dental bite guards by various dental clinics. Additionally, the growing sports culture increased their use by athletes, which, in turn, encouraged their innovations. Therefore, different types of dental bite guards were developed by the companies, which contributed to the market growth.

The U.S. is experiencing a rise in dental problems, such as bruxism, which is driving the dental bite guard market. At the same time, the growing dental injuries is also increasing the demand for protective mouthguards. This is increasing the use of dental bite guards, where the clinics are also offering insurance polices, which is attracting the patients.

For instance,

Asia Pacific is expected to host the fastest-growing dental bite guard market with a CAGR of 9.0% during the forecast period, due to growing oral health awareness. At the same time, with the growing sport activities and technological advancements, the use and development of advanced, comfortable, and more protective dental bite guards is increasing. Moreover, the industries are collaborating to accelerate their developments, enhancing the market growth.

The growth in sports activities like martial arts, football, and basketball in China is driving the dental bite guard market. Moreover, growing dental health awareness and manufacturing hubs are also increasing their use and production rates. Additionally, the industries are focusing on developing more affordable, accessible, and customizable dental bite guards.

Europe is expected to grow significantly in the dental bite guard market during the forecast period, due to growing innovations, to develop more durable and comfortable bite guards along with antimicrobial coating. Additionally, the growing sports participation and increasing case of bruxism are increasing their use. Moreover, different types of online platforms and collaborations are increasing their advancements, promoting market growth.

Due to growing oral health awareness, the dental bite guard market is experiencing growth in Germany. This, in turn, is increasing the use of dental bite guards as a preventive and protective device for bruxism and other dental problems and injuries. Moreover, the growing online platforms are increasing their accessibility, increasing their use by geriatric populations to enhance their comfort.

South America is growing in the dental bite guard market during the forecast period due to rising awareness of bruxism and expanded dental care access are fueling growth in South America’s bite-guard market. Urbanization, higher disposable incomes, and growing dental tourism boost demand for both custom and over-the-counter guards. Local clinics and e-commerce channels accelerate distribution, while manufacturers invest in regional production and patient education programs.

In Brazil, a study found sleep bruxism prevalence at 8.1% among adults in one city, with 70.3% of those showing notable tooth-wear. Among dental students, awake bruxism was 36.5% and sleep bruxism 21.5%, signaling rising awareness and treatment demand.

Middle East and Africa markets are seeing an accelerating uptake of dental bite guards, driven by expanding private dentistry, rising bruxism diagnoses, and growing awareness of sleep-related disorders. Regulatory improvements and partnerships with international dental brands support product availability. Affluent urban centers lead adoption, while NGO initiatives and tele-dentistry broaden reach into underserved regions rapidly.

In a study at Gulf Medical University in the UAE, 41.7% of students self-reported bruxism, and 38.1% reported night grinding. Among Saudi Arabian fighter pilots, bruxism prevalence reached 52.7%, highlighting elevated risk in high-stress occupations.

To develop smart guards with sensors to monitor and collect data on conditions like bruxism and develop more durable, precise, and comfortable devices with the use of advanced manufacturing, such as 3D printing, is the focus for the R&D of dental bite guards.

Key Players: Dentsply Sirona, Glidewell Laboratories, 3M Health Care, Colgate-Palmolive, GSK.

The formulation and final dosage preparation of dental bite guards focuses on the fabrication or molding of non-medical biocompatible materials to fit a patient's mouth.

Key Players: Dentsply Sirona, Glidewell Laboratories, 3M Health Care, Colgate-Palmolive, Procter & Gamble, Akervall Technologies Inc.

The packaging and serialization of dental bite guard involve the protection of the devices, with clear labeling and instructions for their proper use and unique device identification for their traceability.

Key Players: Dentsply Sirona, Glidewell Laboratories, 3M Health Care, Colgate-Palmolive, Procter & Gamble.

Proper fitting of dental bite guards by dental professionals, follow-up care to ensure proper function and address any issues, as well as instructions for cleaning and storage of the guards, are included in the patient support and services of dental bite guards.

Key Players: Dentsply Sirona, Glidewell Laboratories, 3M Health Care, Colgate-Palmolive, Procter & Gamble, Akervall Technologies Inc.

Company Overview

A leading global brand specializing in sports mouthguards and protective gear for athletes.

Corporate Information

History & Background

Founded in 1993, the brand expanded from basic mouthguards into protective sports apparel and accessories. In 2015, the merger of ShockDoctor and McDavid formed United Sports Brands.

Key Milestones/Timeline

Business Overview

Focuses on athlete protection gear: mouthguards, braces, apparel, and related accessories. Sales via direct-to-consumer, retail, and team/league channels.

Geographic Presence

Active globally; packaging redesign referenced UK/Europe markets.

Key Offerings

Mouthguards (boil-and-bite, custom), braces, performance apparel. Packaging redesign included a tiered product ladder “Good/Better/Best”.

Distribution channel strategy

Omni-channel: e-commerce (direct), retail partners (sports/athletic stores), team/league programs (youth and pro). The packaging initiative stressed retail shelf optimization.

Competitive Positioning

Strong brand recognition in sports protection; emphasis on retail-ready packaging and athlete/ambassador programs.

SWOT Analysis

Recent News & Updates/Industry Recognitions/Awards

Company Overview

UK-based specialist manufacturer of technically advanced mouthguards for sports and dental protection.

Corporate Information

Headquarters: Hemel Hempstead, Hertfordshire | United Kingdom. Founded: 1997 | Ownership: Private / family-owned.

History & Background

Founded by a dentist (Dr. Anthony Lovat) to develop higher-performance mouthguards. Grew into a global supplier and official partner for major sports bodies.

Key Milestones/Timeline

Business Overview

Manufactures custom and boil-and-bite mouthguards, including sensor-enabled smart models; serves sports teams, dental professionals, and retail consumers.

Geographic Presence

Global distribution; manufacturing in the UK; partnerships with international sporting bodies and clubs (e.g., Harlequins, RPA).

Key Offerings

Custom-fit mouthguards, Instant Custom-Fit home impression units, sensor-embedded smart mouthguards (with head-impact monitoring).

Business Segments/Divisions

Sports performance mouthguards, dental/therapeutic mouthguards, smart instrumented products, licensed sports partner portfolios (e.g., UFC).

End-Use Industries Served

Contact sports (rugby, MMA, football, etc.), dental clinics (bruxism, night guards), youth clubs, and professional teams.

Key Developments and Strategic Initiatives

Competitive Positioning

Market leader in high-performance/custom mouthguards with sensor technology, strong sports licensing, and clinical credibility.

SWOT Analysis

Recent News & Updates / Industry Recognitions/Awards

Top Vendors and Their Offerings

By Product

By Material

By End User

By Application

By Distribution Channel

By Region

December 2025

December 2025

December 2025

October 2025