February 2026

The worldwide dental panoramic CT market is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2025 to 2034. This growth is driven by emerging trends and strong demand across key sectors.

The dental panoramic CT market marked a significant advancement by offering a detailed view of the entire maxillofacial region in a single image. This digital transformation enhanced image quality and efficiency, along with the emergence of CBCT scans. The dental imaging is continuously evolving to meet the growing demands of accurate diagnosis and effective treatment planning. The future of dental imaging is shaping greater precision, patient-centered care, and efficiency. The ongoing advancements through robust research and development aim to reduce radiation exposure by maintaining image quality and improving patient safety.

The Dental Panoramic CT market covers imaging systems used in dentistry that produce panoramic 2-D images and 3-D volumetric images (cone-beam computed tomography, CBCT) of the jaws, teeth, and surrounding anatomy. These systems are used for diagnosis, treatment planning (implants, orthodontics, endodontics), trauma assessment, and surgical guidance. The market includes equipment (panoramic X-ray units, CBCT scanners), associated software (3D reconstruction, implant planning, orthodontic analysis), service & maintenance, and accessories. Advantages include comprehensive anatomical visualization, improved diagnostic accuracy, optimized treatment planning, and reduced need for multiple imaging appointments.

Artificial intelligence plays a pivotal role in different fields of dentistry, which involves automated interpretation of radiographs and detection of pathological formations across dental, oral and maxillofacial radiology. AI also helps in 3D image analysis for surgical planning and the diagnosis of cysts and tumors. AI works well in periodontology in the early diagnosis of periodontal diseases, monitoring treatment progress, and prognosis prediction. AI contributes to the simulation of tooth movements and individualized treatment planning across orthodontics.

What are the Major Drifts in the Dental Panoramic CT Market?

The rise of artificial intelligence (AI), improved image quality, reduced radiation, and seamless integration with digital workflows are the latest improvements in dental cone beam computed tomography (CBCT) that can replace traditional panoramic X-rays. The higher precision of 3D CBCT imaging dominated the modern dental practice. The enhanced patient experience is driven by compact and accessible devices, faster and quieter scans, and virtual reality (VR) and augmented reality (AR).

What are the Potential Challenges in the Dental Panoramic CT Market?

There are certain limitations of CBCT in endodontics, which include radiation risks, resolution limits, high costs, and contraindications like pregnancy or unnecessary repeated imaging. The CBCT images may not always capture very fine details of minute periapical changes and early-stage root fractures due to lower resolution than that of conventional medical CT. These artifacts can produce misleading images and result in misdiagnosis or unnecessary treatment.

What is the Future of the Dental Panoramic CT Market?

There are expanding clinical applications of dental panoramic CT across specialized dentistry and preventive and routine care. The integration with digital workflows creates several opportunities for creating CAD/CAM systems, intraoral scanners, and many other technologies and systems. There is a rising demand for more precise dental diagnostics and massive technological advancements.

The panoramic 2D X-ray systems segment dominated the market in 2024, with a revenue of approximately 52%, owing to the immense role in screening, initial evaluation, and detection of abnormalities. These are the routine initial diagnostic tools in dentistry, and they help in planning for a CBCT scan. They provide a 3D detail essential for complex diagnosis and treatment.

The cone-beam CT (CBCT) systems segment is expected to grow at the fastest CAGR in the market during the forecast period due to high-resolution 3D images and the capturing of several 2D images by CBCT tools. They hold specific roles and applications in dental implant planning, oral surgery, endodontics, orthodontics, trauma, etc. They help in the complex diagnosis of facial fractures that are difficult to visualize on 2D radiographs.

The small FOV segment dominated the market in 2024, with a revenue of approximately 42%, owing to higher image resolution, improved image quality, and localized diagnosis offered by the small field of view. It holds clinical applications across endodontics, implantology, oral surgery, traumatology, and pathology. This is a targeted approach that is more significant than a conventional dental panoramic X-ray.

The large FOV segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to comprehensive visualization, surgical planning, and pathology assessment offered by the large field of view. The large FOV scan is more efficient than multiple smaller scans, and it prevents increased radiation and risk of image distortion. It allows clinicians to evaluate complex connections and plan effective treatments.

The digital flat-panel detectors/CMOS segment dominated the market in 2024, with a revenue of approximately 75%, owing to the potential in enabling 3D imaging, rapid image capture, and improved image quality and resolution. They allow efficient workflow and introduce compact and accessible technology. The high spatial resolution is ideal for seeing fine details of dental structures.

The 3D cone-beam reconstruction algorithms & AI-assisted imaging segment is anticipated to grow at a notable rate in the market during the upcoming period due to their role in volumetric imaging, overcoming 2D imaging limitations, and enabling enhanced diagnostics. They are vital in automated pathology detection and improved treatment planning. They result in increased efficiency and standardization of tedious tasks.

The private dental clinics/group practices segment dominated the market in 2024, with a revenue of approximately 65%, owing to their role in offering in-house diagnostics that improve the speed and precision of treatment planning. They increase patient convenience and satisfaction through enhanced collaborations among dental specialists within a group practice. They retain greater control over the timing and quality of the imaging.

The dental & maxillofacial imaging centers/hospitals segment is predicted to grow at a rapid rate in the market during the studied period due to expert image interpretation and efficient data processing and storage. They offer greater access to advanced technologies and improved patient workflow. They improve patient comfort and deliver safety by minimizing the radiation exposure through the latest CBCT scanners.

The fixed/room-mounted systems segment dominated the market in 2024, with a revenue of approximately 82%, owing to the creation of virtual panoramic views and undistorted panoramic images. These systems enable precise 3D reconstruction and reduced radiation dosage. They aid in achieving enhanced image quality, greater functionality, and superior stability for specific scans.

The portable/mobile panoramic units segment is expected to grow at the fastest CAGR in the market during the forecast period due to the rising trend of mobile and community dentistry, emergency medicine, and trauma care. These units facilitate streamlined workflow, 3D visualization, and lower radiation dose. They enhance patient experience and their safety through faster diagnosis and efficient treatment planning.

The general dentistry & routine diagnostics segment dominated the market in 2024, with a revenue of approximately 45%, owing to the efficient diagnosis and detection of dental problems like advanced periodontal disease, impacted teeth, such as wisdom teeth, and Cysts and tumors in the jawbones. They help in the initial treatment planning of dentures, extractions, braces, and implants. They aid in providing valuable information for the initial treatment planning of dentures, extractions, braces, and implants.

The implantology & oral surgery segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to the major role of panoramic CT in implantology in providing a wide field of view, aiding in initial assessment, and enabling lower radiation and cost. Moreover, it helps in oral surgery in the initial evaluation of impacted teeth, fractures, trauma, and broad pathology screening. A dental panoramic CT in implantology and oral surgery serves as an initial broad-view assessment tool, which is a far superior and most widely used form of cone-beam computed tomography (CBCT).

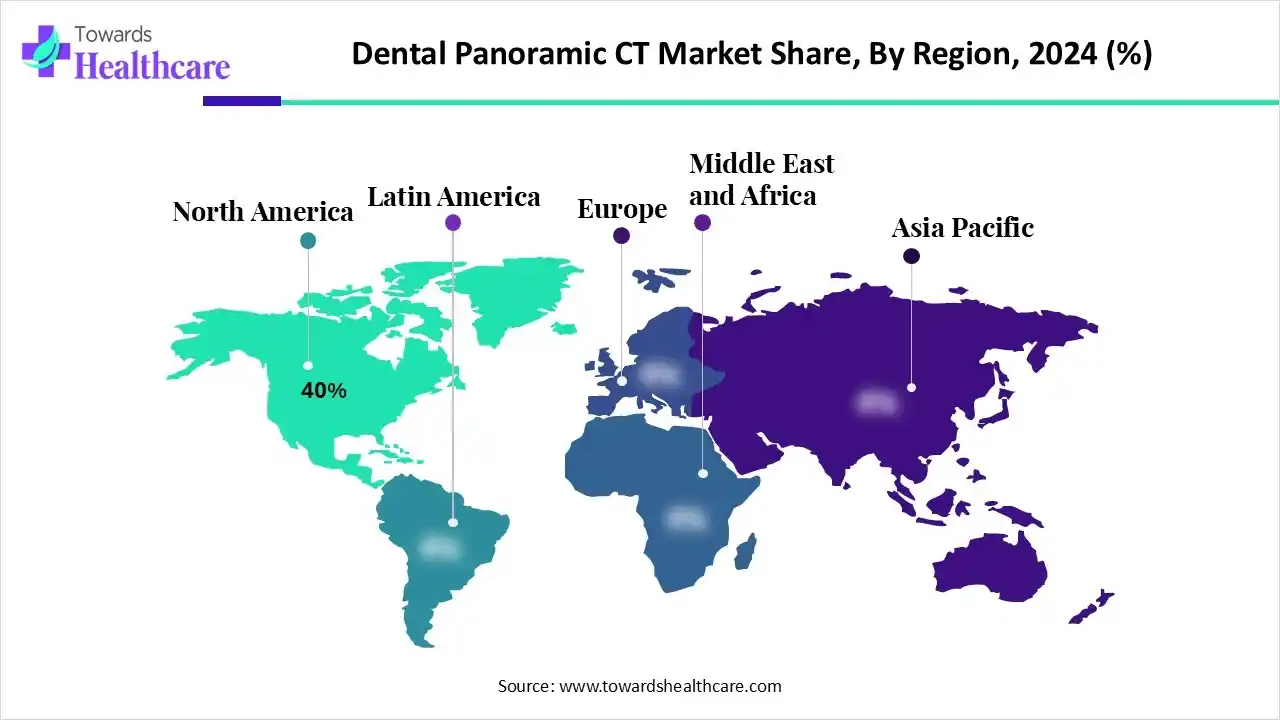

North America dominated the market in 2024, with a revenue of approximately 40%, owing to the greater emphasis on preventive dental care and a rapid shift towards advanced digital imaging. According to the Radiological Society of North America (RSNA), the most frequently used tests and treatments are computed tomography (CT), ultrasound (sonography), magnetic resonance imaging (MRI), and X-ray (radiography). The Journal of the American Dental Association focused on optimizing radiation safety in dentistry. In February 2024, the American Dental Association (ADA) published updated recommendations to improve radiography safety in dentistry.

They aim to enhance radiation protection in dental radiography and cone-beam computed tomography (CBCT). In February 2025, Carestream Dental announced advancements in the dental industry with solutions that are designed to help practitioners expand treatments with greater confidence.

The U.S. Food and Drug Administration (FDA) supports the development of safe, innovative, and effective medical devices, including AI-enabled medical appliances. The FDA provided the AI-enabled medical device list to identify those specific devices that are authorized for marketing in the U.S. The Office of Oral Health’s Mission (OOH), U.S., aims to provide expertise and leadership in dental public health. The OOH also aims to maintain a strong and sustainable infrastructure that could support necessary public health initiatives related to oral health.

The Canadian dental care plan planned to expand its initiative by including millions of new eligible candidates. About 1.7 million Canadians have already received this care, while more than 3.4 million people have been approved to be a part of the plan. The Canadian government announced many services that are included under this plan, which encompass preventive, diagnostic, and restorative services, root canal treatments, deep scaling, tooth extractions, etc.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to advanced dental procedures, rising incomes, and technological advances. The patients and dental care providers highly prefer cost-effective and long-term alternatives to traditional treatments. The government contributed to improving dental care and driving advancements in imaging technology. Many Southeast Asian countries work in collaboration with the World Health Organization (WHO), which implements the ‘WHO action plan’ for oral health in Southeast Asia 2022-2030. Southeast Asia also experienced the medical information and communication technology (ICT) initiatives to share dental images, including CBCT images and digital panoramic radiographs (DPR).

The Indian government supports oral and dental health and medical devices through the national oral health program (NOHP) and budget initiatives for medical technology. It also boosts domestic manufacturing in the medical device industry. It is expected that India will experience significant growth in the market for dental digital X-ray technology over the next few years.

In July 2025, China introduced new measures to advance MedTech and AI-powered diagnostics through a new policy for high-end medical devices. These efforts aim to boost industrial innovation and global competitiveness. The National Medical Products Administration (NMPA) of China released 10 measures to create a more efficient, supportive, and science-based regulatory framework for high-end medical devices in China.

The R&D process for dental panoramic CT encompasses key stages, including ideation, concept refinement, prototype development, preclinical research, regulatory pathway strategy, clinical trials, regulatory submission, FDA review, launch, and post-market surveillance.

Key Players: Dentsply Sirona, Vatech Co. Ltd., Planmeca Oy, Carestream Dental LLC, J. Morita Corp., Acteon Group, Envista Holdings, Dürr Dental, Midmark Corporation.

The distribution channels for dental panoramic CT machines involve direct sales, specialized distributors and suppliers, hybrid models, etc. The end-users of these products and services include dental clinics, hospitals, imaging centers, and dental academic and research organizations.

Key Players: Dentsply Sirona, Carestream Dental, Vatech, Planmeca, Acteon Group, J. Morita Corp., Envista Holdings Corporation.

The patient education resources are radiologyinfo.org, Image Gently Alliance, American Dental Association (ADA), and the U.S. FDA. The patient support programs focus on health, safety, patient preparation, expert analysis, etc. The services like insurance coverage, costs, and insurance guidance are supportive to patients.

Key Players: Dentsply Sirona, Planmeca, Vatech, Carestream Dental, DEXIS, GE Healthcare.

In February 2025, Heikki Kyöstilä, Founder and President of Planmeca Group, announced that the grand opening of the shared North American headquarters is an important milestone that reflects the company’s long-term investment in supporting North American customers. Moreover, this facility will showcase Planmeca’s cutting-edge solutions in a shared space, and the company will continue to build its dedication to innovation and customer experience.

By Product Type

By Imaging Field of View (FOV)

By Technology/Detector Type

By End User

By Deployment Mode

By Application

By Region

February 2026

February 2026

February 2026

February 2026