January 2026

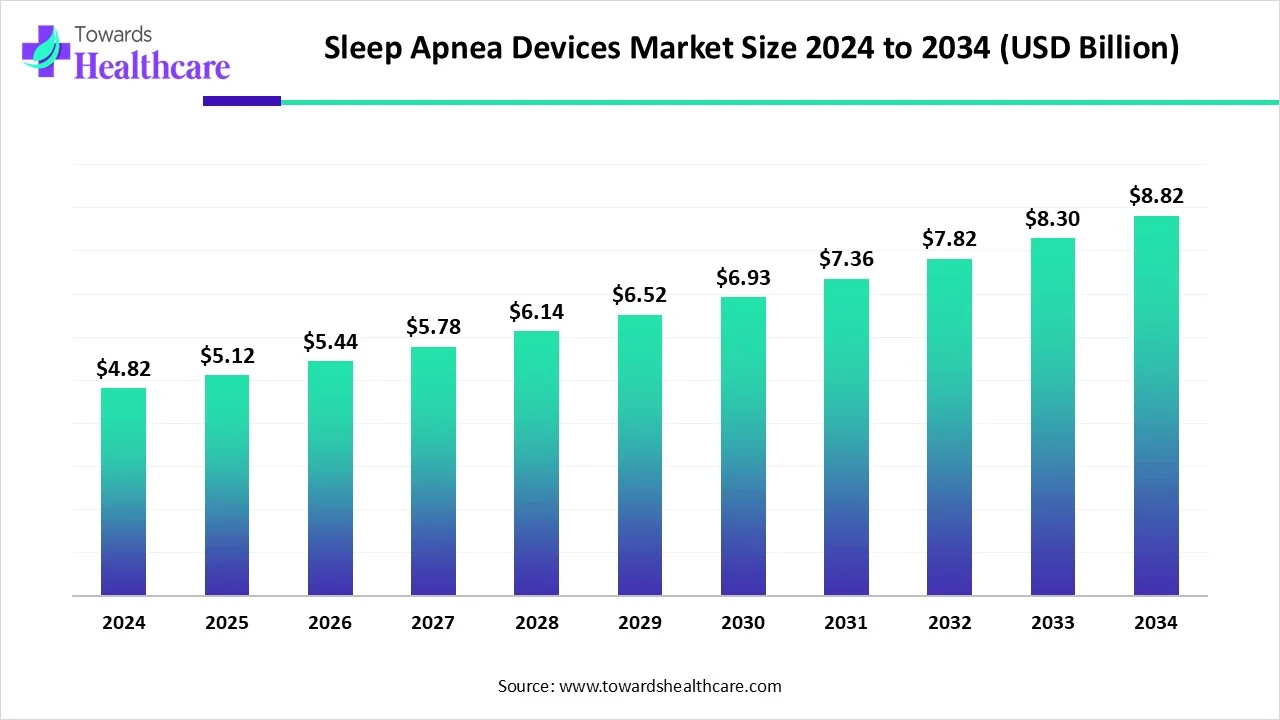

The global sleep apnea devices market size is calculated at USD 4.82 in 2024, grew to USD 5.12 billion in 2025, and is projected to reach around USD 8.82 billion by 2034. The market is expanding at a CAGR of 6.24% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 5.12 Billion |

| Projected Market Size in 2034 | USD 8.82 Billion |

| CAGR (2025 - 2034) | 6.24% |

| Leading Region | North America share by 49% |

| Market Segmentation | By Product Type, By End Use, By Region |

| Top Key Players | ResMed, Respironics (a subsidiary of Koninklijke Philips N.V.), Fisher & Paykel Healthcare Limited, Curative Medical, Inc., React Health (Respiratory Product Line from Invacare Corporation), Somnetics International, Inc., BMC Medical Co., Ltd., Natus Medical Incorporated, SOMNOmedics GmbH, Compumedics, Itamar Medical Ltd., Nihon Kohden Corporation |

Sleep apnea devices, devices are mainly created to highlight obstructive sleep apnea (OSA) by maintaining the upper airway during sleep time. Nowadays, several cases diagnosed with sleep apnea, especially in the geriatric and overweight populations, are a crucial driver for the growth of the market. Different types of devices are used, of which the most common is a CPAP (continuous positive airway pressure) machine, which conveys pressurized air to the nose or mouth via a mask, which avoids fall down of the airway. Also, this device has specific features such as lightweight, more comfort, and reduced noise, which are generating interest among patients in this device. Seeking prospects by employing innovative technologies, including AI-aided diagnosis and highly personalized treatment alternatives, like implanted devices and novel therapies.

AI has a significant role in the market, as its AI algorithms enable analysis of huge datasets of sleep data, containing physiological signals and wearable device data, to detect patterns and estimate the severity of OSA. This may result in rapid and highly precise diagnoses, certainly in instances where conventional approaches might not be effective that much. As well as it also assists clinicians in selecting the most suitable treatment approach for individual cases, including factors such as their particular OSA characteristics, coexisting conditions, and medication history.

For instance,

Escalating Number of Obstructive Sleep Apnea (OSA) Cases

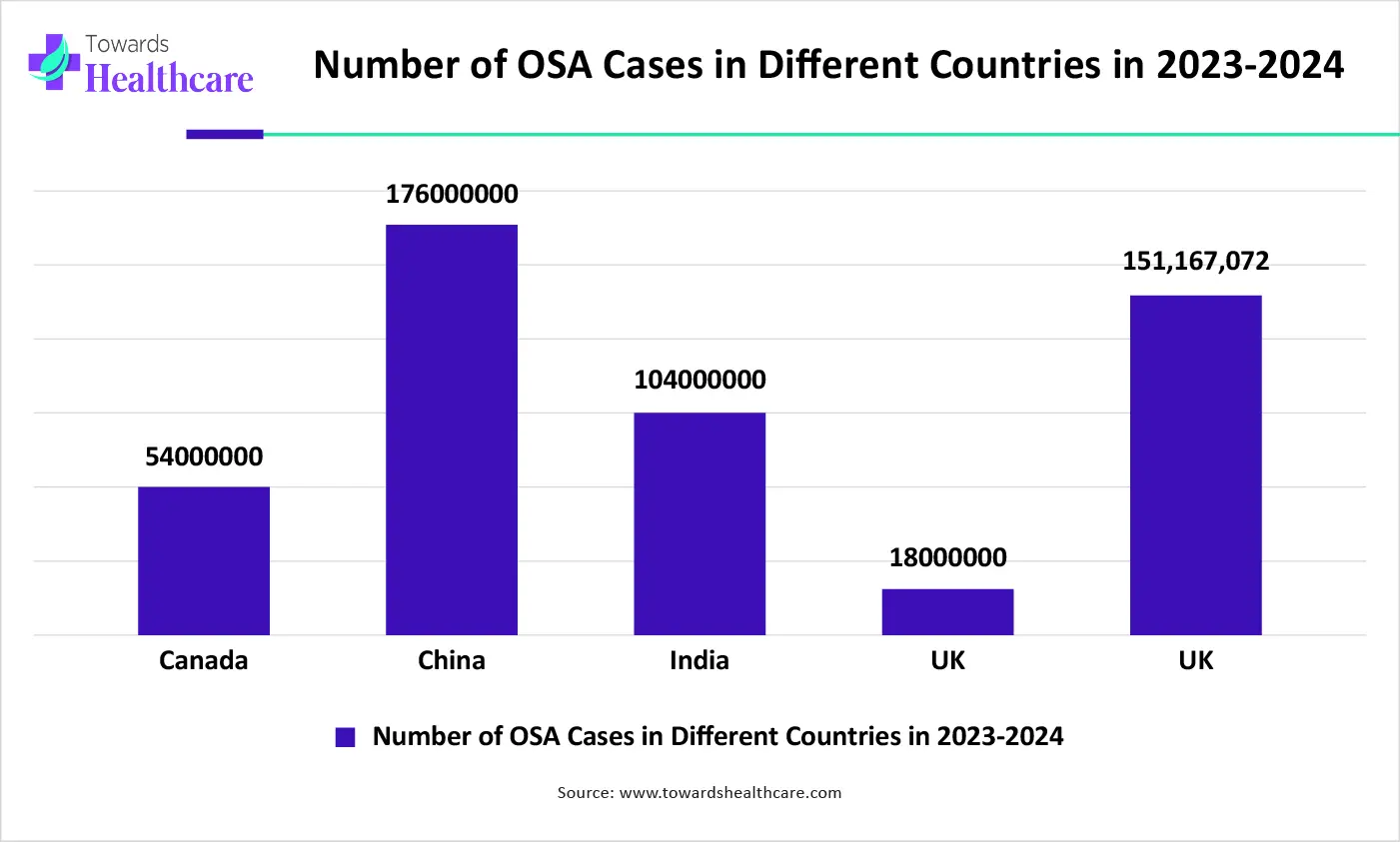

The sleep apnea devices market is driven by the increasing number of obstructive sleep apnea instances, which is a common sleep concern in which breathing frequently stops and starts during sleep because of an obstruction in the upper airway. Along with this, rising awareness about OSA health challenges and development in advanced technologies. Moreover, due to growing diagnosis rates and the number of unidentified patients are propelling demand for efficient treatment alternatives such as CPAP machines, oral appliances, and diagnostic tools, etc.

The globally rising number of obstructive sleep apnea cases is significantly fueling demand for sleep apnea devices like CPAP machines, oral appliances, and diagnostic tools etc. These widely accelerating demand and need are driving the growth of the sleep apnea devices market. The major risk factors are obesity, hypertension, and age. The above graph displays about growing number of OSA in various countries due to numerous factors, which is highly impacting the expansion of the market.

Increased Spending on Devices and Treatments

Due to rising expenditure on various devices and treatments, such as CPAP machines are expensive, with repetitive costs for masks, filters, and tubing, and diagnostic tests, including Polysomnography, with a few home sleep tests, are pricey. Furthermore, follow-up consultations and device adaptation generate a sustained load of finances by creating narrowed access for individuals without enough insurance.

Progressing Technological Advancements and Growing Cases of Sleep Apnea

In the sleep apnea devices market, the rising cases of sleep apnea are a vital opportunity, as they demand well-developed devices for diagnosis. Also, boosting progress in technological advancements like CPAP machines, oral appliances, and novel methods, including implantable devices. However, the acquisition of telemedicine and digital health for diagnosis and treatment creates opportunities for patient tracking and digital health integrations at home.

By product type, the therapeutic devices segment dominated in 2024, capturing the major share of the market. This segment has been impelled by the numerous factors, like growing advancements in PAP devices such as CPAP and BiPAP machines, which have shown dominance because of their efficiency in maintaining open airways during sleep, for the sleep apnea devices market growth. Also, enhancing the geriatric population with raised sleep disorders is demanding for this type of device.

By product type, the sleep apnea mask segment is expected to grow at the fastest CAGR in the upcoming years. This kind of mask is also termed a CPAP mask, which is utilized in conjunction with a CPAP machine. As a CPAP machine is a common solution for sleep apnea, the use of masks is necessary for conveying the pressurized air, is plays a crucial role in the growth of the market. Additionally, the comorbidities with sleep apnea, including obesity and diabetes, are becoming more prevailing.

By end use, the homecare settings segment led the sleep apnea devices market in 2024, as it possesses various characteristics like being able to operate at home without requiring frequent hospital visits or sleep laboratory tests, which is influencing as a significant factor. Also, the boosting advancements in technologies such as dense and mobile CPAP machines, coupled with other therapeutic devices like oral appliances and compatible servoventilation (ASV) machines, have generated home-based treatment highly approachable and easy for respective patients.

By end use, the hospital and sleep lab segment is expected to grow significantly during the forecast period. This segment is also called a polysomnography lab, which provides facilities in a hospital where sleep examinations are performed to detect and treat sleep disorders. The growth of the segment in the sleep apnea market is propelled by factors like rising prevalence of sleep apnea, advancements in diagnostic and therapeutic technologies, and accelerating awareness about sleep disorders.

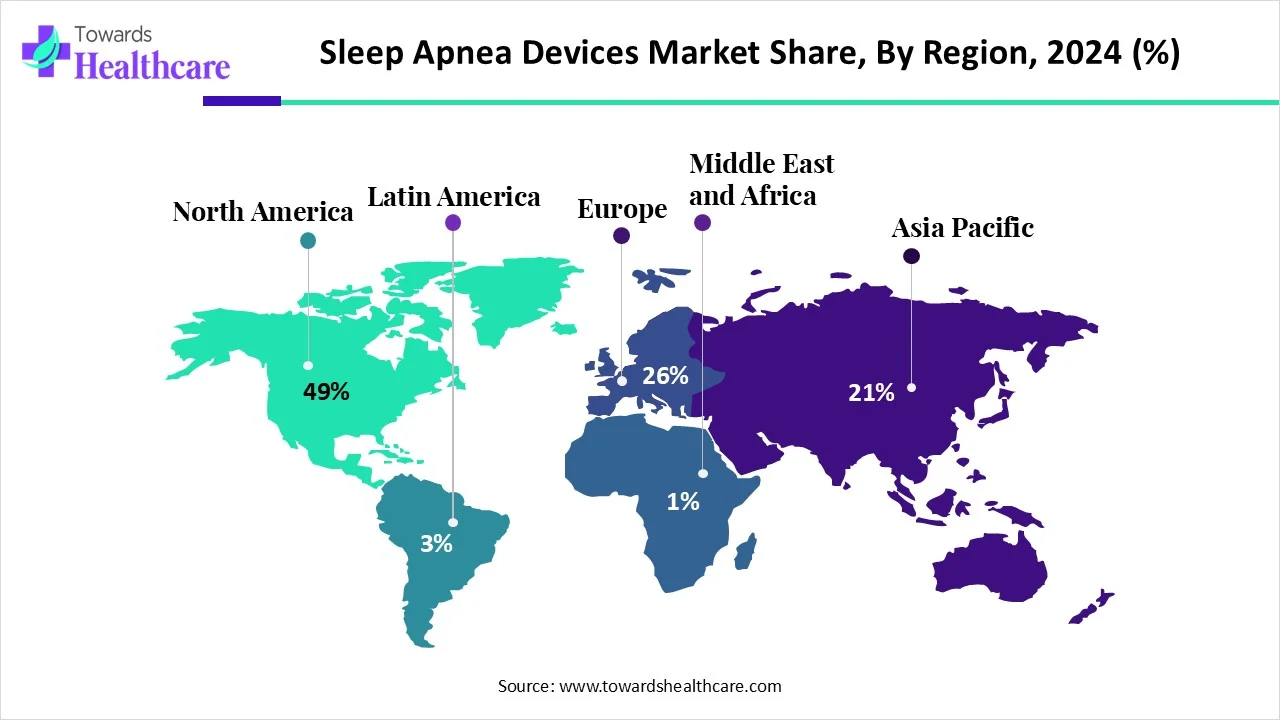

North America held the largest revenue share of the market share by 49% in 2024. The sleep apnea devices market growth is impacted by factors including growing occurrences of obstructive sleep apnea (OSA), boosting technological advancements in diagnosis and therapeutics like home sleep tests and highly movable and user-friendly devices, and escalating encouraging reimbursement policies. Also, North America possesses a robust healthcare infrastructure with well-developed sleep centers and expertise that are contributing as a significant role in the market growth.

In the US, along with rising sleep apnea cases, the accelerating awareness about sleep apnea’s interferences and the advantages of treatment are driving the expansion of the market. Also, the respective government has supported to utilization of these devices. Emerging technological advancements in these devices for home-based features are playing an immense role in the patient's convenience and approach.

For instance,

The market is driven by the adoption of modern CPAP machines, which have specific characteristics such as auto-adjusting pressure settings, unified humidifiers, and a noiseless motor, boosting customer comfort and appeal. Also, Canada is focusing on the development of individual treatment plans, comprising novel devices and therapies modified to certain patient needs. Moreover, they are emphasizing home sleep testing kits and wearable devices to convey convenience and access for diagnosis alternatives, which gives early identification and treatment.

Asia Pacific is expected to be the fastest-growing region in the projected period. In Asia Pacific, sleep apnea instances are rising due to increasing obesity rates, and a sedentary lifestyle is a critical risk factor for the same. Additionally, the geriatric population in many countries contributes to a wider pool of individuals at risk of sleep apnea. Also, merging technologies like mHealth and IoT are united into sleep apnea devices, which provide remote monitoring, data examination, and personalized treatment plans.

In India, nowadays, there are major risk factors associated with sleep apnea, are rising cases of hypertension and obesity, which are fueling the demand for treatment devices, which are contributing as a major driver in the growth of the market. Also, in CPAP and BiPAP technologies, boosting innovations that provide more comfort and lightweight masks are increasing individuals' compliance and impacting adoption.

For instance,

In Japan, an excessive proportion of geriatric citizens are highly prone to sleep apnea because of factors such as muscle infirmity, obesity, and age-related concerns. Besides this, Japan has a larger number of OSA instances, particularly in adults, which is rising, resulting in a greater demand for diagnostic and therapeutic devices. Widely advanced technologies are also contributing as a significant factor in the growth of the market.

In Europe, a major portion of the European population is experiencing concerns related to sleep, like sleep apnea. Along with this, rising awareness about sleep apnea is leading to more individuals looking for their diagnosis and treatment, ultimately accelerating demand for these devices. Also, the development of more comfort-providing and efficient sleep apnea devices, such as CPAP machines and other therapies, is impacting the growth of the market.

The market is driven by a huge portion of the rising population affected by sleep apnea, with a well-established healthcare system, possessing technical facilities and skilled professionals, which are assisting the diagnosis and treatment of sleep concerns like sleep apnea. At the end, it influences the demand for sleep apnea devices and resulting in the growth of the market.

The healthcare system in the UK promotes an approach to diagnosis and treatment, including sleep analysis, which is vital for detecting sleep apnea. Also, boosting technological advancements in cloud-connected PAP machines, wearable tracking systems, and AI-powered therapy management solutions are enhancing device effectiveness and customer experience, accelerating acquisition.

For instance,

Latin America is expected to grow at a considerable CAGR in the market in the upcoming period. The market is driven by the increasing prevalence of OSA and advancements in medical technology. People are becoming aware of the early diagnosis of OSA, enabling healthcare professionals to provide timely treatment. Government organizations provide funding for the development and launch of sleep apnea devices. The growing demand for personalized treatment also contributes to market growth.

In Mexico, 27.3% of adults face an elevated risk of OSA, especially in people aged 40 years and above. The prevalence rate of OSA in Mexico is 23% in women and 26% in men. The increasing geriatric population is also a major concern in Mexico. In 2024, about 8.2% of the total population was above 65 years of age. (Source: https://hia.paho.org/en/country-profiles/mexico)

According to a recent cohort study, 32.9% of the total population had OSA, including 40.6% of males and 26.1% of females. A study involving 347 OSA patients found that 35.9% of participants were using CPAP devices for sleep apnea. The Brazilian government supports the development of innovative sleep apnea devices through funding programs.

Research activities include the development of innovative sleep apnea devices using neuromodulation techniques and AI/ML technologies, making them more user-friendly.

Key Players: Sibel Health, Inc., Omron Corporation, and Nyxoah.

Clinical trials are conducted to test the efficacy of sleep apnea devices on humans and to determine their safety profile. Based on these results, regulatory agencies, like the FDA, NMPA, and EMA, approve a device.

Key Players: Apnimed, LivaNova, Braebon Medical Corporation, and Philips.

Once approved, sleep apnea devices are distributed to hospitals and pharmacies through distributors or wholesalers to reach a large patient population.

Key Players: ResMed, Pty. Ltd., Genotronics, and Fisher & Paykel Healthcare.

Patient support & services refers to guidance by healthcare professionals to help patients achieve and maintain effective therapy.

Professionals also assist patients with the use of devices.

By Product Type

By End Use

By Region

January 2026

December 2025

December 2025

December 2025