January 2026

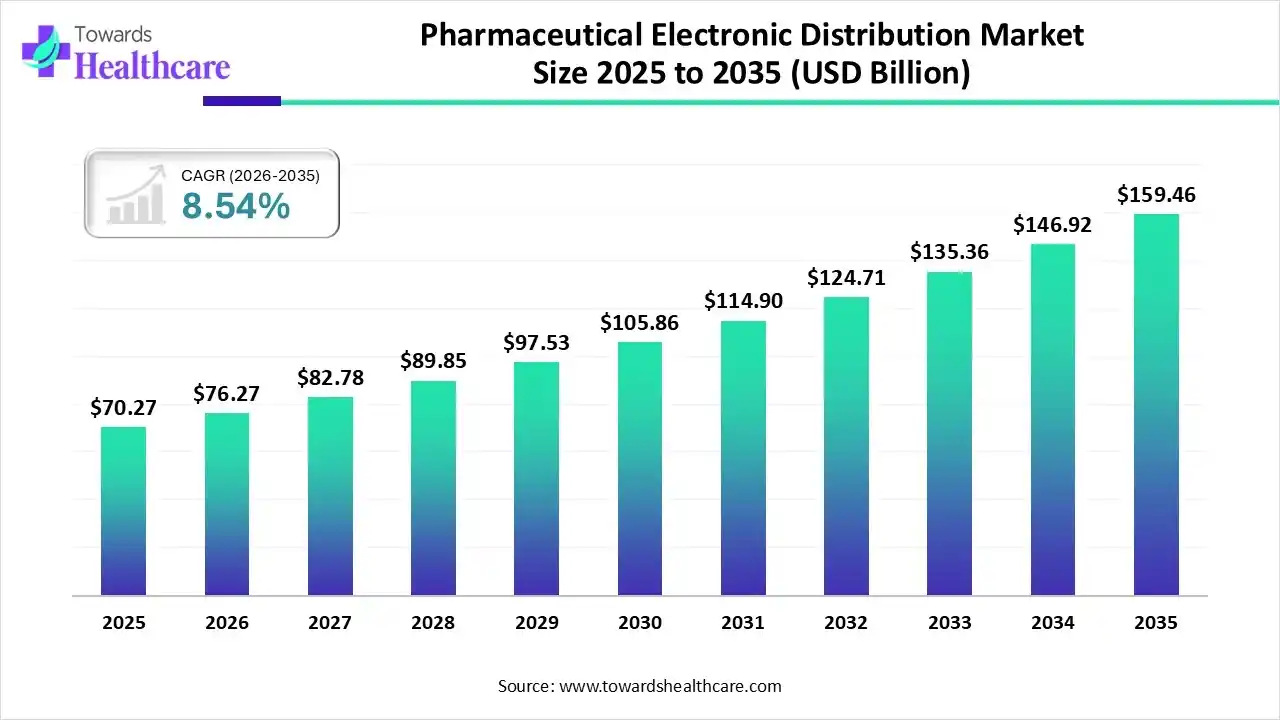

The global pharmaceutical electronic distribution market size was estimated at USD 70.27 billion in 2025 and is predicted to increase from USD 76.27 billion in 2026 to approximately USD 159.46 billion by 2035, expanding at a CAGR of 8.54% from 2026 to 2035.

The growing digital transformation globally is increasing the adoption of pharmaceutical electronic distribution systems across the healthcare sector. Expanding e-pharmacies, increasing use of smartphones, AI integration, collaboration, and the launch of new platforms are also promoting the market growth.

The pharmaceutical electronic distribution market is driven by a growing shift towards telemedicine and direct-to-patient (DTP) delivery models. The pharmaceutical electronic distribution refers to the electronic systems promoting the digital supply and delivery of healthcare products. These systems utilized digital tools, online platforms, and software for the management of inventory, orders, and delivery of pharmaceutical products.

AI technologies are being utilized in pharmaceutical electronic distribution systems for inventory management and supply chain optimization. They also help in the detection of counterfeit drugs and ensure regulatory compliance, where their automation also helps in reducing human errors. They also offer 24/7 assistance, order tracking, and recommend personalized medication, analyzing patient health history, where their predictive analytics help in preventing product failure and spoilage during storage and transportation.

There is a rise in the adoption of telemedicine platforms, which is increasing the use of pharmaceutical electronic distribution systems, to enable patients to order medication through these online platforms.

The growing collaborations among the hospitals, e-pharmacies, and manufacturers are increasing to promote their growth, which is driving the adoption of pharmaceutical electronic distribution platforms for better market penetration.

To offer improved delivery solutions, enhanced cold chain systems, drug traceability, compliance with regulatory standards, chronic disease management services, and reduce counterfeit medication supply, advancements in pharmaceutical electronic distribution platforms are increasing.

| Key Elements | Scope |

| Market Size in 2026 | USD 76.27 Billion |

| Projected Market Size in 2035 | USD 159.46 Billion |

| CAGR (2026 - 2035) | 8.54% |

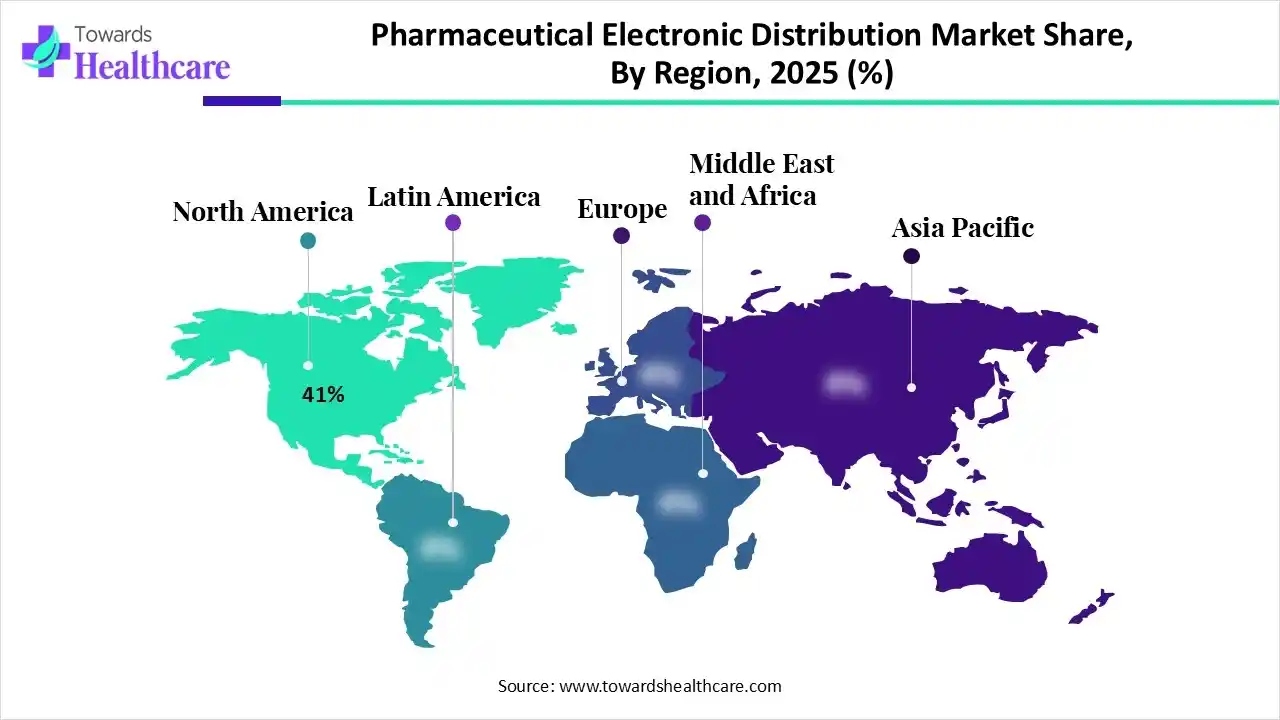

| Leading Region | North America by 41% |

| Market Segmentation | By Type, By Technology/Platform, By End User, By Region |

| Top Key Players | McKesson Corporation, Cardinal Health, Inc., Cencora (formerly AmerisourceBergen), PHOENIX Pharmahandel GmbH & Co KG,Zur Rose Group (DocMorris), Shop Apotheke Europe,Amazon Pharmacy, Walgreens Boots Alliance, CVS Health, Optum Specialty Distribution, Sinopharm Group Co., Ltd., Alfresa Holdings Corporation, Tata 1mg (India) |

Why Did the Prescription Drugs Segment Dominate in the Pharmaceutical Electronic Distribution Market in 2025?

The prescription drugs segment held the largest share of approximate 68% in the market in 2025, due to their repeated use. They were also used for the management of chronic diseases. At the same time, the growth in the telemedicine platforms also increased their use, which enhanced the adoption of pharmaceutical electronic distribution platforms.

Over-the-Counter (OTC) Drugs

The over-the-counter (OTC) drugs segment is expected to show the highest growth during the predicted time, due to a growing shift towards self-medication. This, in turn, is increasing the use of pharmaceutical electronic distribution platforms as they offer home delivery with discounts. Moreover, their widespread availability is also increasing their use.

Which Technology/Platform Type Segment Held the Dominating Share of the Pharmaceutical Electronic Distribution Market in 2025?

The distributor-owned platforms segment held the dominating share of approximate 45% share in the market in 2025, due to their enhanced compliance with regulatory standards. They also offered improved inventory control and lower transaction costs, which increased their use. Moreover, the presence of improved logistics platforms also increased their adoption rates.

Third-Party Marketplaces

The third-party marketplaces segment is expected to show the fastest growth rate during the predicted time, due to the presence of a wide range of products. They also offered advanced digital features and discounts, which also attracted the consumers, driving their adoption. Additionally, increasing collaborations are also increasing their advancements.

What Made Hospital Pharmacies the Dominant Segment in the Pharmaceutical Electronic Distribution Market in 2025?

The hospital pharmacies segment led the market with approximately 54% share in 2025, due to the high prescription volume. They also offered direct access to the patient, which increased the continuous distribution of the medications. Moreover, their integration with hospital systems also increased patient trust and use of pharmaceutical electronic distribution platforms.

Online/E-Pharmacies

The online/e-pharmacies segment is expected to show the highest growth during the upcoming years, due to 24/7 availability. They also offer home deliveries and a wide range of products, enhancing the patient's convenience. Furthermore, growing home care and telemedicine platforms are also increasing their use, ultimately driving the demand for pharmaceutical electronic distribution systems.

North America dominated the pharmaceutical electronic distribution market with approximate 41.0% in 2025, due to the presence of well-developed healthcare infrastructures, which increased their integration with the healthcare system. The growth in the use of smartphones and expanding e-pharmacies also increased their use. Moreover, a rise in healthcare investments also increased their advancements, which contributed to the market growth.

U.S. Market Trends

Due to the presence of advanced healthcare, the adoption of the pharmaceutical electronic distribution platforms across the U.S. is increasing. The growing patient awareness and expanding e-pharmacies are also increasing the use of these platforms, where the growing healthcare investments are also encouraging their utilization.

Asia Pacific is expected to host the fastest-growing pharmaceutical electronic distribution market during the forecast period, due to growing internet and smartphone penetration. Increasing chronic diseases and the expanding pharmaceutical sector are also increasing the adoption of these platforms. Additionally, growing government initiatives and digitalization are also enhancing the market growth.

The presence of large populations and increasing health awareness are driving the demand for various medications, which is ultimately increasing the adoption of pharmaceutical electronic distribution platforms. The increasing use of smartphones and growing government initiatives are also increasing their use, promoting self-medication and enhancing the product's availability, respectively.

Europe is expected to grow significantly in the pharmaceutical electronic distribution market during the forecast period, due to the presence of robust e-pharmacies, healthcare systems, and distribution networks, which are driving the adoption of these platforms. Furthermore, the growing use of the internet and smartphones are also increasing their use, where the growing shift towards home care is also increasing their demand, promoting the market growth.

UK Market Trends

The UK consists of a well-developed healthcare system, which is driving the integration of pharmaceutical electronic distribution systems to enhance the access and availability of various drug products. Moreover, growing use of telemedicine and expanding e-pharmacies are also increasing their use to improve patient convenience and their outcomes.

| Companies | Headquarters | Pharmaceutical Electronic Distribution Systems |

| McKesson Corporation | Irving, U.S. | Enterprise Information Solutions (EIS) |

| Cardinal Health, Inc. | Dublin, U.S. | Inventory Management Solutions (IMS) |

| Cencora (formerly AmerisourceBergen) | Conshohocken, U.S. | World Courier Logistics and digital sourcing services |

| PHOENIX Pharmahandel GmbH & Co KG | Mannheim, Germany | LAVENDEL digital inventory and retail network |

| Zur Rose Group (DocMorris) | Frauenfeld, Switzerland | DocMorris Health Ecosystem |

| Shop Apotheke Europe | Sevenum, Netherlands | Redcare Digital Platform |

| Amazon Pharmacy | Seattle, U.S. | Direct to patient logistics and RxPass platform |

| Walgreens Boots Alliance | Deerfield, U.S. | Retail-driven digital distribution hubs |

| CVS Health | Woonsocket, U.S. | Caremark PBM Services and Cordavis Biosimilar Platform |

| OptumRx (UnitedHealth Group) | Eden Prairie, U.S. | Optum Specialty Distribution |

| Shanghai Fosun Pharmaceutical Group | Shanghai, China | Integrated logistics |

| Sinopharm Group Co., Ltd. | Shanghai, China | Integrated logistics and digital inventory systems |

| Alfresa Holdings Corporation | Tokyo, Japan | B2B pharma delivery systems |

| Medipal Holdings Corporation | Tokyo, Japan | Specialty pharma and diagnostic logistics portal |

| Tata 1mg (India) | Gurugram, India | D2C digital healthcare and diagnostics marketplace |

By Type

By Technology/Platform

By End User

By Region

January 2026

December 2025

November 2025

November 2025