January 2026

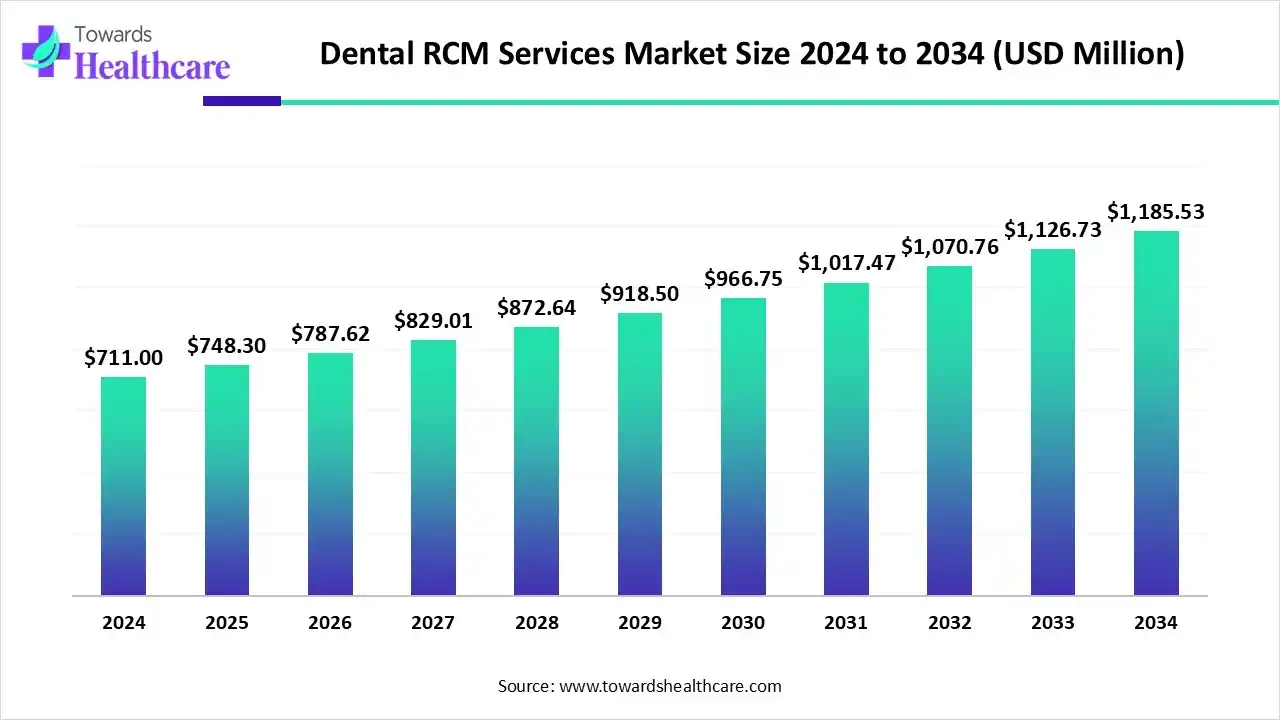

The global dental RCM services market size is calculated at US$ 711 million in 2024, grew to US$ 748.3 million in 2025, and is projected to reach around US$ 1185.53 million by 2034. The market is expanding at a CAGR of 5.25% between 2025 and 2034.

The dental RCM services market is expanding due to the rising use of cloud-based RCM systems and the increased complexity of dental insurance claim regulations. Large companies like Medusind, Dental Revenue Group, and CareRevenue are investing in AI-powered automation to increase the effectiveness of claim processing.

| Table | Scope |

| Market Size in 2025 | USD 748.3 Million |

| Projected Market Size in 2034 | USD 1185.53 Million |

| CAGR (2025 - 2034) | 5.25% |

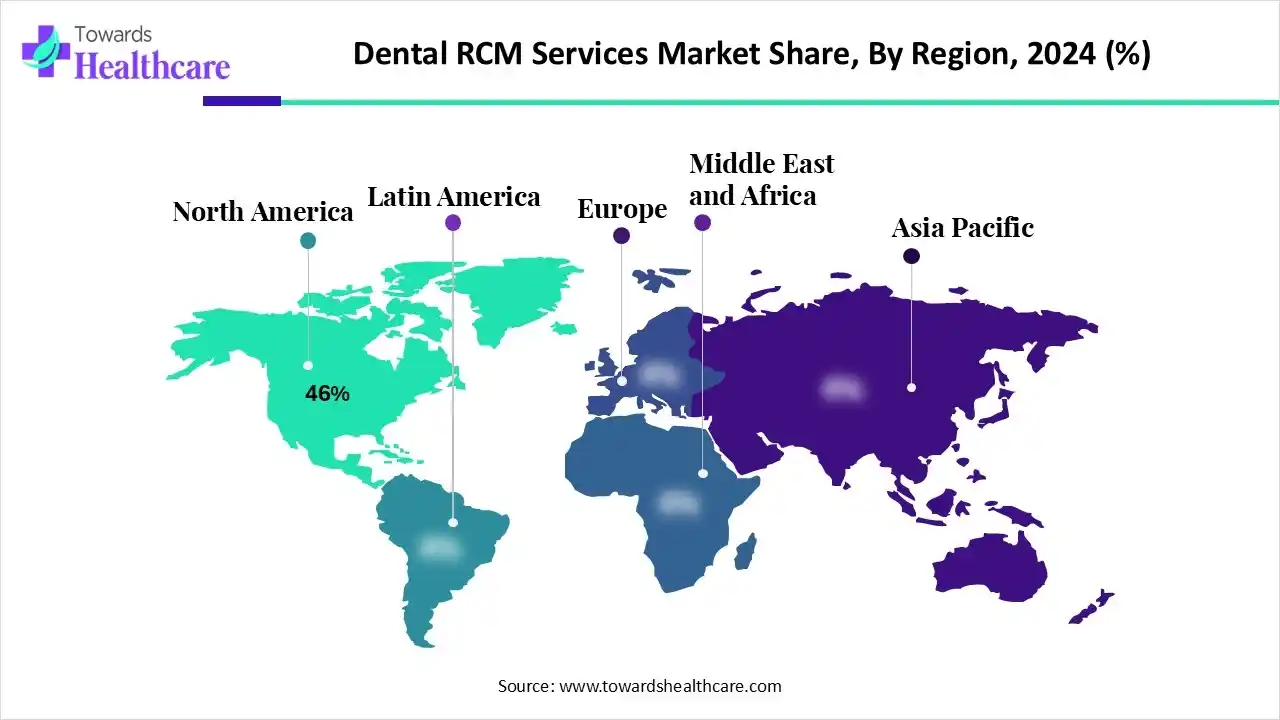

| Leading Region | North America by 46% |

| Market Segmentation | By Service Type, By Delivery Model, By End-User/Customer Segment, By Function/Process Focus, By Technology/Capability, By Region |

| Top Key Players | AnnexMed, CareRevenue, Dental Cashflow Solutions, Dental Revenue Group, Flatworld Solutions, Access Healthcare, Outsource Strategies International, Zentist, Medusind, Dental Claim Support, Kids Dental Brands, BizProc, Resolv Healthcare, Carestream Dental, Henry Schein One, Dentrix (by Henry Schein), Patterson Dental, Open Dental Software, Curve Dental, Dental Intelligence |

The dental RCM services refer to the outsourcing and provision of revenue-cycle-management (RCM) services specifically tailored for dental providers (clinics, dental hospitals, dental service organizations). These services support the entire financial process from patient scheduling and insurance eligibility verification, through claim coding and submission, payment posting and reconciliation, to accounts receivable follow-up and denial management.

This dental RCM services market is being driven by the increasing complexity of dental billing (multiple procedure codes, crossover medical claims, varied insurance plans), the growing number of multi-site dental practices/DSOs seeking operational efficiencies, rising cost pressures on dental practices, and a trend toward outsourcing non-core administrative functions.

Which Service Type is Dominating the Market?

By service type, the end-to-end RCM services segment accounted for 40% of the dental RCM services market revenue in 2024. Reduced patient satisfaction, increased mistakes and rejections, and lost income are all consequences of inefficiencies in revenue cycle management. In this situation, end-to-end revenue cycle management is useful. By collaborating with an end-to-end revenue cycle management provider, a dental practice may improve its cash flow and efficiency.

Patient Collection & Billing

By service type, the patient collections & billing segment is expected to grow at the fastest CAGR in the dental RCM services market during the 2025-2034 period. Dental RCM and dental billing both guarantee that claims are promptly filed for simple reimbursement, are comprehensive and error-free, and are sent to insurance carriers. Both keep note of rejected claims, investigate the reasons for the rejection, and, if needed, enhance internal procedures to prevent future encounters with the same barrier.

Claims Processing & Submission Services

By service type, the claims processing & submission services segment is expected to grow at a significant CAGR during the forecast period. Processing dental insurance claims can be done manually in-house or by a third party. Because BPO vendors have automated procedures that are continuously improved via processing high numbers of claims, working with them helps expedite claims workflows and improve billing accuracy.

What made the Outsourced Segment Dominant in the Market in 2024?

By delivery model, the outsourced segment accounted for 45% of the dental RCM services market revenue in 2024. Practices can improve revenue cycle efficiency by collaborating with dental billing providers such as DentalXChange, Apex Dental, or Planet DDS. This collaboration lowers the number of denied claims, enhances financial results, and frees up staff members to concentrate on patient care while professionals manage intricate billing duties.

Saas/Cloud RCM Platforms

By delivery model, the Saas/cloud RCM platforms segment is expected to grow at the fastest CAGR in the dental RCM services market during the 2025-2034 period. SaaS healthcare software's affordability and scalability make it essential for the dentistry sector. It promotes creativity, improves efficiency, and simplifies processes. By removing the need for large infrastructure expenditures, this SaaS development strategy helps startups and dental service organizations to remain competitive and quickly adjust to changing healthcare demands.

Hybrid

By delivery model, the hybrid segment is expected to grow significantly during the forecast period. For dental revenue cycle management (RCM), a hybrid Software-as-a-Service (SaaS) and managed services package combines RCM software with a group of billing professionals that manage the procedure on behalf of a dental practice. The hybrid method enables a customized blend of automation and human competence, as opposed to a practice managing its own RCM solely through software or by totally outsourcing.

How the Dental Group Practices/DSOs Dominated the Market in 2024?

By end user/customer, the dental group practices/DSOs segment dominated the dental RCM services market, accounting for 40% of revenue in 2024. DSOs' top RCM goals include integrated workflow tools, automation, and easier access to insurance information. These are essential for resolving issues with expediency and promoting a satisfying patient experience.

By end-user/customer, the specialty practices segment is expected to grow at the fastest CAGR in the dental RCM services market during the 2025-2034 period. The greatest dentists are available to people in one handy location at a multispecialty dental clinic. It enables each dental professional to focus on their area of expertise while collaborating to provide exceptional patient outcomes. It's convenient to have a number of dental professionals in one place.

Corporate Employee Dental Programs

By end-user/customer, the corporate employee dental programs segment is expected to grow at a significant CAGR during the forecast period. A company's oral health policies give its employees' dental health first priority. Frequent examinations lower the risk of dental crises, and courses on dental health awareness emphasize the value of maintaining proper oral hygiene. Employee morale and productivity will rise as a result of funding such initiatives, which will increase their sense of worth and appreciation.

Claims Management & AR Recovery

By function/process focus, the claims management & AR recovery segment dominated the dental RCM services market, accounting for 35% of revenue in 2024. A well-written claim paves the way for prompt payment. A successful AR follow-up guarantees that no claim is overlooked. One's practice has higher financial performance, reduced denial rates, and speedier cash flow when both functions are in sync.

Patient Financial Experience & Collections

By function/process focus, the patient financial experience & collections segment is expected to grow at the fastest CAGR in the dental RCM services market during the 2025-2034 period. The dental team may use technologies like AI/ML, IoT, cloud systems, and a well-defined RCM process to guarantee smooth and effective collection procedures and increased collection rates. Additionally, the practice's receivables statement would become more accurate as a result.

Denial Prevention & Appeals

By function/process focus, the denial prevention & appeals segment is expected to grow at a significant CAGR during the forecast period. Because of their extensive industry experience and cutting-edge technology, a skilled dental billing services company can effectively manage denials, addressing the underlying issues and expediting timely claim submissions and appeals.

How the Traditional Practice Management Integration Dominated the Market?

By technology/capability, the traditional practice management integration segment dominated the dental RCM services market, accounting for 35% of revenue in 2024. The efficiency, profitability, and expansion of the practice are all increased by effective practice management. Additionally, it enhances patient happiness and cultivates a favorable reputation. Modern technology is essential for dental offices to enhance patient satisfaction and care quality.

Cloud-Native RCM Platforms + APIs

By technology/capability, the cloud-native RCM platforms + APIs segment is expected to grow at the fastest CAGR during the forecast period. Many of the laborious processes that staff members have historically completed are automated by a contemporary dental RCM platform that employs APIs to interface with various systems and data sources. For dental offices and DSOs, a number of businesses provide sophisticated, API-focused RCM solutions.

AI/ML

By technology/capability, the AL/ML segment is expected to grow at a significant CAGR in the dental RCM services market during the 2025-2034 period. AI in dentistry. By automating a large number of the tedious, error-prone processes associated with insurance verification, RCM brings about a revolutionary change. AI agents greatly reduce human mistakes and time consumption by speeding up and improving eligibility verification. Dental clinics benefit from ML-powered solutions that speed up payment, save administrative costs, and minimize billing mistakes.

North America dominated the dental RCM services market share by 46% in 2024. Data from the American Dental Association shows that office size and technology adoption are strongly correlated, with group clinics using advanced billing systems first. In contrast to multi-payer systems in the U.S., Canadian markets have simplified provincial insurance programs that simplify verification. In both nations, DSO consolidation is accelerating, and enterprise-scale platform adoption is being driven by large companies like 123Dentist and Heartland Dental.

In the U.S., dental caries, often known as tooth decay, is a prevalent yet avoidable chronic illness that affects children. To help states improve oral health care for children enrolled in Medicaid and CHIP, as well as the delivery of preventive services and ongoing dental care, the Centers for Medicare & Medicaid Services (CMS) offers quality improvement (QI) technical assistance.

Asia Pacific is estimated to host the fastest-growing dental RCM services market during the forecast period. The aging population, the growing prevalence of dental diseases, the development of dental practice management software, and the growing requirement to handle the massive volumes of medical data produced by dental offices are all expected to drive market expansion over the course of the forecast period.

India has serious issues with oral health due to a lack of infrastructure, inadequate knowledge, and financial constraints. A number of factors contribute to the startlingly high frequency of oral health disorders in India. Despite the fact that 68.84% of people reside in rural areas, most dentists would rather operate in cities.

Europe is expected to grow at a significant CAGR in the dental RCM services market during the forecast period. Advanced dental operations, such as restorative procedures, preventative care, and cosmetic improvements, are in high demand due to Europe's aging population and increased knowledge of oral health and cosmetic dentistry. These elements are pushing governments and regional organizations to spend more on dental care in order to expand the market's access to cutting-edge items.

The UK's NHS dental activity in 2024–2025 had an "encouraging recovery," delivering 35 million courses of treatment (COTs), a 4% increase over the year before. With 12 million COTs and 6.9 million child patients seen in England over that time, the number of children's treatments increased by 7%. At the same time, there were 11,976 dental offices, a 1.2% rise.

Latin America is expected to grow significantly in the dental RCM services market during the forecast period. The dental RCM services market across Latin America is witnessing strong growth as healthcare providers digitize workflow, adopt outsourcing strategies, and expand payer networks, boosting demand for revenue cycle management tailored to dentistry across the region.

In Brazil, about 87% of the population now lives in urban areas, enhancing access to dental clinics and managed care services. Additionally, more than 85 % of households have internet access, paving the way for digital tools and remote RCM solutions in dentistry.

The Middle East and Africa are expected to grow at a lucrative CAGR in the dental RCM services market during the forecast period. The dental RCM services market in the MEA region is expanding rapidly, fueled by the rise of private dental networks, increased insurance coverage, and government-led healthcare digitalization across Gulf countries, aiming for efficiency and automation.

The UAE invests over AED 5 billion annually in health tech innovation, while over 75 % of hospitals are now integrated with electronic health records. This strong digital infrastructure encourages the adoption of automated RCM platforms and AI-driven billing in dental care.

Company Overview

Key Milestones/Timeline:

Business Overview

Key Offerings:

Key Developments & Strategic Initiatives

Technological Capabilities/R&D Focus

Competitive Positioning

SWOT Analysis:

Recent News and Updates

Company Overview

Key Milestones / Timeline

Business Overview

Key Offerings:

Key Developments & Strategic Initiatives

Technological Capabilities / R&D Focus

Competitive Positioning

SWOT Analysis:

Recent News and Updates

| Company | Headquarters | Key Strengths | Latest Info (2025) |

| AnnexMed | New York, USA | AI-driven automation, strong denial management | Leading dental RCM provider automating claims and A/R workflows. |

| Dental Cashflow Solutions | Texas, USA | Full-cycle RCM, automation focus | Expanding automation tools for DSOs and private practices. |

| Dental Revenue Group | California, USA | Accuracy, transparency | Enhancing claim audit analytics for small practices. |

| Flatworld Solutions | India/USA | Scalable outsourcing, secure delivery | Expanding AI-based credentialing and claims services. |

| Access Healthcare | Texas, USA | Large-scale automation, analytics | Growing dental RCM unit with new AI-driven solutions. |

By Service Type

By Delivery Model

By End-User/Customer Segment

By Function/Process Focus

By Technology/Capability

By Region

January 2026

January 2026

January 2026

January 2026