January 2026

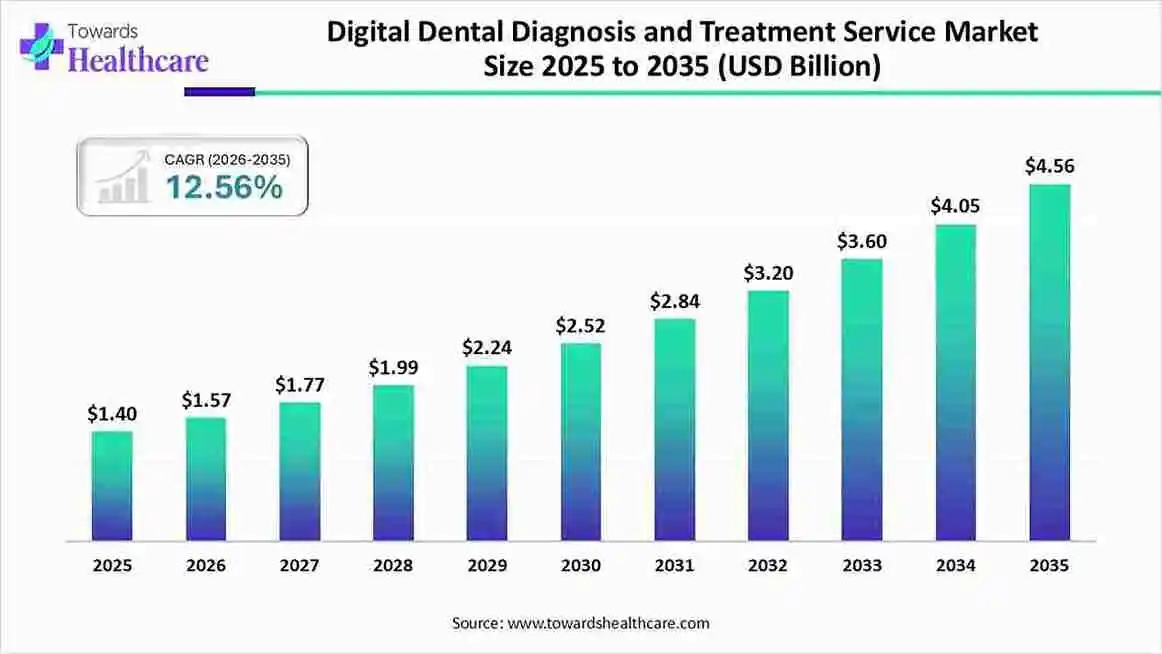

The digital dental diagnosis and treatment service market size was valued at US$ 1.4 billion in 2025 and is projected to grow to 1.57 billion in 2026. Forecasts suggest it will reach approximately US$ 4.56 billion by 2035, registering a CAGR of 12.56% during the period.

The digital dental diagnosis and treatment service market is witnessing rapid growth driven by technological advancements like AI, 3D imaging, and CAD/CAM systems. Increasing demand for accurate, efficient, and minimally invasive dental procedures, along with rising adoption in developed regions such as North America, further fuels market expansion globally.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.09 Billion |

| Projected Market Size in 2035 | USD 4.38 Billion |

| CAGR (2026 - 2035) | 12.56% |

| Leading Region | North America by 40% |

| Market Segmentation | By Service Type / Offering, By Technology / Modality, By Clinical Application, By Delivery Model, By Customer / End-User, By Integration / Workflow Stage, By Region |

| Top Key Players | Carestream Health, Inc., Ivoclar Vivadent AG, Institut Straumann AG, Zimmer Biomet Holdings, Inc., Henry Schein, Inc., Patterson Companies, Inc., KaVo Dental, Roland DG Corporation, 3Shape A/S, Kuraray Noritake Dental Inc., Desktop Health (Desktop Metal), GC Corporation, Midmark Corporation, Vatech Co., Ltd., Carestream Dental LLC |

The digital dental diagnosis and treatment service market is growing due to rising adoption of advanced technologies like AI, 3D imaging, nd CAD/CAM for faster, more accurate, and minimally invasive dental care. The market for digital dental diagnosis and treatment services refers to technologies, platforms, and services that enable diagnosis, treatment planning, delivery, and monitoring of dental care via digital tools.

The emphasis is on replacing or augmenting traditional analog workflows (manual impressions, 2D imaging, manual planning) with digital, data-enabled, often connected services to improve accuracy, patient experience, speed, and outcomes.

For Instance,

AI is transforming the Digital Dental Diagnosis and Treatment Service market by enabling faster and more accurate image analysis, personalized treatment planning, and predictive diagnostics. It enhances efficiency, reduces human error, and supports data-driven decision-making, leading to improved patient outcomes and higher adoption of digital dental technology.

How does the Chairside Digital Diagnosis & Treatment Services Segment dominate the Market in 2024?

In 2024, the chairside digital diagnosis & treatment services segment held the largest digital dental diagnosis and treatment service market share of 30%, due to its ability to provide real-time imaging, faster diagnostics, and same-day restorations. The integration of CAD/CAM and 3D scanning technologies enables efficient workflows, improved patient experience, and reduced chair time, driving its widespread adoption across dental clinics.

Remote/Teledentistry Diagnosis & Treatment Planning

The remote/teledentistry diagnosis & treatment planning segment is expected to grow rapidly over the forecast period, driven by rising demand for virtual consultations, improved internet connectivity, and AI-based diagnostic tools. Its convenience, cost-effectiveness, and ability to reach patients in remote areas are driving adoption, particularly after the increased digital shifts post-pandemic.

Lab-connected Digital Treatment Services

The lab-connected digital treatment services segment is expected to grow rapidly in the digital dental diagnosis and treatment service market during the forecast period, driven by advanced integration of CAD/CAM systems, cloud-based workflows, and AI-driven design solutions. These innovations enhanced accuracy, efficiency, and collaboration between dental labs and clinics, resulting in faster turnaround times and improved customization in dental restorations and treatment planning.

Why Did the Intraoral Scanning (IOS)+3D Model Services Segment Dominate the Market in 2024?

The intraoral scanning (IOS)+3D model services segment leads the digital dental diagnosis and treatment service market with a revenue share of 28% as it streamlines dental workflows through high-resolution imaging, real-time visualization, and precise digital impressions. Its ability to reduce manual errors, enhance patient comfort, and support same-day restorations has accelerated its adoption across dental practices, boosting overall revenue share.

3D printing

The 3D printing segment is projected to grow at the fastest CAGR during the forecast period due to its ability to produce highly accurate, customized dental prosthetics and aligners at reduced costs and turnaround times. Its integration with digital design software enhances treatment precision, sustainability, and scalability, driving widespread adoption in modern dental practices and labs.

CAD/CAM Design & Milling Services

The CAD/CAM design & milling services segment is expected to grow at the fastest CAGR in the digital dental diagnosis and treatment service market during the forecast period due to increasing demand for precise, aesthetic, and same-day dental restorations. These technologies enhance workflow efficiency, reduce manual labor, and improve the quality of crowns, bridges, and implants, driving adoption across dental clinics and dental laboratories worldwide.

For Instance,

What made the Restorative Dentistry Segment Dominant in the Market in 2024?

The restorative dentistry segment held the highest digital dental diagnosis and treatment service market share of approximately 30% in 2024 due to the growing prevalence of dental caries, tooth loss, and aesthetic dental procedures. Increasing adoption of digital tools like CAD/CAM and 3D imaging improved treatment accuracy and efficiency, driving higher demand for crowns, bridges, and implants across dental clinics and laboratories.

Orthodontics

The orthodontics segment is expected to grow at a faster CAGR in the digital dental diagnosis and treatment service market during the forecast period due to rising demand for aesthetic dental solutions, such as clear aligners and digital braces. Technological advancements in 3D imaging, AI-based treatment planning, and remote monitoring are improving accuracy, patient comfort, and treatment efficiency, driving rapid adoption among dental professionals globally.

Implantology

The implantology segment is anticipated to grow significantly during the forecast period due to the increasing preference for minimally invasive dental procedures and the rising success rate of digital implant solutions. A growing geriatric population, improved biocompatible materials, and integration of guided surgery systems are further boosting adoption and market expansion.

How does the in-clinic dominate the Market in 2024?

The in-clinic segment held the highest digital dental diagnosis and treatment service market share of 40% due to the continued reliance on direct dental consultations, advanced equipment availability, and comprehensive treatment options under one roof. High patient trust in professional in-person care, combined with clinics adopting digital technologies like 3D imaging and CAD/CAM systems, strengthened this segment’s dominance in 2024.

Fully Remote/Teledentistry + Delivery

The fully remote/teledentistry + delivery segment is expected to grow at the fastest CAGR in the digital dental diagnosis and treatment service market during the forecast period due to rising demand for accessible and convenient dental care. Advancements in digital imaging, AI-based diagnostics, and secure teleconsultation platforms enable real-time assessments and personalized treatment planning, especially benefiting patients in rural and underserved regions.

Cloud/Lab Connected Model

The cloud/lab-connected model segment is projected to grow notably during the forecast period as it supports seamless remote access to patient data, real-time case tracking, and automated design updates. Its scalability, reduced operational costs, and improved coordination between dental professionals and laboratories are accelerating its adoption in modern digital dentistry.

Why do the Private Dental Clinics & Group Practices Segment dominate the Market in 2024?

The private dental clinics & group practices segment held the highest digital dental diagnosis and treatment service market share of 55% in 2024 due to their rapid adoption of advanced digital technologies, such as CAD/CAM, 3D imaging, and AI-based diagnostics. Their flexibility in investing in modern equipment, focus on patient experience, and growing demand for cosmetic and restorative procedures further boosted segment dominance.

Orthodontic Clinics & Clear Aligner Providers

The orthodontics clinics & clear aligner providers segment is expected to grow at the fastest CAGR in the digital dental diagnosis and treatment service market during the forecast period due to rising demand for aesthetic and non-invasive dental corrections. The increasing popularity of clear aligners, supported by AI-driven treatment planning, 3D printing, and digital monitoring tools, is driving adoption and accelerating market expansion globally.

Dental Laboratories

The dental laboratories segment is projected to grow notably in 2024 as labs increasingly adopt cloud-based systems and digital scanning tools to streamline case management. Rising demand for customized dental restorations, automation in design processes, and stronger collaboration with dentists are enhancing productivity and driving consistent market expansion.

How does the End-to-End Segment dominate the Market in 2024?

The end-to-end segment dominated the digital dental diagnosis and treatment service market with the largest revenue share of 35% as it offers a complete digital workflow from diagnosis and design to fabrication and delivery within a unified platform. This integration minimizes errors, enhances treatment accuracy, and improves efficiency, making it the preferred choice for clinics and labs adopting comprehensive digital dental solutions.

Fabrication Only

The fabrication only segment is projected to grow at the fastest CAGR in the digital dental diagnosis and treatment service market during the forecast period due to rising demand for customized dental restorations and prosthetics. Advancements in 3D printing, milling, and AI-driven design systems enable precise, cost-effective production, while increased outsourcing by clinics to specialized labs further accelerates market growth in this segment.

Scan & Diagnostic Only

The scan and diagnostic-only segment is expected to grow at a notable rate due to increasing adoption of advanced imaging technologies like intraoral scanners and 3D diagnostic systems. These tools enhance early detection accuracy, reduce patient discomfort, and streamline data collection for treatment planning, driving their widespread use across dental clinics and diagnostic centers.

North America dominated the digital dental diagnosis and treatment service market with a major revenue share of in 40% 2024, driven by its advanced healthcare infrastructure, high adoption of digital technologies, and strong presence of key industry players. Increased demand for cosmetic and restorative dental procedures, supportive reimbursement frameworks, and growing awareness of AI-driven diagnostics further strengthened the region’s leadership. Additionally, continuous investments in research, innovation, and integration of cloud-based and 3D imaging solutions contributed to its substantial market share.

For Instance,

The U.S. is revolutionizing the market by emphasizing personalized and data-driven dental care. Widespread use of connected devices, remote monitoring, and virtual consultations is enhancing accessibility. Collaboration between dental tech firms and research institutions, along with increasing digitalization of clinics, is boosting efficiency and advancing treatment precision nationwide.

Asia-Pacific is accelerating the market through rapid adoption of advanced dental technologies, growing healthcare investments, and increasing awareness of oral care health. Expanding dental tourism in countries like India, Thailand, and South Korea, along with government support for digital healthcare, is driving regional growth. Additionally, the rising number of tech-savvy dental professionals and the adoption of AI-based diagnostics and 3D imaging are transforming clinical efficiency and patient experience.

China is advancing the market through strong government support for healthcare digitalization and innovation. Initiatives like the “Healthy China 2030” plan promote AI integration, telemedicine, and smart dental solutions. Domestic manufacturers are investing in 3D imaging, CAD/CAM, and cloud-based systems, enhancing accessibility and precision. Partnerships between tech companies and dental institutions are also accelerating the adoption of intelligent diagnostic tools and boosting the nation’s presence in the global dental technology landscape.

Europe is driving growth in the market through initiatives focused on healthcare digitalization, interoperability, and innovation. The European Union’s “Digital Health and Care Strategy” promotes AI integration, data sharing, and cross-border telemedicine. Investments in 3D printing, CAD/CAM systems, and cloud-based dental platforms enhance precision and accessibility. Additionally, collaborations between universities, dental associations, and technology firms are strengthening clinical training and advancing the adoption of smart dental solutions across the region.

The UK is advancing the market through the National Health Service (NHS) digital transformation initiatives and strong private sector participation. Increased adoption of AI-based diagnostics, intraoral scanners, and cloud-integrated dental records is enhancing accuracy and workflow efficiency. Government funding for tele-dentistry and digital health innovation, along with rising demand for aesthetic and preventive care, is driving modernization across clinics and strengthening the country’s position in digital dentistry.

South America is accelerating the market through expanding healthcare infrastructure, growing middle-class awareness of oral health, and rising adoption of digital imaging and CAD/CAM technologies. Countries like Brazil, Mexico, and Chile are investing in modern dental equipment and training programs. The increasing presence of global dental technology companies and the rise of tele-dentistry platforms are further improving accessibility, efficiency, and precision in regional dental care delivery.

Brazil is reshaping the market by emphasizing technology-driven dental care and patient-centered solutions. The country is integrating cloud-based platforms, mobile dental apps, and remote consultation services to improve accessibility. Collaboration between universities and dental tech firms, along with a growing demand for digital workflows, is modernizing clinics and boosting operational efficiency nationwide.

The Middle East and Africa are accelerating the market by focusing on modernizing dental facilities and integrating smart healthcare solutions. Increased collaborations with global dental tech firms, expansion of training programs for digital dentistry, and rising demand for affordable, high-quality treatments are strengthening regional capabilities and encouraging widespread adoption of advanced diagnostic tools.

The United Arab Emirates (UAE) is advancing the market by positioning itself as a regional hub for dental innovation. The government’s strong support for healthcare digitalization, along with initiatives under the UAE Vision 2031, promotes AI-based diagnostics, 3D imaging, and cloud-connected dental systems. Growing dental tourism, collaboration with global technology providers, and the adoption of smart clinic models are enhancing precision, efficiency, and patient experience across the country’s dental sector.

Company Overview:

A global dental equipment and consumables company offering diagnostic, imaging, and treatment solutions in dentistry, aiming to digitalize the dental workflow.

Corporate Information (Headquarters, Year Founded, Ownership Type):

History and Background:

Key Milestones / Timeline:

Business Overview:

The company provides dental equipment, consumables, digital imaging and diagnostics, orthodontic and implant solutions, and software workflows for dental practices and labs.

Business Segments / Divisions:

Key segments include:

Geographic Presence:

Global presence across the Americas, EMEA, and Asia-Pacific regions with manufacturing, sales, and service operations worldwide.

Key Offerings:

Intraoral scanners, CAD/CAM systems, imaging equipment (CBCT, 2D X-ray), dental consumables (implants, restorative materials), orthodontic systems, cloud software (DS Core), and services.

End-Use Industries Served:

Dental practices (general, orthodontic, implant), dental laboratories, dental service organizations, and hospitals with dental/imaging departments.

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

While many historical acquisitions exist, recent publicly-noted moves include a strategic review rather than large acquisitions announced.

Partnerships & Collaborations:

Product Launches / Innovations:

Capacity Expansions / Investments:

Recent note of issuing US $550 million of junior subordinated notes (June 2025) to fund operations/capital.

Distribution Channel Strategy:

Utilizes direct sales and service for equipment in major markets, plus dental-lab networks and consumables distribution globally. Emphasis on digital platform and cloud services for recurring revenues.

Technological Capabilities / R&D Focus:

Core Technologies / Patents:

Proprietary imaging systems, intraoral scanners, CAD/CAM workflows, cloud-platform technologies.

Research & Development Infrastructure:

Global R&D centers, and collaboration with dental education institutions for training and innovation (e.g., High Point University).

Innovation Focus Areas:

Digital dentistry workflows, AI diagnostics in dental radiology, integration of imaging with treatment planning, and practice-centric software tools.

Competitive Positioning:

Strengths & Differentiators:

Market presence & ecosystem role:

Plays a major role in enabling dental practices, labs, and service-providers with end-to-end digital solutions; an ecosystem player rather than a niche.

SWOT Analysis:

Recent News and Updates:

Press Releases:

Company Overview:

A global medical-device company specializing in clear aligner treatment systems, intraoral scanners, and digital dentistry software, enabling orthodontic and restorative workflows.

Corporate Information (Headquarters, Year Founded, Ownership Type):

History and Background:

Key Milestones / Timeline:

Business Overview:

Provides clear aligner systems (Invisalign), intraoral scanning devices (iTero), digital platforms and software (Align Digital Platform, exocad) for orthodontics and restorative dentistry.

Business Segments / Divisions:

Geographic Presence:

Global operations across the Americas, EMEA, and Asia-Pacific; manufacturing and supply chain include Mexico (aligners), scanners in Israel/China.

Key Offerings:

Invisalign clear aligners, iTero intraoral scanners, digital orthodontics software, treatment-planning tools, 3D printing / milling-compatible digital workflows.

End-Use Industries Served:

Orthodontic practices, general dental practices adopting digital workflows, dental labs, and restorative dentistry practices.

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

While specifics are not detailed in the recent sources used here, the company has historically acquired CAD/CAM software company exocad and expanded digital solutions.

Partnerships & Collaborations:

Educational programs and global faculty for the Invisalign system, pushing peer-to-peer learning events for dentists.

Product Launches / Innovations:

Capacity Expansions / Investments:

New US$1 billion stock repurchase program approved (May 2025) indicates strong investment posture.

Distribution Channel Strategy:

Direct sales to dental/orthodontic practices, indirect via distributors globally; emphasizes digital platform adoption within practices to drive conversion and recurring usage.

Technological Capabilities / R&D Focus:

Strong R&D in clear aligner materials, intraoral scanning, digital workflow integration (scan-plan-treat-monitor), and software that enhances patient engagement and workflow efficiency.

Core Technologies / Patents:

Patented clear-aligner materials and treatment-planning algorithms; intraoral scanning technologies; digital workflow software integrations. The company actively litigates to protect IP.

Research & Development Infrastructure:

Global teams focused on orthodontic and restorative innovation, digital workflow research, new patient-engagement tools, and manufacturing process optimization (automation/regionalization).

Innovation Focus Areas:

Competitive Positioning:

Strengths & Differentiators:

Market presence & ecosystem role:

Plays a pivotal role in orthodontic digital transformation, bridging aligner therapy, scanning, software, and practice workflow in a unified ecosystem.

SWOT Analysis:

Recent News and Updates:

Press Releases:

| Company | Core Digital offerings | Recent breakthroughs |

| Align Technology, Inc. | ITero intraoral scanners, Invisalign digital treatment workflow, restorative/imaging integration | Launched the iTero Lumina intraoral scanner (50% smaller wand, 3x wider field of capture), restoration capabilities announced in March 2025. |

| Dentsply Sirona | CEREC chairside CAD/CAM systems, digital imaging, milling solutions, cloud-enabled workflows | Highlighted expanded AI-powered CEREC workflow and new milling/cloud solution at industry events. |

| 3M Company | Restorative materials plus digital oral-care platforms and intraoral scanning history | Continues investment in its Digital Oral Care technology platform and scanner-related solutions. |

| Danaher Corporation | Historically owned a broad dental portfolio( Nobel Biocare, KaVo, Ormoco)-dental operations were reorganized into Envista. | Announced/implemented the separation of its dental platform into Envists. |

| Planmeca Oy | Intraoral & extraoral imaging CAD/CAM systems, dental units, clinic/lab software, and workflows | Launched multiple new imaging CAD/CAM and CAD/CAM workflow products at IDS 2025, expanding clinics and lab digital capabilities. |

By Service Type / Offering

By Technology / Modality

By Clinical Application

By Delivery Model

By Customer / End-User

By Integration / Workflow Stage

By Region

January 2026

January 2026

January 2026

January 2026