February 2026

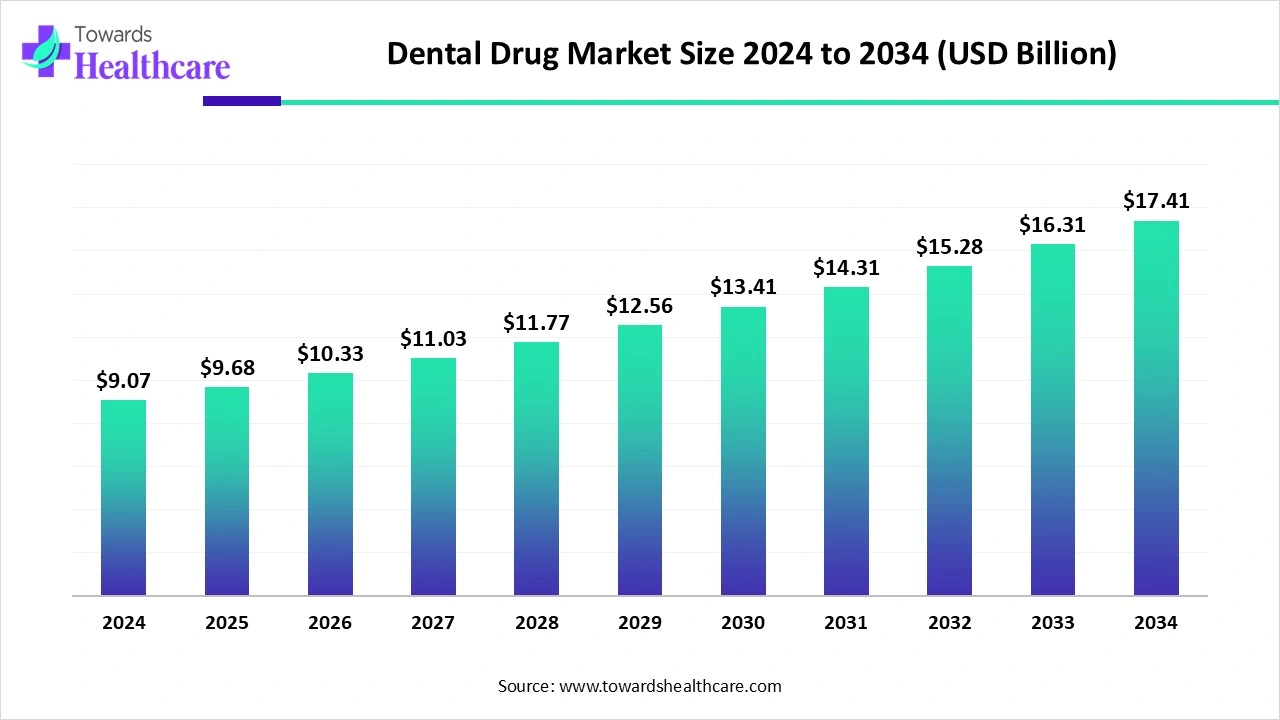

The global dental drug market size is calculated at US$ 9.07 billion in 2024, grew to US$ 9.68 billion in 2025, and is projected to reach around US$ 17.41 billion by 2034. The market is expanding at a CAGR of 6.75% between 2025 and 2034.

The globe is facing several prevalent of of tooth decay, gum disease, and periodontal diseases, as well as expanding demand for advanced dental cosmetic and aesthetic, AI, and other technologies are supporting to enhance self-esteem. Alongside, the global dental drug market is focusing on the widespread innovations in dental materials, like nanomaterials, to deliver antimicrobials and develop regeneration of dental hard tissues and cartilage. Alongside, researchers are working on evolving novel approaches in delivery systems, such as transmucosal/subgingival, which accelerate drug absorption with enhanced efficacy.

| Table | Scope |

| Market Size in 2025 | USD 9.68 Billion |

| Projected Market Size in 2034 | USD 17.41 Billion |

| CAGR (2025 - 2034) | 6.75% |

| Leading Region | North America |

| Market Segmentation | By Product Type/Formulation, By Therapeutic Class/Active Purpose, By Route & Administration, By End-User/Buyer, By Distribution channel, By Region |

| Top Key Players | Colgate-Palmolive, Haleon/GSK, Procter & Gamble, Johnson & Johnson, 3M, Dentsply Sirona, Septodont, Ultradent Products, VOCO GmbH, Patterson Dental, Henry Schein, Kerr (Envista), GC Corporation, Sunstar/GUM, Regional & specialty dental pharmaceutical manufacturers and CDMOs |

Pharmaceuticals, biologics and topical therapeutics formulated specifically for oral/dental use, including local anesthetics, antimicrobials (systemic & local), anti-inflammatories, fluorides, desensitizers, hemostatics, local drug-delivery systems (gels, varnishes, chips), mouthrinses, and combination drug-device products used in preventive, restorative, endodontic, periodontic, surgical and orthodontic dental care; sold via dental and retail channels and supported by compounding, packaging and clinical services.

Ongoing advances are promoting the use of AI algorithms, especially deep learning models, that support the analysis of dental radiographs and other imaging data with a greater precision level. This further assists in determining and categorizing concerns, including dental caries, root caries, periodontal diseases, and other anomalies. Moreover, the widespread adoption of intraoral scanners and CAD/CAM systems, AI helps in developing accurate 3D models for orthodontics, prosthetics, and surgical guides. Alongside, AI plays a crucial role in comprehensive drug discovery, the evolution of precision medicine, and other major approaches to dental issues.

A Surge in Disposable Income and Aesthetic Dentistry

In the present era, the aging population and other growing cases of tooth decay, gum disease, and periodontal diseases are widely driving the need for advanced dental treatments, including dental drugs. The global dental drug market is expanding due to a rise in disposable incomes in various regions, where people can invest in dental care and cosmetic approaches. This rising income is supporting the shift towards aesthetic appeal and self-esteem, which is demanding dental products for employing in teeth whitening and restorations.

Limitations Regarding Insurance & Adverse Effects

As mentioned, the globe is increasingly merging into the dental care, but still, certain regions are facing restricted insurance coverage for dental procedures. This develops financial hurdles for patients. Also, people are facing some issues related to the adverse side effects of a few dental drugs, like allergic reactions or other complications, which is another limitation in the market growth.

Stepping Into Infection Control & Nanorobotics

The global dental drug market will have numerous prospective opportunities, such as a rise in efforts into infection control and regeneration. This mainly includes the use of nanoparticles to deliver antimicrobial agents, especially silver and copper, to capture dental caries and treat periodontitis more efficiently. Furthermore, nanomaterials are serving as scaffolds for the regeneration of dental hard tissues and cartilage, promoting biomimetic mineralization. Besides this, the emergence of nanorobotics, which assists in micro-scale dentifrobots conveyed through toothpaste or mouthwash, facilitates consistent guard and metabolizes organic matter, performs debridement, and repairs blemishes on teeth.

In 2024, the topical gels/pastes segment captured the dominating share of the market. A wide range of benefits of these products, like their pain-free, convenient, and non-invasive nature, with an immense role in cavities, gum disease, and oral lesions, is propelling the expansion of the overall market. Currently, many regions’ researchers are working on the development of gels infused with bioactive glass and other nanoparticles to accelerate their ability to foster enamel remineralization.

Whereas the local delivery systems segment is anticipated to expand rapidly during 2025-2034. The increasing instances of periodontitis are fueling broader demand for efficacious, localized treatments like LDDS. Alongside, these kinds of products have robust effects in the preservation of pulp vitality and enhancing hard tissue formation in vital pulp therapy. Recently developed minocycline ointment and Periocline (minocycline gel) have the ability of sustained-release systems to deliver antimicrobials. Research activities are exploring the application of quantum dots as nanocarriers to escalate drug efficacy and minimize side effects.

The local anesthetics segment held the biggest share of the dental drug market in 2024. Globally, accelerating root canals, tooth extractions, and restorative treatments are widely demanding local anesthetics for safer and effective further treatment. Nowadays, liposomal and long-acting anesthetics, and the efforts into minimally invasive outpatient procedures, are supporting the progressive use of this class of approaches. The latest evolved an amide anesthetic with a thiophene ring offering a rapid onset, longer duration, and higher potency than other lignocaine, with reduced potential for systemic intoxication.

In the coming era, the fluoride & remineralization agents segment is estimated to register rapid expansion in the dental drug market during 2025-2034. Mainly, the segment is experiencing growth due to escalating dental caries, awareness of oral hygiene, developments in non-fluoride agents, and the demand for preventative solutions. Nowadays, promising effects of Nano-Hydroxyapatite (nHA) as an alternative to fluoride are expanding remineralizing lesions by facilitating a mineral source. Moreover, the application of Silver Diamine Fluoride (SDF) and CPP-ACP (Casein Phosphopeptide-Amorphous Calcium Phosphate) is also enhancing remineralization activities by developing a protective layer and delivering calcium and phosphateions.

Primarily, the topical intraoral application segment accounted for a major share of the market in 2024. Due to a pain-free, non-invasive route of administration, it omits the need for needles and improves patient compliance, mainly for children and the elderly, assisting the progress of this segment. Ongoing advances, like personalized delivery systems, likewise custom-fit 3D-printed patches for controlled anesthetic release, and groundbreaking administration devices, such as DentalVibe's vibrating technology to lower injection pain, are also impacting dental treatment.

However, the transmucosal/subgingival delivery segment is predicted to expand at a rapid CAGR in the dental drug market. Provision of faster and more effective drug absorption directly into the bloodstream, skipping the digestive system and enabling quicker systemic delivery and relief of this route, is fueling its worldwide adoption. Continuous establishments in nanoparticle technologies, mucoadhesive polymers, and nanofibers are contributing to a boost in drug efficiency and sustained release in treating oral and periodontal diseases is playing a major role in the segment expansion.

In the global dental drug market, the dental clinics & individual practitioners segment captured the largest share in 2024. An elevating demand for advanced and safer dental procedures, particularly in the geriatric population and other people emphasizing dental care, is fostering the establishment of several well-equipped dental clinics & individual practitioners. Also, these end-users are broadly utilizing novel techniques, such as 3D printing, CAD/CAM systems, laser treatments, and AI to evolve more efficient, less invasive, and more aesthetically pleasing treatment options.

On the other hand, the retail/pharmacy & OTC consumers segment is anticipated to register the fastest growth in the dental drug market. These facilities offer diverse dental approaches, including anesthetics like benzocaine for toothaches, antiseptics, mainly hydrogen peroxide mouthwash, and analgesics, like acetaminophen or ibuprofen for pain. Whereas, the greater consultation fees for doctors and dentists prompt consumers to choose self-treatment with accessible OTC products for minor dental conditions. Consumers are having trust in retail pharmacies, with an allowance for immediate access to approaches for minor dental issues, especially toothaches or gum sensitivity.

In 2024, the dental distributors & wholesalers segment led the market. An expanding, strong management of distribution and delivery of a diverse range of dental products, from small consumables to large equipment, by these facilities is influencing their entire global growth. Consistent developments, such as digital transformation (online ordering, inventory management), a rise in demand for sustainable products, the requirements for customized services, and supportive technological advancements in dentistry, like digital X-rays, CAD/CAM technology, and optimized dental materials, are boosting the overall market progress.

Moreover, the e-commerce & DTC channels segment will expand rapidly during 2025-2034. The growing digitalization is also driving the widespread application of these platforms, which facilitate doorstep delivery, subscription services, and a broader range of product selection, ultimately making oral care products more feasible to purchase and access than ever before. Enhancing customer connections and convenience, and the increasing importance of data-driven marketing and personalized experiences through channels, particularly AI and social media, are updating wider e-commerce & DTC channels.

The dental drug market in North America held the dominating share in 2024. This region’s greater healthcare expenses and government support for research and development in oral health are mainly fueling the demand for novel and advanced dental treatments. These research activities are exploring newer analgesics for pain management, other novel drug delivery systems, eventually intraoral patches for localized treatment, and the development of biomaterials for tooth regeneration are also expanding the regional market progression.

For instance,

The US’s emerging digital dentistry, especially intraoral scanners, CAD/CAM systems, and AI-enabled diagnostics, as well as the expanding awareness regarding oral health, is fostering the respective market growth. Recently, Penn Dental Medicine has developed novel drug therapy by employing a natural compound and ‘senotherapy’, which has shown a strong effect in the management of gingivitis and periodontitis.

Canada’s developments in new specialty dental anesthesiology to accelerate access to dental care through public programs are driving its market expansion.

For this market,

Across the ASAP, the dental drug market is anticipated to expand rapidly during 2025-2034. As this region’s various governments are focusing on oral health approaches and innovative treatments are acting as a major driver. Eventually, Japan is aiming at the progress and clinical trials of a drug that supports the regrowth of teeth from scratch, providing a living alternative to dentures and implants. Although leveraging hybrid collagen-synthetic membranes and resorbable membranes is represented as standard, with expanded stability and bioactivity.

For instance,

Basically, this comprises advanced drug discovery approaches to detect dental needs, then preclinical research for efficacy and safety, and at the ned clinical studies with the required dose and post-market activities in the dental drug market.

Key Players: Procter & Gamble, Dentsply Sirona, and DMG Dental, etc.

After the successful preclinical stage, sponsors should conduct robust multi-phase clinical trials to investigate safety and efficacy, followed by a complete review by regulatory bodies, mainly India's Drugs Controller General of India (DCGI) or the U.S. Food and Drug Administration (FDA).

Key Players: Cairo University, King Abdulaziz University, Craig Miller, etc.

The dental drug market encompasses a pre-treatment medical history review, including current medications, to assess drug interactions and allergies. This further gives a treatment plan, which comprises options and informed patient consent before medication is prescribed or administered.

Key Players: Life Vision Healthcare, Epitome Lifesciences, Pax Healthcare, etc.

By Product Type/Formulation

By Therapeutic Class/Active Purpose

By Route & Administration

By End-User/Buyer

By Distribution channel

By Region

February 2026

February 2026

February 2026

February 2026