February 2026

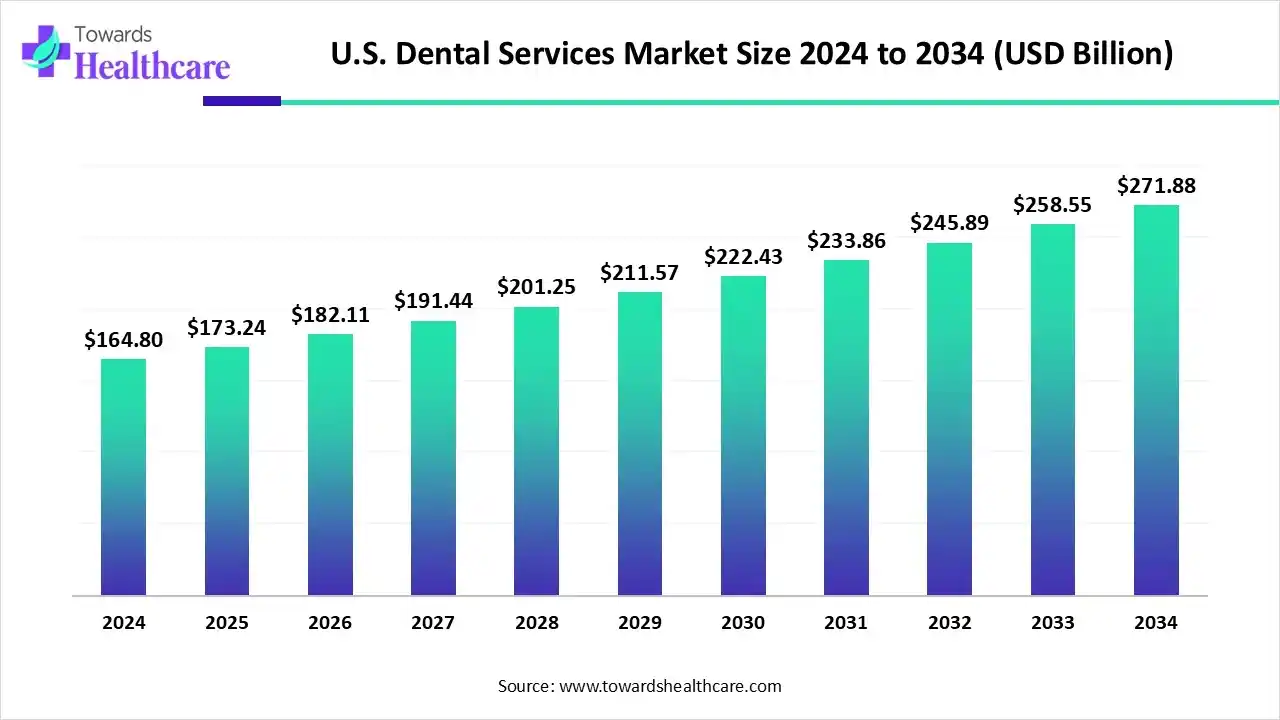

The U.S. dental services market size is calculated at US$ 166.5 billion in 2024, grew to US$ 172.6 billion in 2025, and is projected to reach around US$ 254.7 billion by 2034. The market is expanding at a CAGR of 4.4% between 2025 and 2034.

People's disposable incomes have consistently increased as a result of the U.S.’s rapid urbanisation and ongoing economic growth. In addition, it is anticipated that future per capita spending on healthcare services would rise significantly. Over the course of the projection period, it is expected that millennials' growing purchasing power and increased awareness of health and wellbeing will drive market expansion.

| Table | Scope |

| Market Size in 2025 | USD 172.6 Billion |

| Projected Market Size in 2034 | USD 254.7 Billion |

| CAGR (2025 - 2034) | 4.4% |

| Market Segmentation | By Service Type/Specialty, By End-User/Practice Type, By Payment/Financing Method, By Patient Age/Demographics |

| Top Key Players | Aspen Dental Management, Inc., Heartland Dental, Smile Brands Inc., Dental Care Alliance, InterDent/Gentle Dental, Coast Dental Services, Affordable Dentures & Implants, Great Expressions Dental Centers,Western Dental, Align Technology, DentaQuest, MB2 Dental Solutions, 42 North Dental, Sage Dental Management, LLC, Gentle Dental (InterDent), Colosseum Dental Group, GSD Dental Clinics |

The U.S. dental services market is growing due to rising government initiatives and awareness among people living in rural areas. The market comprises all clinical services related to oral health delivered by dental professionals in clinics, hospitals, and other care settings. This includes preventive, diagnostic, restorative, orthodontic, cosmetic, surgical, and specialty procedures. Growth is driven by expanding public and private insurance coverage, rising awareness of oral health’s link to systemic health, evolving patient preferences (cosmetics, clear aligners), dental service organization (DSO) consolidation, and technology adoption (digital imaging, teledentistry, CAD/CAM).

The investigation of more recent aspects of dental care has benefited greatly from dental AI. The great potential for AI-led diagnostic help and hitherto unrealised financial rewards in dentistry may be implemented by dentists, researchers, and dental business consultants. Higher patient engagement, better follow-up experiences, and a quicker transition from the evaluation to the treatment phase are all guaranteed by a dental AI-infused workflow.

| Organizations | Agency | Information & Programs for Oral Health |

| Federal Government |

Centers for Disease Control and Prevention (CDC) – Oral Health |

Offers information on oral health programs, water fluoridation, dental sealants, oral health data, infection control guidance, and research reports. |

| US Centers for Medicare and Medicaid Services (CMS) | Contains information on dental care coverage through Medicaid, Medicaid services utilization data, and oral health initiatives. | |

| US Health Resources and Services Administration (HRSA) – Oral Health | Offers resources on oral health programs and policies, the workforce, Health Professional Shortage Areas (HPSAs), oral health data, and grants. | |

| State Government | Agency for Health Care Administration (AHCA) | Provides information on the Florida Medicaid Dental Program. |

| Florida Department of Environmental Protection | Regulates public water systems in Florida and provides information on Florida’s public water systems and their fluoridation status | |

| Organizations | American Academy of Pediatric Dentistry (AAPD) | Represents the specialty of pediatric dentistry and provides resources for professionals to improve children’s oral health |

| American Association of Public Health Dentistry (AAPHD) | Focuses on meeting the challenges to improve the oral health of the public. | |

| American Dental Association (ADA) | Promotes good oral health habits to the public while representing the dental profession. | |

| Association of State and Territorial Dental Directors (ASTDD) | The association represents Florida’s dentists. Represents state public health agency programs for oral health | |

| Florida Dental Hygiene Association (FDHA) | Represents Florida’s dental hygienists and provides continuing education and support for dental hygienists. | |

| Hispanic Dental Association (HDA) | Focuses on the overall health of Hispanic and other underserved communities. | |

| National Dental Association (NDA) | Promotes oral health equity among people of color and mentors dental students of color. | |

| National Maternal and Child Health Oral Health Resource Center (OHRC) | Provides technical assistance, training, and resources for maternal and child health professionals to improve oral health services | |

| National Network for Oral Health Access (NNOHA) | Offers resources and support for effective oral health safety-net programs. | |

| Oral Health Florida (OHF) coalition | Promotes optimal oral health and well-being for all persons in Florida. | |

| Oral Health Progress and Equity Network (OPEN) | Engages health equity advocates, community-based organizations, providers, policymakers, and health justice organizers to improve the oral health system. | |

| Rural Oral Health Information Hub | Provides information and resources on oral health in rural communities. | |

| Schools | Lake Erie College of Osteopathic Medicine School of Dentistry, Nova Southeastern University College of Dental Medicine, University of Florida College of Dentistry |

By service type/speciality, the endodontic procedures segment captured a share of approximately 23-25% of the U.S. dental services market in 2024. The speciality area of dentistry known as endodontics is dedicated to identifying and treating problems with the dental pulp and adjacent tissues. Endodontics, often known as root canal therapy, is essential for preserving teeth that may otherwise have to be extracted because of extensive decay or damage.

By service type/speciality, the cosmetic dentistry segment is expected to grow at the fastest CAGR during the forecast period. The way that individuals feel and look at their smiles is being changed by cosmetic dentistry. More Americans are looking for healthier, straighter, and whiter teeth in 2025 in order to feel more confident at work, social gatherings, and special occasions. With so many cutting-edge procedures now accessible, cosmetic dentistry offers quicker, safer, and more efficient ways to get the smile of your dreams.

By end-user/practice type, the dental clinics/private practices segment captured a share of approximately 62-68% of the U.S. dental services market in 2024. Private practices offer a more laid-back and intimate environment for patients. Furthermore, scheduling and treatment choices are typically more flexible in private offices, enabling them to customise their offerings to meet the specific needs of each patient.

By end-user/practice type, the dental service organizations (DSOs)/group practices segment is expected to grow at the fastest CAGR during the forecast period. All of the back-end tasks, including hiring, billing, and purchasing equipment, are managed by DSOs. They serve as the foundation of contemporary dentistry offices, allowing them to expand effectively, use cutting-edge technology, and enhance patient care without having to deal with the hassles of administration.

By payment/financing method, the private health insurance segment dominated the U.S. dental services market in 2024. According to the National Association of Dental Plans (NADP), 79% of Americans have dental benefits. The majority of individuals have private insurance, often through a group programme or their employment. Dental benefits are more likely to be provided by large businesses than by small ones, and they are more likely to be received by high-wage employees than by low-wage employees.

By payment/financing method, the out-of-pocket/self-pay segment is expected to grow at the fastest CAGR during the forecast period. Benefits of self-paying for dental services include avoiding insurance complications, communicating directly with your dentist, maybe gaining access to savings, and guaranteeing timely emergency care free from insurance limitations or delays.

By patient age/demographics, the adults segment captured the largest share of the U.S. dental services market in 2024. Adults in the U.S. have poor dental health, and those with lower earnings are most affected. Oral illness can worsen the symptoms of chronic diseases and is more common in those with a variety of chronic ailments.

By patient age/demographics, the children & adolescents segment is expected to grow at the fastest CAGR during the forecast period. For the health and wellbeing of your kid, dental care is crucial! Children can receive complete dental care up until the age of 21, as long as it is medically required. For routine treatment, parents are urged to take their kids to the dentist.

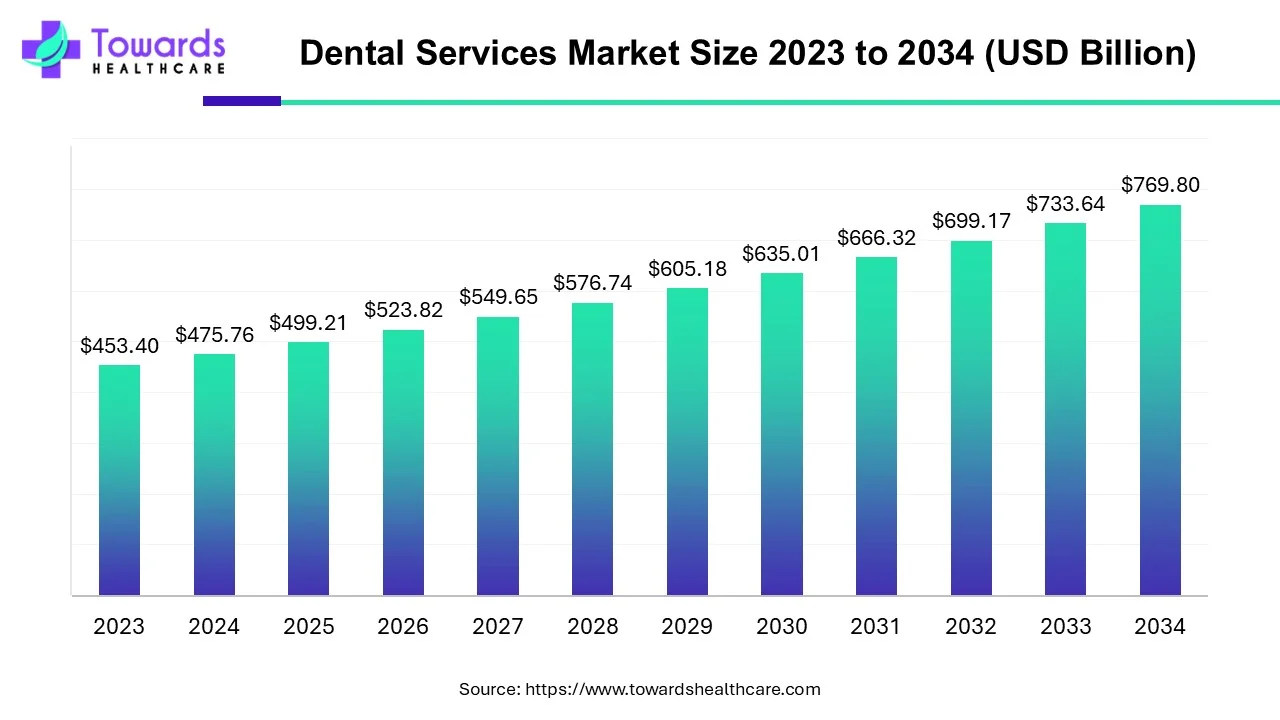

The global dental services market is expected to grow significantly over the next decade, reaching USD 769.7billion by 2034, up from USD 493 billion in 2025. This represents a steady CAGR of 5.1% between 2025 and 2034.

By Service Type/Specialty

By End-User/Practice Type

By Payment/Financing Method

By Patient Age/Demographics

February 2026

February 2026

February 2026

February 2026